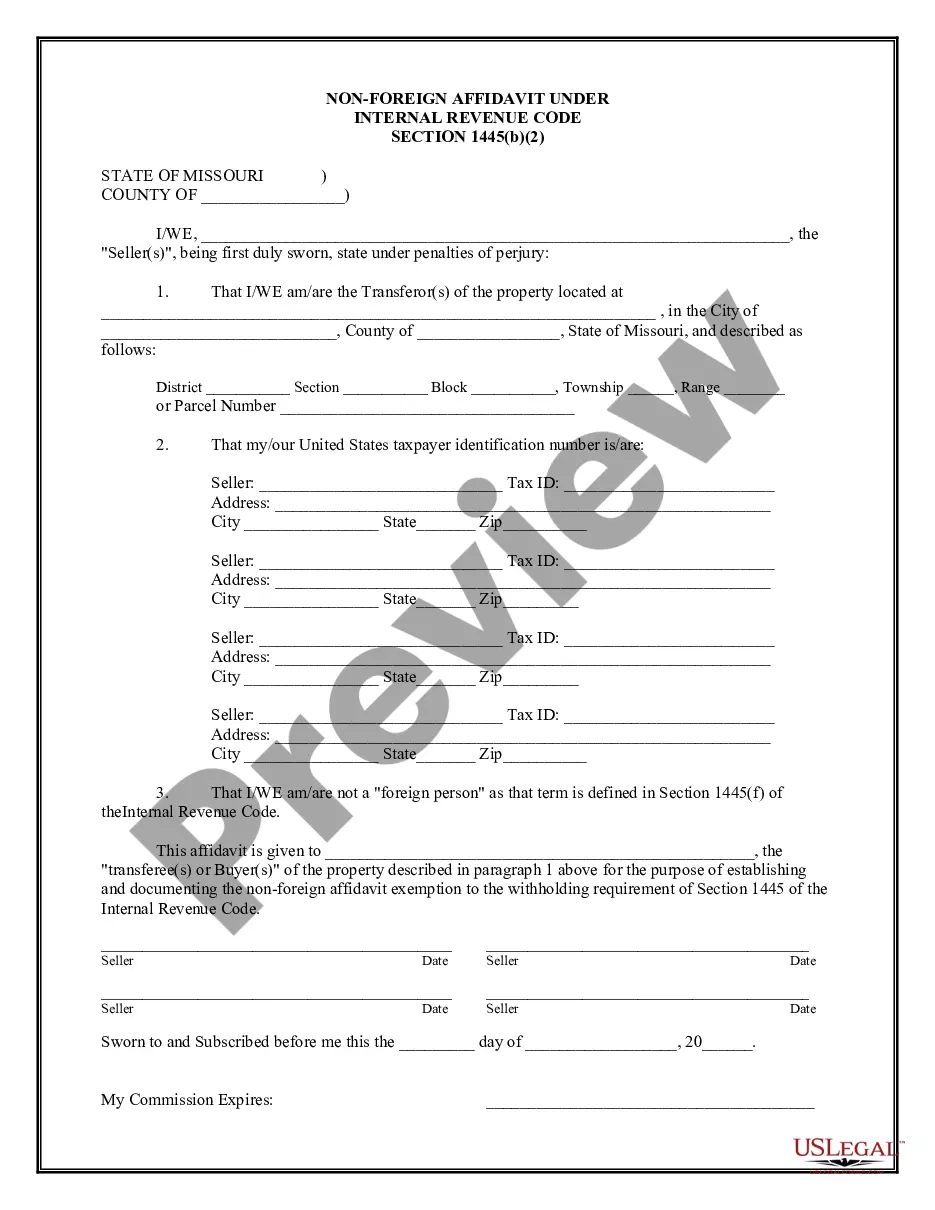

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Missouri Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Missouri Non-Foreign Affidavit Under IRC 1445?

Get any form from 85,000 legal documents including Missouri Non-Foreign Affidavit Under IRC 1445 on-line with US Legal Forms. Every template is drafted and updated by state-licensed legal professionals.

If you already have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the steps below:

- Check the state-specific requirements for the Missouri Non-Foreign Affidavit Under IRC 1445 you need to use.

- Read through description and preview the template.

- As soon as you’re confident the template is what you need, click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by bank card or via PayPal.

- Select a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have instant access to the proper downloadable sample. The platform provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to obtain your Missouri Non-Foreign Affidavit Under IRC 1445 easy and fast.

Form popularity

FAQ

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.If the law applies to your purchase, then within 20 days of the sale, you are required to file Form 8288 with the IRS.

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.