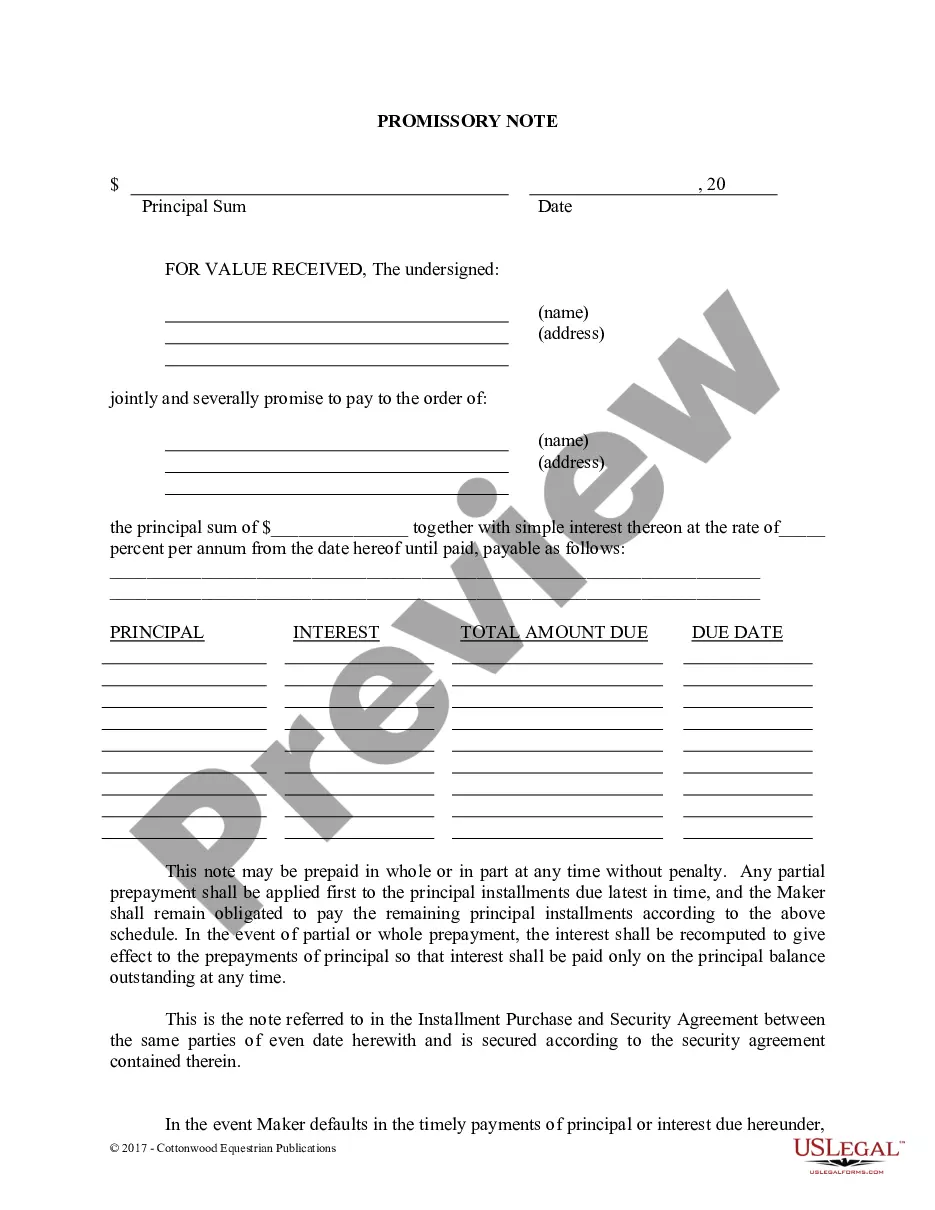

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Missouri Promissory Note - Horse Equine Forms

Description

How to fill out Missouri Promissory Note - Horse Equine Forms?

Have any template from 85,000 legal documents such as Missouri Promissory Note - Horse Equine Forms on-line with US Legal Forms. Every template is prepared and updated by state-accredited attorneys.

If you already have a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Missouri Promissory Note - Horse Equine Forms you want to use.

- Read description and preview the template.

- When you are sure the sample is what you need, just click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the right downloadable template. The service provides you with access to documents and divides them into groups to simplify your search. Use US Legal Forms to obtain your Missouri Promissory Note - Horse Equine Forms easy and fast.

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Personal Promissory Notes This is a particular loan taken from family or friends. Commercial Here, the note is made when dealing with commercial lenders such as banks. Real Estate This is similar to commercial notes in terms of nonpayment consequences.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

A promissory note is very similar to a loan. Each is a legally binding contract to unconditionally repay a specified amount within a defined time frame. However, a promissory note is generally less detailed and less rigid than a loan contract.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.