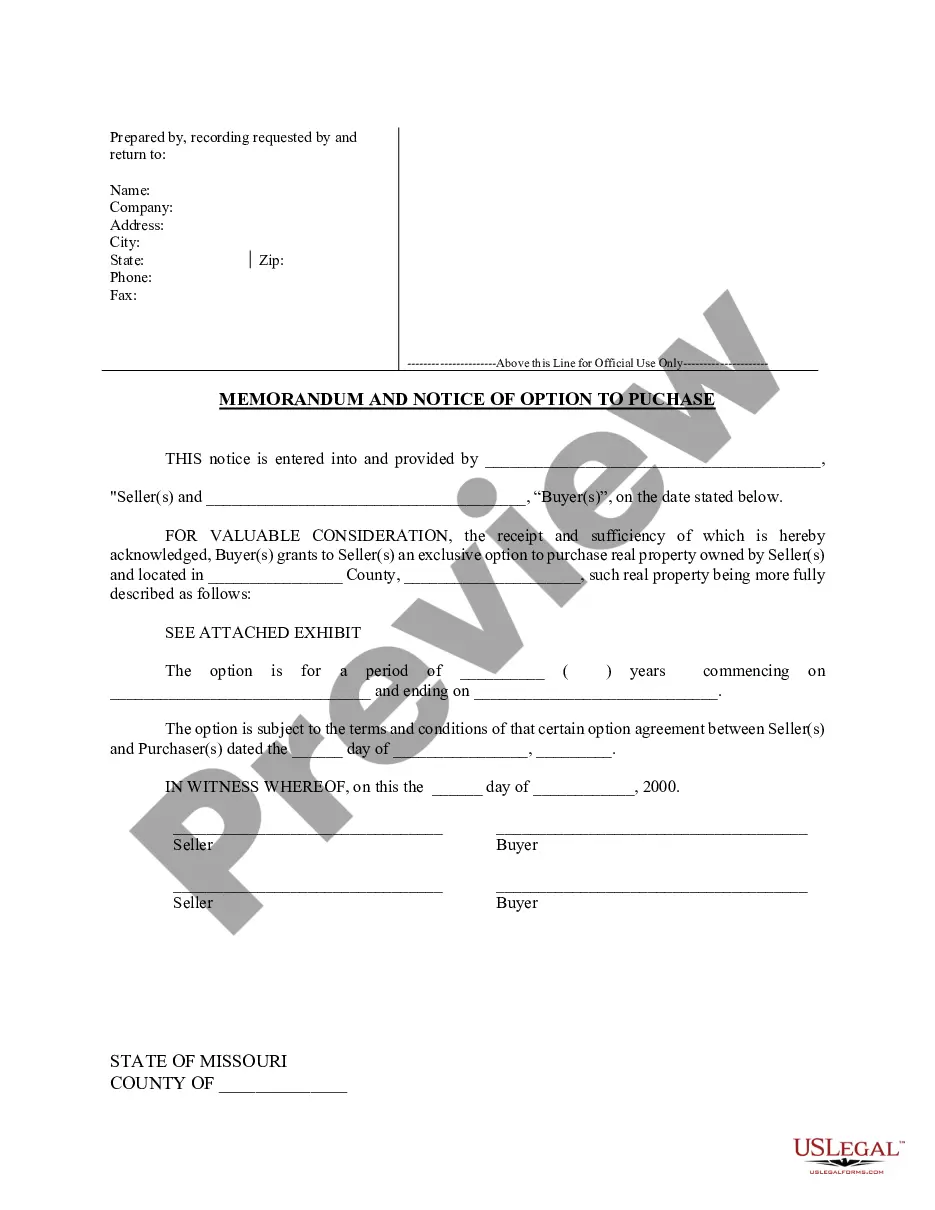

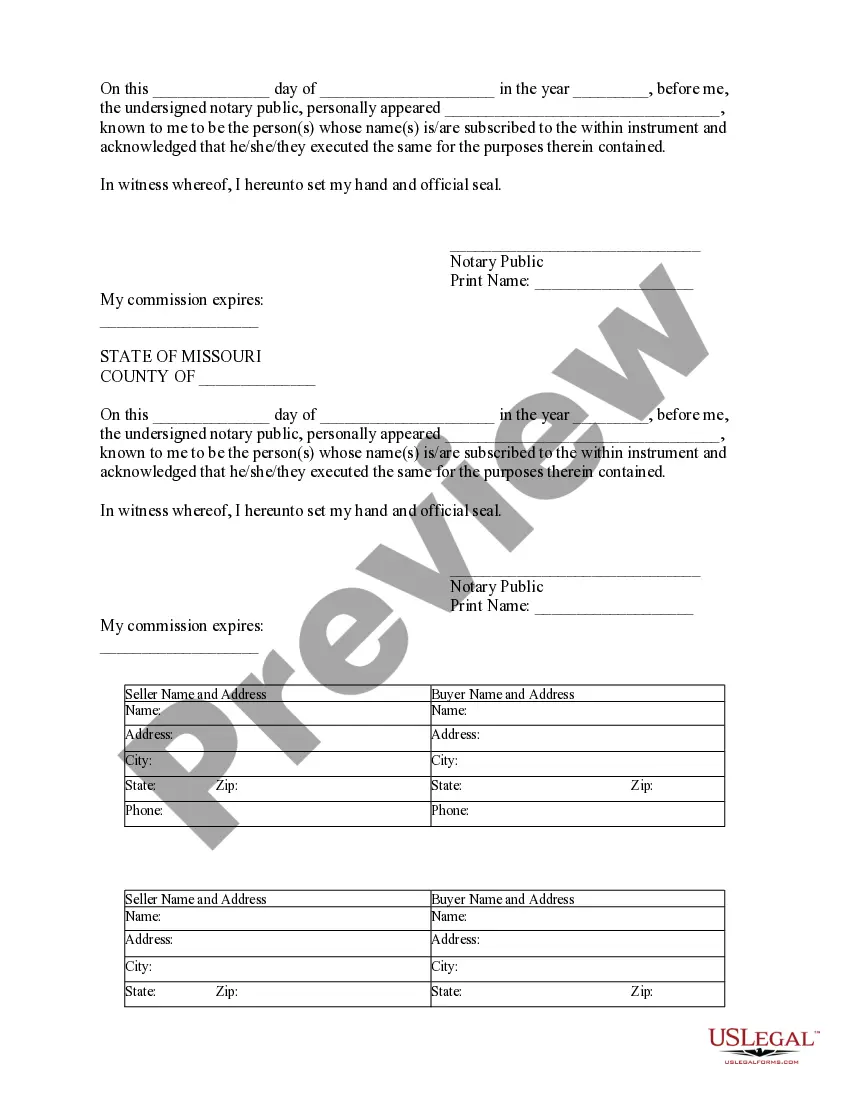

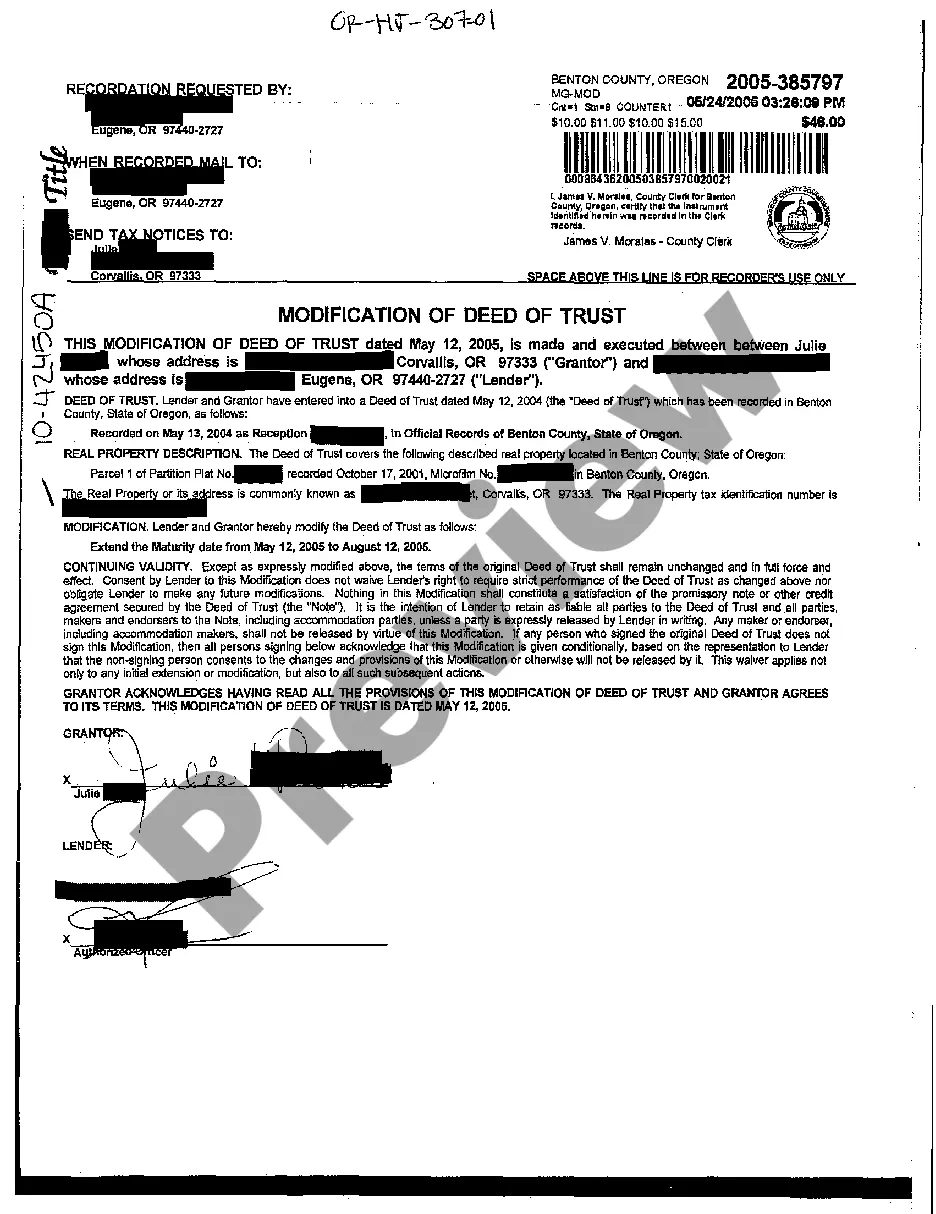

This Memorandum and Notice of Option Agreement is for recording in the official records in order to provide notice that an Option to Purchase exists on a certain parcel of real estate. It is used in lieu of recording the entire Option Agreement.

Missouri Notice of Option for Recording

Description

How to fill out Missouri Notice Of Option For Recording?

Get any template from 85,000 legal documents including Missouri Notice of Option for Recording online with US Legal Forms. Every template is prepared and updated by state-certified legal professionals.

If you already have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the steps below:

- Check the state-specific requirements for the Missouri Notice of Option for Recording you would like to use.

- Read description and preview the template.

- When you’re confident the sample is what you need, click on Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by bank card or via PayPal.

- Pick a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable sample. The service will give you access to forms and divides them into categories to streamline your search. Use US Legal Forms to obtain your Missouri Notice of Option for Recording easy and fast.

Form popularity

FAQ

A recording act that gives priority of title to the party that records first, but only if the party also lacked notice of prior unrecorded claims on the same property. See Notice statute and Race statute. PROPERTY. property & real estate law. wex definitions.

According to MO state laws, you have 30 days from the purchase of your new car to register and title it with the Missouri DMV. To complete this process, you must submit the following paperwork in person at your local licensing office: Documents proving vehicle ownership.

Missouri Resident Titling RequirementsYou have 30 days from the date of purchase to title and pay sales tax on your newly purchased vehicle. If you do not title the vehicle within 30 days, there is a title penalty of $25 on the 31st day after purchase.

Currently, Alabama, Arizona, Connecticut, Florida, Illinois, Iowa, Kansas, Massachusetts, Missouri, New Hampshire, New Mexico, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Vermont, and West Virginia are the jurisdictions where a notice statute is in effect.

The notice of intended sale shall include all of the following:(i) A statement that if the parcel remains unsold after the tax sale, the date, time, and location of any subsequent sale. (j) If applicable, that a deposit is required as a condition to submit bids on the property.

Missouri law requires that applications for a certificate of title for a motor vehicle, trailer, manufactured home, or an ATV must be made within 30 days from the date of purchase. A title penalty will be assessed for units not titled within 30 days after the date of purchase.

There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin. In the other 41 states, titles are issued to the lien holder of your vehicle until the loan is fully paid off.

An Application for Missouri Title and License (Form 108) Document, completed in full and signed, including the following: If applicable, a notarized Lien Release (Form 4809) is required. Submit an $8.50 duplicate title fee and a $6.00 processing fee.

I paid off the loan for my vehicle. How can I remove the lien from my title? You may apply for a new title at any Missouri license office. You must submit the notarized lien release (copy or original), your current title (if in your possession) and pay an $8.50 title fee and a $6.00 processing fee.