Missouri Claim Against Estate is a claim filed against an estate in the state of Missouri for payment of debts owed. This includes any money, property, or services owed to the claimant. There are two types of Missouri Claim Against Estate: Small Claims and General Claims. Small Claims are for debts up to $3,000, and General Claims are for any amount over $3,000. Missouri Claim Against Estate requires the claimant to provide proof of the debt owed, such as a contract, invoice, or statement from the decedent or other evidence of the debt. Once the claim is filed, the executor of the estate is responsible for evaluating the claim and making a determination of its validity. If the claim is approved, the claimant must be paid within the timeframe set forth by law.

Missouri Claim Against Estate

Description

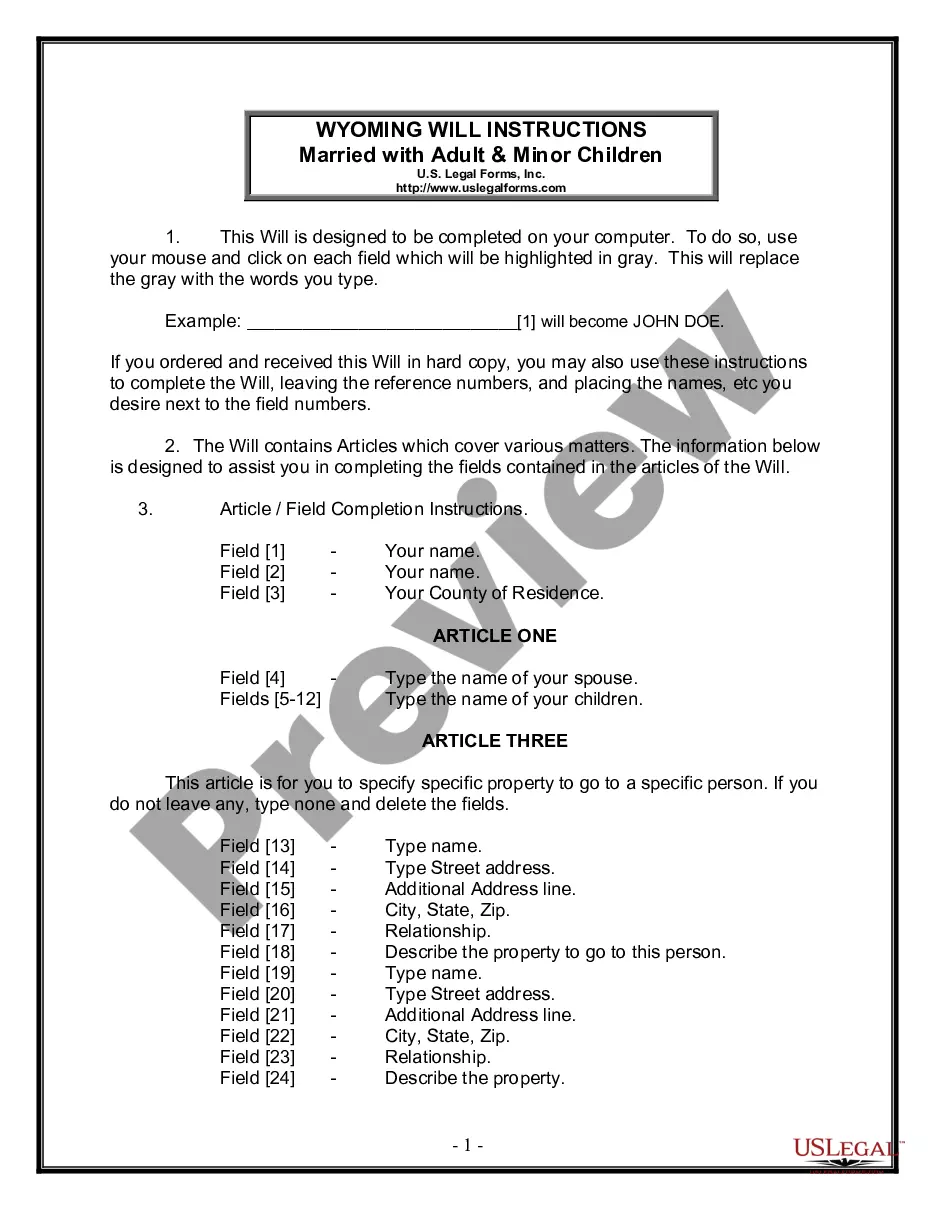

How to fill out Missouri Claim Against Estate?

How much time and resources do you typically spend on drafting formal paperwork? There’s a greater option to get such forms than hiring legal experts or wasting hours searching the web for a proper template. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Missouri Claim Against Estate.

To get and prepare a suitable Missouri Claim Against Estate template, follow these simple steps:

- Look through the form content to ensure it complies with your state regulations. To do so, check the form description or use the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Missouri Claim Against Estate. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Missouri Claim Against Estate on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

The legal process of probate can take as little time as 6 months or as long as 2 years. There are several factors on how long the process will take. The complexity of an estate will extend the process, as well as cases where heirs dispute the will.

In Missouri, after a person dies, the heirs have one year to open a probate estate if full probate is necessary. The biggest issue that arises is that Wills are not effective unless admitted to the probate court within one year of the death of the owner of the property.

A full probate administration must generally be opened within one year from the decedent's date of death. Also, a Will must be filed within one year from the decedent's date of death.

The time limit to contest a will in Missouri is within six months ?after the date of the probate or rejection thereof by the probate division . . . or within six months after the first publication of notice granting of letters on the estate of the decedent, whichever is later . . . .? Mo. Rev.

You can use a small estate proceeding in Missouri if: the value of the entire estate (all of the property the deceased person left behind) does not exceed $40,000. 30 days have passed since the death, and. no application for letters testamentary or administration has been granted or is pending.

MO Specifics In Missouri, creditors have 1 year from the decedent's death to file a claim against the estate, or 6 months from the initial publication of the executor appointment notice, whichever comes earlier.

These fees are based on the value of the estate assets administered during a supervised or independent probate: 5% on the first $5,000. 4% on the next $20,000. 3% on the next $75,000.