The Missouri Wages, Hours and Dismissal Rights dictate the minimums for wages, hours, and dismissal rights in the state of Missouri. This includes the minimum wage, overtime, holidays, vacation time, meal and rest breaks, and dismissal rights. These rights are established under the Missouri Minimum Wage Law. The minimum wage in Missouri is currently $9.45/hour. Employees must be paid 1.5 times their regular rate for all hours worked over 40 hours in a workweek. Employers are generally not required to pay overtime for hours worked on holidays, Saturdays, or Sundays. Missouri employers are not required to provide vacation, holiday, or sick pay. However, if an employer voluntarily provides vacation, holiday, or sick pay, it must comply with its own policies and procedures. In Missouri, employers are required to provide employees with a 30-minute meal break for every 5 hours of work, and a 10-minute rest break for every 4 hours of work. Employers in Missouri must adhere to the state and federal laws regarding dismissal. Generally, employers must provide employees with a written notice of termination and a specified period of time to appeal the decision. Employees may also be entitled to receive certain benefits, such as severance pay, depending on the circumstances of their dismissal.

Missouri Wages, Hours and Dismissal Rights

Description

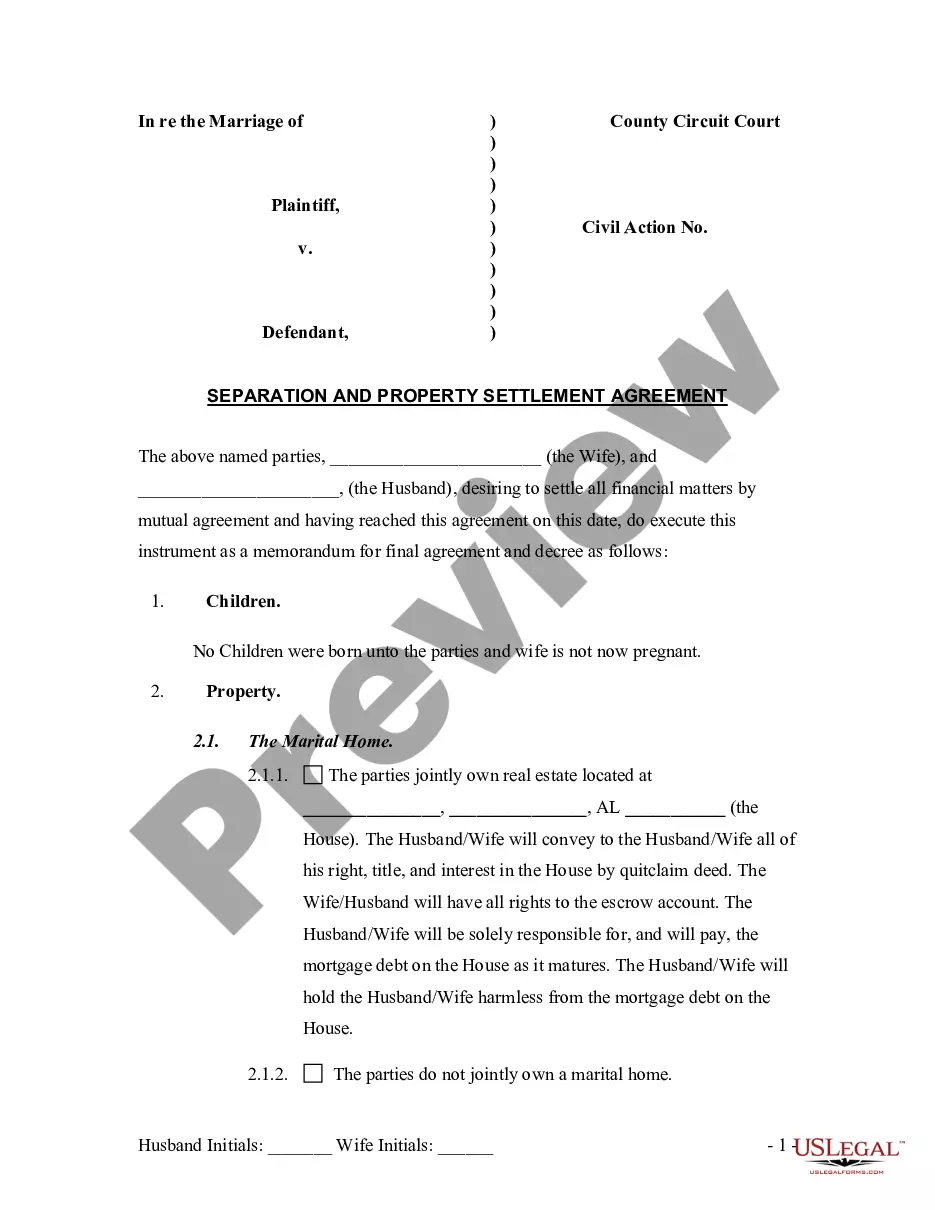

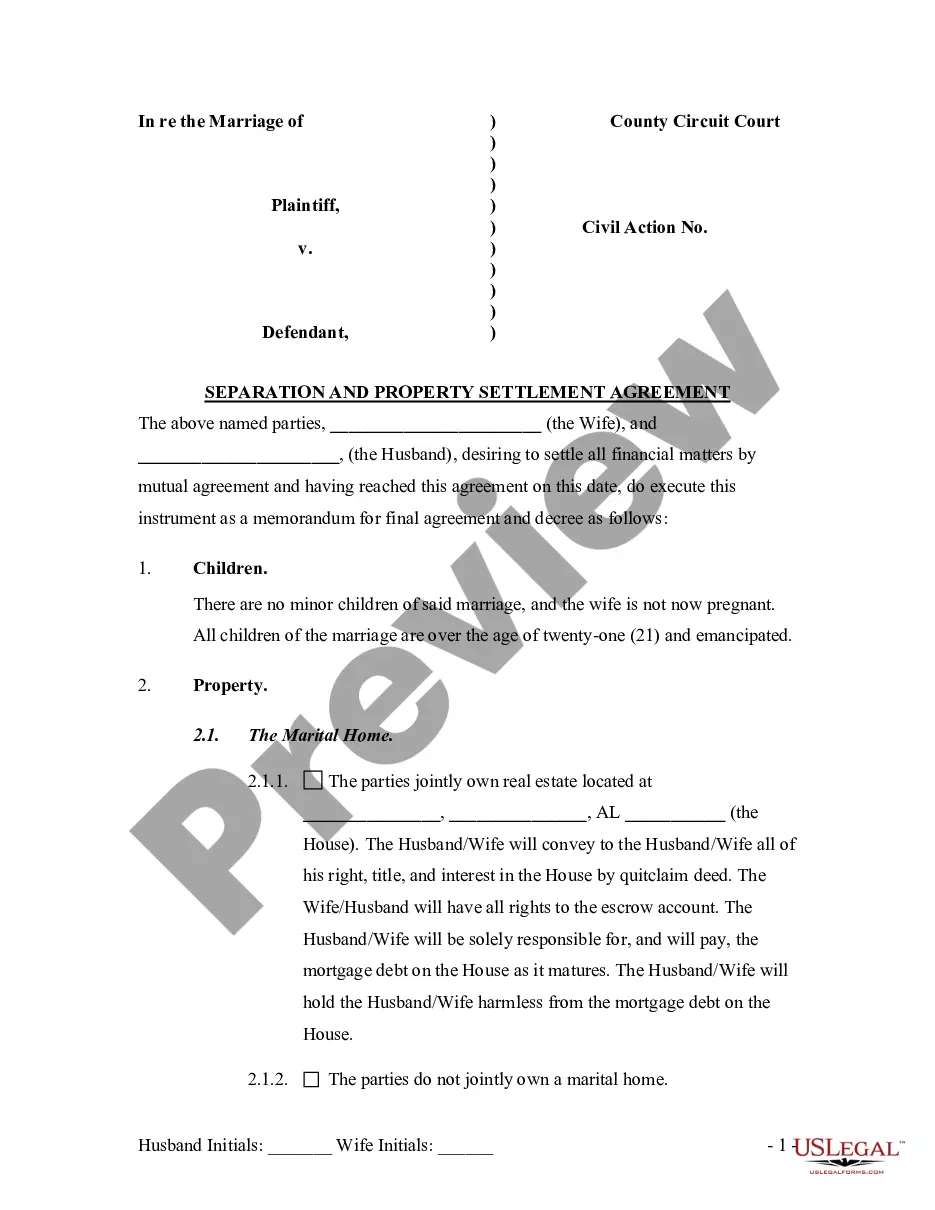

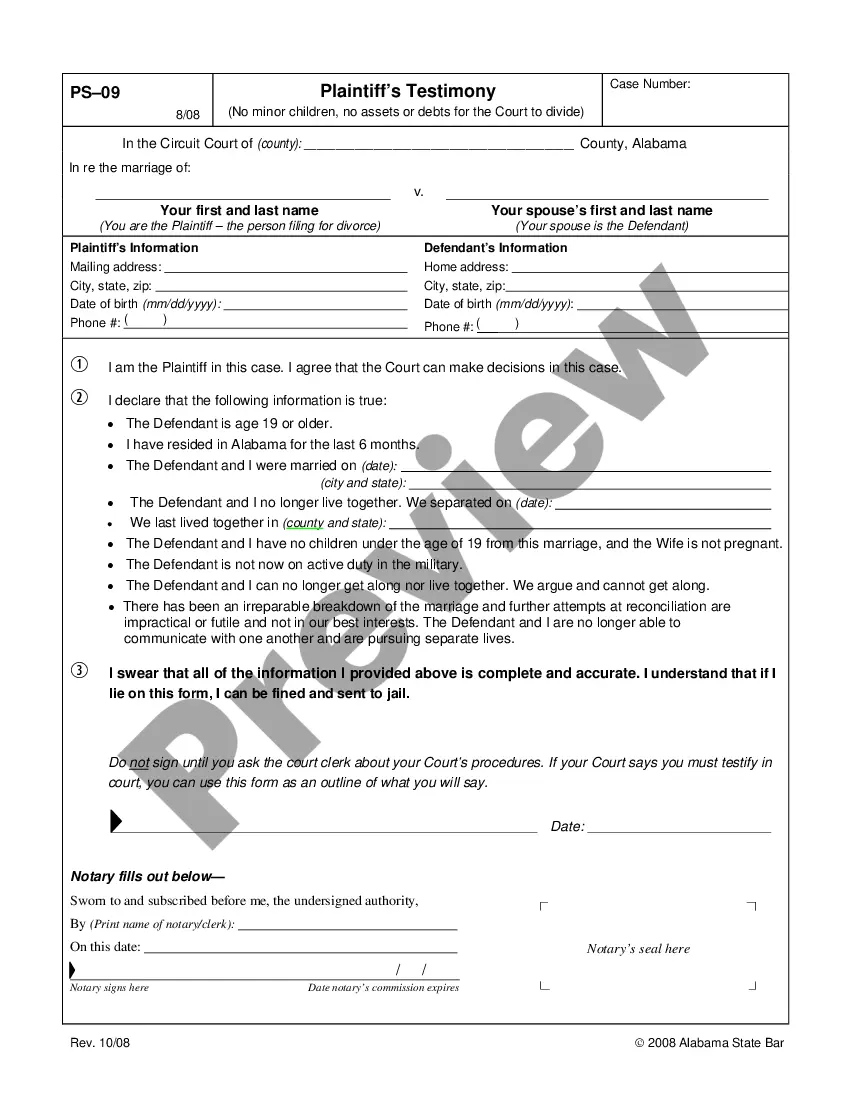

How to fill out Missouri Wages, Hours And Dismissal Rights?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are checked by our experts. So if you need to prepare Missouri Wages, Hours and Dismissal Rights, our service is the perfect place to download it.

Obtaining your Missouri Wages, Hours and Dismissal Rights from our service is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they find the proper template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance verification. You should carefully examine the content of the form you want and make sure whether it suits your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Missouri Wages, Hours and Dismissal Rights and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Missouri payment law The wages or salaries due to an employee must be paid within 16 days of the close of each payroll period. Yet, salespeople, executive, administrative, and professional employees may be paid their salaries or commissions monthly.

The State of Missouri follows the employment-at-will doctrine. That means employers can fire employees for almost any reason or no reason as long as they don't have a written employment contract promising them employment for a certain period. However, this rule has exceptions.

There is no minimum or maximum number of hours an employee may be scheduled or asked to work. This is in ance with the Fair Labor Standards Act. Missouri labor laws also require most employers to pay or compensate their employees for the number of actual hours worked.

Employers are required to pay a discharged employee all wages due at the time of dismissal. If not paid at that time, the employee should contact his or her former employer by certified mail return receipt requested, requesting wages that are due. The employer has seven days to respond to the written request.

There are no requirements under Missouri law that address when wages are due when an employee quits a job. If wages are not paid by the next regular pay period, then the wages can be collected by legal action.

Ing to Missouri law, the constitution of wrongful termination occurs when you report issues and any violations concerning workplace safety. If you report or reject to commit any illegal activity or take action against public policies, or any of these specific reasons, you have a valid wrongful termination claim.

Mandatory Overtime in Missouri Your boss can also require you to work overtime with limited notice. If you refuse, you may be terminated or otherwise penalized by your employer.