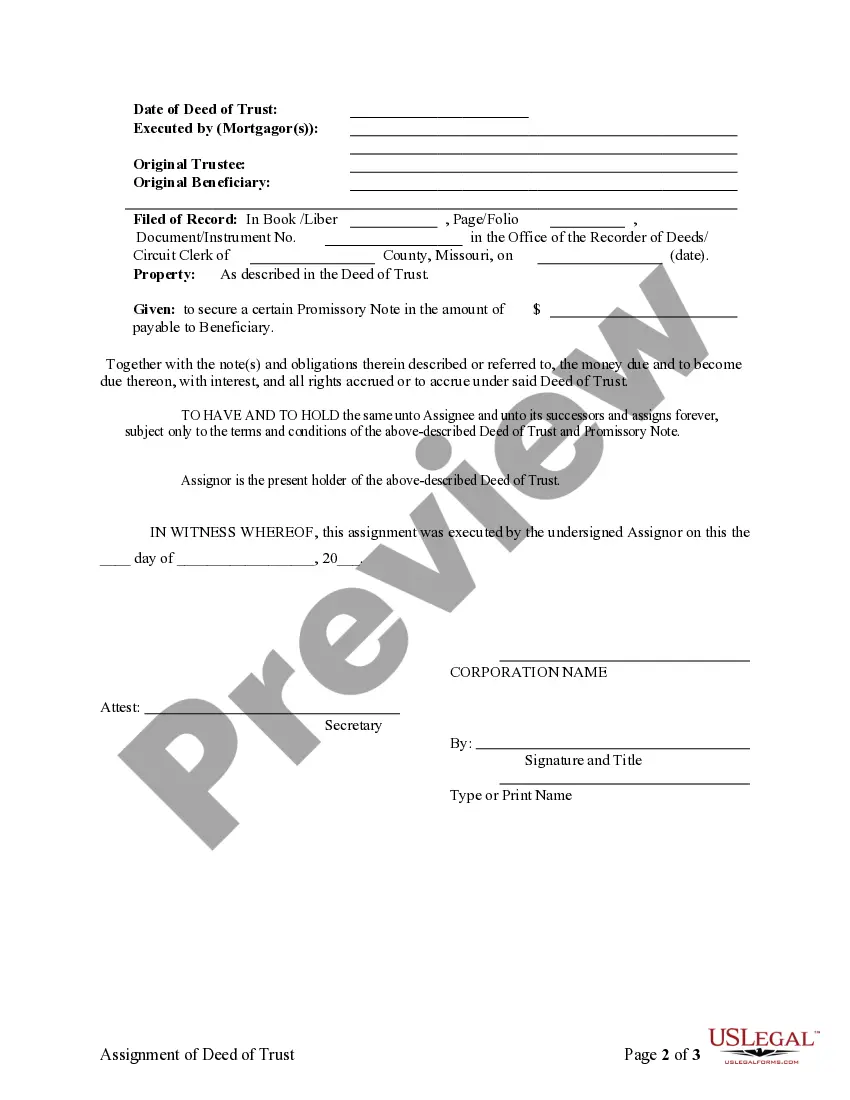

Assignment of Deed of Trust by Corporate Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rules

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Missouri Law

Execution of Assignment or Satisfaction: Must

be signed by the mortgagee.

Assignment: Security instruments may be

assigned by instrument in writing, acknowledged by the assignor in the

manner provided for the acknowledgment of other instruments affecting the

title to real property, and may be recorded in the office of the recorder

of deeds in the county or counties in which the security instrument being

assigned was recorded.

Demand to Satisfy: Upon full payoff, borrower

(mortgagor) may make written demand upon the lender (mortgagee) to satisfy

the deed of trust, whereupon lender has 30 days to do so or face liability.

Recording Satisfaction: The lender shall

deliver to the borrower a certificate of satisfaction (and see 443.060,

below).

Penalty: If mortgagee fails to record satisfaction

within 30 days of written request after full payoff, mortgagee is liable

for 10% of the amount of the instrument, plus other recoverable damages.

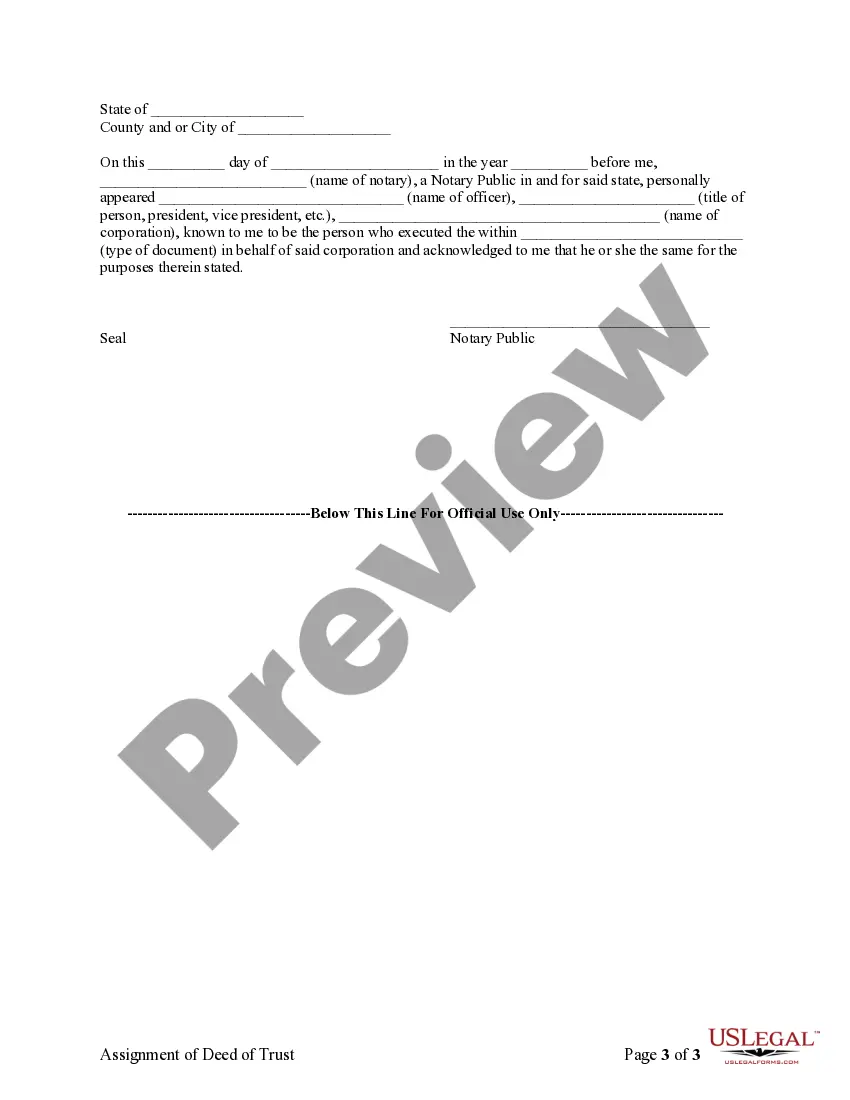

Acknowledgment: An assignment or satisfaction

must contain a proper Missouri acknowledgment, or other acknowledgment

approved by Statute.

Missouri Statutes

443.035. Recording of instrument required--failure to record,

effect on persons subsequently obtaining interest or lien.

1. Security instruments may be assigned by instrument in writing,

acknowledged by the assignor in the manner provided for the acknowledgment

of other instruments affecting the title to real property, and may be recorded

in the office of the recorder of deeds in the county or counties in which

the security instrument being assigned was recorded.

2. Any person who acquires an interest in or a lien upon real property

for value and without notice of an unrecorded assignment of a security

instrument recorded on or after January 1, 1986, and who has relied upon

a release of such security instrument executed by the party last shown

of record to be the owner thereof, shall acquire the interest in or lien

upon such real property free from the lien of the security instrument to

the same extent as if the release upon which reliance was placed had been

executed by the lawful holder of the debt or other obligation secured by

such security instrument.

3. No recorder of deeds in this state shall accept for record any

security instrument of assignment thereof in which the mortgagee, cestui

que trust or assignee is named as bearer or the actual identity of the

mortgagee, cestui que trust or assignee is otherwise not ascertainable

from the face of the security instrument or assignment. All security instruments

and assignments thereof presented for record shall contain the mailing

address of the mortgagee, cestui que trust or assignee except, that the

omission thereof shall not affect the validity of any security instrument

or assignment, or the constructive notice imparted by the record thereof.

443.060. Acknowledgment of satisfaction and release, how made.

1. If any mortgagee, cestui que trust or assignee, or personal

representative of the mortgagee, cestui que trust or assignee, receive

full satisfaction of any security instrument, he shall, at the request

and cost of the person making the same, deliver to such person a sufficient

deed of release of the security instrument; but it shall not in any case

be necessary for the trustee to join in such deed of release. In the case

of security instruments recorded prior to January 1, 1986, if a full deed

of release is offered for record, and except as otherwise provided in subsection

3 of this section, the note or notes secured shall be produced and canceled

in the presence of the recorder, who shall enter that fact on the deed

of release prior to its recordation and attest the same with his official

signature; and except as otherwise provided in subsection 3 of this section,

no full deed of release of such a security instrument shall be admitted

to record unless the note or notes are so produced and canceled, and that

fact entered on the deed of release and attested as above provided.

2. If such note or notes are required by subsection 1 of this section

to be presented for cancellation and are not presented for the alleged

reason that they have been lost or destroyed, the recorder, before allowing

any deed of release to be placed on the file or record, shall require the

mortgagee or cestui que trust named in the security instrument desired

to be released or his legal representative, to make oath, in writing, stating

that the note or other evidences of debt named in the security instrument

sought to be released have been paid and delivered to the maker thereof

or his representative. The recorder shall also require the maker of such

note or notes, or his legal representative, to make affidavit, in writing,

that the note or notes in question have been paid, and cannot be produced

because lost or destroyed, and that they are not then in the possession

of any person having any lawful claim to the same. If such note or notes

shall not have been delivered to the maker or his legal representative,

the affidavit so required of the mortgagee or cestui que trust or his legal

representative shall recite that the note or other evidence of the debt

named in the security instrument has been paid and cannot be produced because

lost or destroyed, and that it is* not then in the possession of any person

having any lawful claim to the same. The term "legal representatives" as

used in this section shall include assigns. The affidavit of the maker

of such note or notes or his legal representative shall recite that such

note or notes have been paid. The affidavits so required shall be recorded

in the same manner as deeds, in a permanent record. Nothing in this chapter

shall be so construed as to require that any interest coupon notes shall

be produced and canceled in the presence of the recorder, but that all

such interest coupon notes shall conclusively be taken and be deemed to

have been paid in full, when the principal note described in the security

instrument shall have been produced and canceled in the presence of the

recorder as provided for in this chapter.

3. In case any mortgagee, cestui que trust or assignee, or personal

representative of the mortgagee, cestui que trust or assignee shall desire

to release the property described in any security instrument recorded prior

to January 1, 1986, without receiving full satisfaction of the debt, note

or obligation thereby secured, he shall be permitted to do so by the recorder

on presentation to the recorder of the notes or other obligations evidencing

the principal of the debt secured thereby, or accounting for them by affidavits

or otherwise as now or hereafter provided by law in the case of full release,

and the recorder shall note the fact of the filing for record of such release

on such notes or obligations in substantially the following form: "See

release dated ..................... Recorder" and of the presentation of

such notes or other obligations, or accounting therefor, on the deed of

release prior to its recordation, but shall not cancel such notes or other

obligations. Nothing in this section shall be construed as making it necessary

for any trustee named in the security instrument to join in such deed of

release.

443.070. Affidavit required with deed of release, when--penalty

for failure.

Every person who shall execute a deed of release of a security instrument

recorded prior to January 1, 1986, shall at the same time of making and

delivering such release deed, make and deliver the affidavit required by

section 443.060 unless such deed of release states that the indebtedness

remains unpaid in whole or in part; and a neglect or refusal to do so shall

subject the party or person thus neglecting or refusing to the same penalties

as provided by law in case of refusing to satisfy security instruments

when paid. The affidavit named in this section may be endorsed upon the

deed of release and recorded with it.

443.150. Acknowledgment and satisfaction--how made by a corporation.

Hereafter any president, vice president, secretary, treasurer or

cashier of any corporation may, in the name and on behalf of such corporation,

execute releases of any security instrument by release deed, with the same

force and effect and in like manner as if executed by the president of

such corporation.

443.170. Penalty for failing to acknowledge satisfaction and

deliver deed of release.

If such personal representative, upon satisfactory proof produced

to the personal representative of the payment of such indebtedness to the

decedent, does not, within thirty days after request and tender

of expenses, deliver to the person owning the property a sufficient deed

of release, the personal representative shall personally forfeit to the

party aggrieved ten percent of the amount of the security instrument,

absolutely, and any other damages such aggrieved party may be able to prove

such party has sustained, to be recovered in any court of competent

jurisdiction.