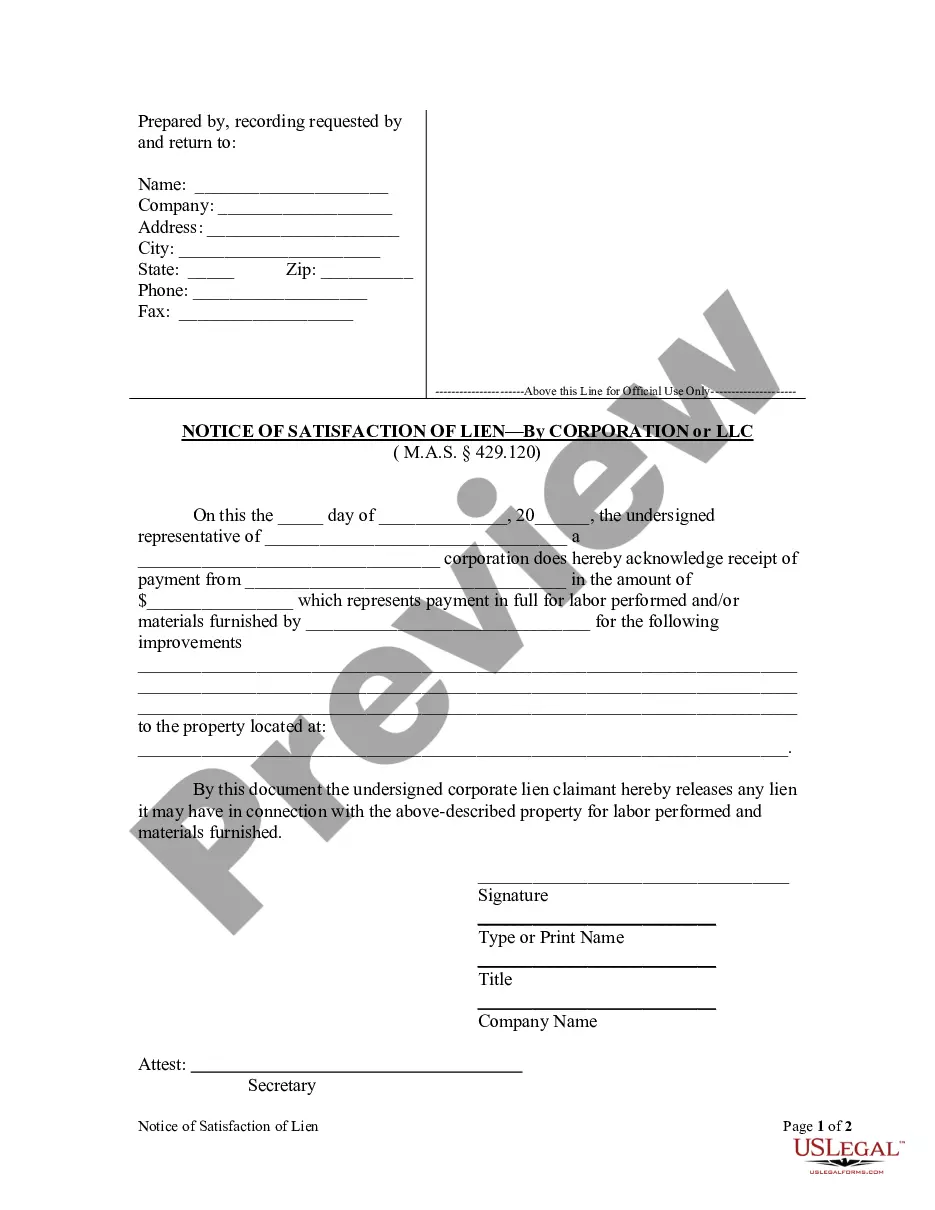

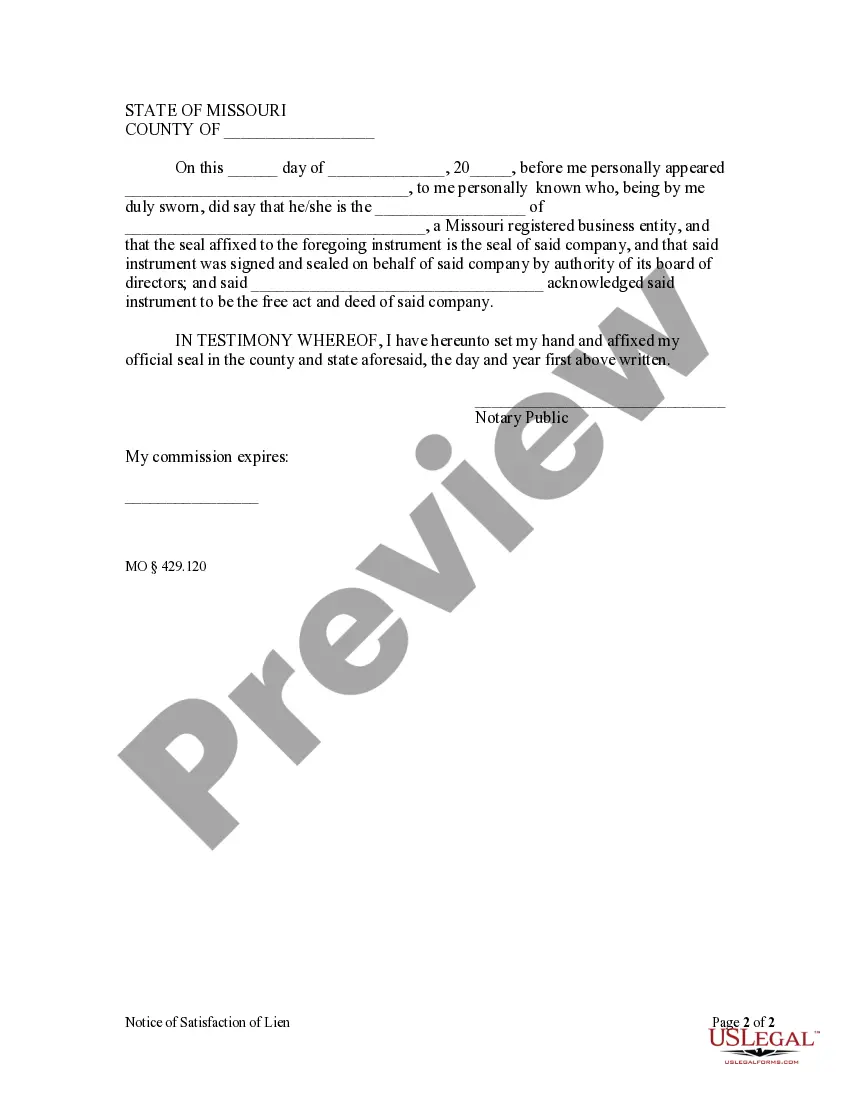

In the event that a lien has been satisfied by payment in full, this form allows a lien claimant to certify that the lien has been satisfied.

Missouri Notice of Satisfaction - Corporation

Description

How to fill out Missouri Notice Of Satisfaction - Corporation?

Have any form from 85,000 legal documents such as Missouri Notice of Satisfaction - Corporation or LLC online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Missouri Notice of Satisfaction - Corporation or LLC you want to use.

- Look through description and preview the sample.

- As soon as you’re confident the sample is what you need, just click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by bank card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The service provides you with access to documents and divides them into groups to streamline your search. Use US Legal Forms to obtain your Missouri Notice of Satisfaction - Corporation or LLC fast and easy.

Form popularity

FAQ

Key takeaway: Having your LLC taxed as an S corporation can save you money on self-employment taxes. However, you will have to file an individual S-corp tax return, which means paying your CPA to file an additional form. An S-corp is also less structurally flexible than an LLC.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

Unlike most other states, Missouri does not require LLCs to file an annual report.

Although being taxed like an S corporation is probably chosen the least often by small business owners, it is an option. For some LLCs and their owners, this can actually provide a tax saving2248particularly if the LLC operates an active trade or business and the payroll taxes on the owner or owners is high.

Key takeaway: Having your LLC taxed as an S corporation can save you money on self-employment taxes. However, you will have to file an individual S-corp tax return, which means paying your CPA to file an additional form. An S-corp is also less structurally flexible than an LLC.

S Corps have more advantageous self-employment taxes than LLC's. S Corp owners can be considered employees and paid a reasonable salary. FICA taxes are taken out and paid on the amount of the salary.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

One major advantage of an S corporation is that it provides owners limited liability protection, regardless of its tax status. Limited liability protection means that the owners' personal assets are shielded from the claims of business creditorswhether the claims arise from contracts or litigation.