Missouri Release and Authorization is a form that is used to authorize the release of confidential information from an individual or business. This form is required by the Missouri Department of Revenue (FOR) in order to process a taxpayer’s request for an individual or business tax return, or other confidential information. There are two types of Missouri Release and Authorization forms: the Authorization to Release Tax Return Information (Form 149) and the Authorization to Release Personal Information (Form 150). Form 149 allows a taxpayer to authorize the release of their tax return information to a third party, such as an accountant or attorney, while Form 150 allows them to authorize the release of their personal information to a third party. Both forms require the taxpayer’s signature, the signature of the person to whom the information is to be released, and the date when the form is signed.

Missouri Release and Authorization

Description

How to fill out Missouri Release And Authorization?

US Legal Forms is the simplest and most lucrative method to find suitable legal templates.

It’s the most comprehensive online collection of business and personal legal documents created and verified by legal experts.

Here, you can discover printable and fillable forms that adhere to national and local laws - just like your Missouri Release and Authorization.

Examine the form description or preview the document to ensure you’ve found the one that matches your needs, or search for another one using the search bar above.

Click Buy now when you’re confident of its suitability with all the criteria, and choose the subscription plan you prefer the most.

- Acquiring your template involves just a few easy steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the document onto their device.

- Afterward, they can locate it in their profile under the My documents section.

- And here’s how you can secure a properly prepared Missouri Release and Authorization if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

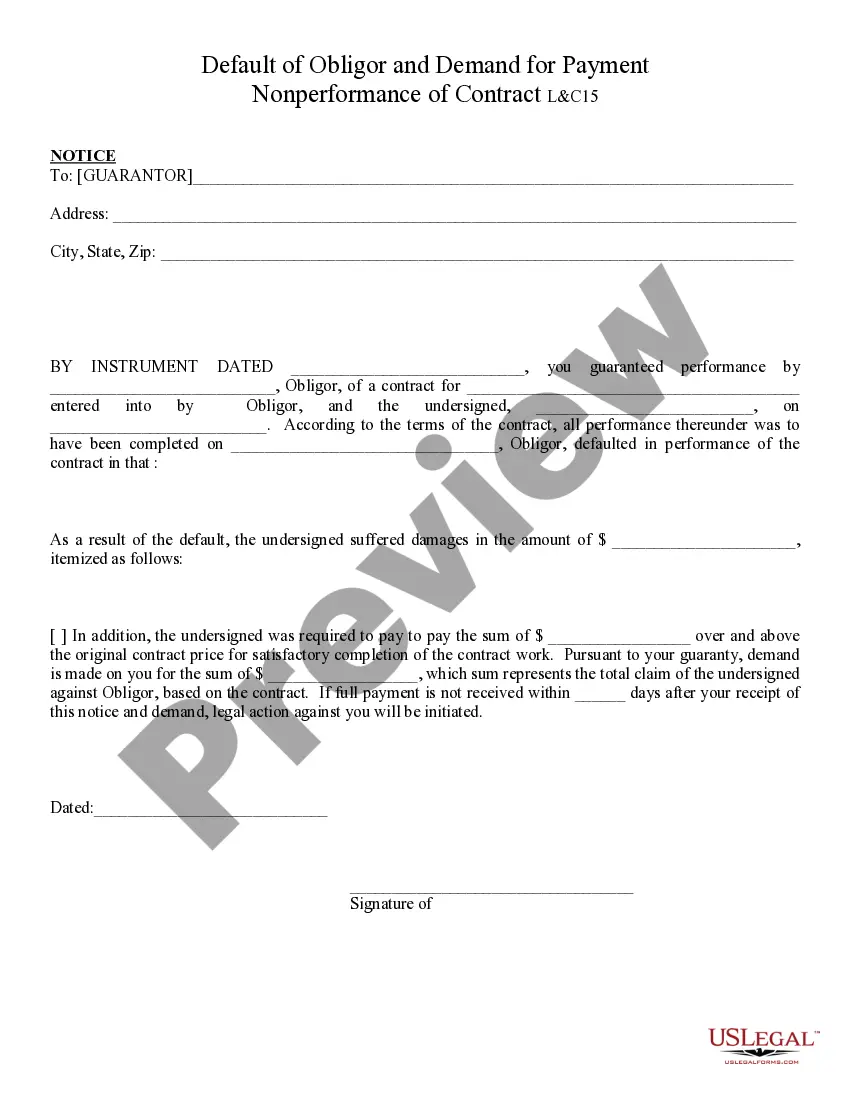

To obtain a lien release in Missouri, you need to gather the necessary documentation, such as proof of payment or fulfillment of the obligation. Submit a written request to the lienholder, asking for the release. Utilizing the Missouri Release and Authorization process can streamline this procedure. US Legal Forms provides templates and guidance to help you draft the appropriate request and ensure compliance with state laws.

Yes, Missouri Medicaid often requires prior authorization for certain services and procedures. This means you must obtain approval before receiving specific medical treatments or services to ensure coverage. Understanding the Missouri Release and Authorization process can help you navigate these requirements efficiently. For more guidance, US Legal Forms offers resources to assist you in preparing the necessary documentation.

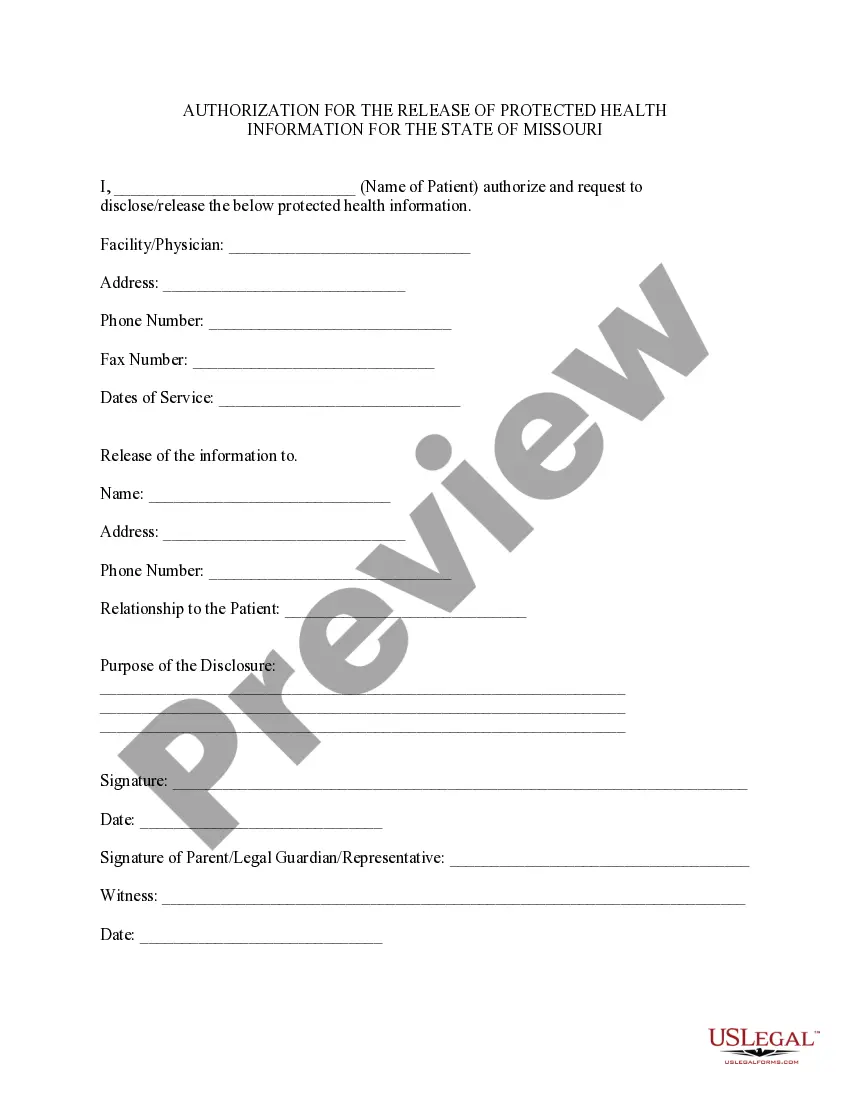

To fill out an authorization for release of information, start by identifying the specific information you want released. Clearly state who is authorized to release this information and to whom it should be sent. Ensure you include your contact information and signature, which validates the Missouri Release and Authorization. For a seamless process, consider using US Legal Forms to access pre-made templates tailored for your needs.

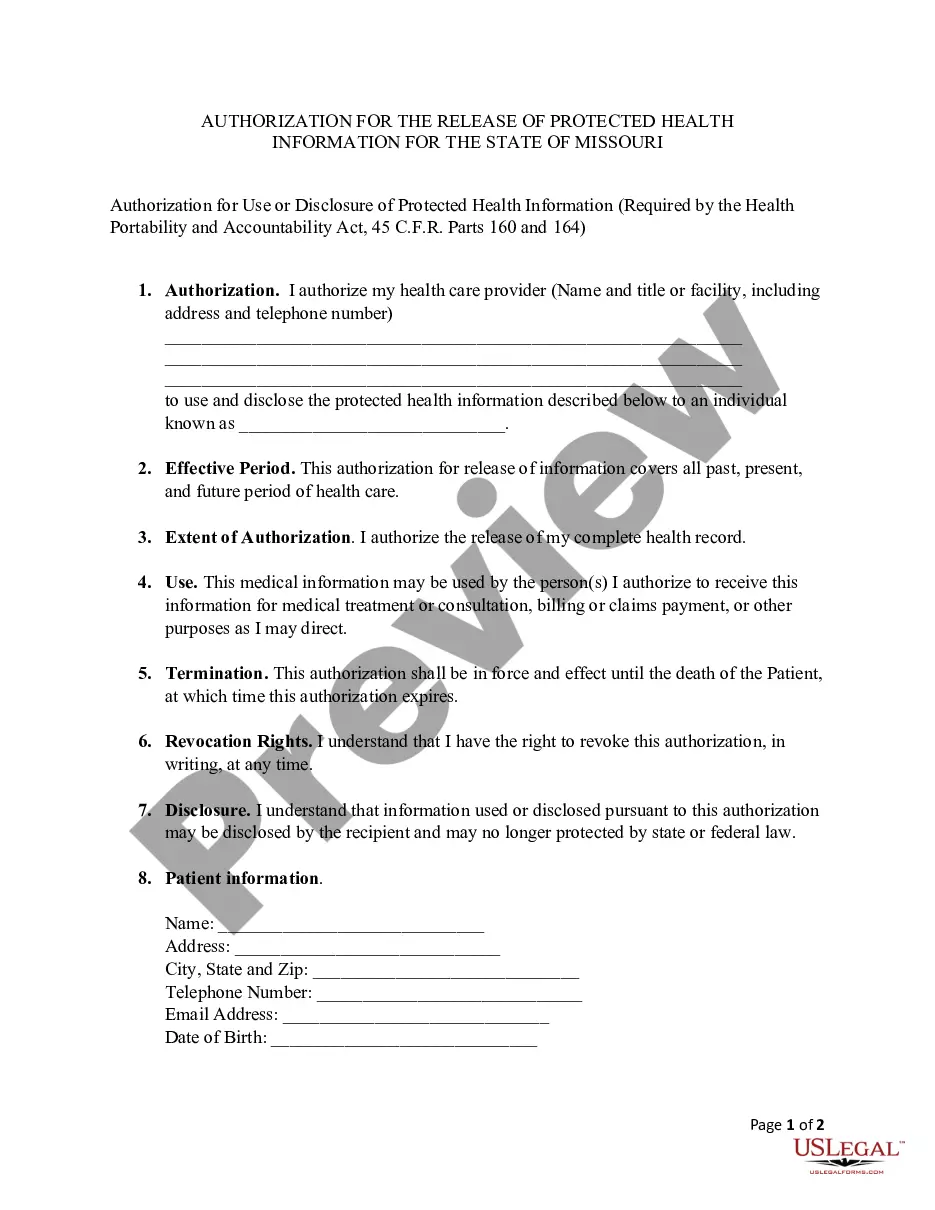

HIPAA Authorization is a document that authorizes the release of medical records which are protected under HIPAA. The authorization names designated representatives who may receive protected medical records, despite the privacy protections of HIPAA. HIPAA is an important piece of legislation.

A: ?Consent? is a general term under the Privacy Rule, but ?authorization? has much more specific requirements. The Privacy Rule permits, but does not require, a CE to obtain patient ?consent? for uses and disclosures of PHI for treatment, payment, and healthcare operations.

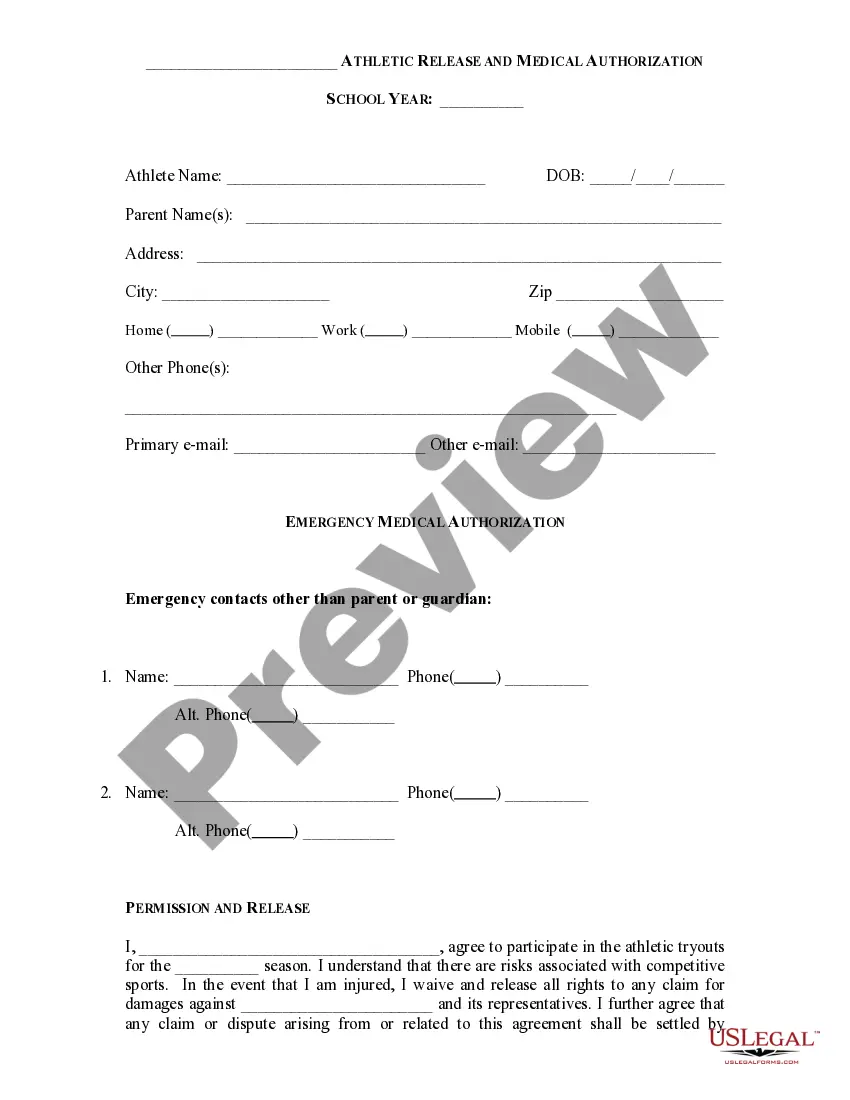

By setting up a Release Authorization (ARI), you are giving customer service your permission to disclose information about your accounts to another person. Typically, this is used to give account access to a spouse or other family member.

Authorization for release of information means the form prescribed by the agency for the purpose of authorizing the release of a confidential record, signed and dated by the person empowered to release the information.

The medical record information release (HIPAA) form allows a patient to give authorization to a 3rd party and access their health records.

Under the HIPAA Privacy Rule, healthcare providers, health plans, business associates, and others involved in administration of healthcare, may not share a patient's protected health information (PHI) without that patient's written authorization.

Under HIPAA, your site must retain the authorization for at least six years after the subject has signed it. Covered entities may use or disclose health information that is de-identified without restriction under the Privacy Rule.