Missouri Are You Off the Books? 1099 Fraud — Worker Misclassification is a type of fraud that involves employers misclassifying their employees as independent contractors, rather than as employees, in order to avoid paying taxes, Social Security, workers' compensation and other benefits. This type of fraud is particularly common in Missouri, where employers are required to send a 1099 form to each of their independent contractors. There are several types of Missouri Are You Off the Books? 1099 Fraud — Worker Misclassification. These include: 1. Misclassifying employees as independent contractors: This is when employers misclassify their employees as independent contractors, rather than as employees, in order to avoid paying taxes, Social Security, workers' compensation and other benefits. 2. Intentionally misclassifying employees in order to avoid taxation: This is when an employer intentionally misclassifies their employees as independent contractors in order to avoid paying taxes and other benefits. 3. Misclassifying employees in order to avoid the payment of wages and benefits: This is when an employer misclassifies their employees in order to avoid paying wages and benefits that are due to employees. 4. Misclassifying employees in order to avoid the payment of overtime: This is when an employer misclassifies their employees in order to avoid paying overtime wages. 5. Misclassifying employees in order to avoid providing workers' compensation: This is when an employer misclassifies their employees in order to avoid providing workers' compensation benefits.

Missouri Are You Off the Books? 1099 Fraud - Worker Misclassification

Description

How to fill out Missouri Are You Off The Books? 1099 Fraud - Worker Misclassification?

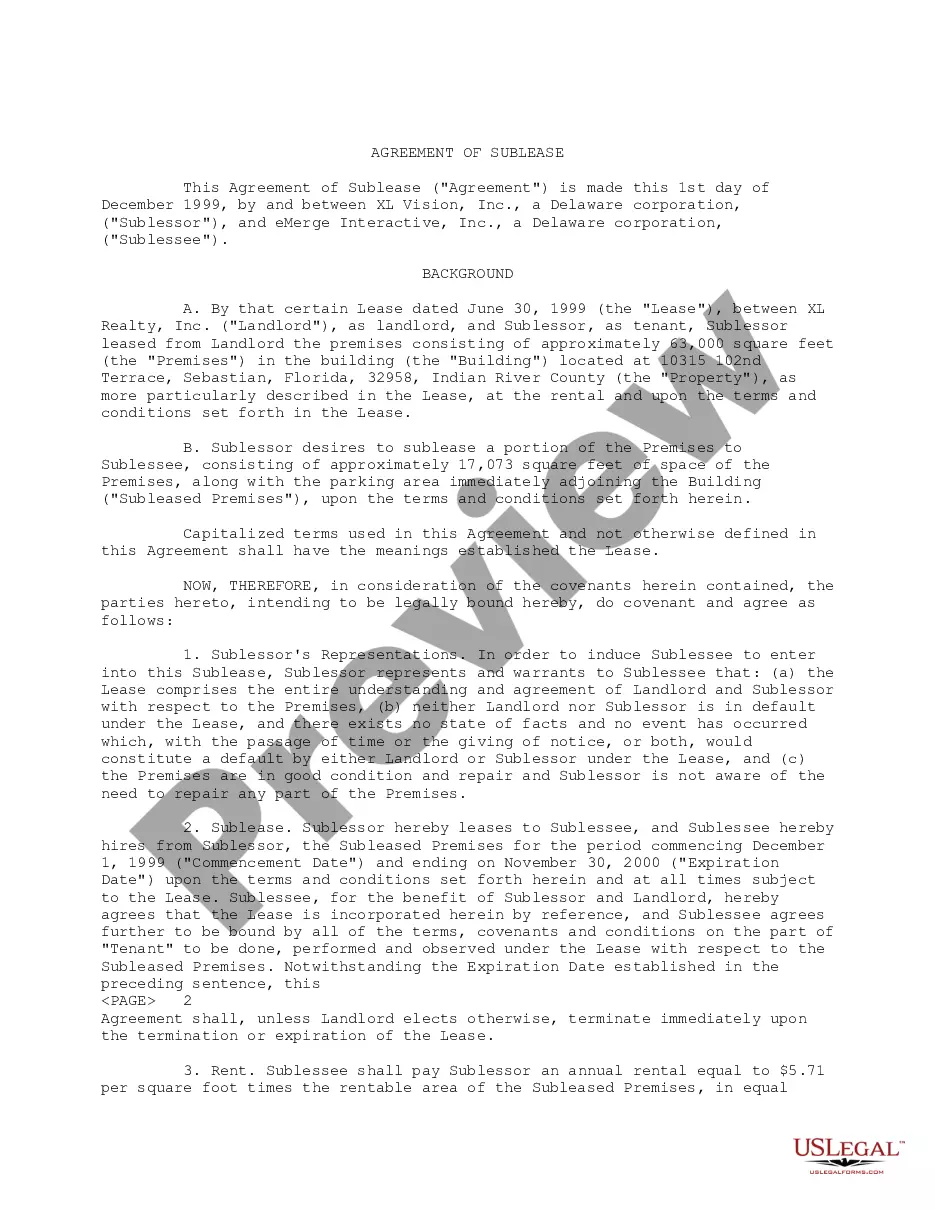

Coping with official documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Missouri Are You Off the Books? 1099 Fraud - Worker Misclassification template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is simple and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your Missouri Are You Off the Books? 1099 Fraud - Worker Misclassification within minutes:

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Missouri Are You Off the Books? 1099 Fraud - Worker Misclassification in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Missouri Are You Off the Books? 1099 Fraud - Worker Misclassification you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Misclassified worker Misclassifying workers as independent contractors adversely affects employees because the employer's share of taxes is not paid, and the employee's share is not withheld. If a business misclassified an employee, the business can be held liable for employment taxes for that worker.

If employers misclassify employees, they may be violating wage, tax, and employment eligibility laws. Organizations can be held liable for failing to pay overtime and minimum wage under the Federal Fair Labor Standards Act (FLSA) as well as under state wage laws.

In the US, individuals can use IRS form 3949-A to report a business for misclassification. The form collects information about the individual and company you suspect has violated tax laws by misclassifying the worker.

California law allows civil penalties to be charged to employers that intentionally misclassify workers. The fine can range between $5,000 and $15,000 per violation, and if there is a pattern of willful misclassification, the courts can fine employers an additional $10,000 to $25,000.

The IRS strongly encourages employees to report any concerns they have that their employer is failing to properly withhold and pay federal income and employment taxes. You can call the IRS at 800-829-1040 or report suspected tax fraud by calling 800-829-0433.

Employment tax evasion schemes can take many forms. The IRS says that some of the more common include pyramiding, misclassifying workers as independent contractors, paying employees in cash, filing false payroll tax returns, or failing to file payroll tax returns.

Misclassified worker If a business misclassified an employee, the business can be held liable for employment taxes for that worker. Generally, an employer must withhold and pay income taxes, Social Security and Medicare taxes, as well as unemployment taxes.

When employers incorrectly classify workers who are employees as independent contractors, it's called ?misclassification.? If you are misclassified as an independent contractor, you may still qualify for unemployment benefits.