Missouri Inventory and Appeasement is a system of accounting used by the state of Missouri to track the value of certain assets and property. These assets and property include real estate, vehicles, furniture, equipment, and other tangible assets. The purpose of the system is to ensure that all public assets are accurately valued. The Missouri Inventory and Appeasement system is managed by the Missouri State Auditor's Office. There are two types of Missouri Inventory and Appeasement: physical inventory and appraised value. Physical inventory involves taking a physical count of the assets and property, noting their condition, and recording the details in the inventory system. Appraised value is the process of assessing the current market value of the assets and property. This value is determined by qualified appraisers and is used for tax purposes and for valuation purposes.

Missouri Inventory and Appraisement

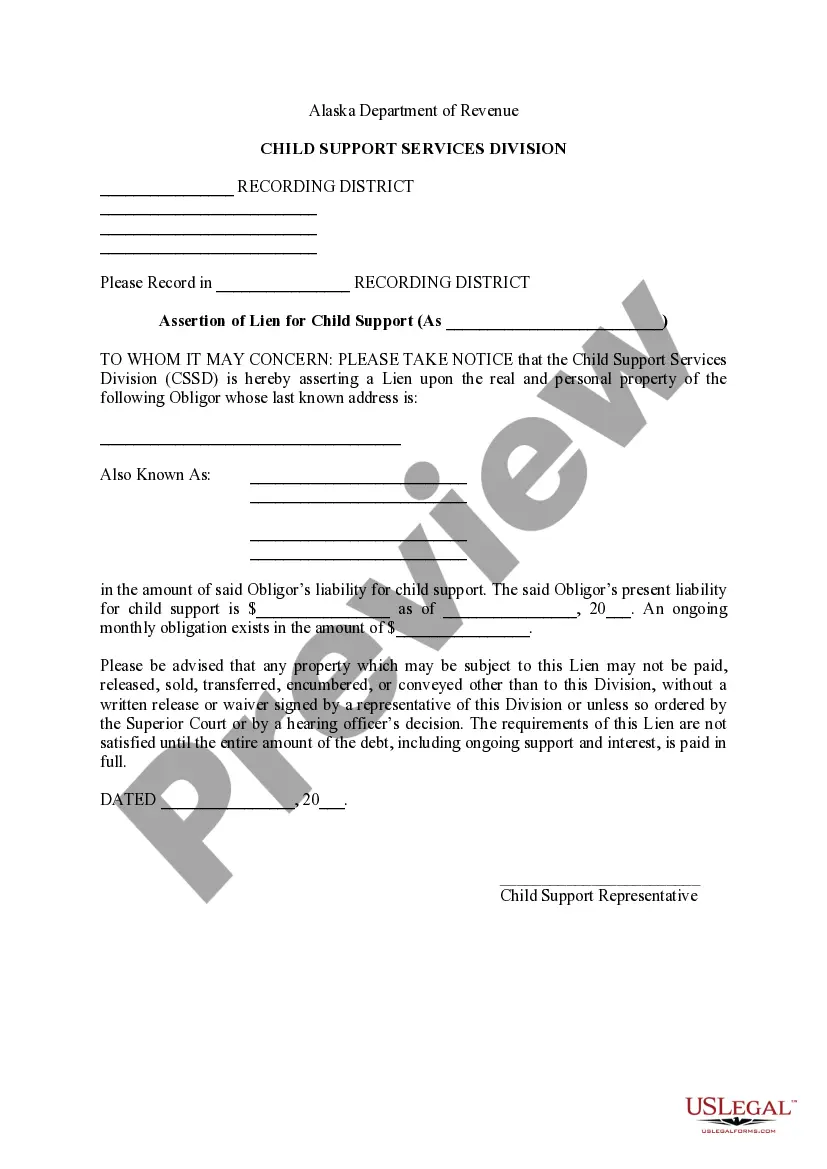

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Inventory And Appraisement?

US Legal Forms is the easiest and most economical method to discover suitable legal templates.

It boasts the largest online collection of business and personal legal documents created and validated by legal experts.

Here, you can locate printable and fillable forms that adhere to federal and local laws - just like your Missouri Inventory and Appraisement.

Examine the form description or preview the document to ensure you’ve located the one that fits your requirements, or search for another using the search tab above.

Click Buy now when you’re confident of its suitability with all the stipulations, and choose the subscription plan you prefer most.

- Acquiring your template requires just a few straightforward steps.

- Users with an existing account and valid subscription only need to Log In to the web service and download the document on their device.

- Afterward, they can find it in their profile under the My documents section.

- And here’s how you can obtain a correctly drafted Missouri Inventory and Appraisement if you are using US Legal Forms for the first time.

Form popularity

FAQ

To take inventory in a deceased estate, begin by gathering all important documents, such as wills and property titles. Then, systematically assess all assets, documenting each item thoroughly in your Missouri Inventory and Appraisement. Ensure to include valuations and keep everything organized for probate court. Utilizing platforms like US Legal Forms can simplify this process, providing templates and guidance.

In Missouri, an estate must exceed $15,000 in value to require probate. This threshold applies to the total value of assets, including real estate and personal property. If the estate's value is below this amount, you may not need to go through the Missouri Inventory and Appraisement process. Always consult with a legal professional to understand your specific situation.

To inventory household items for probate, start by going through each room and listing all valuable items. Include furniture, electronics, jewelry, and important documents in your Missouri Inventory and Appraisement. It’s helpful to take photos and note the condition of each item. This thorough approach ensures you have an accurate record for the probate process.

If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit. Beneficiaries can petition the court to have the executor removed from their positon if they can prove they should be removed for one of the reasons listed above.

What is the Inventory and Appraisal? The Inventory and Appraisal is a complete listing of the estate assets as of a particular date, usually the date of death. In a guardianship or conservatorship estate, it is the date of appointment.

Put simply, an Inventory lists the property owned by a decedent at the time of their death. The personal representative of an estate must file an Inventory with the court within three months after the date of their appointment.

In Missouri, after a person dies, the heirs have one year to open a probate estate if full probate is necessary. The biggest issue that arises is that Wills are not effective unless admitted to the probate court within one year of the death of the owner of the property.

Probate is necessary when a person dies with property in his or her name or with rights to receive property. Examples of having property at death include: Bank accounts in the decedent's name with no co-owner and no beneficiary designation. A home or land that is owned by the decedent individually.

Missouri probate code provides guidance for the payment of the executor. Their pay is based on the value of the estate. For the first $5000 of an estate, they receive a minimum of 5 percent. For the next $20,000, they receive four percent, for the next $75,000 it is three percent.