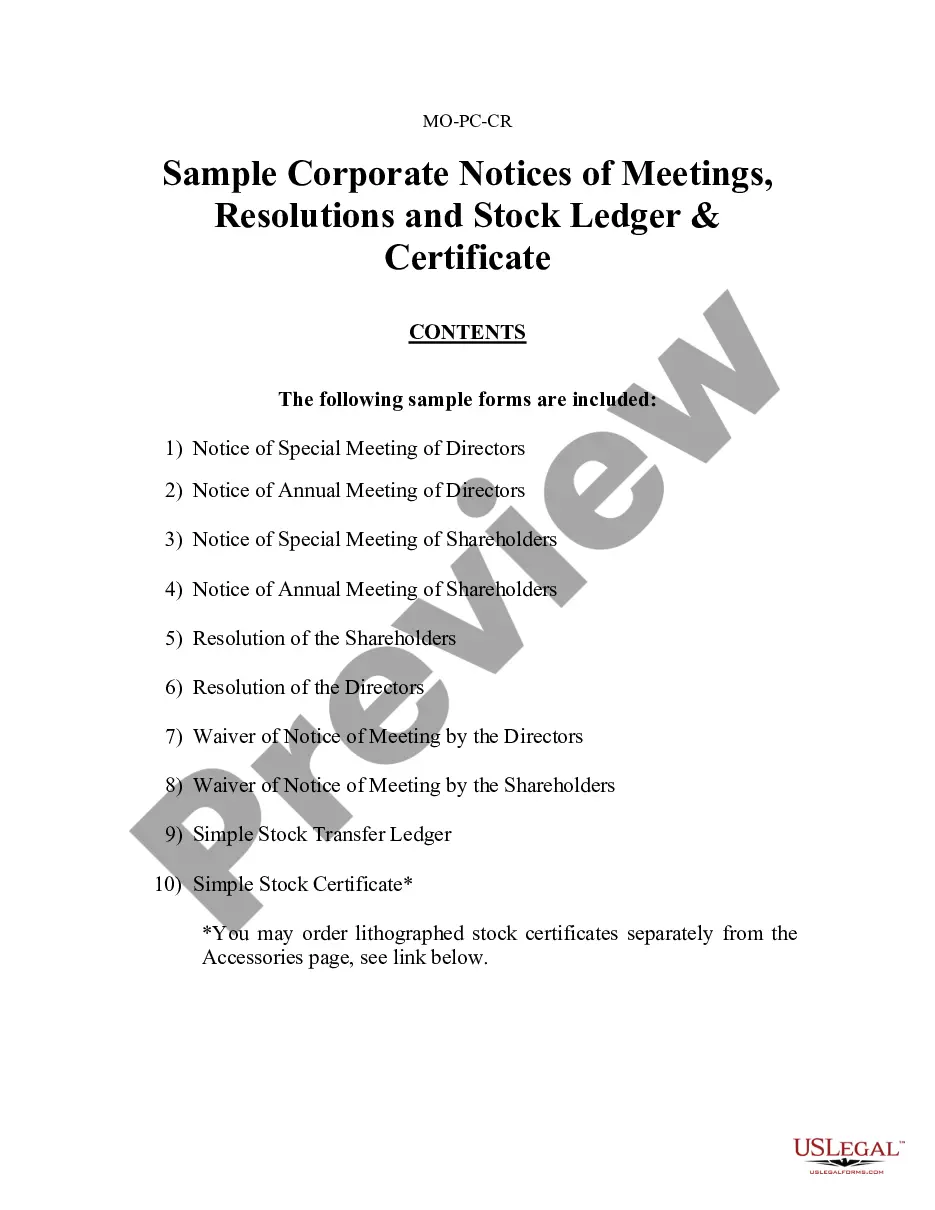

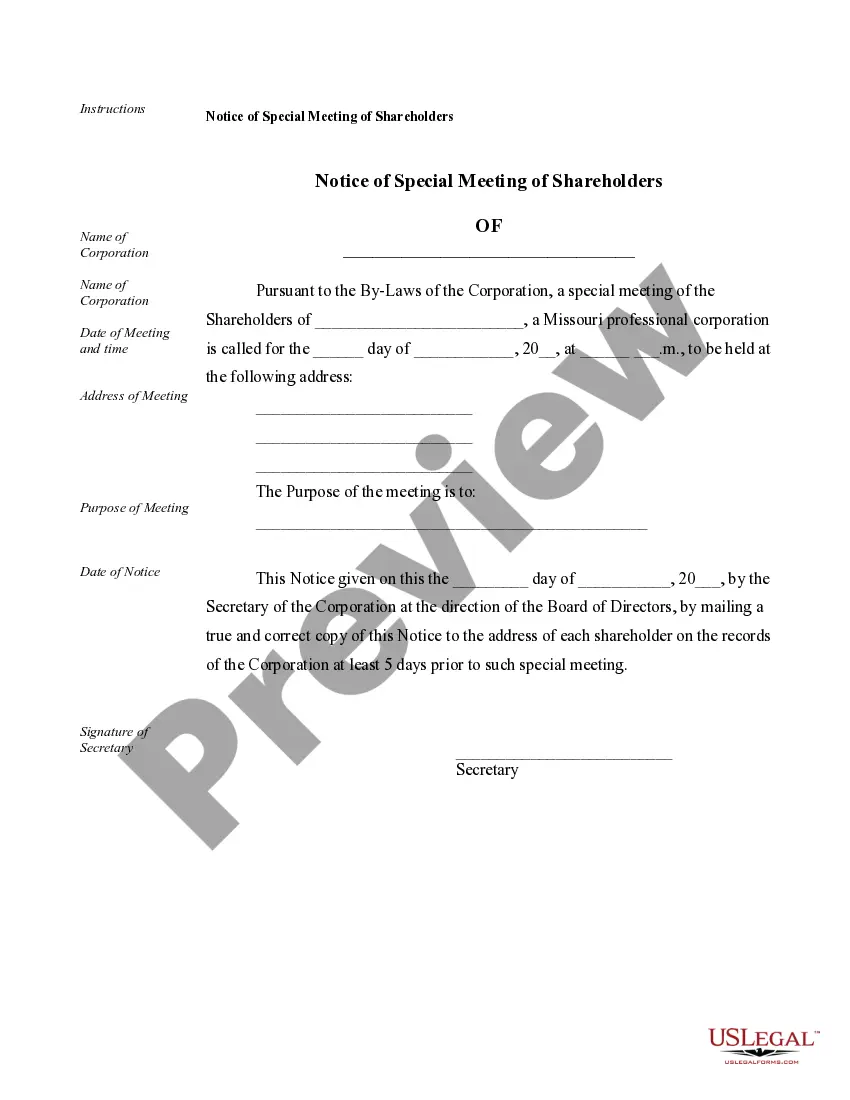

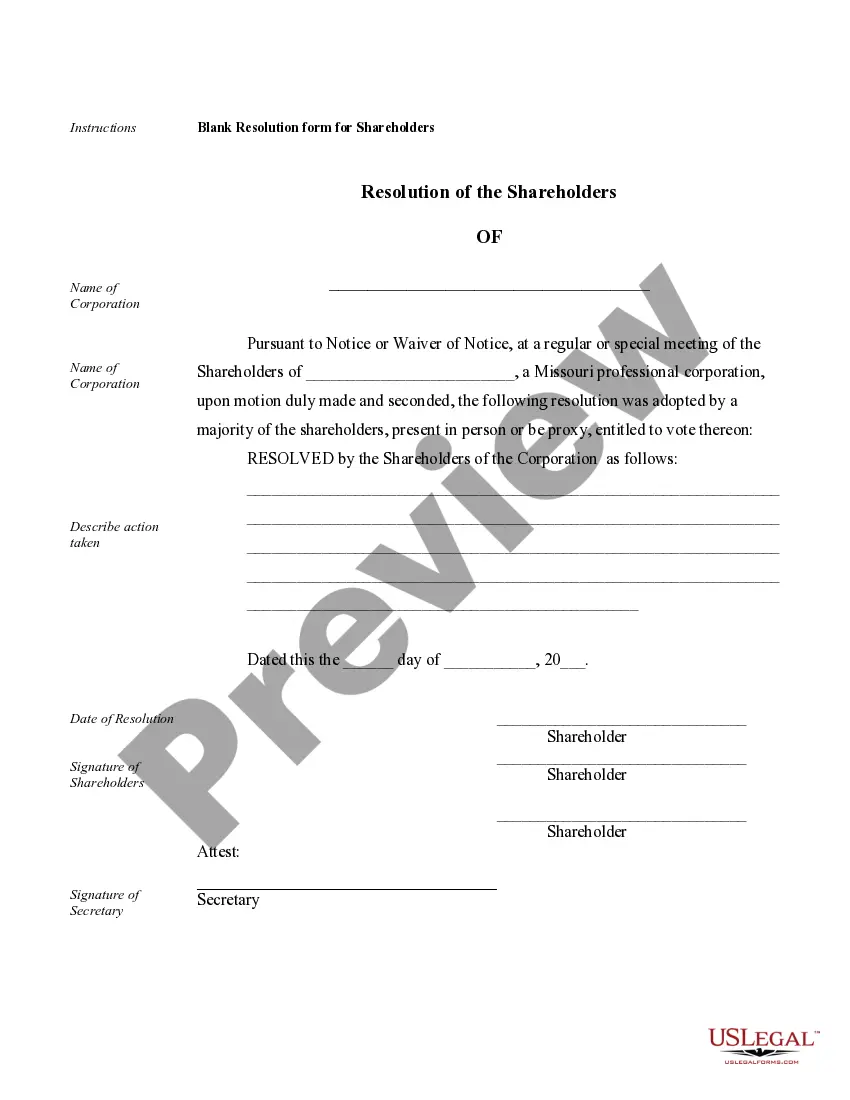

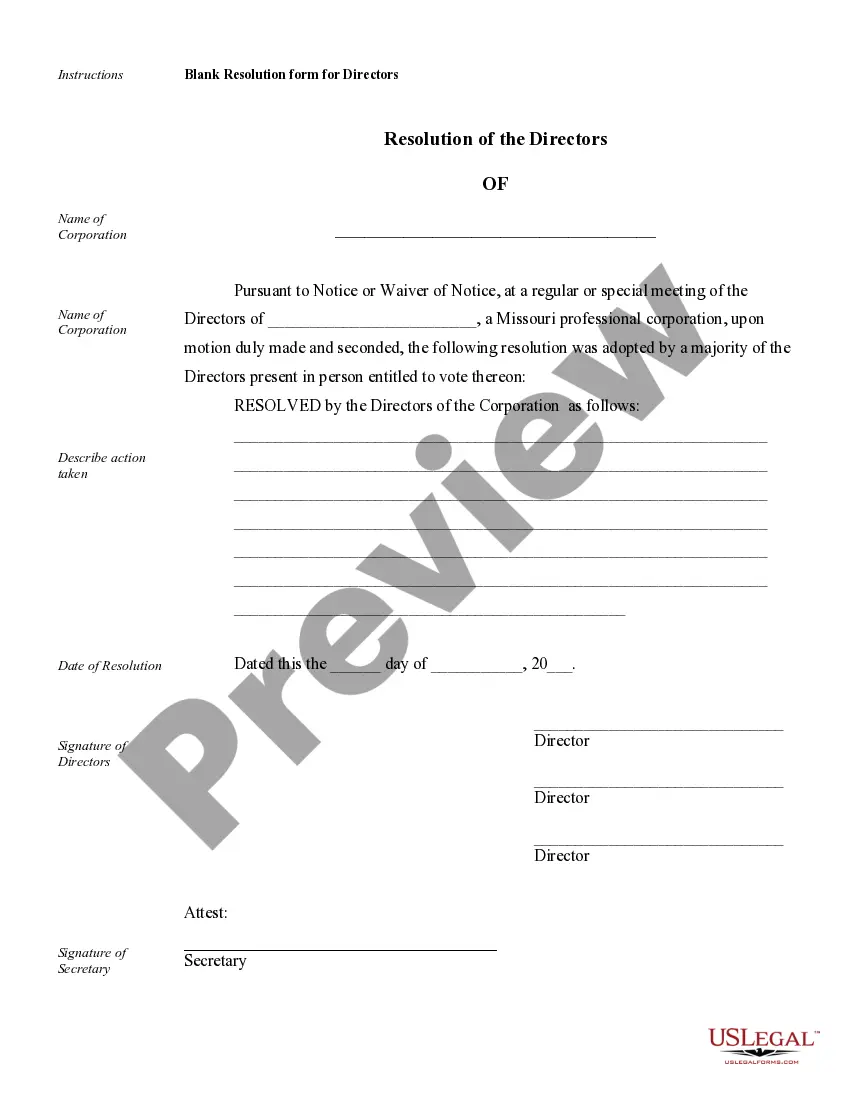

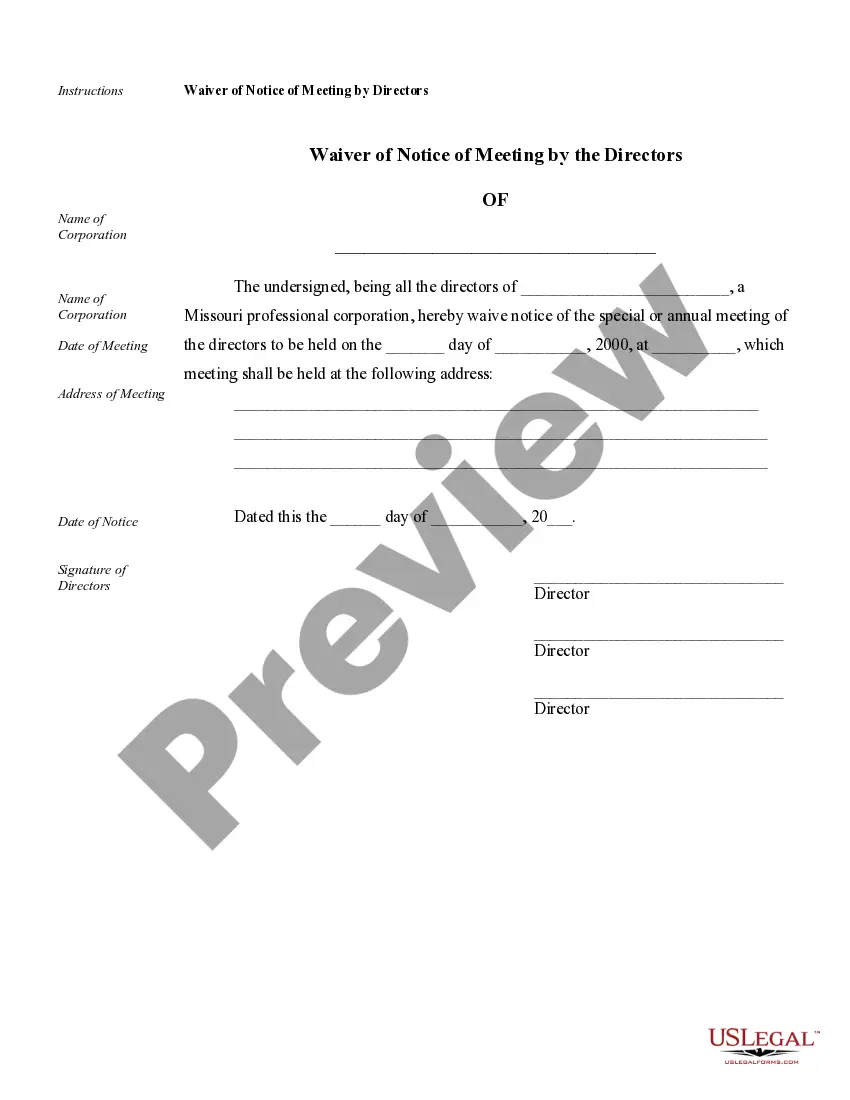

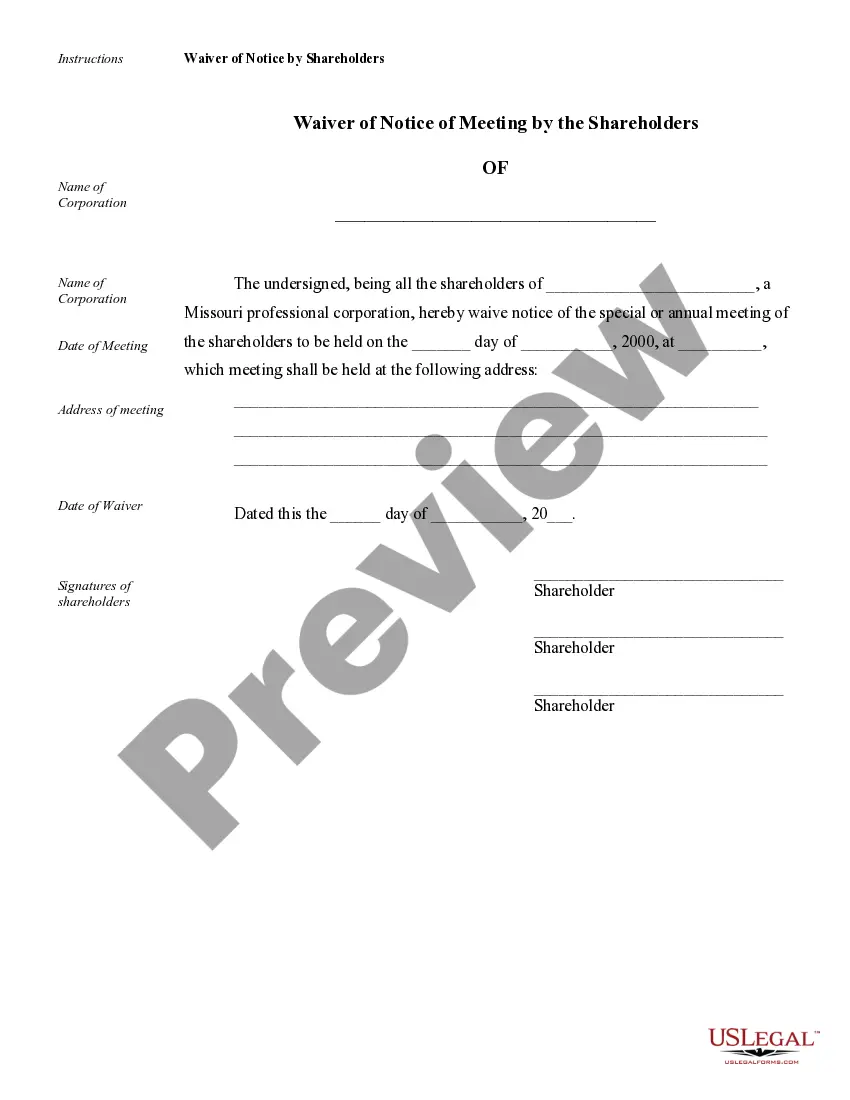

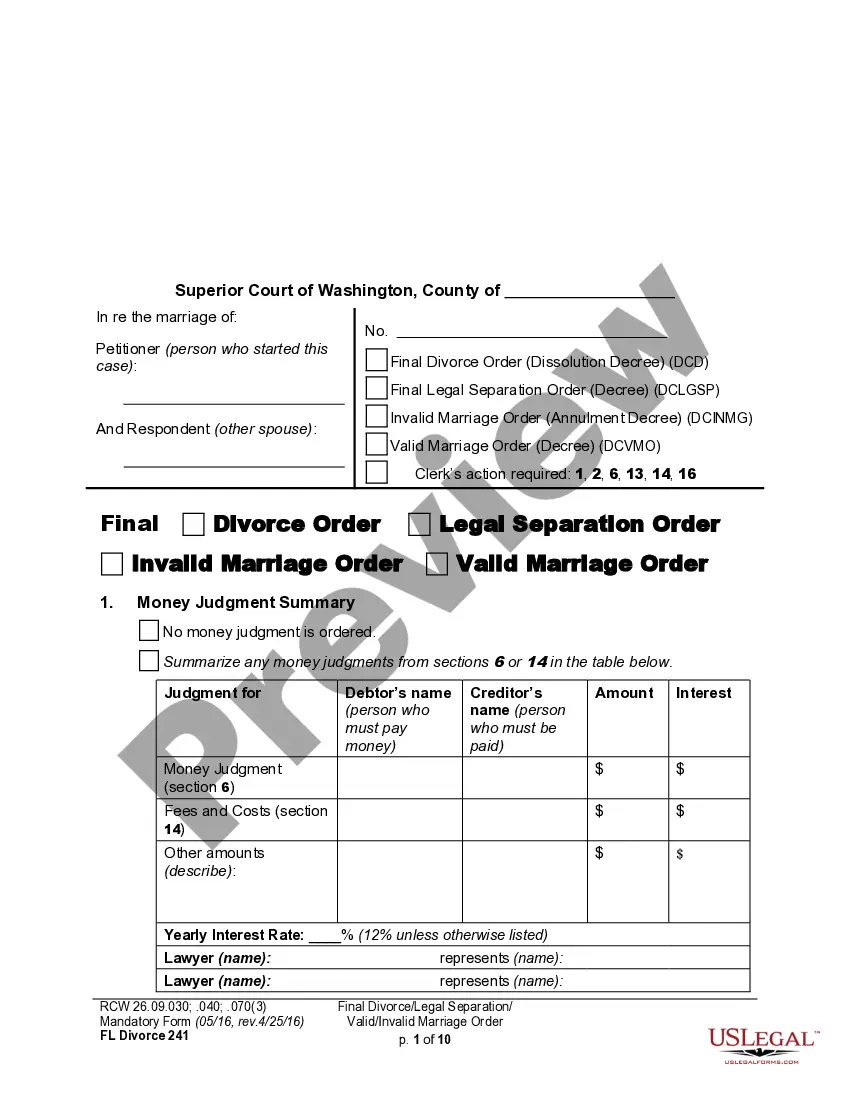

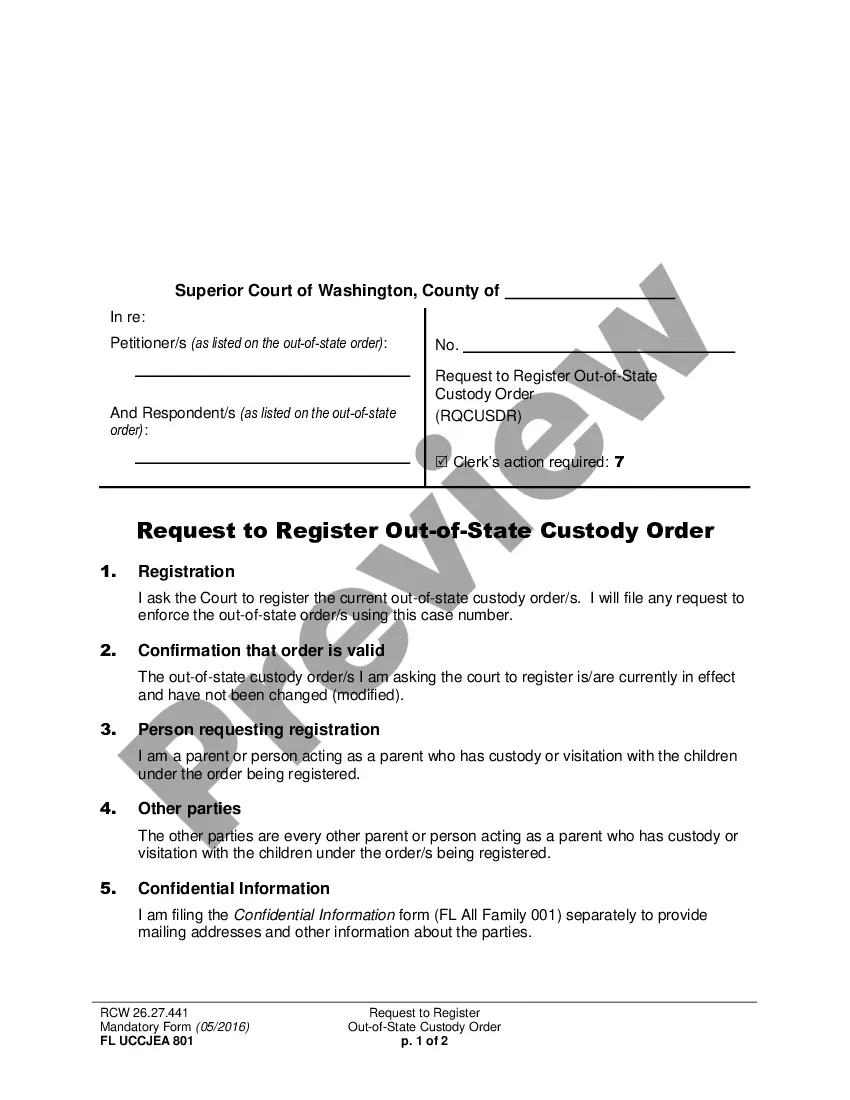

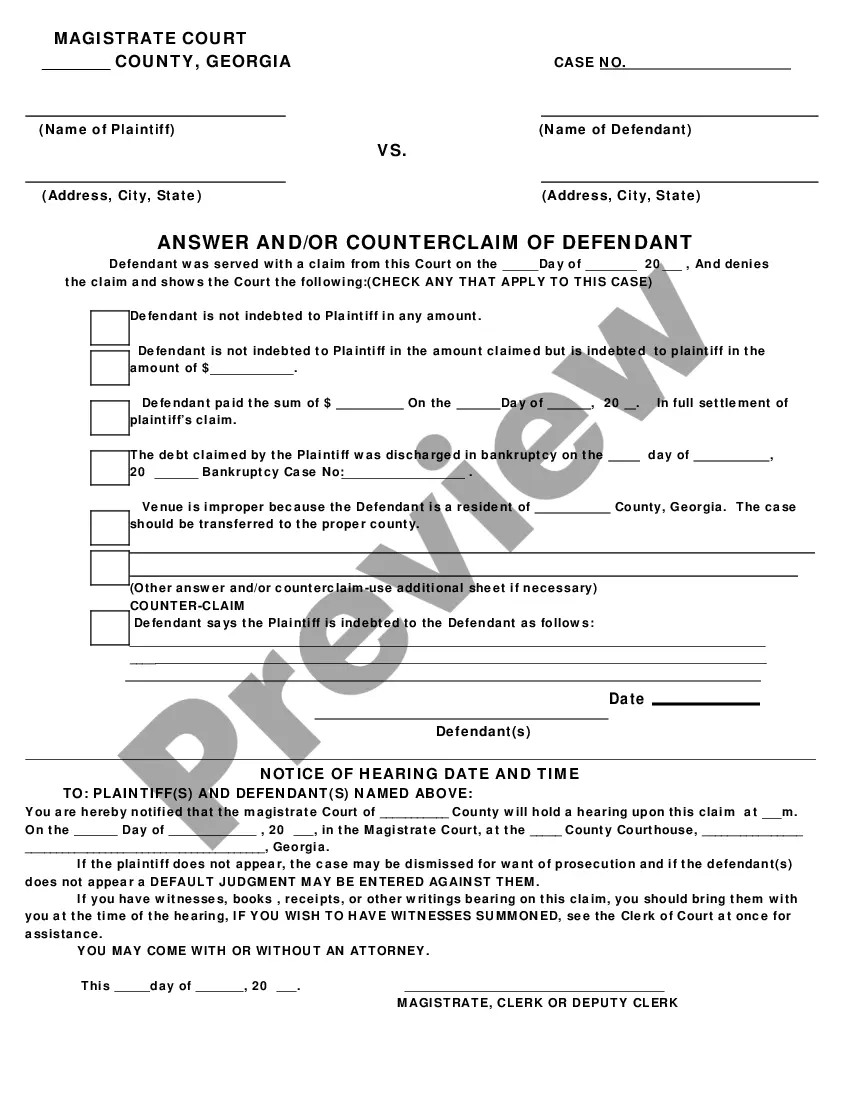

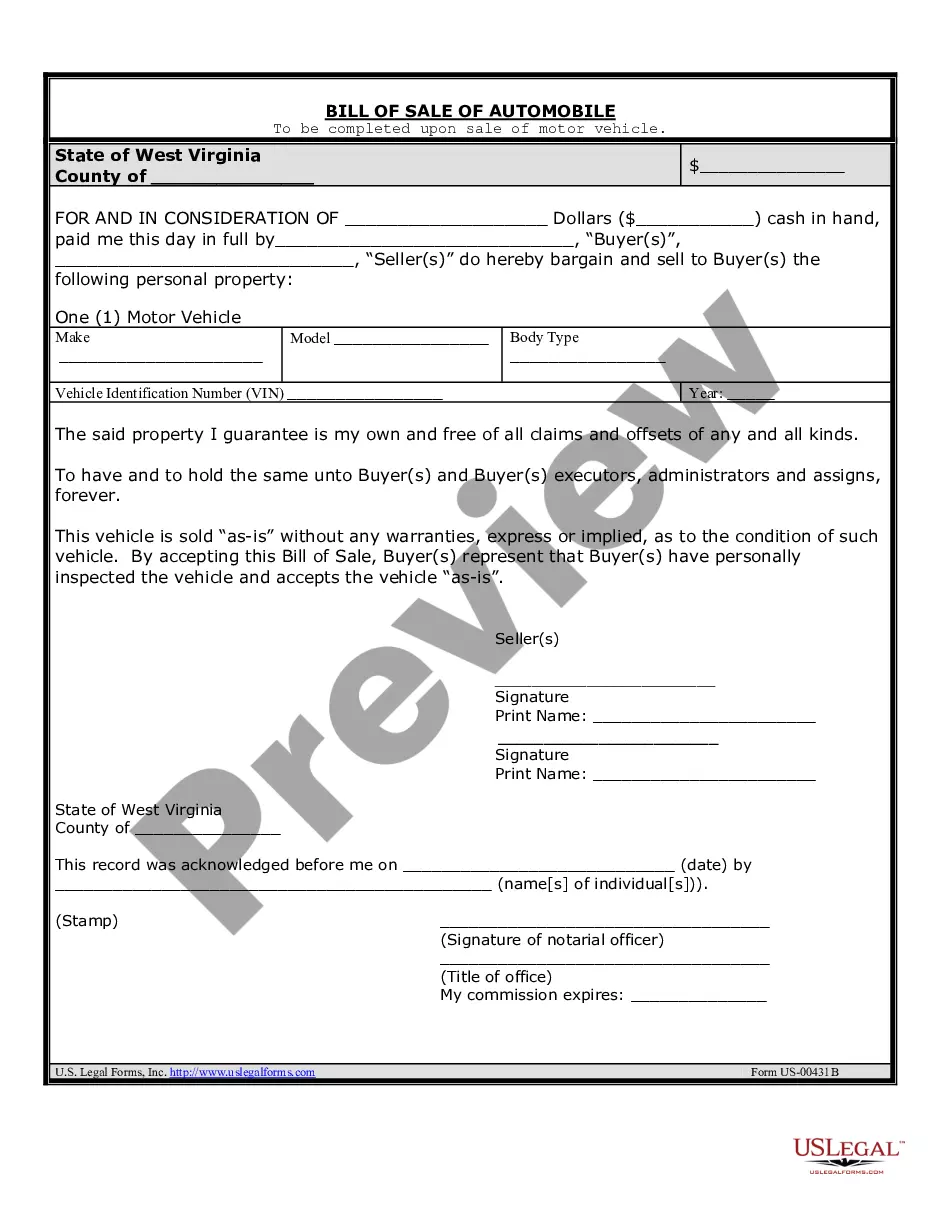

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Sample Corporate Records for a Missouri Professional Corporation

Description Missouri Corporation Stock Certificate

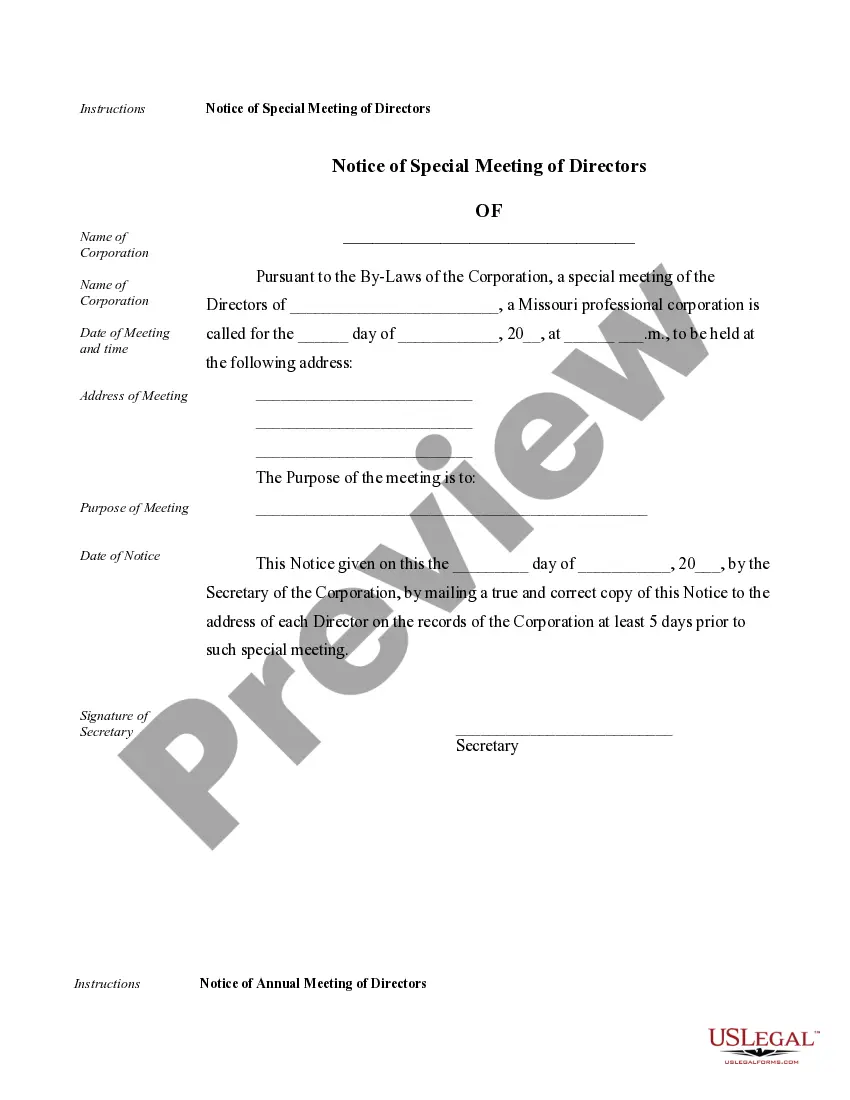

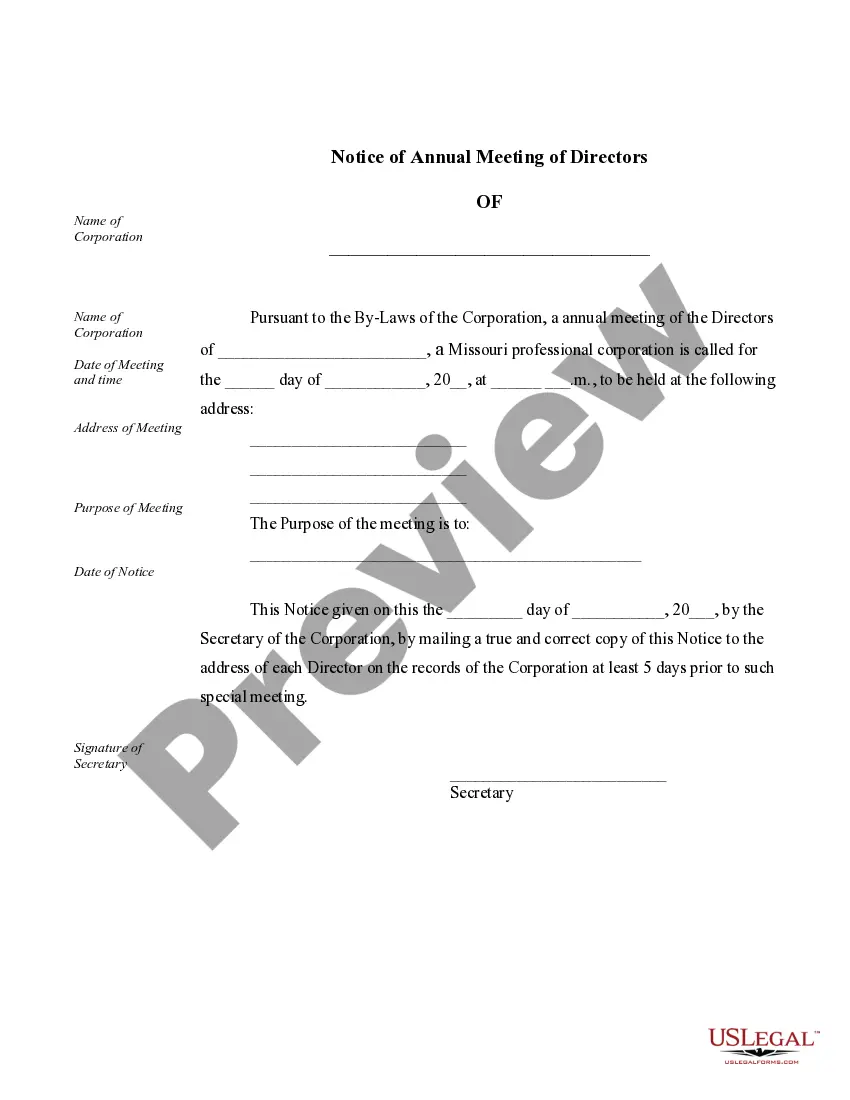

How to fill out Sample Corporate Records For A Missouri Professional Corporation?

Obtain a printable Sample Corporate Records for a Missouri Professional Corporation in only several clicks in the most complete library of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of reasonably priced legal and tax templates for US citizens and residents online starting from 1997.

Customers who have already a subscription, must log in into their US Legal Forms account, down load the Sample Corporate Records for a Missouri Professional Corporation see it saved in the My Forms tab. Users who don’t have a subscription are required to follow the tips listed below:

- Make certain your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If accessible, preview the shape to discover more content.

- As soon as you are confident the template suits you, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out via PayPal or credit card.

- Download the form in Word or PDF format.

Once you have downloaded your Sample Corporate Records for a Missouri Professional Corporation, you are able to fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Missouri businesses are not legally required to obtain a certificate of good standing. However, your business may choose to get one if you decide to do business outside of Missouri or get a business bank account.

A Missouri State Resale Certificate can be used to purchase items at wholesale costs and will allow you to resell those items. This Certificate is used to collect sales tax from your clients and to avoid paying sales tax to your supplier.

You can complete the online registration application that can be found at Online Business Registration to register with the Missouri Department of Revenue, or, you can complete the paper Form 2643, Missouri Tax Registration Application, and submit the form to the Missouri Department of Revenue.

Order a Certificate of Good Standing from the Corporations Division. You can order online or contact the Corporations Division directly to place your order. Online certificates feature a verification number which allows anyone to confirm the authenticity of the certificate.

Resale Certificate. Even though it's important for your taxes, your resale number isn't the same as a tax ID number. Your business's TIN goes on federal tax returns, and if you need to pay state taxes on your business income, you can apply for a state TIN. The resale number involves state sales tax.

A resale certificate is also called a sales tax certificate, reseller permit, or sales tax exemption certificate.It does not exempt you from paying sales tax on items you use in your business (e.g., office supplies). Qualifying goods are either items you plan to resell or use as parts in products or services you sell.

General Affidavit Form (DOR-768) Note that some require notarization of the applicant's signature. Non-Use (notary required): Must be completed when applicant asks to license a vehicle that has not been operated on the highways, and applicant wishes to have registration fee prorated.

A Missouri certificate of good standing verifies that a limited liability company (LLC) or corporation was legally formed and has been properly maintained.

The Good Standing certification will form part of the legal documentation of the entity. Typically, applying for a business loan or line of credit will require good standing certification.The California Certificate of Good Standing expires after 90 days.