Missouri Process Receipt and Return is a system provided by the Missouri Secretary of State that allows businesses and individuals to receive and return various legal documents. This process is used to submit documents such as civil process, court documents, and notices of judgement. There are two types of Missouri Process Receipt and Return: Registered Agent and Non-Registered Agent Process. Registered Agent Process involves the documents being received and returned by a registered agent, such as a law firm, while Non-Registered Agent Process involves the documents being sent directly to the recipient without the involvement of a registered agent. Both processes are governed by Missouri law and require the submitting party to provide the necessary information to the Secretary of State in order for the documents to be accepted.

Missouri Process Receipt and Return

Description

How to fill out Missouri Process Receipt And Return?

If you’re searching for a method to properly finalize the Missouri Process Receipt and Return without hiring a legal professional, then you’re in the perfect place.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of formal templates for every personal and commercial scenario. Every document you encounter on our platform is crafted in accordance with national and state regulations, ensuring that your paperwork is in proper order.

Another fantastic aspect of US Legal Forms is that you will never lose the documents you bought - you can access any of your downloaded forms in the My documents section of your profile whenever you require it.

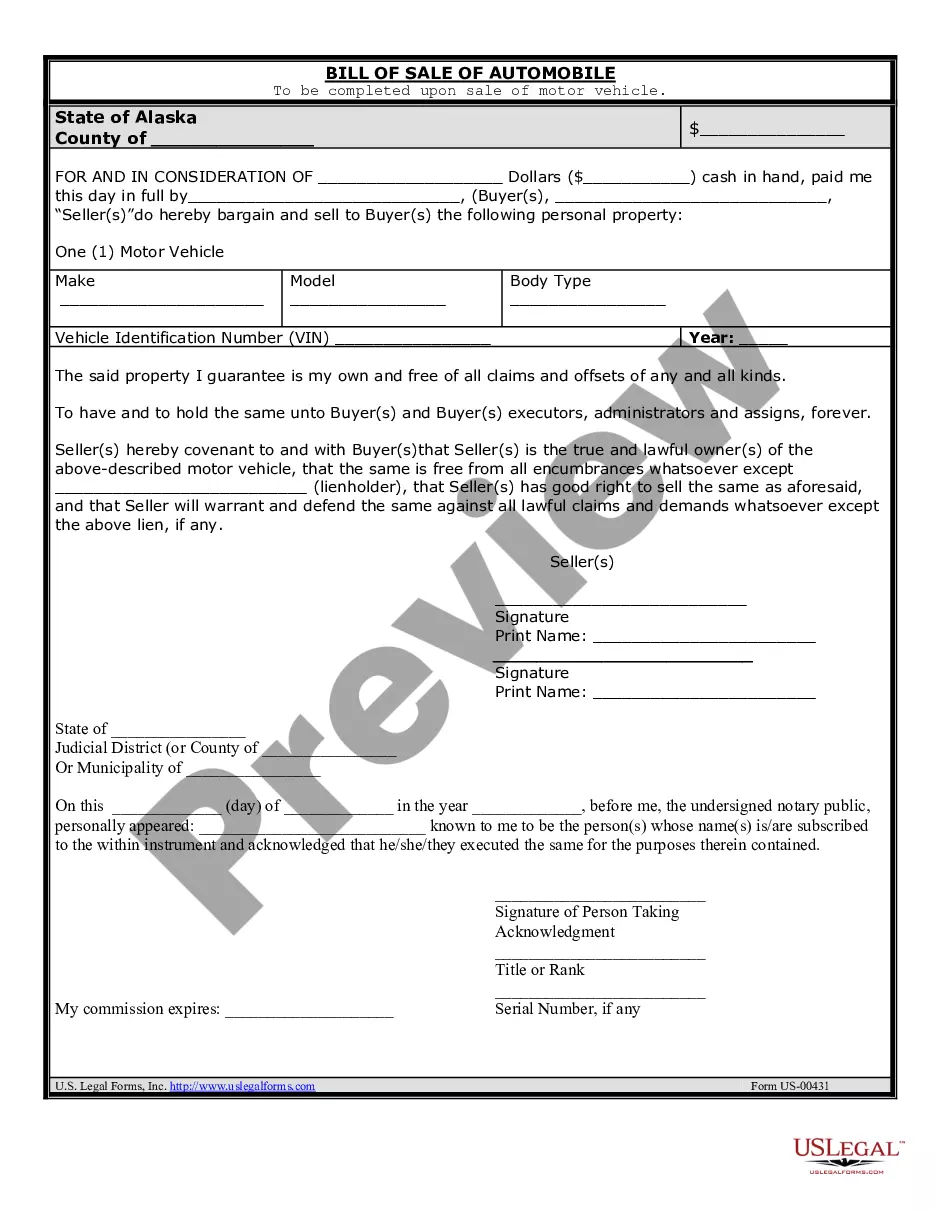

- Confirm the document you see on the page aligns with your legal situation and state laws by reviewing its text description or browsing through the Preview mode.

- Enter the form name in the Search tab at the top of the page and select your state from the list to find an alternative template in case of any discrepancies.

- Repeat with the content validation and click Buy now when you are assured of the paperwork conformity with all the requirements.

- Log in to your account and click Download. Register for the service and choose a subscription plan if you do not have one yet.

- Use your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format you wish to receive your Missouri Process Receipt and Return in and download it by clicking the corresponding button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

Filling out a receipt correctly is vital for the Missouri Process Receipt and Return. Start by entering all necessary details, such as the case number, names of the parties involved, and the date of service. Make sure to sign and date the receipt, as this confirms the delivery of documents. For a comprehensive guide on completing receipts effectively, consider visiting USLegalForms, where you can find templates and instructions tailored to your needs.

The USM 285 form is a crucial document used in the process of serving legal papers. Specifically, it plays an essential role in the Missouri Process Receipt and Return, as it allows for tracking the delivery of documents to defendants. By filling out this form, you ensure that the court receives confirmation that the documents were served correctly. You can find resources on USLegalForms to help you understand and complete the USM 285 form accurately.

Attach a copy of your federal return (pages 1 and 2) and Federal Form 8611. Include only Missouri withholding as shown on your Forms W-2, 1099, or 1099-R. Do not include withholding for federal taxes, local taxes, city earnings taxes, other state's withholding, or payments submitted with Form MO-2NR or Form MO-2ENT.

Your check or money order (U.S. funds only), payable to the Missouri Department of Revenue, should be mailed to the Department of Revenue, PO Box 385, Jefferson City, MO 65105-0385.

Just like the federal level, Missouri imposes income taxes on your earnings if you have a sufficient connection to the state if you work or earn an income within state borders. You may not have to file a Missouri return if: You are a resident and have less than $1,200 of Missouri adjusted gross income.

Rule 54.16 Acknowledgement of Service by Mail Unless good cause is shown for not doing so, the court shall order the payment of costs of service on the person served if such person does not complete and return within thirty days after mailing, the notice and acknowledgment of receipt of summons.