Missouri Self-Insurance By-Laws are regulations that govern the practice of self-insurance in the state of Missouri. The By-Laws establish the rights and responsibilities of employers, employees, and other stakeholders in the self-insurance industry. They provide a framework for the administration of self-insurance plans, including requirements for employers to maintain adequate funding levels, report claims and financial data, and comply with state and federal laws. The By-Laws also set forth the procedures for the evaluation and approval of self-insurance plans. There are two types of Missouri Self-Insurance By-Laws: 1. Workers’ Compensation Self-Insurance By-Laws: These By-Laws govern the practice of self-insurance for workers’ compensation benefits in Missouri. They include requirements for maintaining adequate funding levels, reporting claims and financial data, and complying with state and federal laws. 2. Employer Liability Self-Insurance By-Laws: These By-Laws govern the practice of self-insurance for employer liability in Missouri. They include requirements for maintaining adequate funding levels, reporting claims and financial data, and complying with state and federal laws.

Missouri Self-Insurance By-Laws

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Self-Insurance By-Laws?

If you’re seeking a method to effectively finalize the Missouri Self-Insurance By-Laws without employing a legal expert, then you’re in the perfect spot.

US Legal Forms has established itself as the most comprehensive and dependable repository of official templates for every personal and business scenario. Every document you discover on our online platform is crafted in alignment with federal and state regulations, ensuring that your paperwork is organized.

Another great aspect of US Legal Forms is that you will never misplace the documents you acquired - you can access any of your downloaded forms in the My documents section of your profile whenever you require it.

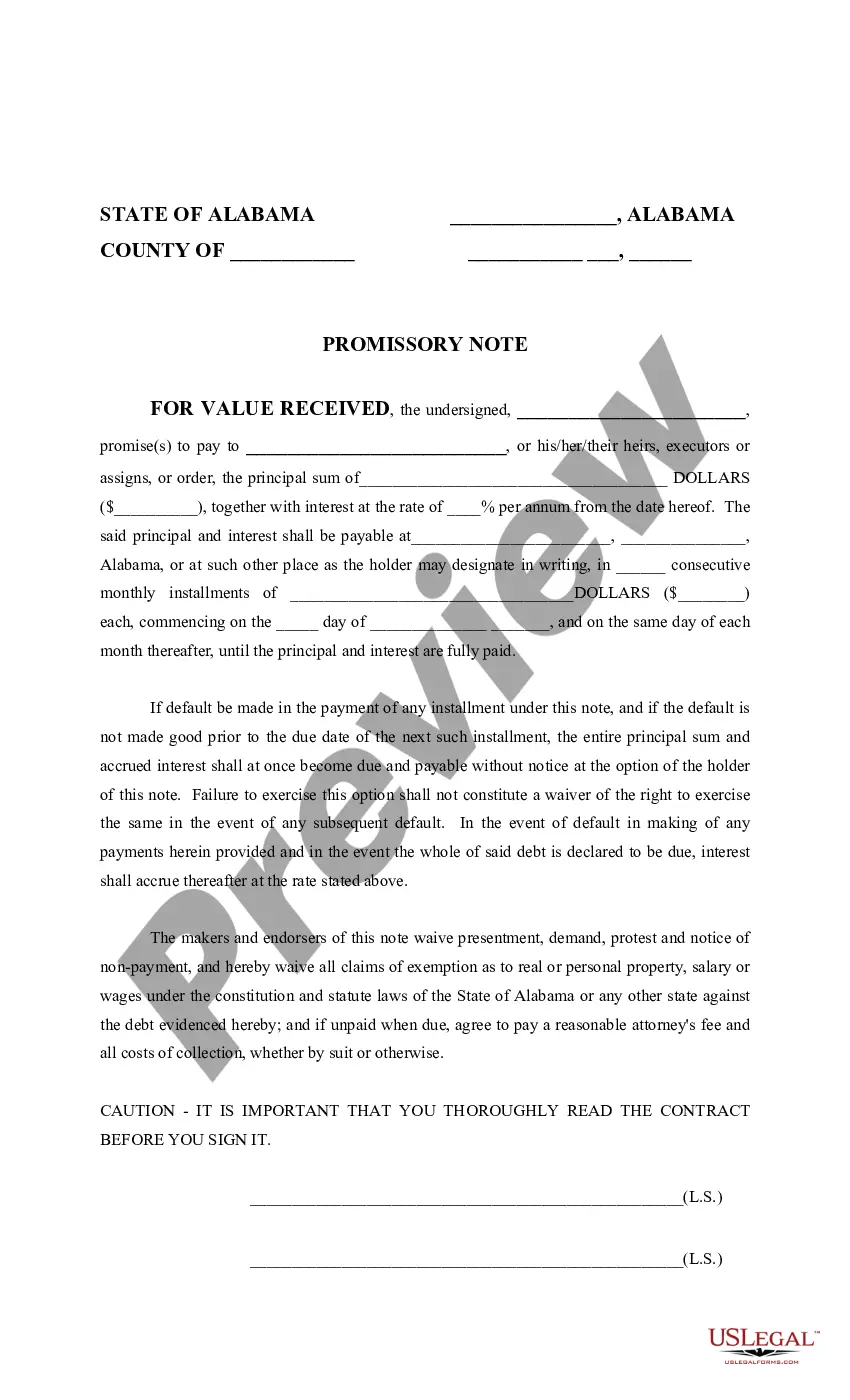

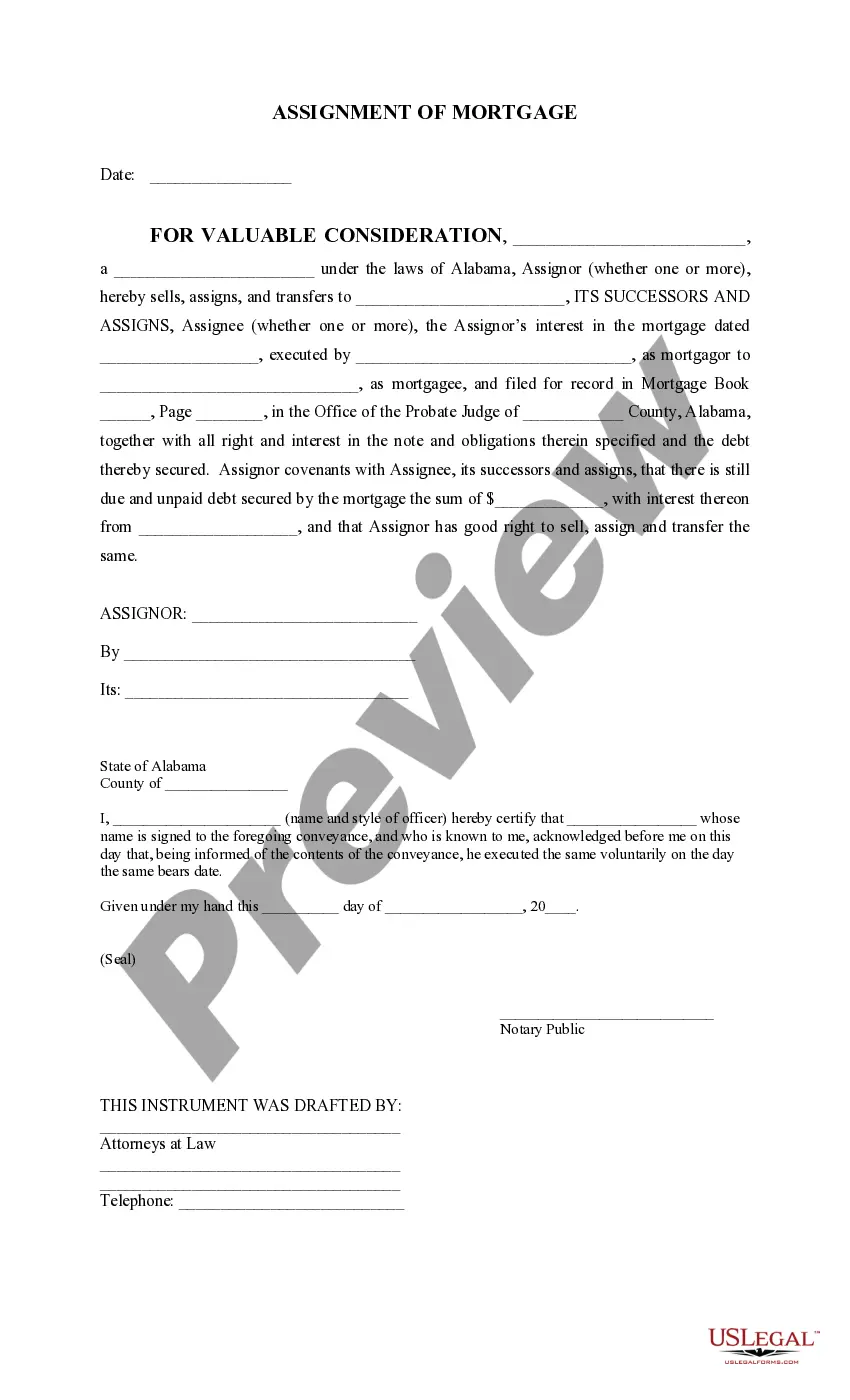

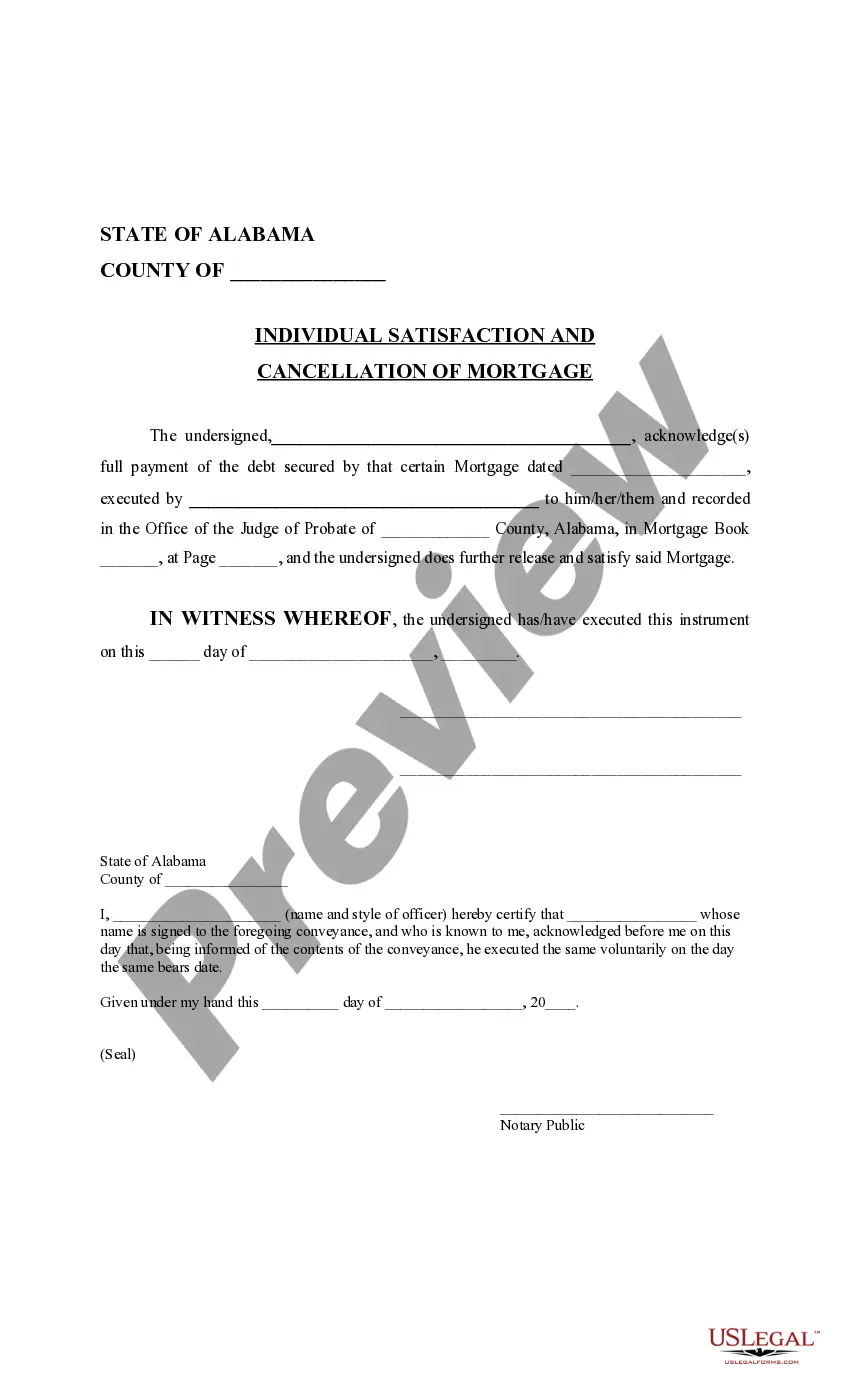

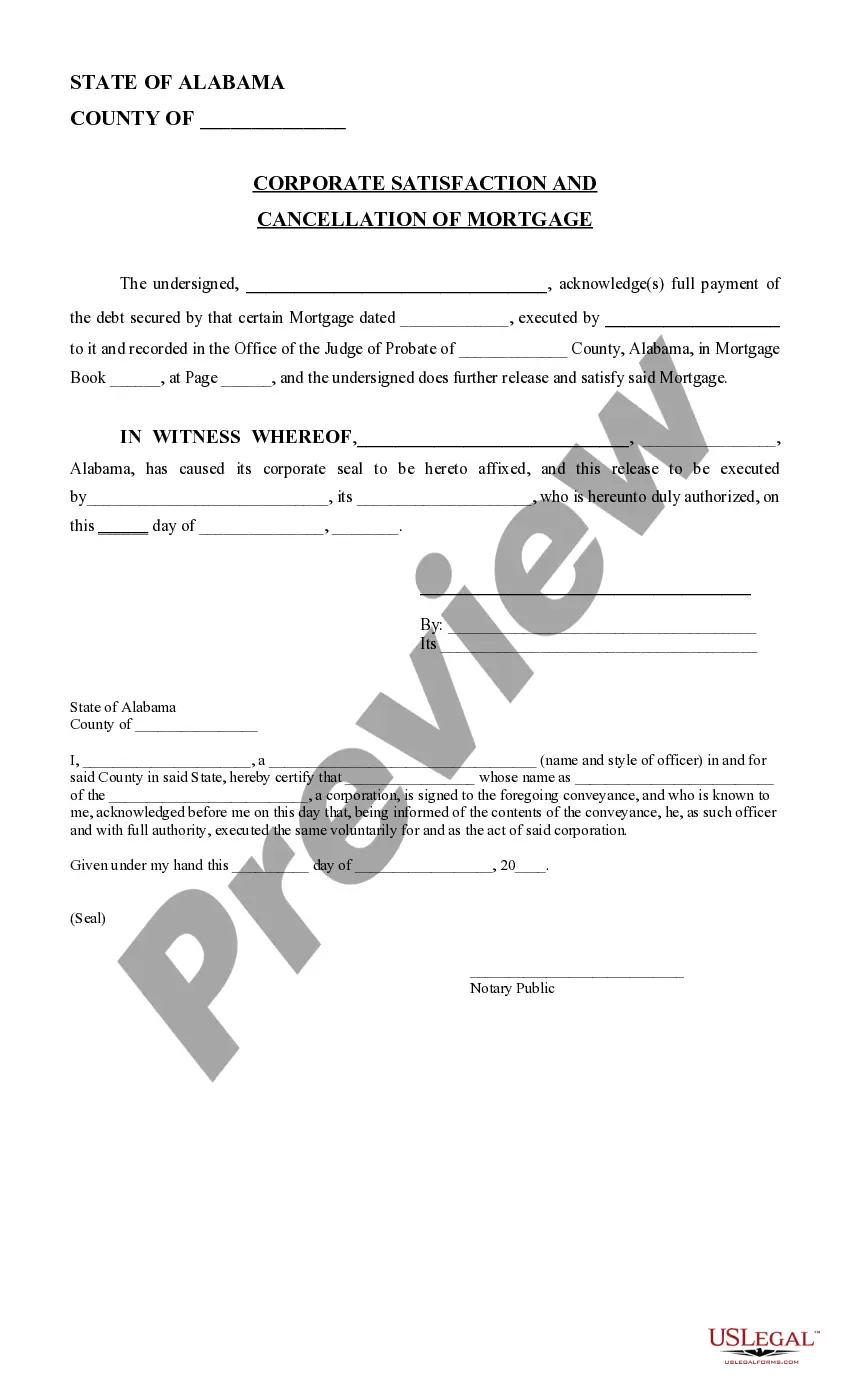

- Ensure the document you observe on the page aligns with your legal circumstances and state regulations by reviewing its text description or browsing through the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the dropdown to locate another template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are assured that the paperwork meets all the criteria.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to settle your US Legal Forms subscription. The template will be accessible for download immediately afterward.

- Choose the format in which you wish to receive your Missouri Self-Insurance By-Laws and download it by clicking the corresponding button.

- Import your template to an online editor to complete and sign it swiftly or print it out to prepare your physical copy manually.

Form popularity

FAQ

Current regulatory financial requirements for an organization desiring entry into self-insurance are: Three calendar years in business in a legally authorized business form. Three years of certified, independently audited financial statements. Acceptable credit rating for three full calendar years prior to application.

For example, the owners of a building situated atop a hill adjacent to a floodplain may opt against paying costly annual premiums for flood insurance. Instead, they choose to set aside money for repairs to the building if in the relatively unlikely event floodwaters rose high enough to damage their building.

Saving money may be the primary driver when companies decide to self-insure, but there are other benefits as well. Employers can eliminate costs for state insurance premium taxes. And they don't have to adhere to state-mandated coverage requirements.

Advantages And Disadvantages Difficult to develop a self-insured plan as the initial costs involved might be complex. There are no policy limits, as the insurance is customized per the applicant's needs. High chances of risk because some claims might be overly costly.

insured health plan is the traditional model of structuring an employersponsored health plan and is the most familiar option to employees. On the other hand, selfinsured plans are funded and managed by an employer, often to reduce health insurance costs.

In essence, being self-insured means having a ready pool of funds to cover any potential losses your business may incur ? such as employee health care costs ? rather than relying on an insurance company to do so.

If you're self-insured, you're not paying an insurance company every year to carry the risk of replacing your income if something happens to you. That's a huge benefit to you because you're saving money! And we're all about saving money where we can?especially on insurance premiums.

insured group health plan (or a 'selffunded' plan as it is also called) is one in which the employer assumes the financial risk for providing health care benefits to its employees.