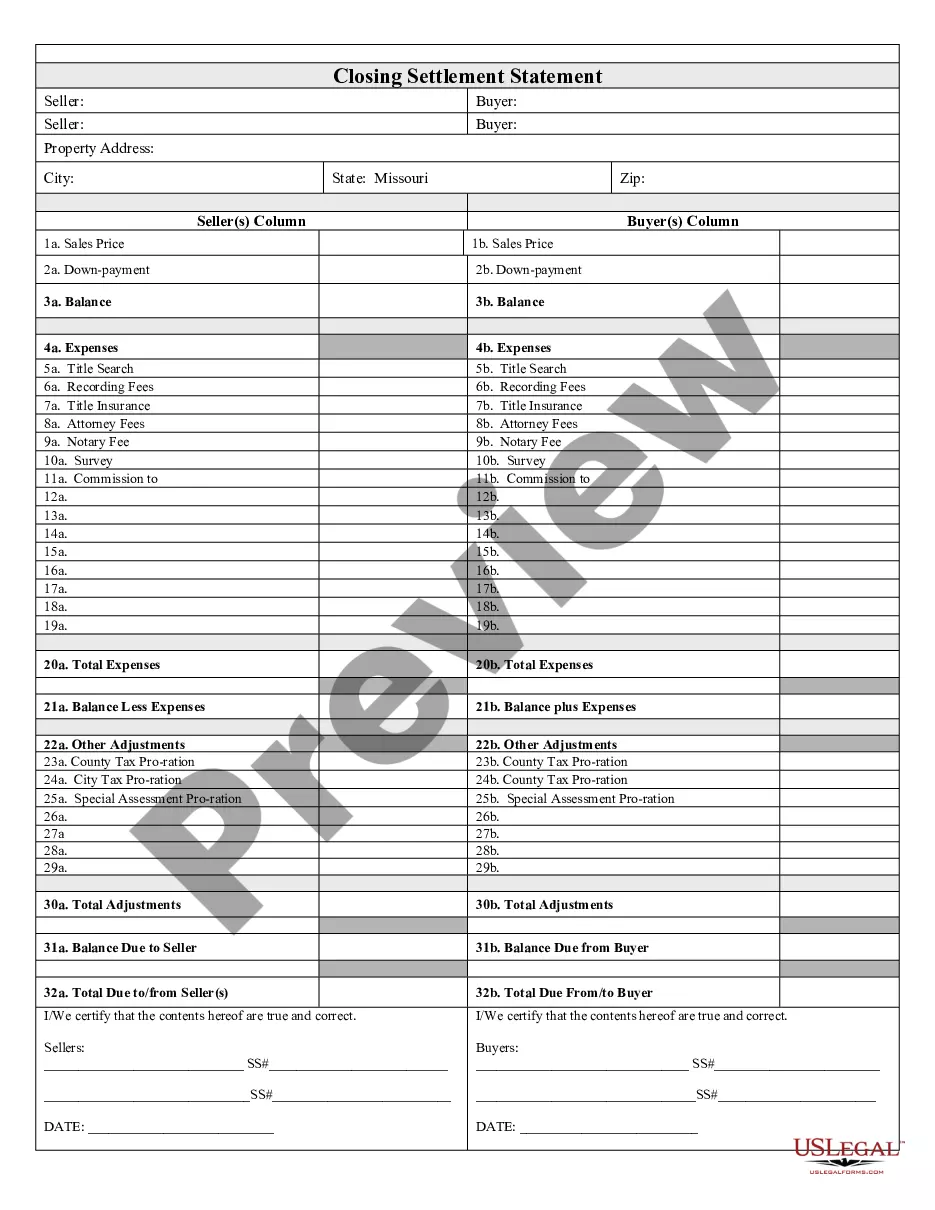

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Missouri Closing Statement

Description

How to fill out Missouri Closing Statement?

Obtain any template from 85,000 legal documents including Missouri Closing Statement online with US Legal Forms. Each template is crafted and refreshed by state-licensed attorneys.

If you possess a subscription, Log In. Once you arrive at the form’s page, click on the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the instructions below: Check the state-specific prerequisites for the Missouri Closing Statement you intend to use. Browse the description and preview the example. When you’re confident the template meets your needs, simply click Buy Now. Select a subscription plan that aligns with your budget. Create a personal account. Make a payment in one of two convenient methods: by credit card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the file to the My documents section. After your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform provides access to forms and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Missouri Closing Statement quickly and efficiently.

- Obtain any template from 85,000 legal documents including Missouri Closing Statement online with US Legal Forms.

- Each template is crafted and refreshed by state-licensed attorneys.

- If you possess a subscription, Log In.

- Once you arrive at the form’s page, click on the Download button.

- Navigate to My documents to access it.

- If you have not yet subscribed, follow the instructions below.

- Check the state-specific prerequisites for the Missouri Closing Statement.

- Browse the description and preview the example.

- When you’re confident the template meets your needs, simply click Buy Now.

Form popularity

FAQ

To obtain a copy of your house deed in Missouri, you should first contact the county recorder of deeds where your property is located. They maintain public records, including the Missouri Closing Statement for your property. You can request a copy in person or online, depending on the resources available in your county. If you prefer a more straightforward process, consider using US Legal Forms, which provides access to essential legal documents and guidance.

In Missouri, a licensed real estate salesperson can assist in the closing process, but they cannot conduct the closing themselves. Typically, a title company or an attorney manages the closing and prepares the Missouri Closing Statement. This ensures that all legalities are properly handled. If you're unsure about the closing process, consider using US Legal Forms for clear guidance and necessary documents.

Yes, a seller can back out of a real estate contract in Missouri, but certain conditions apply. If there are contingencies outlined in the contract, such as inspection or financing, the seller may have valid reasons to withdraw. However, doing so without a lawful reason may lead to legal consequences. Always refer to the Missouri Closing Statement for any obligations regarding the contract.

To file a lien on a property in Missouri, you must complete the necessary paperwork and submit it to the appropriate county recorder's office. The Missouri Closing Statement will often outline any existing liens, making it crucial for understanding your position before filing. Ensure you include all required information to avoid delays. If you need assistance with forms, US Legal Forms provides resources to help streamline the process.

Missouri is not a non-disclosure state when it comes to real estate transactions. This means that property sales prices are public information, which you can find in the Missouri Closing Statement. The transparency helps buyers and sellers understand market trends and property values. If you're navigating real estate in Missouri, knowing these details can empower your decisions.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

What is the seller's closing statement, aka settlement statement? The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

To get a copy of your closing statement of your home purchase in 2006, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your Settlement Documents.

In the United States, a seller disclosure statement is a form disclosing the seller's knowledge of the condition of the property. The seller disclosure notice or statement is anecdotal and does not serve as a substitute for any inspections of warranties the purchaser may wish to obtain.

For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents. You may even give your attorney a power of attorney to sign any incidental documents for the escrowee.