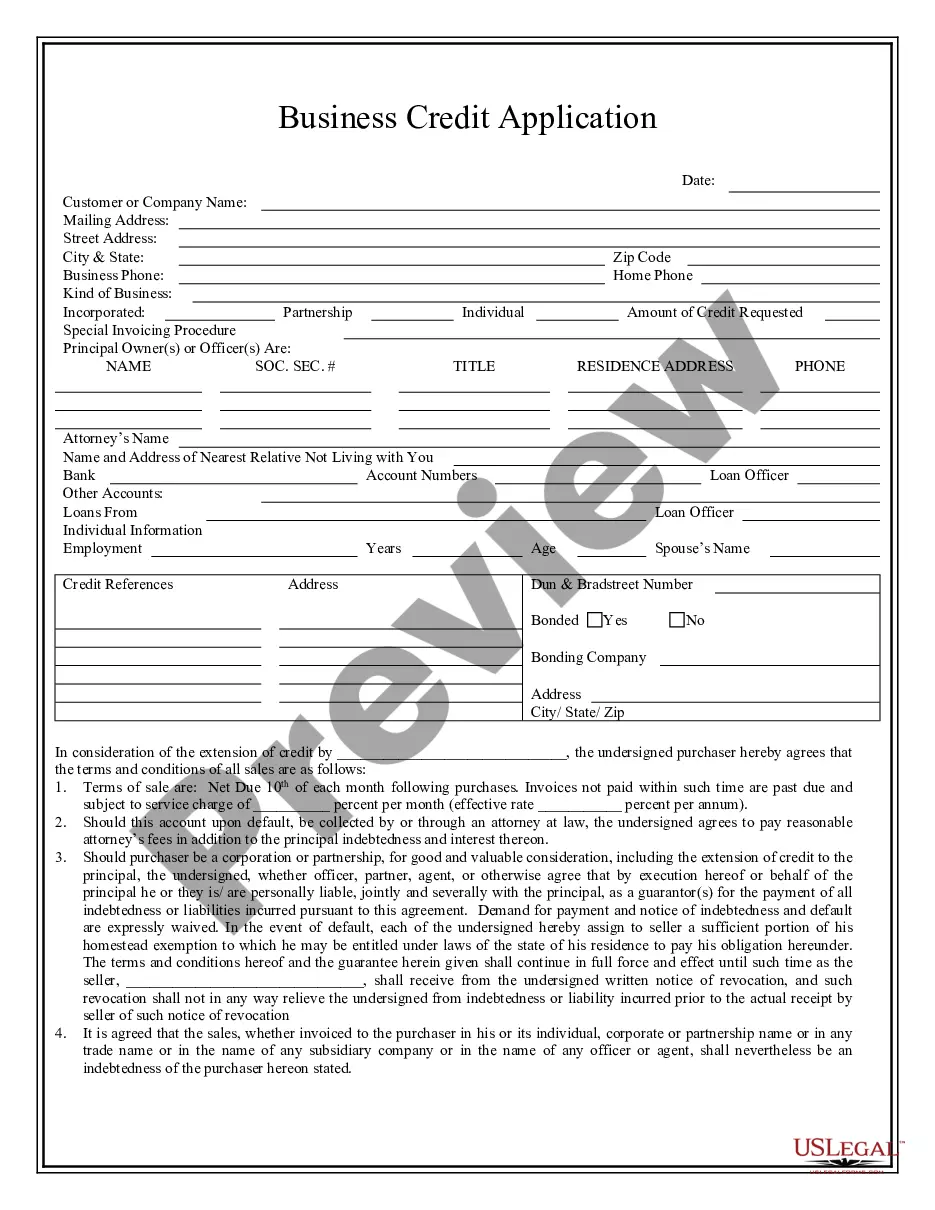

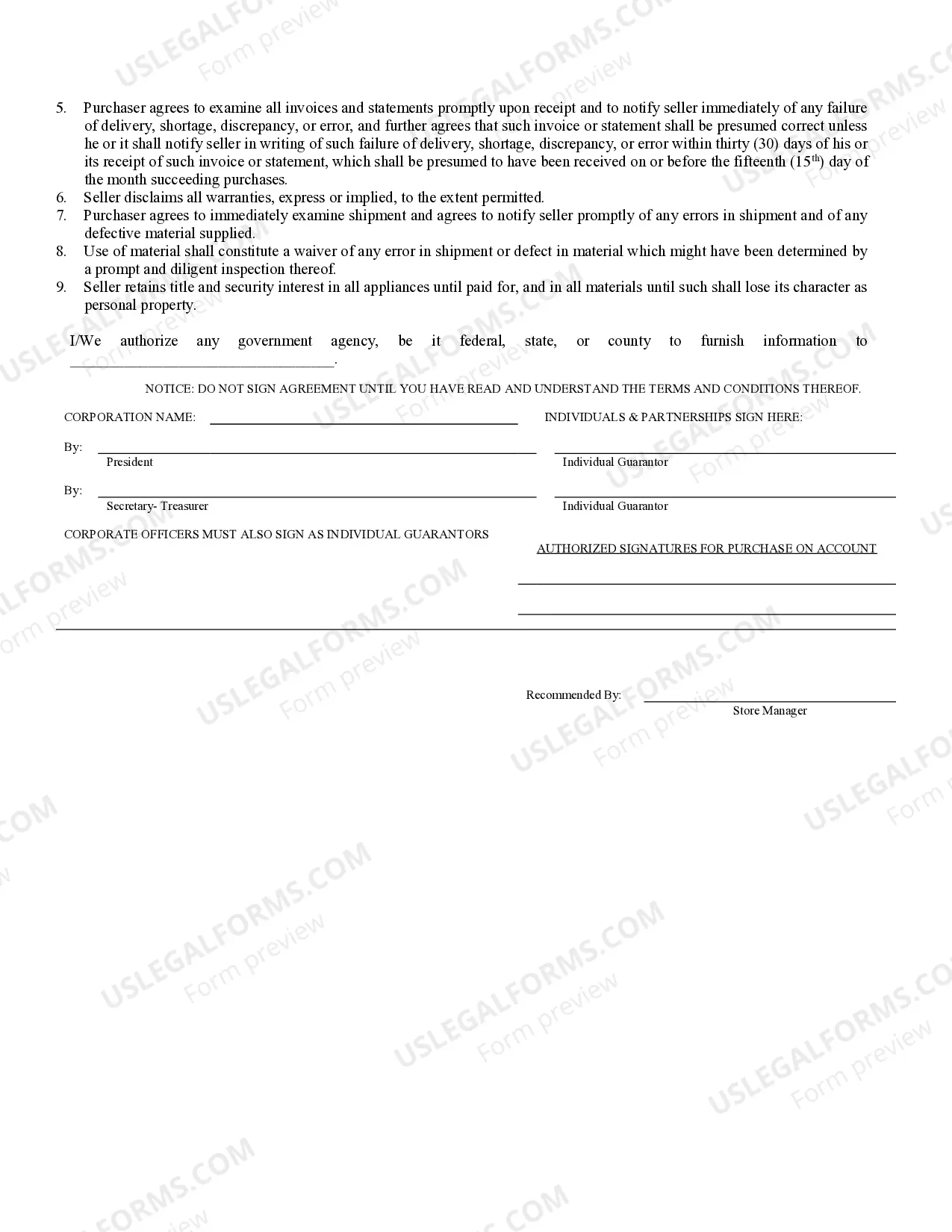

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Missouri Business Credit Application

Description

How to fill out Missouri Business Credit Application?

Obtain any template from 85,000 legal documents including Missouri Business Credit Application online with US Legal Forms. Each template is crafted and refreshed by state-licensed attorneys.

If you already possess a subscription, Log In. When you are on the document’s page, click on the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the instructions provided below: Check the state-specific criteria for the Missouri Business Credit Application you wish to utilize. Review the description and preview the template. Once you are certain the sample meets your needs, simply click Buy Now. Select a subscription plan that aligns with your budget. Establish a personal account. Make payment in one of two convenient methods: by credit card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the document to the My documents tab. After your reusable template is prepared, print it out or save it to your device. With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The platform provides you access to forms and categorizes them to simplify your search. Use US Legal Forms to acquire your Missouri Business Credit Application quickly and effortlessly.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The platform provides you access to forms and categorizes them to simplify your search.

- Obtain any template from 85,000 legal documents including Missouri Business Credit Application online with US Legal Forms.

- Each template is crafted and refreshed by state-licensed attorneys.

- If you already possess a subscription, Log In.

- When you are on the document’s page, click on the Download button.

- Navigate to My documents to access it.

- Check the state-specific criteria for the Missouri Business Credit Application you wish to utilize.

- Review the description and preview the template.

- Once you are certain the sample meets your needs, simply click Buy Now.

- Select a subscription plan that aligns with your budget.

Form popularity

FAQ

Yes, a new LLC can obtain a business credit card, though approval may depend on various factors such as your personal credit score and the financial history of the business. Many credit card companies offer options specifically for new businesses. Establishing a business credit card can help build your LLC's credit profile, making future Missouri Business Credit Applications easier and more favorable.

Filling out a credit application form requires attention to detail. Start by entering your business information, including its legal name, address, and contact numbers. Next, provide financial details and any other required documentation, such as tax returns or bank statements. Ensure all information is accurate and complete to improve your chances of a successful Missouri Business Credit Application.

An LLC typically does not have a credit score when it is first established. Instead, its creditworthiness is built over time through responsible financial practices, such as timely payments and maintaining low debt levels. As your LLC begins to engage in financial activities, it will develop its own credit profile, which is essential for future Missouri Business Credit Applications. Establishing good credit early can significantly benefit your LLC.

When filling out a credit application for your business, start by gathering all necessary information about your business, including your EIN and financial details. Clearly provide your business name, address, and contact information. Be thorough and accurate in your responses to ensure the lender has a complete picture of your business, which can enhance your chances of approval for a Missouri Business Credit Application.

Yes, you can use your Employer Identification Number (EIN) instead of your Social Security Number (SSN) when completing a Missouri Business Credit Application. This is particularly beneficial for business owners who prefer to keep their personal and business finances separate. Using your EIN can also help protect your identity while establishing your business credit. Always ensure that the EIN you provide is correct to avoid delays in the application process.

The small business startup grant in Missouri provides financial assistance to new businesses to help cover initial expenses. These grants aim to promote entrepreneurship and stimulate economic growth in the region. To apply for a Missouri Business Credit Application, make sure you meet the eligibility criteria and prepare a detailed business plan outlining how the funds will be used. Utilizing platforms like uslegalforms can simplify the application process and guide you through the necessary documentation.

To obtain business credit for your LLC, you should start by establishing a solid business credit profile. First, ensure your business is registered with the right authorities and has an Employer Identification Number (EIN). Next, consider applying for a Missouri Business Credit Application with reliable lenders or financial institutions that cater to small businesses. This application typically requires information about your business's financial health, so having your financial statements ready will be essential.