The Missouri Judgment For Exempt Property Allowance To Surviving Spouse is a legal action taken in Missouri for the purpose of assigning a portion of the deceased spouse's estate to the surviving spouse. This action is taken in order to ensure that the surviving spouse is provided with some financial security in the event of the death of the other spouse. The amount of the allowance is determined by the court and is based on the total value of the estate. There are two types of Missouri Judgment For Exempt Property Allowance To Surviving Spouse: the Exempt Property Allowance and the Non-Exempt Property Allowance. The Exempt Property Allowance is a portion of the estate that is not subject to taxation, while the Non-Exempt Property Allowance is a portion of the estate that is subject to taxation. In either case, the allowance is meant to provide the surviving spouse with some financial security after the death of the other spouse.

Missouri Judgment For Exempt Property Allowance To Surviving Spouse

Description

How to fill out Missouri Judgment For Exempt Property Allowance To Surviving Spouse?

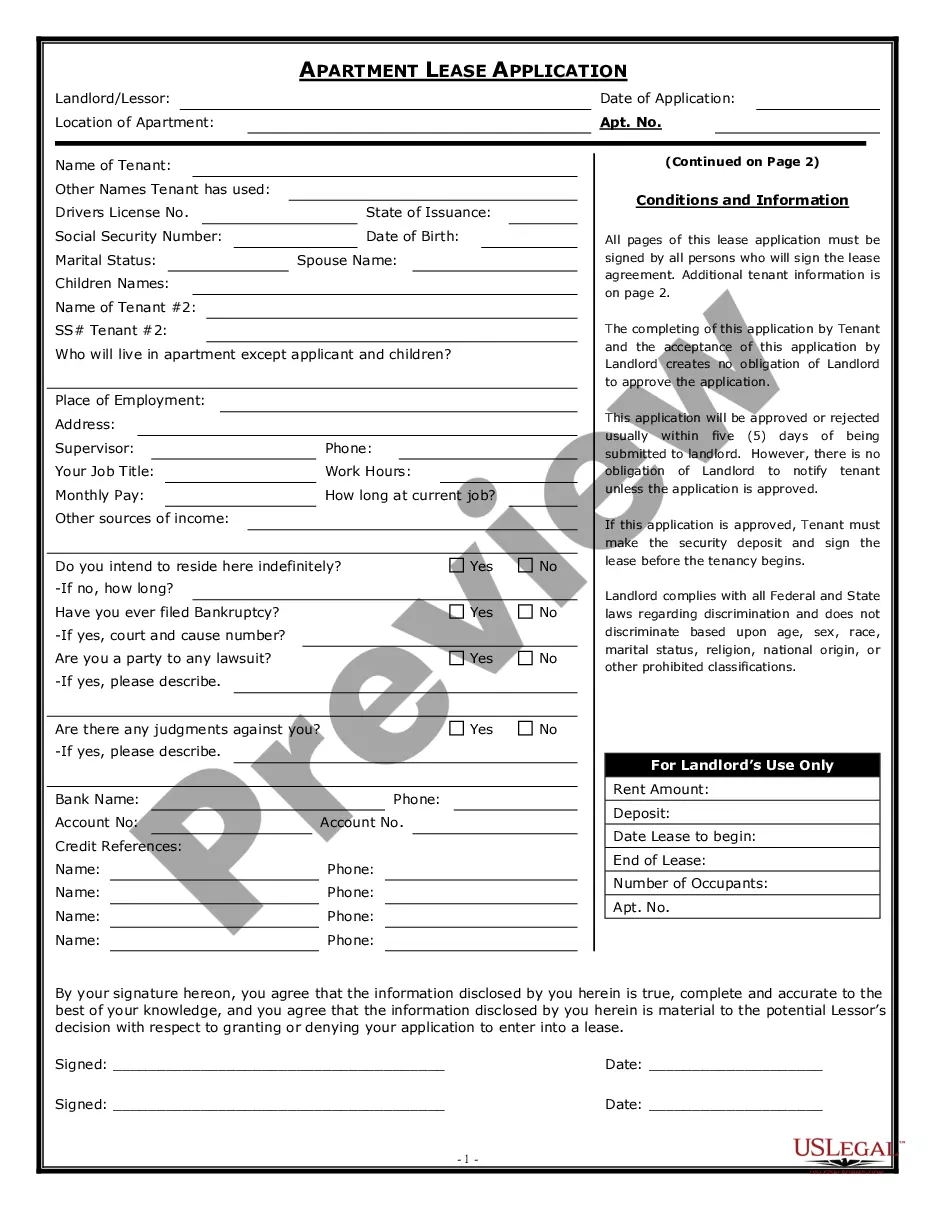

Coping with legal paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Missouri Judgment For Exempt Property Allowance To Surviving Spouse template from our service, you can be sure it complies with federal and state regulations.

Dealing with our service is easy and fast. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your Missouri Judgment For Exempt Property Allowance To Surviving Spouse within minutes:

- Remember to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Missouri Judgment For Exempt Property Allowance To Surviving Spouse in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Missouri Judgment For Exempt Property Allowance To Surviving Spouse you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

In most cases, if someone passes away without a will, all or the majority of their estate will pass on to their spouse, and the remaining amount will be divided between the parents of the individual who passed on or their descendants if they are not the children of the surviving spouse.

For the purposes of section 474.160, the estate consists of all money and property owned by the decedent at his death, reduced by funeral and administration expenses, exempt property, family allowance and enforceable claims, and increased by the aggregate value of all money and property derived by the surviving spouse

The Surviving Spouse's Rights (If There Is A Will) A spouse is entitled to receive either one-half of the deceased's property if there are no children or grandchildren of the decedent, or one-third of the property if the decedent was survived by children or grandchildren.

Ing to the inheritance laws of Missouri, which does not recognize common law marriages, spouses are entitled to 100% of the intestate estate if there are no surviving children. If you have children, your spouse is entitled to the first $20,000 in value of the estate, plus 50% of the balance of the estate.

Ing to the inheritance laws of Missouri, which does not recognize common law marriages, spouses are entitled to 100% of the intestate estate if there are no surviving children. If you have children, your spouse is entitled to the first $20,000 in value of the estate, plus 50% of the balance of the estate.

In Missouri, spouses are entitled to at least half of their spouse's assets. If the deceased leaves less than half in the will, the surviving spouse can take against the estate to get their rightful half ? unless otherwise agreed upon in a prenuptial contract.

Generally, a spouse is not responsible for the medical and credit card debt or loans of their deceased partner, unless they are mutually owned. After your spouse dies, their medical debt will go through the probate process, and the estate pays them off.

The selection of property shall be made by the surviving spouse, if any, otherwise by the guardian or conservator of each unmarried minor child for such child, or by a person designated by the court, but no real estate may be selected or included in any homestead allowance unless selection of the specific real estate