Missouri Release of Temporary Easement Agreement

Description

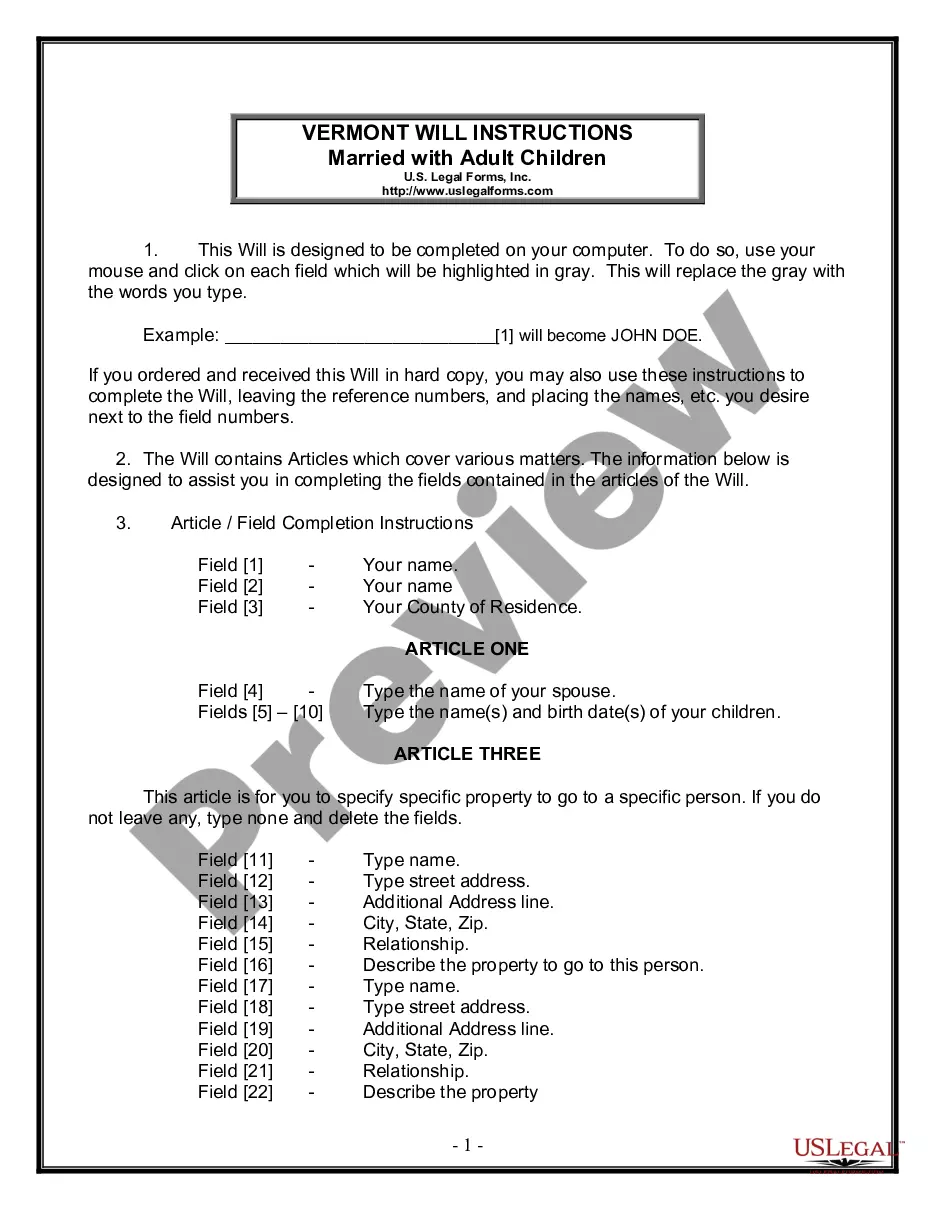

How to fill out Missouri Release Of Temporary Easement Agreement?

Have any template from 85,000 legal documents including Missouri Unimproved Land Sales Agreement online with US Legal Forms. Every template is prepared and updated by state-licensed attorneys.

If you have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Missouri Unimproved Land Sales Agreement you need to use.

- Look through description and preview the sample.

- When you’re sure the template is what you need, click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by bank card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the proper downloadable template. The platform provides you with access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Missouri Unimproved Land Sales Agreement fast and easy.

Form popularity

FAQ

If a seller defaults, he must return all deposits, plus added reasonable expenses, to the buyer. The other party may also seek to compel the erring party to complete the deal under specific performance. From a buyer's point of view, it is advisable to get the sale agreement registered.

Just go to the Missouri page, find your city, and create a "real estate by owner" listing. FSBO websites: There are multiple FSBO listing websites that allow you to post your home for free or a few hundred dollars.

But, there are 12 states that are still considered non-disclosure: Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming. In a non-disclosure state, transaction sale prices are not available to the public.

Seller's Disclosure Statement for Residential Property (Form DSC-8000) Unlike most states, Missouri does not require the sellers of real estate to disclose information regarding a property's condition. Nonetheless, completing and providing a disclosure statement can help reassure potential buyers.

If a seller is actually breaching a contract and you can prove you have been financially damaged, you could sue. However, the amount you can sue for depends on the law in your individual state.With that said, if you can show the seller acted in bad faith, your state may allow you to seek additional damages.

Backing out of a home sale can have costly consequences A home seller who backs out of a purchase contract can be sued for breach of contract. A judge could order the seller to sign over a deed and complete the sale anyway. The buyer could sue for damages, but usually, they sue for the property, Schorr says.

Monetary Damages If the Seller decides to breach the contract and keep their home, they may do so, but the court may order the Buyer receive money for the resulting breach. Generally, the money owed to Buyer may include reimbursing the Buyer with: The buyer's temporary housing costs.

But unlike buyers, sellers can't back out and forfeit their earnest deposit money (usually 1-3 percent of the offer price). If you decide to cancel a deal when the home is already under contract, you can be either legally forced to close anyway or sued for financial damages.

It is common in Missouri for the title company closing on behalf of Buyers to hold the earnest money deposit. For the title company to release the earnest money prior to closing or in a failed deal, both Buyers and Sellers generally need to agree in writing to this.