Missouri Performance Bond and Payment Bond

Description Difference Between Payment And Performance Bond

contract within its set terms and conditions.

The surety is in effect co-signing the contract

How to fill out Performance Bonds In Construction?

Have any template from 85,000 legal documents including Missouri Performance Bond and Payment Bond on-line with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have already a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Missouri Performance Bond and Payment Bond you want to use.

- Read description and preview the template.

- Once you are confident the sample is what you need, simply click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the right downloadable sample. The platform will give you access to documents and divides them into groups to simplify your search. Use US Legal Forms to obtain your Missouri Performance Bond and Payment Bond easy and fast.

Payment Bond Form popularity

Performance Bond Construction Other Form Names

Peformance Bond FAQ

A performance bond is another type of surety bond guaranteeing that a contractor will complete a project to the satisfaction of the project owner. Performance bonds protect against failure to complete the project, defects in workmanship, code violations by the contractor, or contractor bankruptcy.

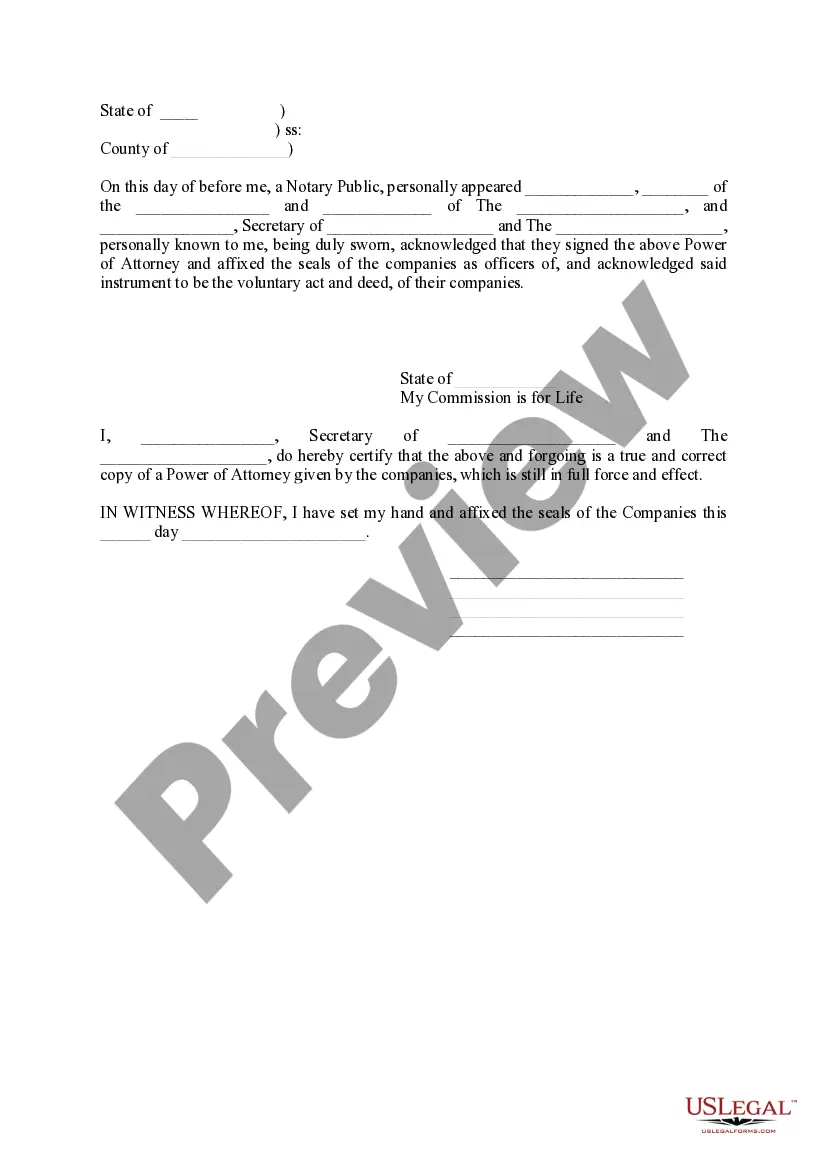

The Performance Bond secures the contractor's promise to perform the contract in accordance with its terms and conditions, at the agreed upon price, and within the time allowed. The Payment Bond protects certain laborers, material suppliers and subcontractors against nonpayment.

A performance bond provides assurance that the obligee will be protected if the principal fails to perform the bonded contract. If the obligee declares the principal in default and terminates the contract, it can call on the surety to meet the surety's obligations under the bond.

The cost of a performance bond usually is less than 1% of the contract price; however, if the contract is under $1 million, the premium may run between 1% and 2%. Bonds may be more costly, depending upon the credit-worthiness of the contractor. Labor and material payment bonds are companions to the performance bond.

The cost of a performance bond usually is less than 1% of the contract price; however, if the contract is under $1 million, the premium may run between 1% and 2%. Bonds may be more costly, depending upon the credit-worthiness of the contractor. Labor and material payment bonds are companions to the performance bond.

Performance bonds are typically provided by a financial institution such as a bank or an insurance company. The bond would be paid for by the party providing the services under the agreement. Performance bonds are common in industries like construction and real estate development.

Performance bonds and surety bonds are the same type of instrument, used to help define business contracts when an owner wants to hire a contractor to do specific work. In general, "surety bond" is a term used to describe all such bonds, while "performance bond" is used to describe a specific type of surety bond.

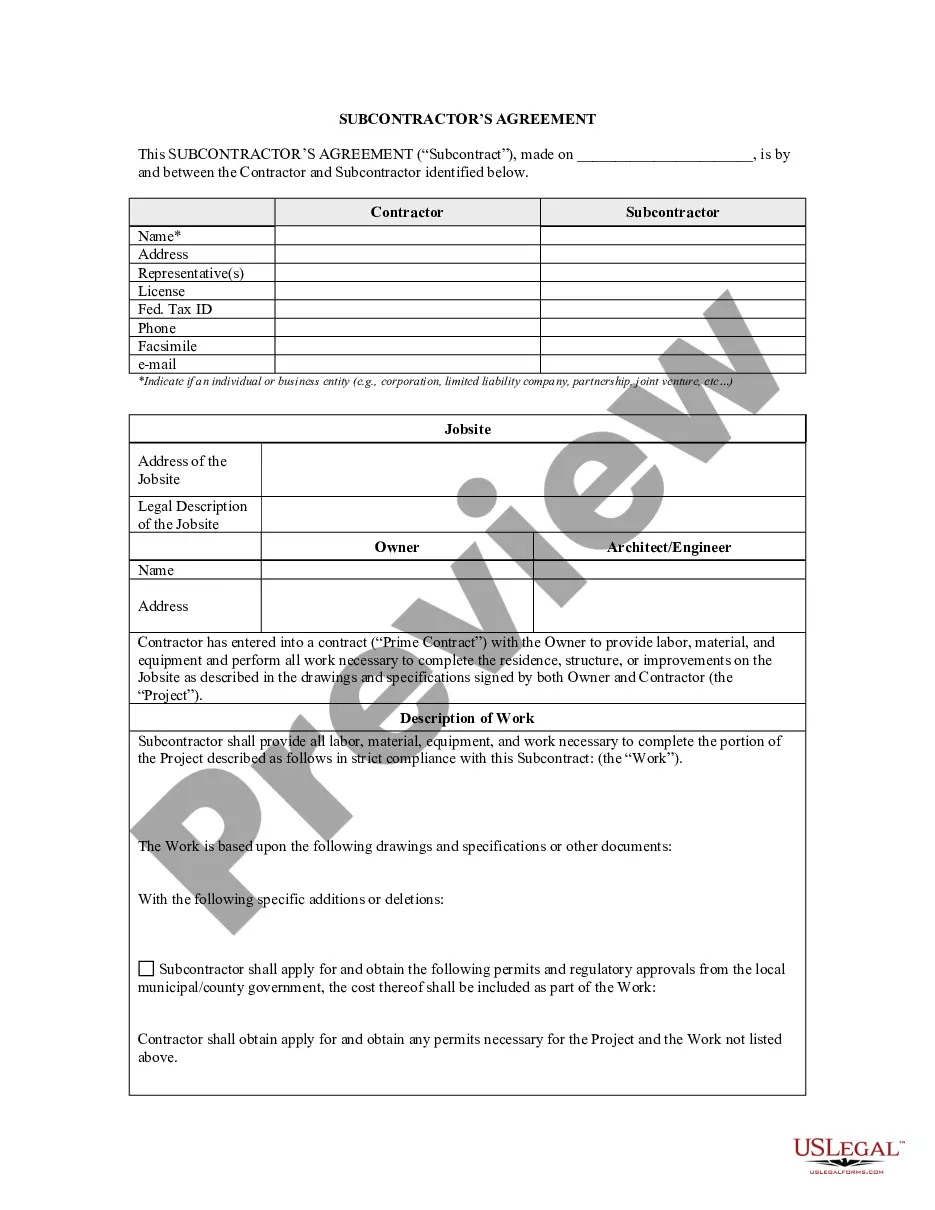

In most cases, a contractor will need to obtain both a payment bond and a performance bond. In these cases, the contractor will often purchase payment and performance bonds together in a so-called P&P bond package. The contractor will apply for a surety bond premium quote through a surety or surety bond broker.

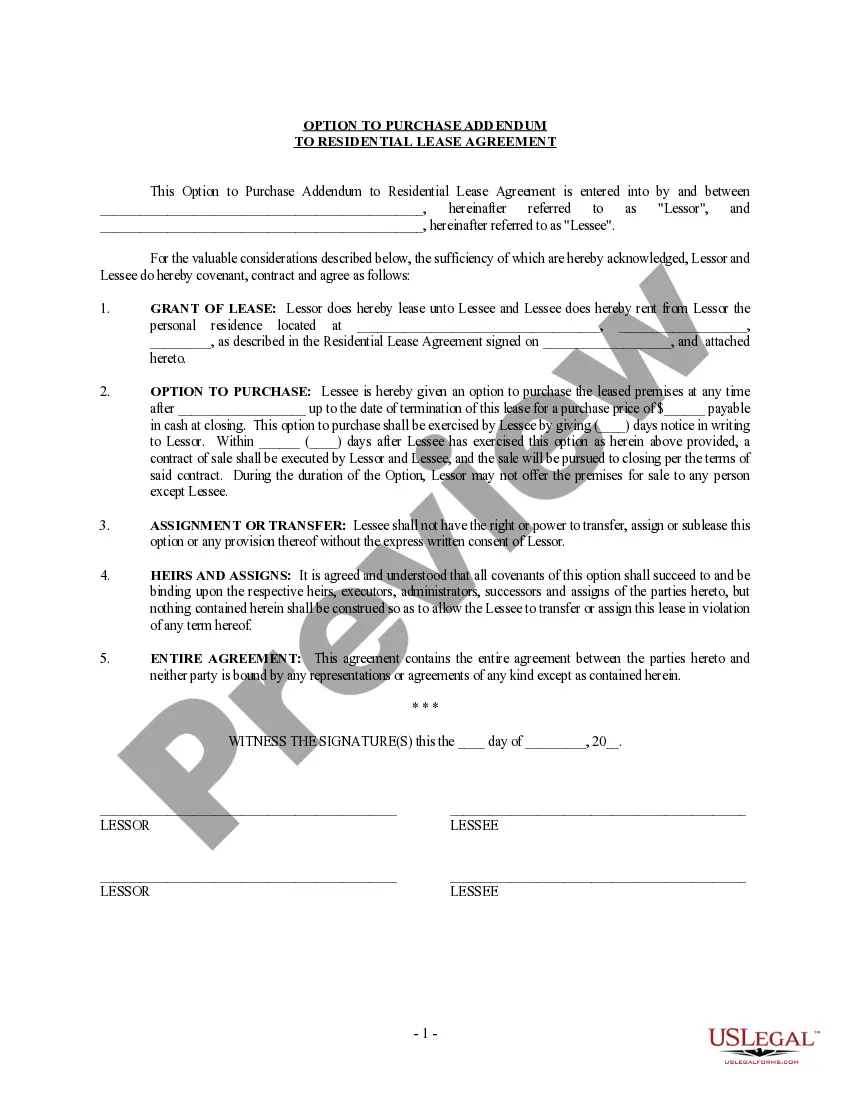

Significant payment and performance protection can be achieved with 100% performance and payment bonds. The full contract value is available to cover the excess costs of contract completion and, in most instances, an additional 100% of the contract value is available to pay the claims of subcontractors and suppliers.