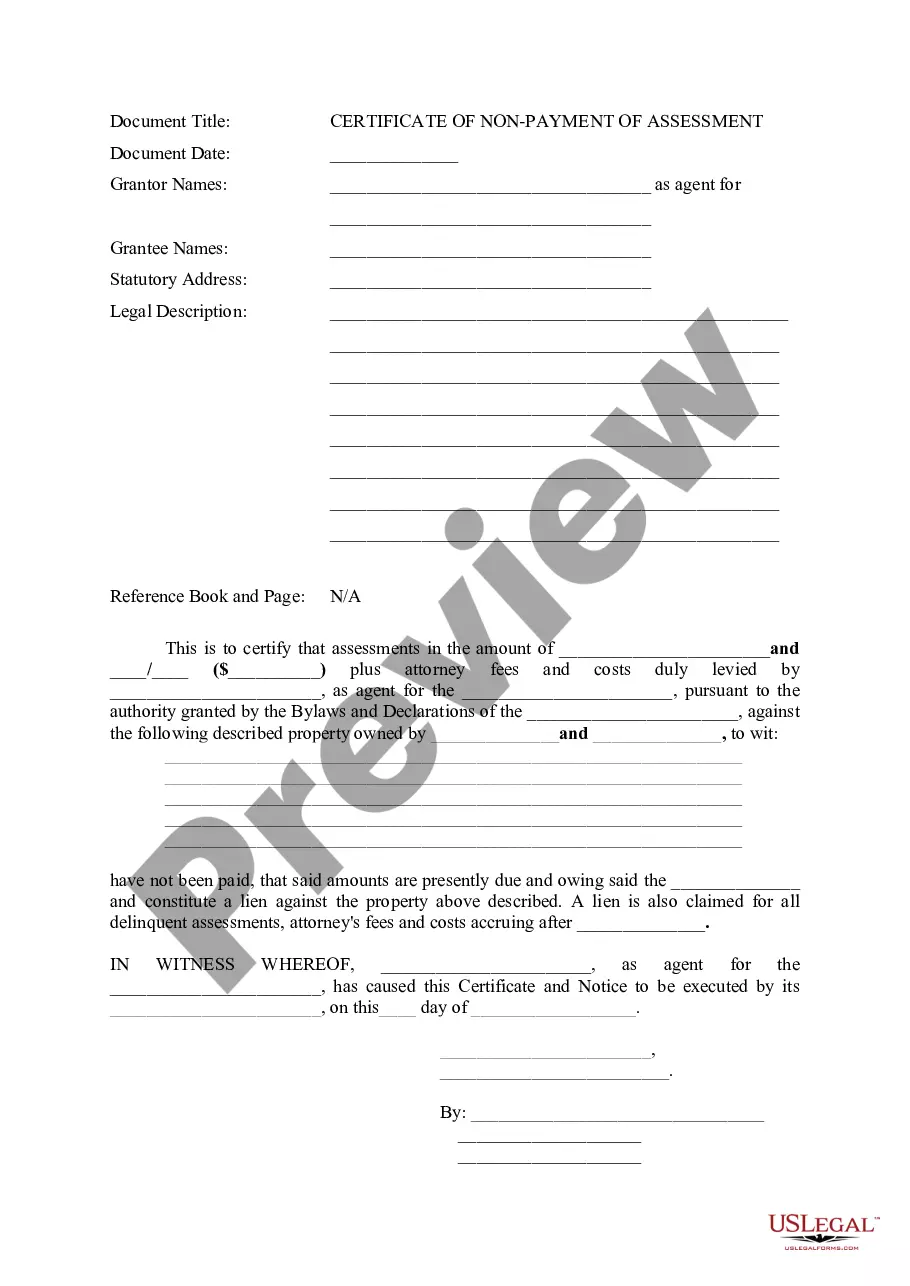

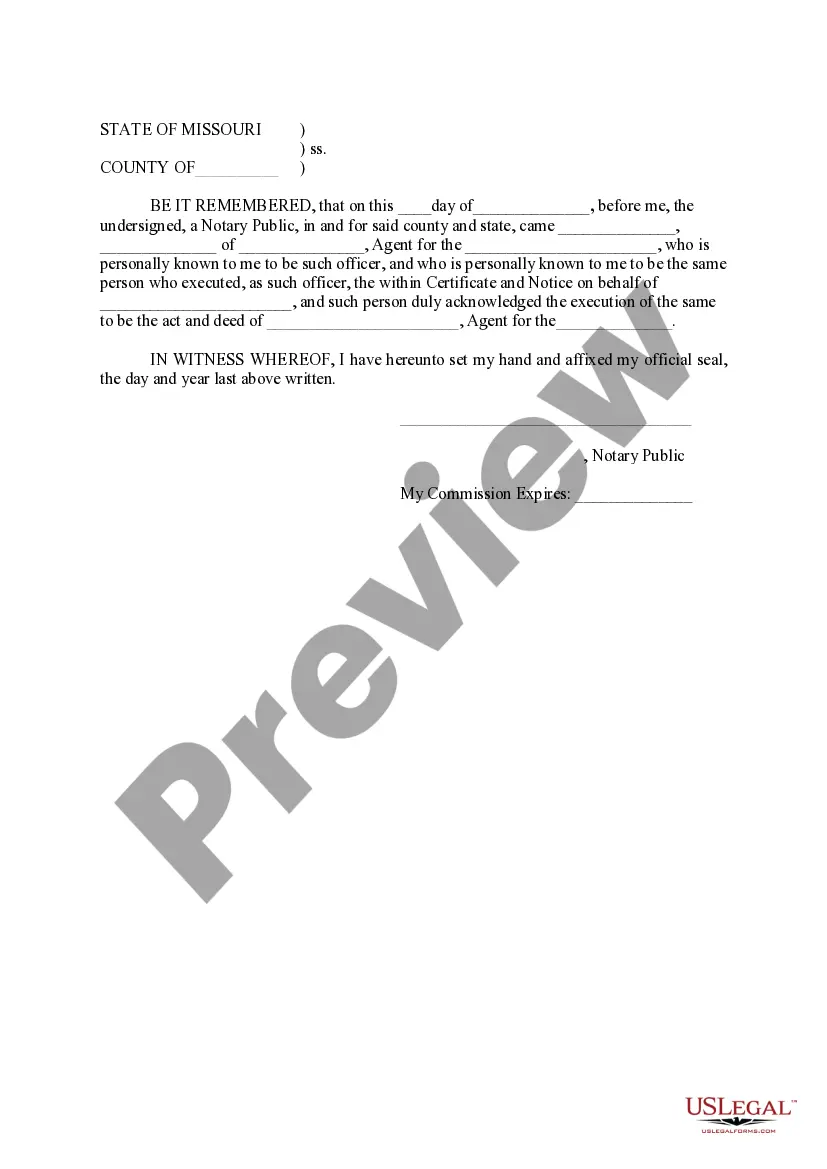

Missouri Certificate of Non-Payment of Assessment

Description Letter Of Closure Bir Job Order

How to fill out Letter Request For Business Closure?

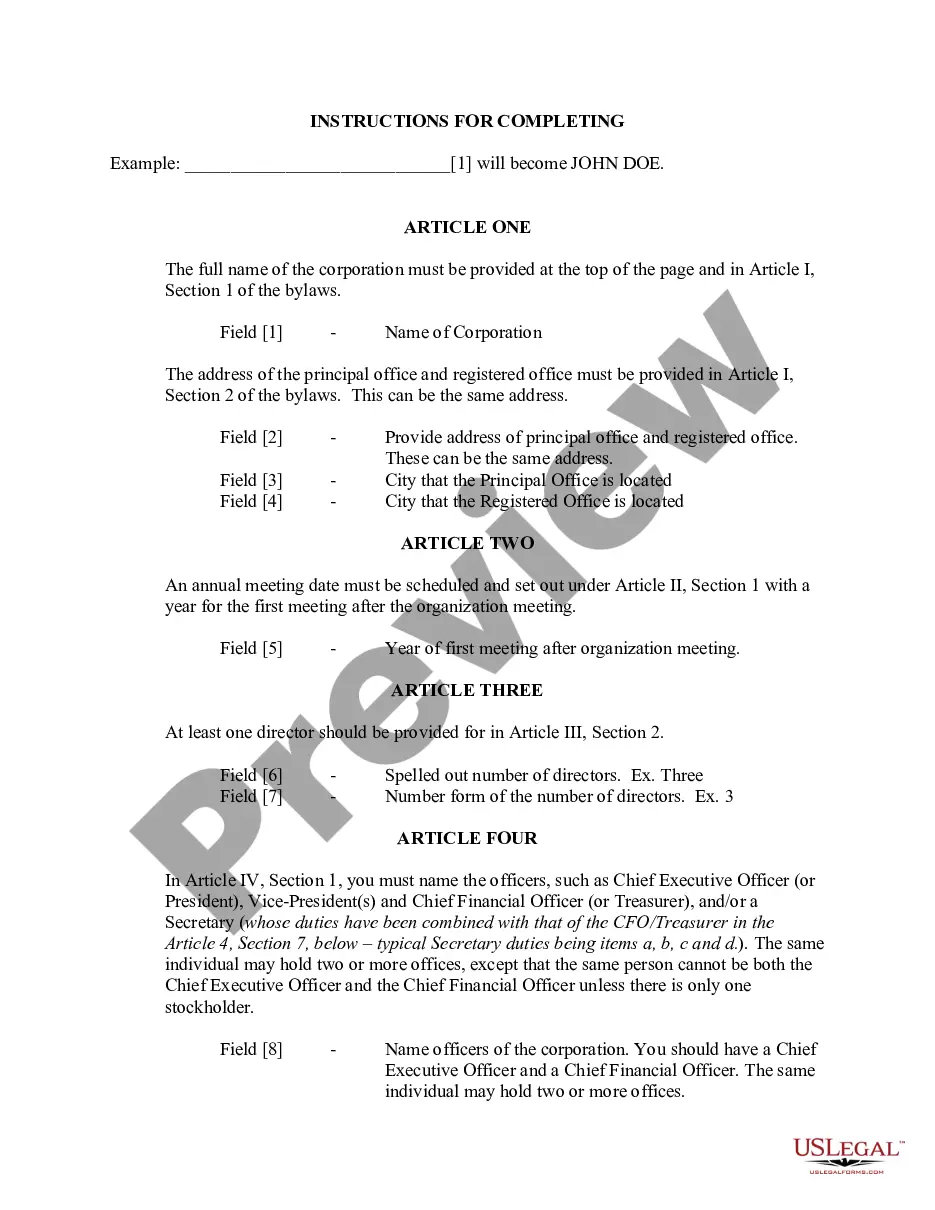

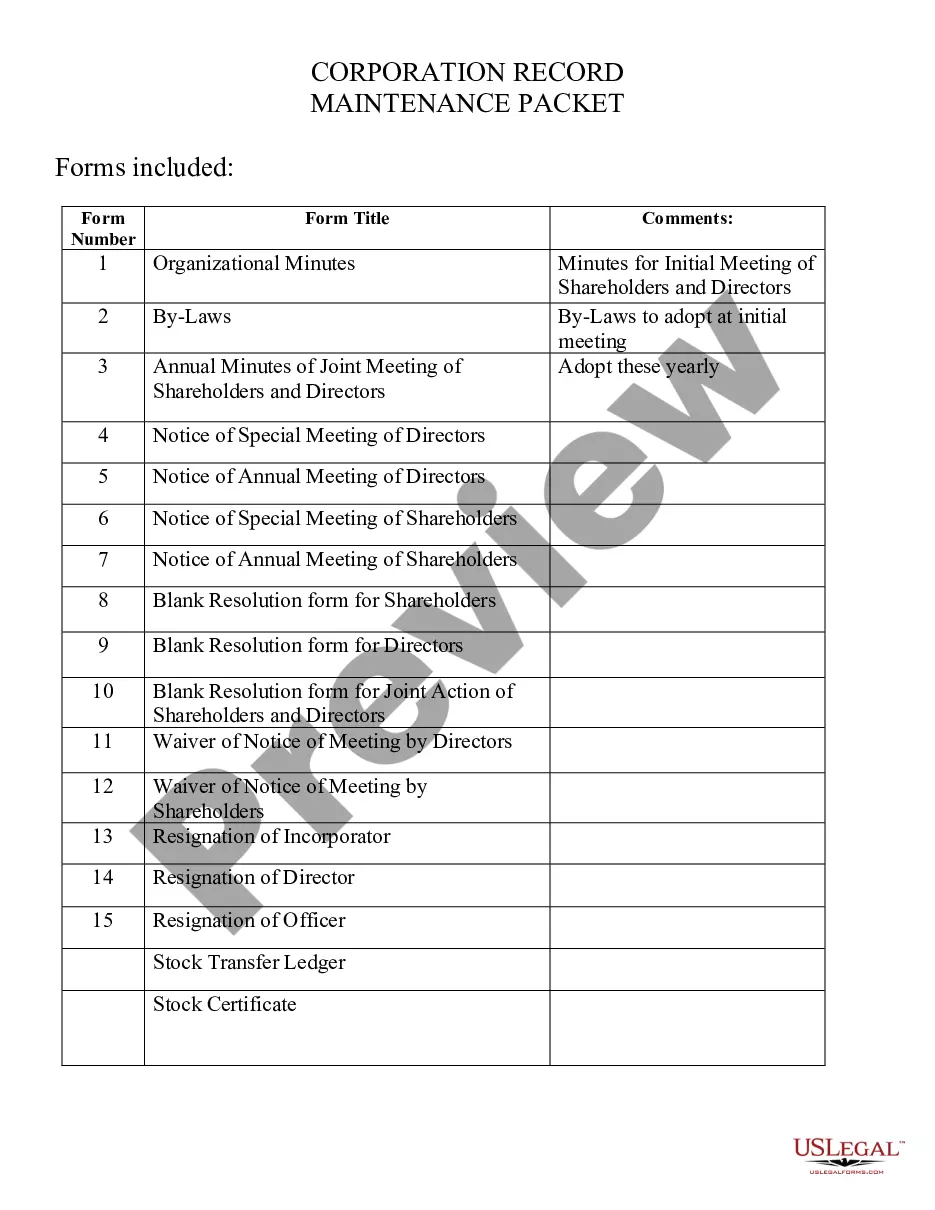

Have any template from 85,000 legal documents such as Missouri Certificate of Non-Payment of Assessment on-line with US Legal Forms. Every template is prepared and updated by state-accredited attorneys.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the tips listed below:

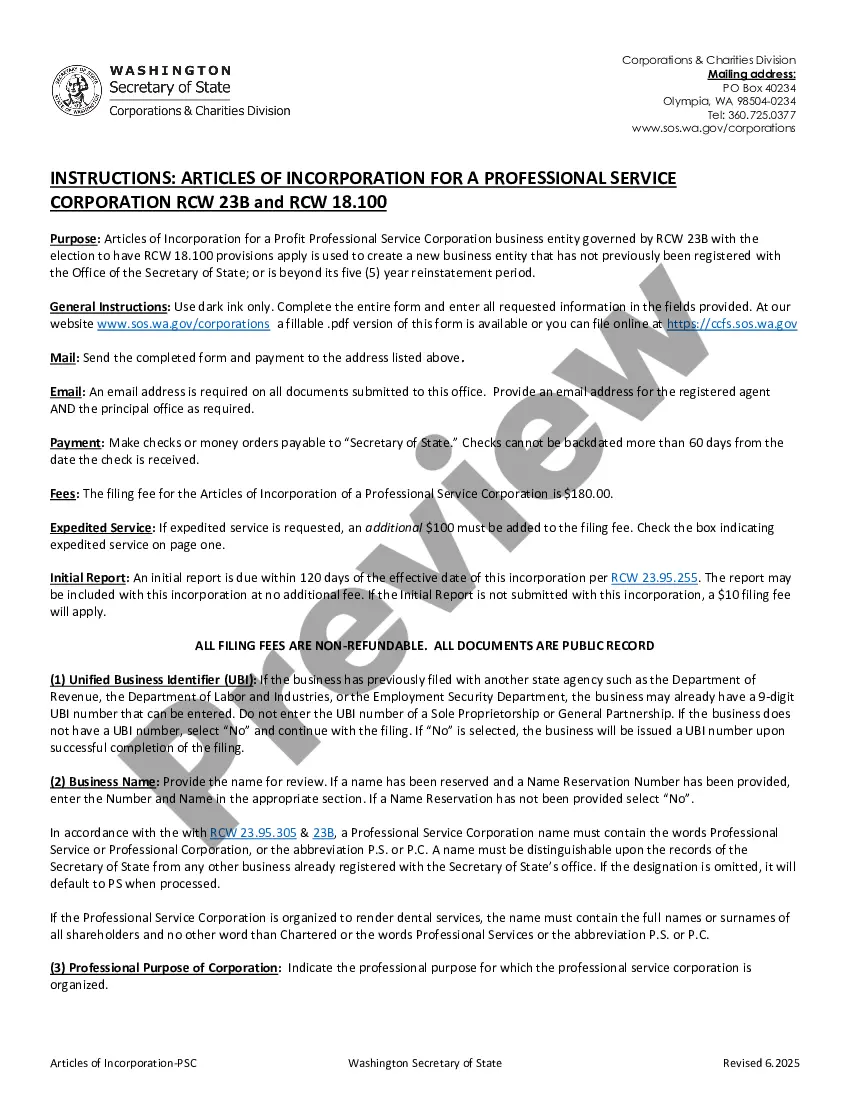

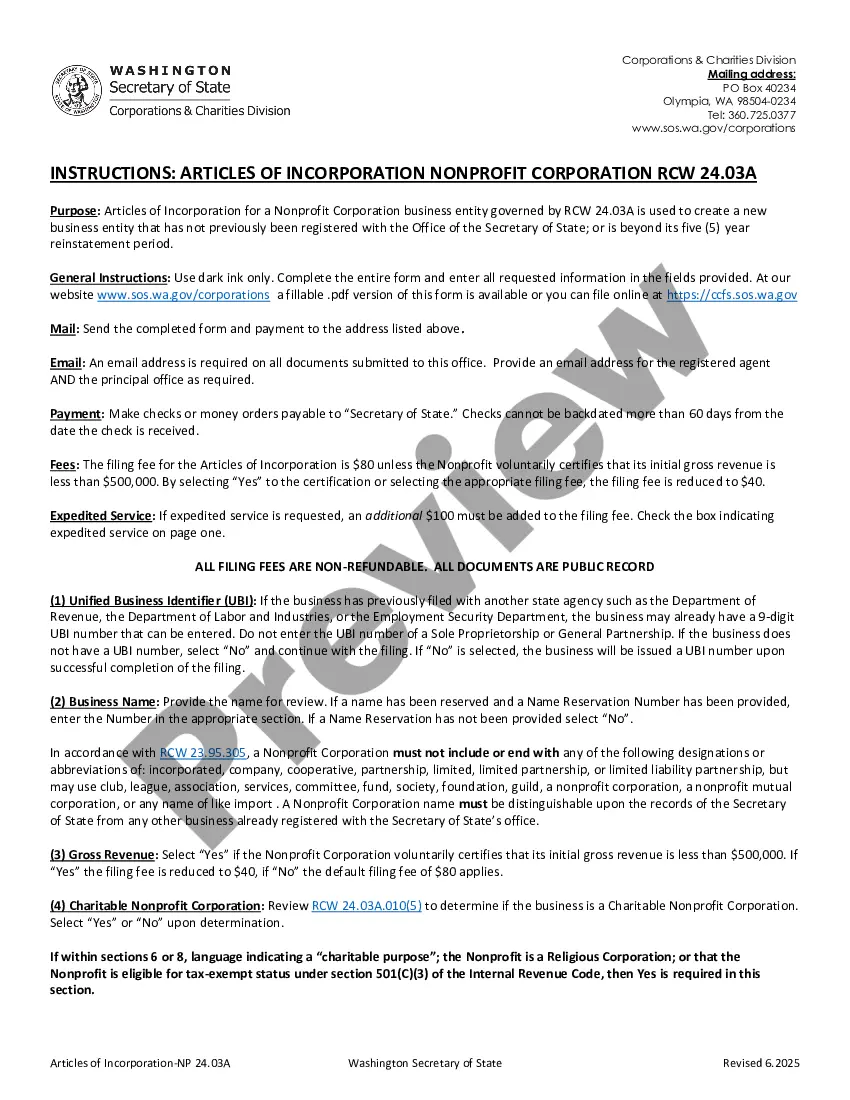

- Check the state-specific requirements for the Missouri Certificate of Non-Payment of Assessment you want to use.

- Read description and preview the template.

- Once you are sure the sample is what you need, click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the appropriate downloadable sample. The platform will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Missouri Certificate of Non-Payment of Assessment fast and easy.

Certificate Of Closure Bir Sample Form popularity

Paid Assessment Letter Template Other Form Names

Sample Letter Of Closure Of Business To Bir FAQ

When a homeowner doesn't pay the property taxes, the overdue amount becomes a lien on the home. In Missouri, all real estate taxes become delinquent on January 1 of the year following their assessment. (Mo. Ann.

A Tax Waiver can normally only be obtained in person at the Assessor's Office. In light of the COVID-19 emergency, the Assessor's Office has implemented a procedure to request it online.

Property taxes are real estate taxes calculated by local governments and paid by homeowners.You will never be free from property taxes while you own your home, but there are a few simple tricks you can use to lower your property tax bill.

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

In Missouri, a tax sale will typically take place if you don't pay the property taxes on your home for three years. But under state law, it could take place sooner. At the sale, the winning bidder bids on the property and gets a certificate of purchase.

You received this notice for one of the following reasons: The Internal Revenue Service (IRS) provided information to the Department indicating your federal return was filed with a Missouri address and a Missouri return was not filed.

Arizona. California. Oklahoma. South Carolina. Texas. Wisconsin.

Missouri homestead law allows for a $15,000 exemption, which is applicable to "a dwelling house and appurtenances, and the land used in connection therewith." In other words, the state's homestead law is limited to homes, corresponding buildings, and the land on which they stand.