The dissolution package contains all forms to dissolve a LLC or PLLC in Missouri, step by step instructions, addresses, transmittal letters, and other information.

Missouri Dissolution Package to Dissolve Limited Liability Company LLC

Description How To Close An Llc In Missouri

How to fill out Missouri Dissolution Of Llc Papers Forms?

Have any template from 85,000 legal documents such as Missouri Dissolution Package to Dissolve Limited Liability Company LLC on-line with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you have a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Missouri Dissolution Package to Dissolve Limited Liability Company LLC you would like to use.

- Look through description and preview the sample.

- When you’re sure the template is what you need, click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in one of two appropriate ways: by bank card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The platform gives you access to forms and divides them into groups to streamline your search. Use US Legal Forms to obtain your Missouri Dissolution Package to Dissolve Limited Liability Company LLC fast and easy.

How To End An Llc In Missouri Form popularity

Limited Liability Company Other Form Names

Dissolution Limited Company FAQ

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.That owner may want to keep the business in the hopes of relaunching it but doesn't want to put any time or expenses into it. The business becomes inactive.

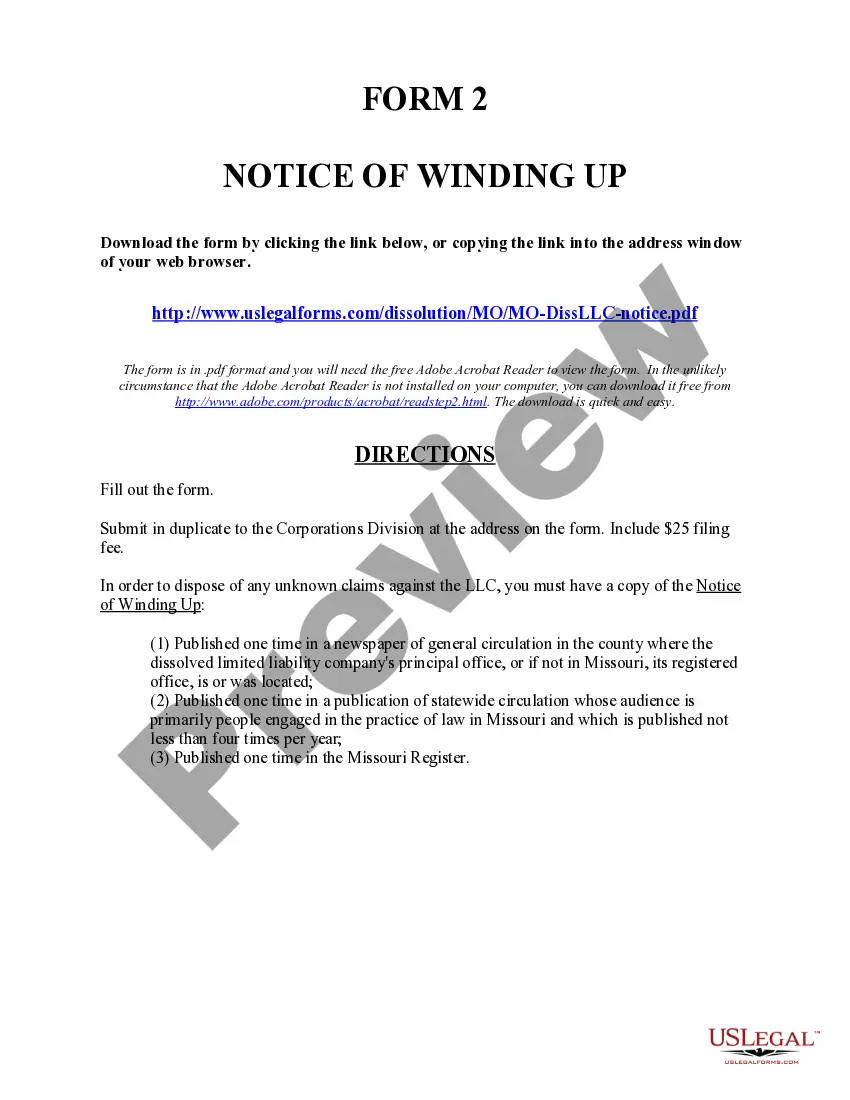

In Missouri, you must first file a Notice of Winding Up to inform the state that you are in the process of ending your business. Then, once you wind up your LLC, you must file the Articles of Termination. Both forms are $25. Missouri requires business owners to submit their Articles of Termination" by mail or online.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

If you are a member of a limited liability company and wish to leave the membership voluntarily, you cannot simply walk away. There are procedures to follow that include methods of notification of the remaining membership, how assets are handled, and what the provisions of withdrawal are for each LLC.

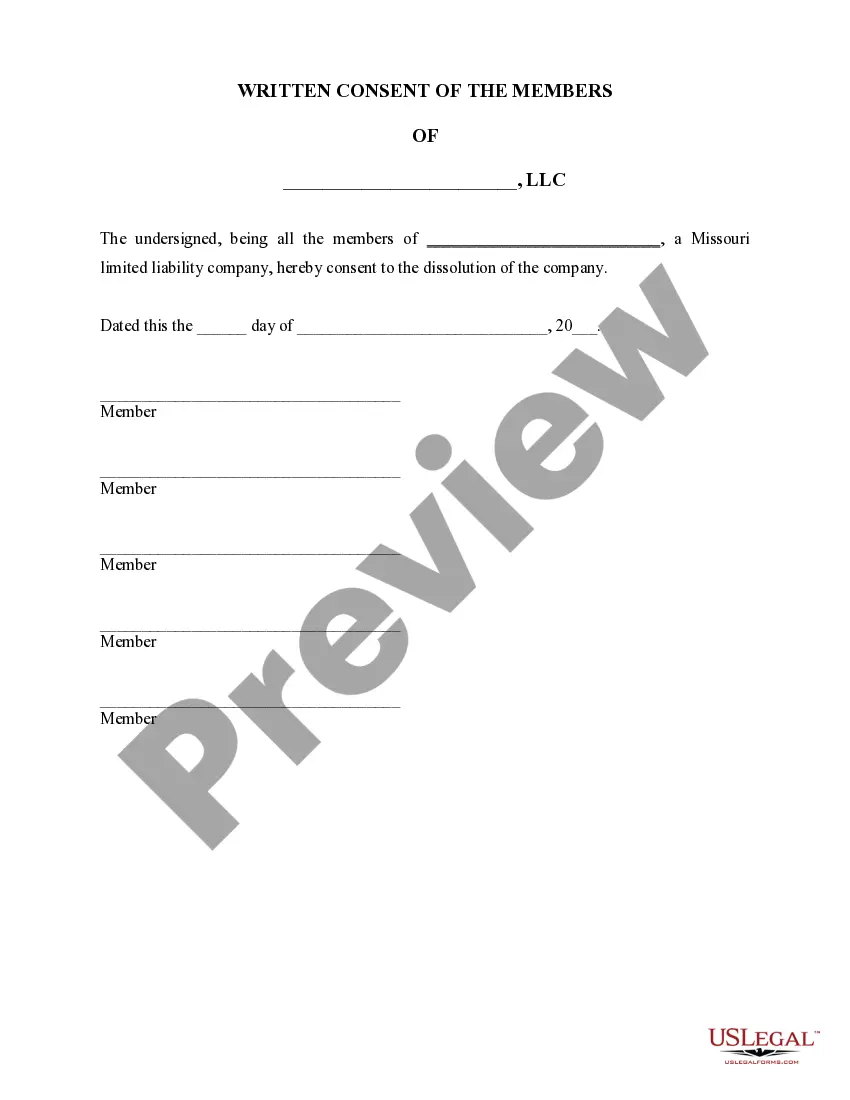

As long as you're willing to continue paying for the LLC, you can hold onto it as long as you need to.To dissolve it, each member must agree to terminate the business and submit an individual statement of dissolution to the Secretary of State for whatever state the LLC was organized in.