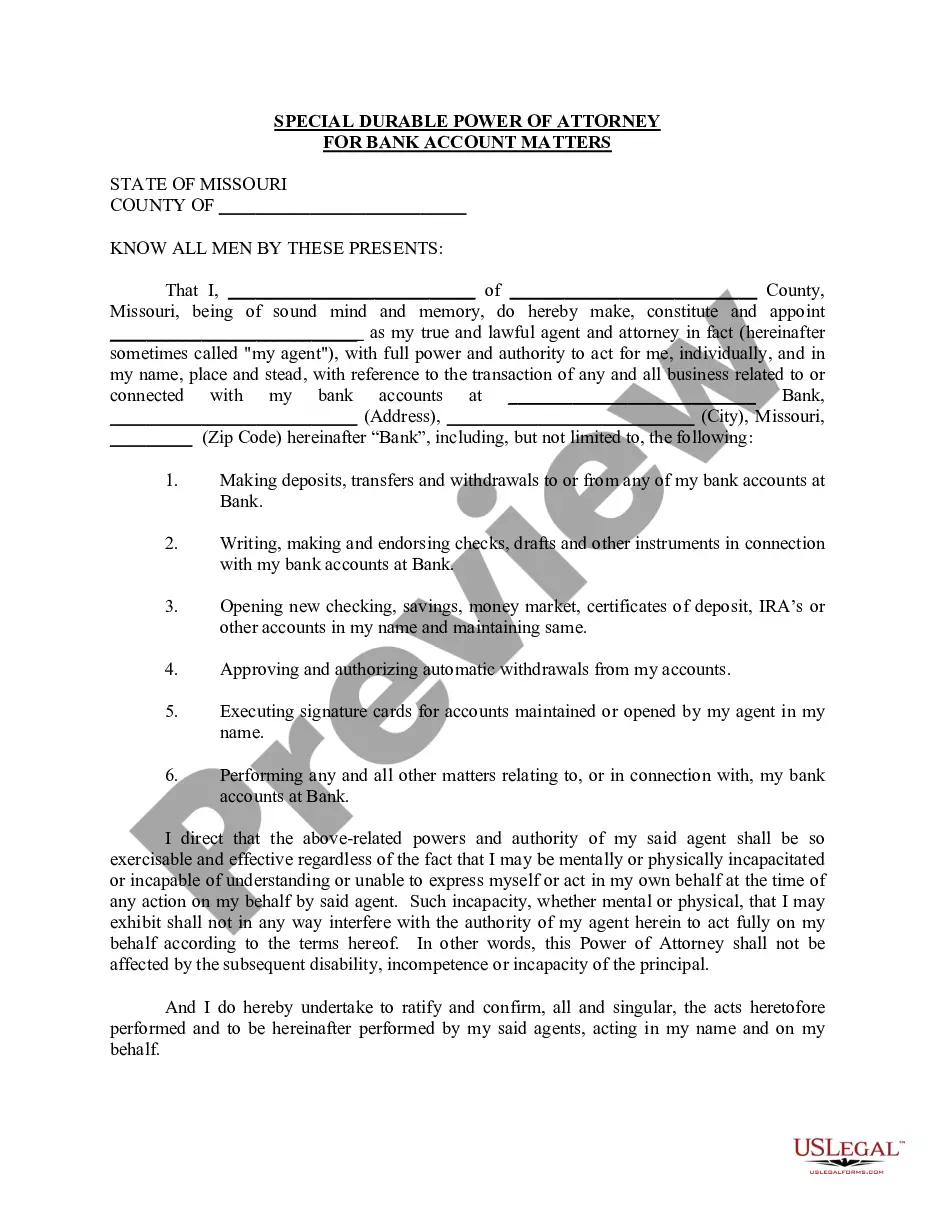

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Missouri Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Missouri Special Durable Power Of Attorney For Bank Account Matters?

Get a printable Missouri Special Durable Power of Attorney for Bank Account Matters within several clicks in the most comprehensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top provider of affordable legal and tax forms for US citizens and residents online since 1997.

Customers who have a subscription, must log in directly into their US Legal Forms account, get the Missouri Special Durable Power of Attorney for Bank Account Matters and find it saved in the My Forms tab. Users who do not have a subscription are required to follow the tips listed below:

- Make sure your template meets your state’s requirements.

- If available, read the form’s description to learn more.

- If accessible, review the form to discover more content.

- As soon as you’re confident the template fits your needs, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- through PayPal or bank card.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Missouri Special Durable Power of Attorney for Bank Account Matters, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

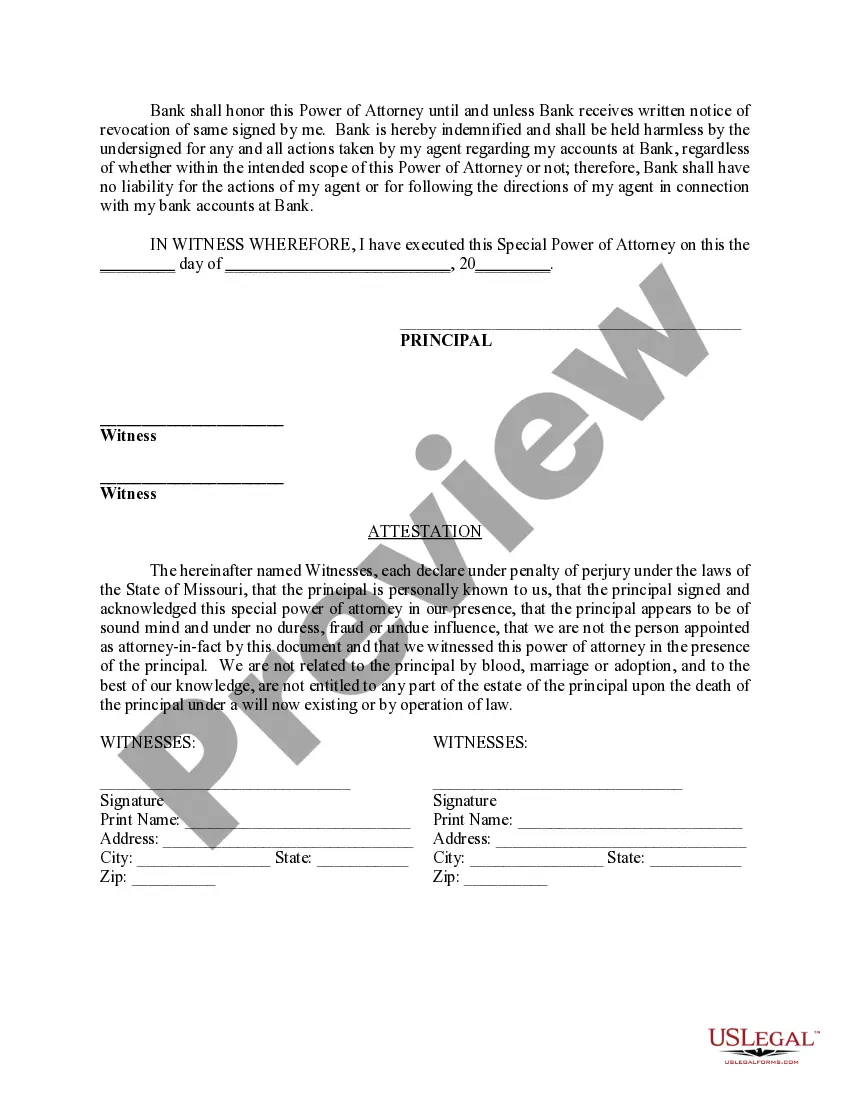

Missouri Power of Attorney Forms permit individuals to have third party representation by authorizing agents to act on their behalf.There is no state statute that requires witnesses when executing the document but it is usually required to have a notary public acknowledge and stamp the completed and signed form.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power.If you grant a power of attorney, check with your bank to find out whether the document you intend to use is sufficient. You may want to change the document or even change your bank.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.