Missouri Bond of Employer Carrying His Own Risk is a surety bond required in the state of Missouri. This bond guarantees that an employer will comply with Missouri's workers' compensation laws and regulations, including the payment of benefits to injured employees. This surety bond protects the injured employee from any non-payment of benefits due to them, as well as the state of Missouri from any non-compliance with the workers' compensation laws. There are two types of Missouri Bond of Employer Carrying His Own Risk: the Statutory bond, which is mandated by Missouri state law, and the Voluntary bond, which is chosen by the employer. The Statutory bond must have a face value of $10,000 or more, depending on the size of the employer's business. The Voluntary bond may be any amount, as long as it is sufficient to cover the cost of any potential claims. Both bonds must be issued by a surety company licensed to do business in Missouri.

Missouri Bond of Employer Carrying His Own Risk

Description

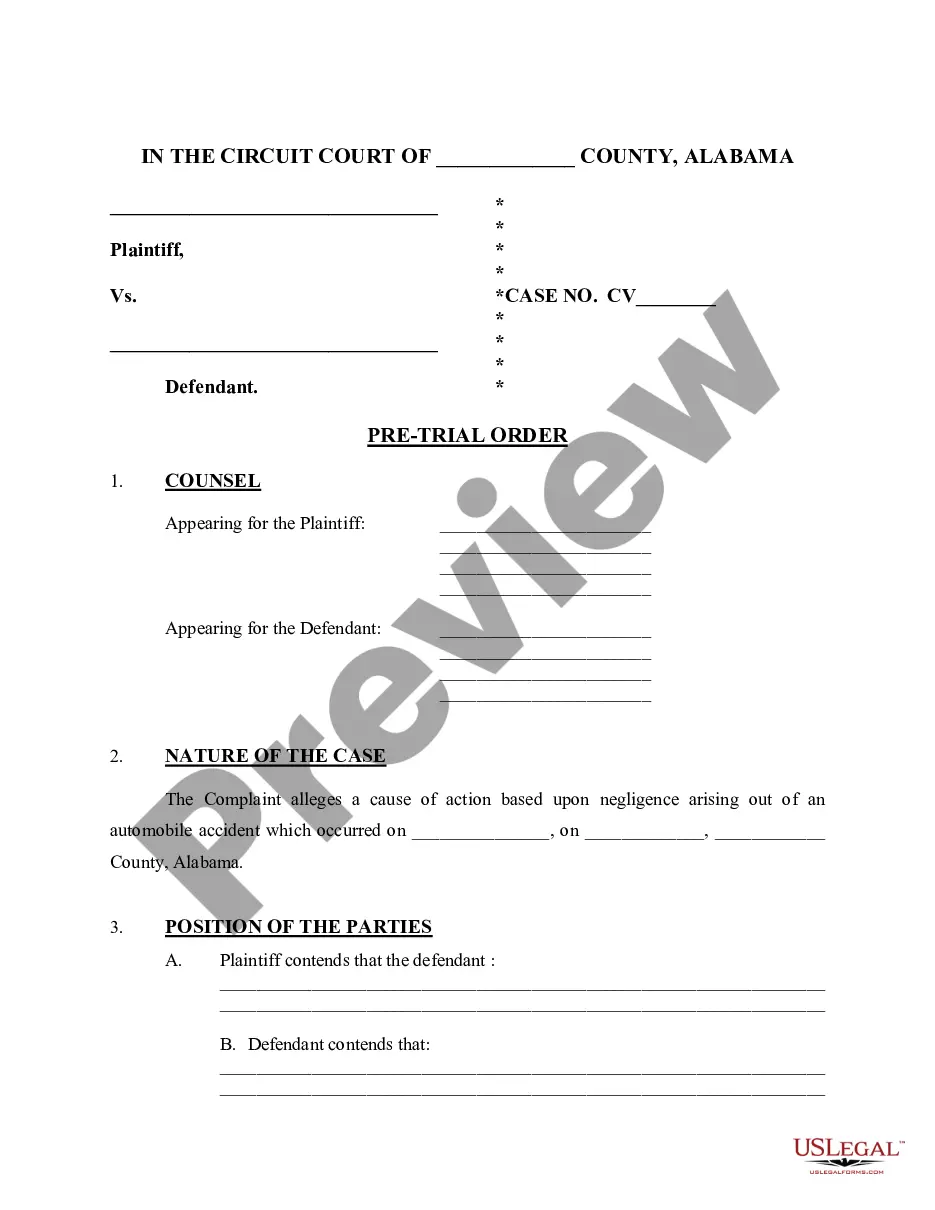

How to fill out Missouri Bond Of Employer Carrying His Own Risk?

US Legal Forms is the most easy and profitable way to locate suitable legal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with federal and local laws - just like your Missouri Bond of Employer Carrying His Own Risk.

Obtaining your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Missouri Bond of Employer Carrying His Own Risk if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make sure you’ve found the one corresponding to your needs, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Missouri Bond of Employer Carrying His Own Risk and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding formal documentation. Give it a try!

Form popularity

FAQ

How Long Does It Take to Reach a Settlement for Workers' Comp? The entire settlement process?from filing your claim to having the money in your hands?can take around 12-18 months depending on the details of your case and whether or not you have legal representation.

Sole proprietors and partners are considered employers, not employees, and are not covered by your policy. However, sole proprietors and partners can be added to the policy by endorsement. Corporate officers are considered employees of the corporation and must be covered.

A waiver of subrogation means that a business and their insurance company is foregoing all rights to file suit, or seek damages, from another business.

To date, the largest settlement payment in a workers' comp case came in March of 2017, with a $10 million settlement agreement.

As used in this section, "transient employer" means an employer as defined in sections 143.191, 287.030, and 288.032 making payment of wages taxable under chapters 143, 287, and 288 who is not domiciled in this state and who temporarily transacts any business within the state, but shall not include any employer who is

How Long Does It Take to Settle a Workers' Comp Case in Missouri? The Missouri Workers' Compensation Commission has a statute of limitations that can vary depending on the circumstances. In general, it takes about six months from the date of injury to settle a workers' comp case.

Generally your compensation rate will be equal to 2/3 of your average weekly wage at the time of the injury not to exceed a maximum rate which is presently 55% of the state average weekly wage (?SAWW?).

How to Calculate the Ruediger Formula. First, we add the amount paid in the workers' compensation claim. Second, we sum the total in the civil claim. In the third step, we divide the total amount of workers' compensation by the total amount of the civil claim.