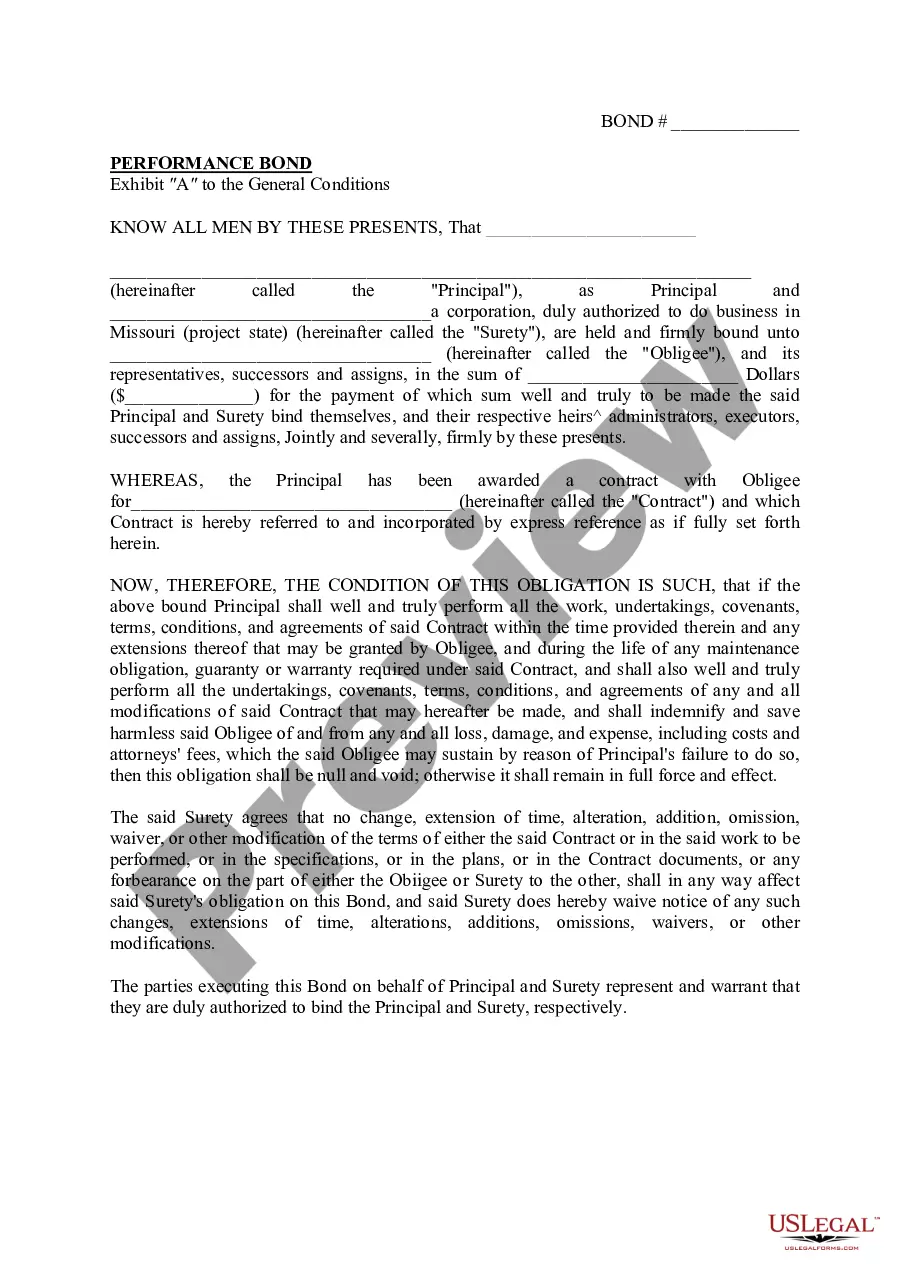

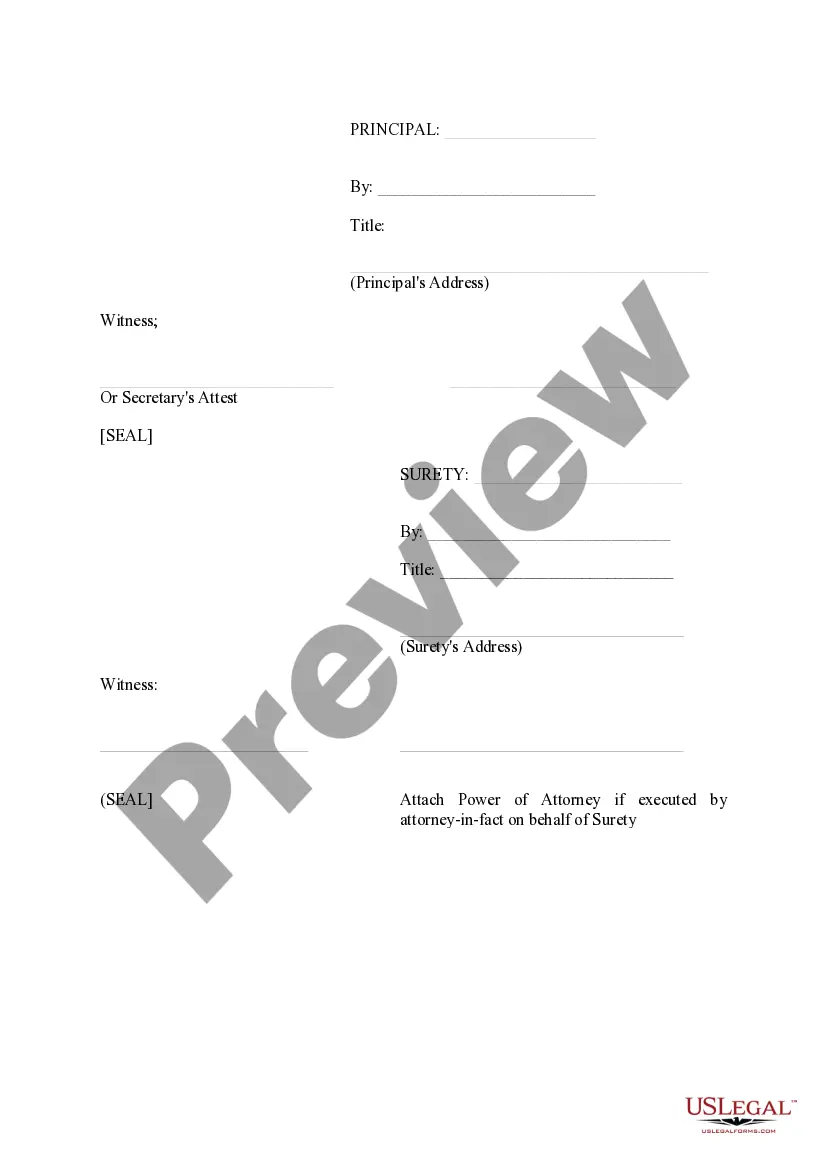

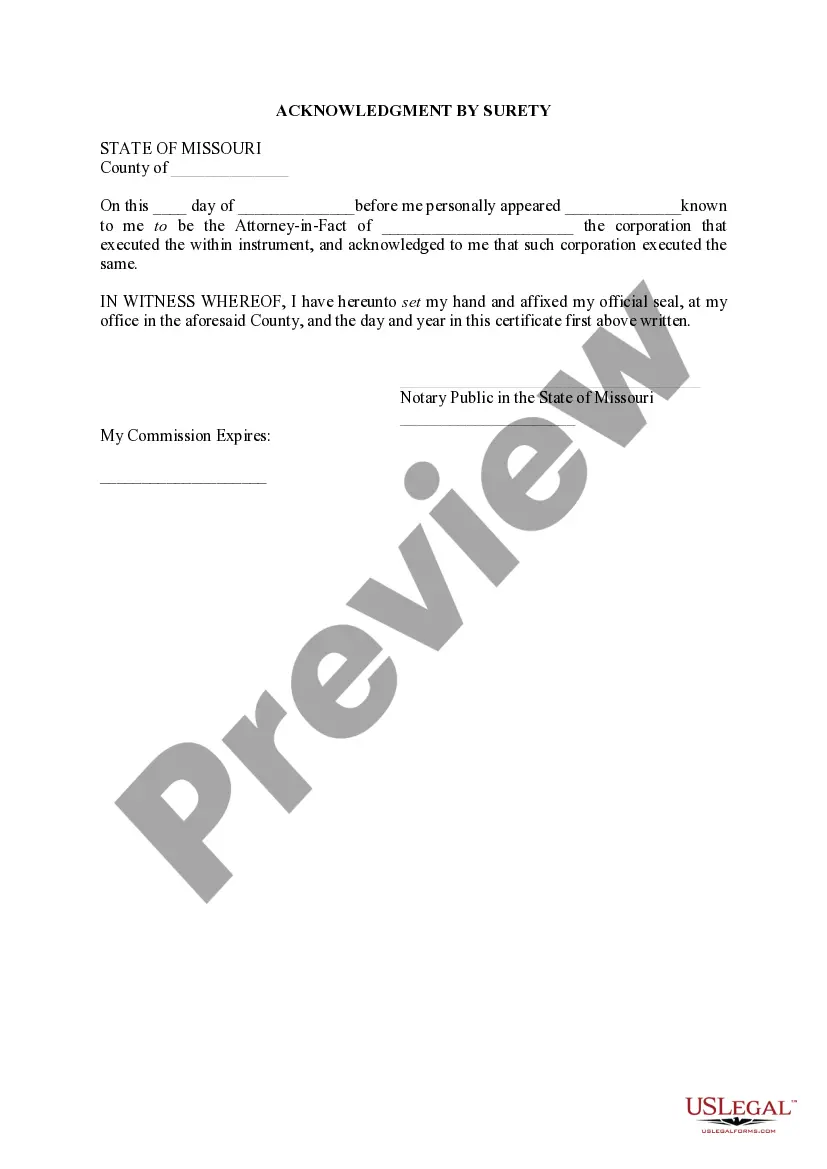

Missouri Performance Bond

Description

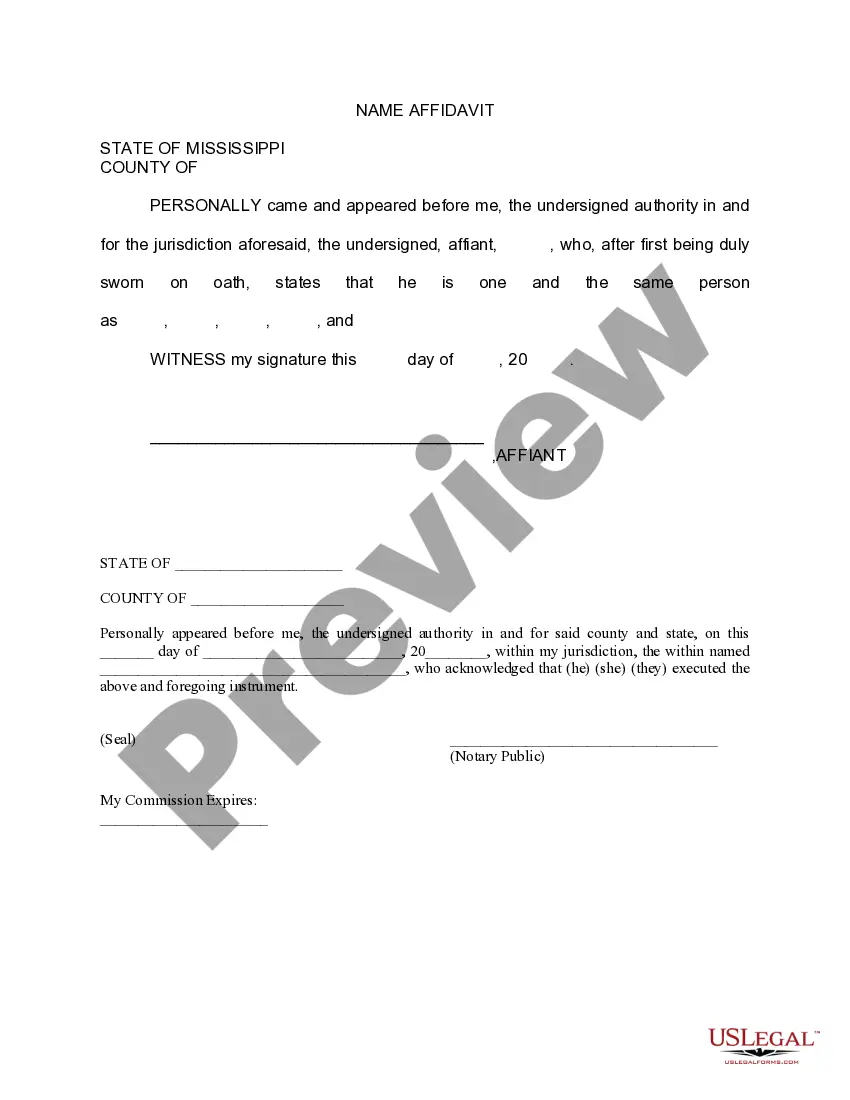

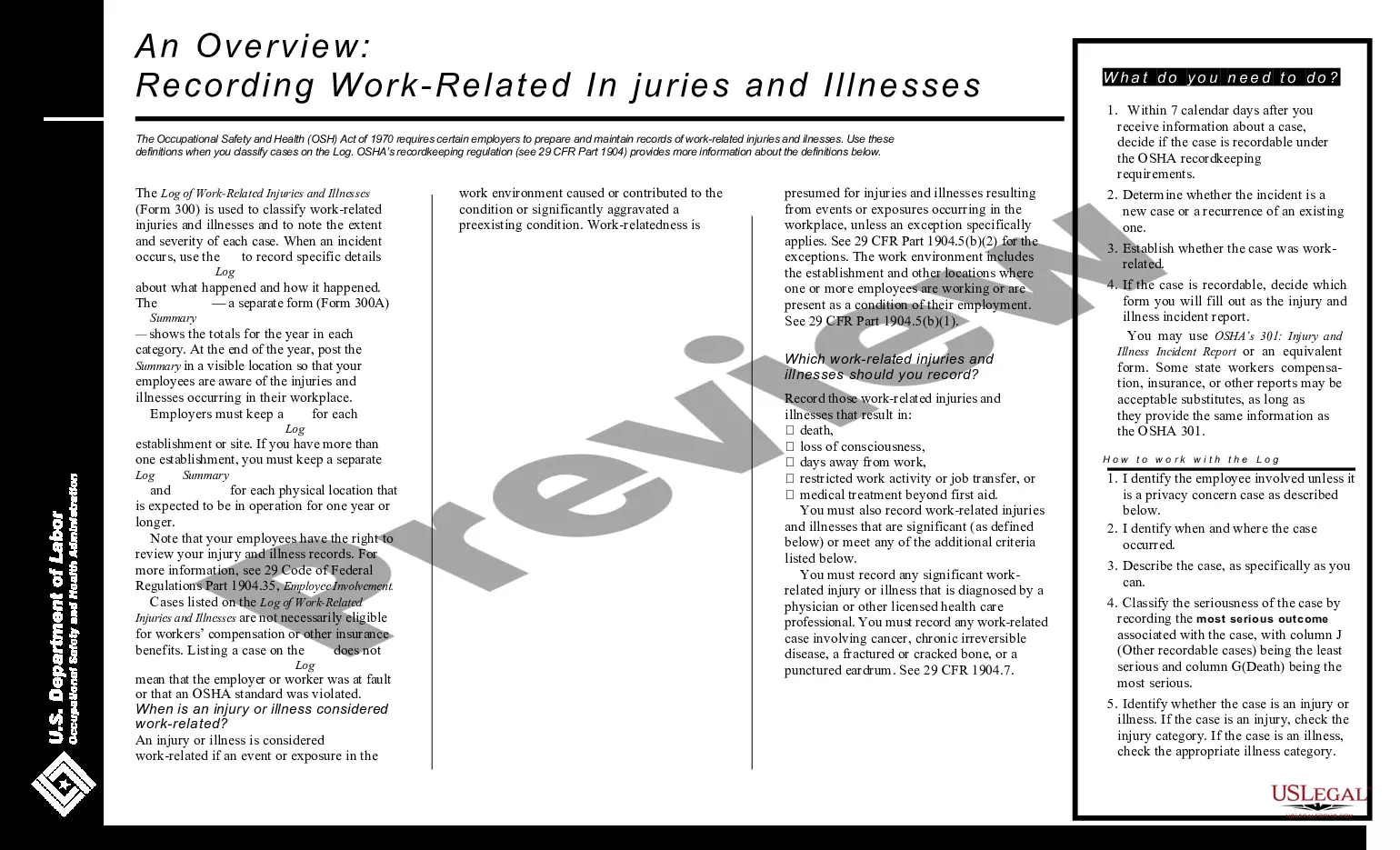

How to fill out Missouri Performance Bond?

Have any template from 85,000 legal documents including Missouri Performance Bond online with US Legal Forms. Every template is drafted and updated by state-certified attorneys.

If you already have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Missouri Performance Bond you need to use.

- Look through description and preview the sample.

- Once you are confident the template is what you need, just click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by bank card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the proper downloadable sample. The platform will give you access to documents and divides them into groups to streamline your search. Use US Legal Forms to obtain your Missouri Performance Bond fast and easy.

Form popularity

FAQ

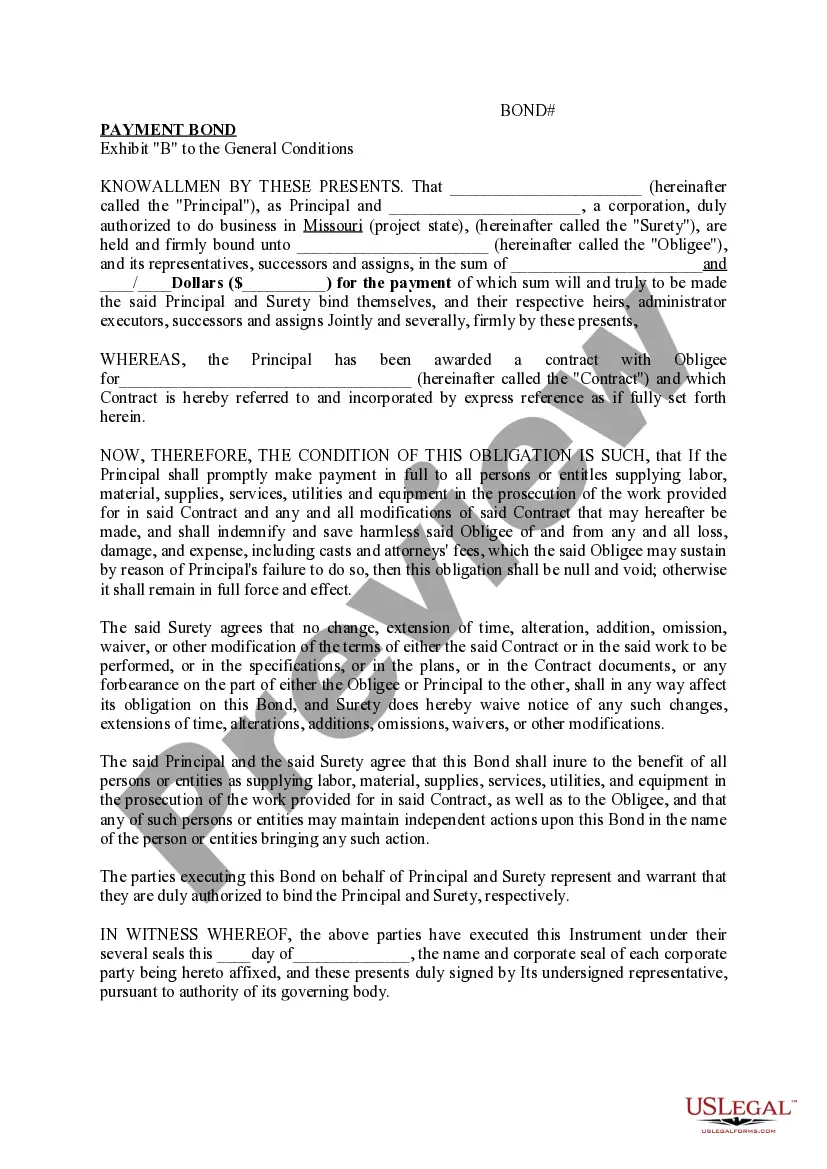

Generally, bond costs are a percentage of the annual amount of the bond that you require. Percentage costs range from 1 -15% of the total bond cost. The rate you pay is based on your personal credit score. A $20,000 bond at a 1% rate will cost you $200, while the same bond at a 15% rate will cost you $3,000.

Performance bonds are typically provided by a financial institution such as a bank or an insurance company. The bond would be paid for by the party providing the services under the agreement. Performance bonds are common in industries like construction and real estate development.

On average, the cost for a surety bond falls somewhere between 1% and 15% of the bond amount. That means you may be charged between $100 and $1,500 to buy a $10,000 bond policy. Most premium amounts are based on your application and credit health, but there are some bond policies that are written freely.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract.A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

The Missouri notary bond is a $10,000 bond and is valid throughout your 4-year notary commission in the State of Missouri.

Collect the funds owed from the performance bond from the bank or brokerage house holding the bond. You may obtain a cashier's check or request a wire transfer into a designated account.

To get your surety bond, you just need to pay and sign an indemnity agreement. Most companies will allow you to pay online. You only need to pay one time for your bond. The only time you would need to pay monthly for your bond is if you choose to finance your bond.

Your Missouri Notary Surety Bond. Missouri law requires all Notaries to purchase and maintain a $10,000 Notary surety bond for the duration of their 4-year commission.

A Missouri surety bond shows your customers that your business complies with state and federal laws and that you can be trusted to follow through, both legally and financially. If you fail to fullfill your obligations, someone can make a claim against your surety bond.