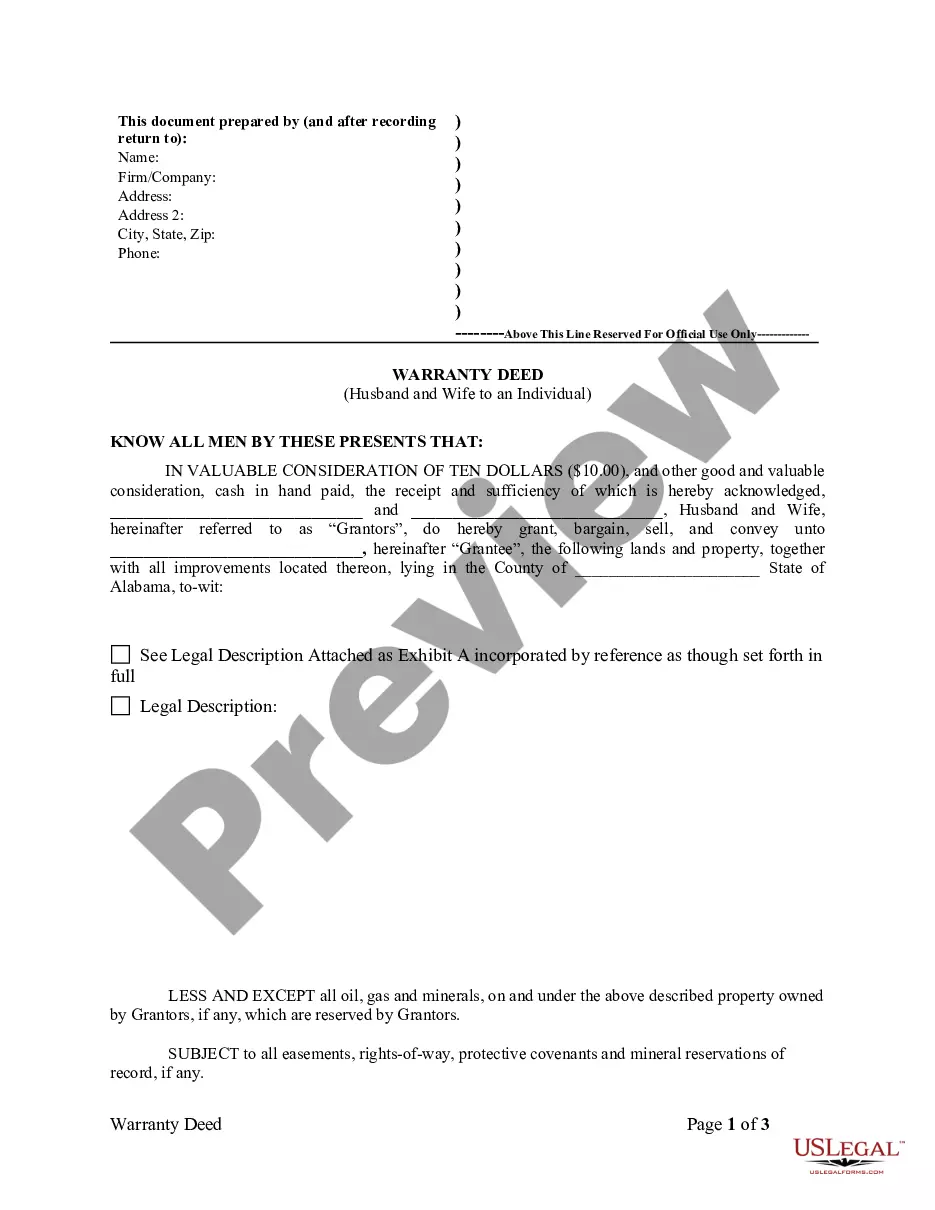

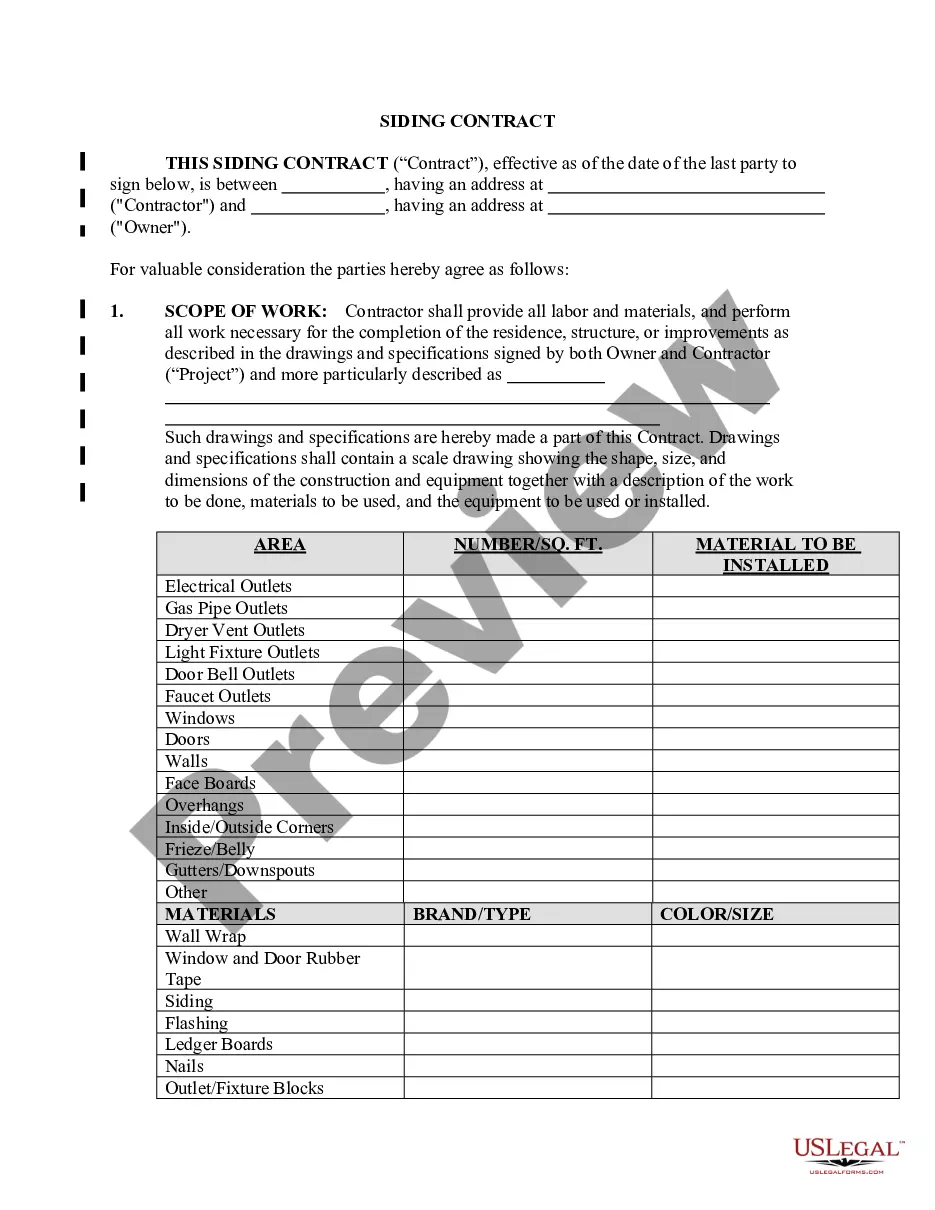

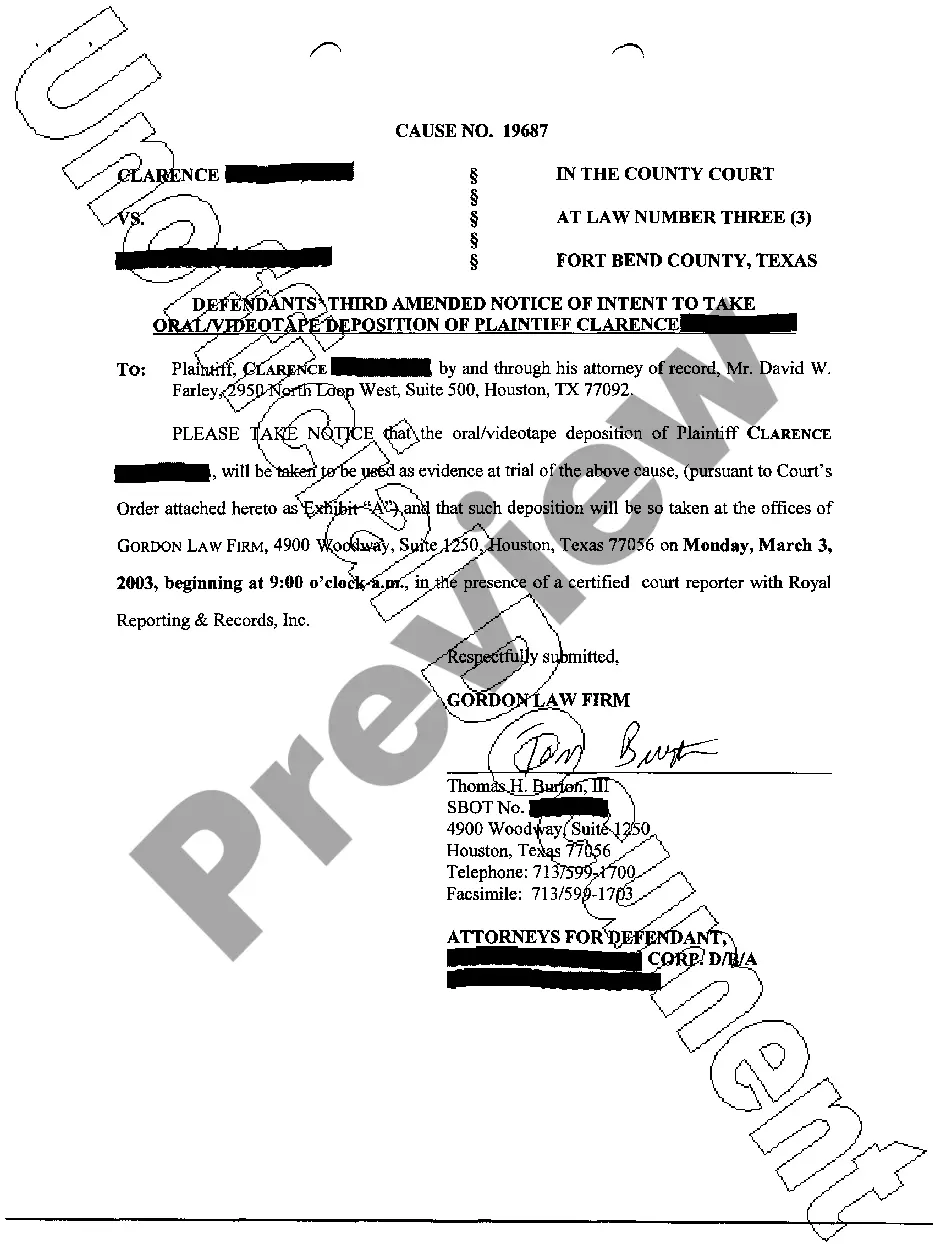

The Missouri Answer To Claim For Compensation (After 12-31-13) is a form that must be completed by employers in the state of Missouri when an employee files a claim for workers' compensation benefits. This form must be completed by the employer within 10 days of receiving the employee's claim. The form is available for download from the Missouri Department of Labor and Industrial Relations website. There are two types of Missouri Answer to Claim for Compensation (After 12-31-13): one for employers that carry workers' compensation insurance and one for employers that do not. For employers that carry workers' compensation insurance, the form must be completed by the insurance carrier. For employers that do not carry workers' compensation insurance, the form must be completed by the employer. The form includes a section for the employer to indicate whether they accept or deny the claim, and if they accept the claim, they must provide information about the employee's job duties and the date of the alleged injury.

Missouri Answer To Claim For Compensation (After 12-31-13)

Description

How to fill out Missouri Answer To Claim For Compensation (After 12-31-13)?

If you’re searching for a way to appropriately complete the Missouri Answer To Claim For Compensation (After 12-31-13) without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Missouri Answer To Claim For Compensation (After 12-31-13):

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the dropdown to find another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Missouri Answer To Claim For Compensation (After 12-31-13) and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Workers' compensation is a state-mandated, "no-fault" insurance system that pays benefits to workers injured on the job to cover medical care, part of lost wages and permanent disability. In return, employers receive immunity from civil lawsuits by employees over such workplace injuries.

The Federal Employees' Compensation Act (FECA) provides that a claim for compensation must be filed within 3 years of the date of injury. For a traumatic injury, the statutory time limitation begins to run from the date of injury.

How Long After a Settlement Do You Get Your Money? Once both parties agree on compensation, the settlement part of a claim goes through several steps. The procedure can take a while to complete. Usually, a person can expect about a month before receiving compensation from the insurance company.

How Long Does It Take to Settle a Workers' Comp Case in Missouri? The Missouri Workers' Compensation Commission has a statute of limitations that can vary depending on the circumstances. In general, it takes about six months from the date of injury to settle a workers' comp case.

Generally your compensation rate will be equal to 2/3 of your average weekly wage at the time of the injury not to exceed a maximum rate which is presently 55% of the state average weekly wage (?SAWW?).

Generally your compensation rate will be equal to 2/3 of your average weekly wage at the time of the injury not to exceed a maximum rate which is presently 55% of the state average weekly wage (?SAWW?).

If your surgery takes place before your settlement, your payout will increase regardless of which type of settlement you receive. Similarly, if your surgery takes place after a stipulation and reward settlement, your medical treatment will still be covered by the insurance company.

How Long Does It Take to Reach a Settlement for Workers' Comp? The entire settlement process?from filing your claim to having the money in your hands?can take around 12-18 months depending on the details of your case and whether or not you have legal representation.