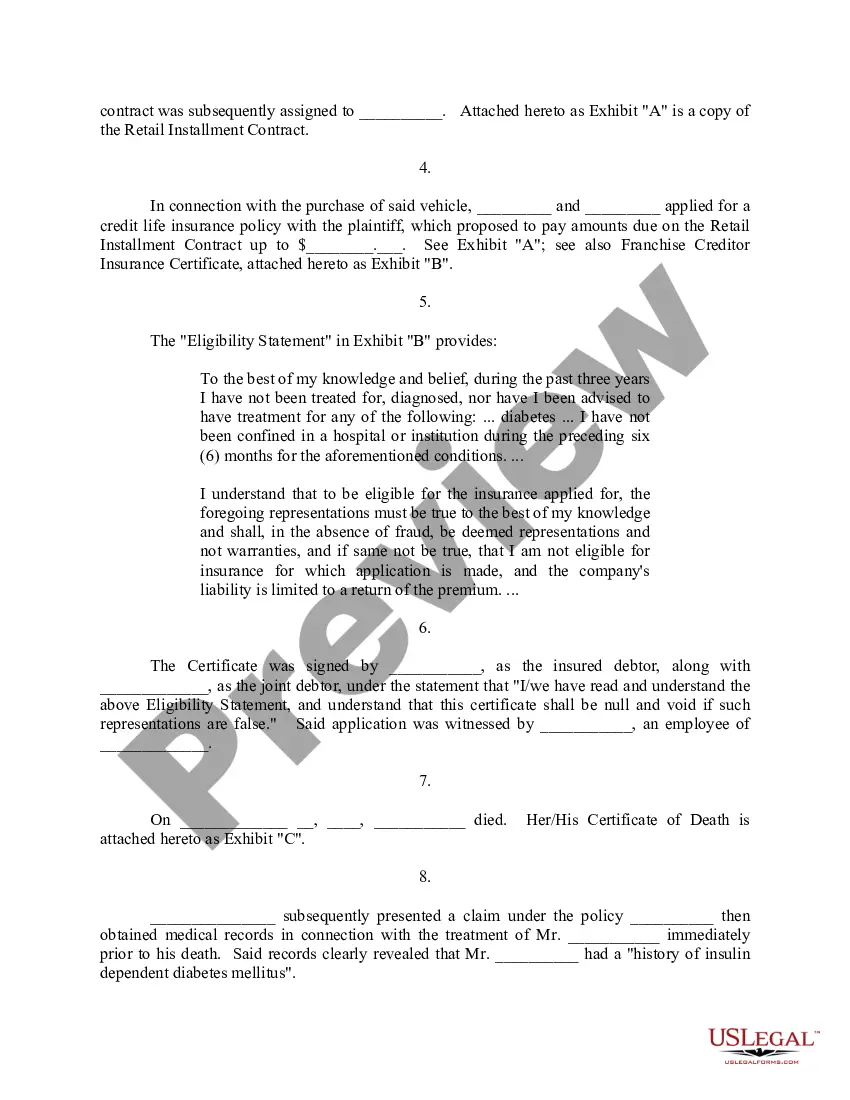

This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

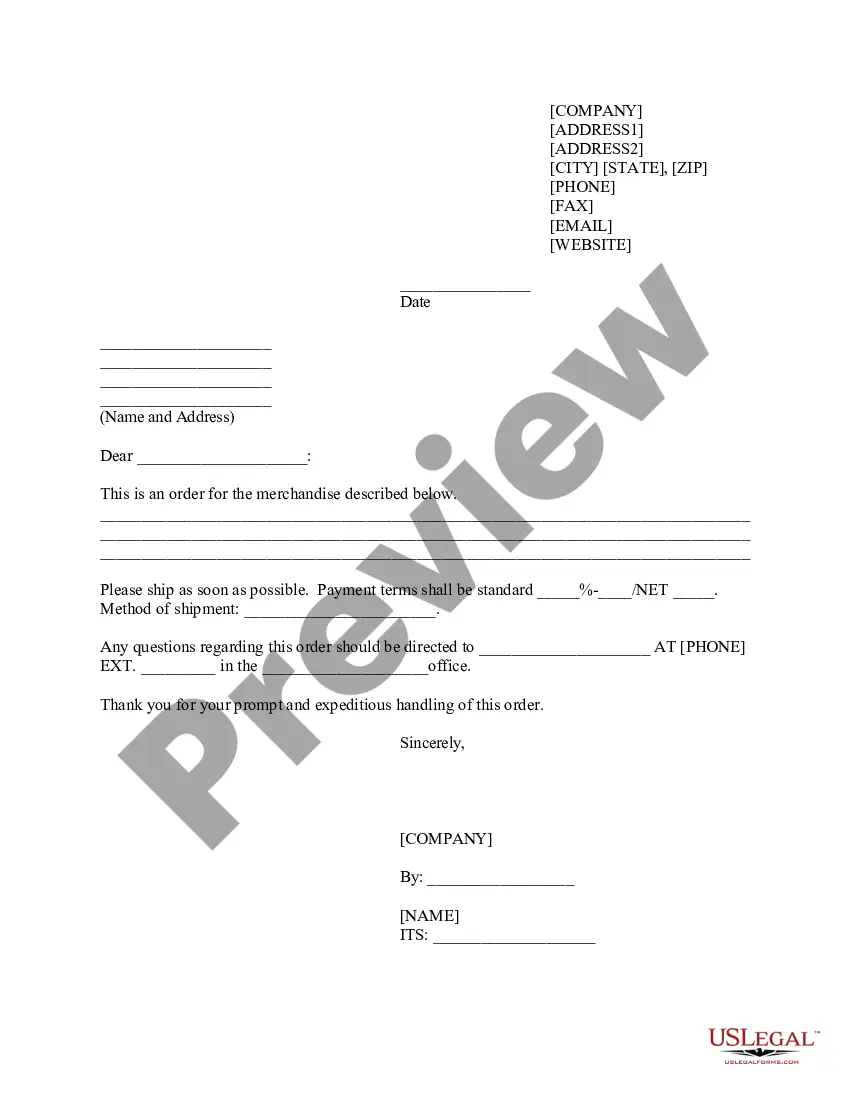

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

If you need to compile, retrieve, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms accessible online. Employ the site's straightforward and user-friendly search to find the documents you need. Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage in just a few clicks.

If you are currently a US Legal Forms member, Log In to your account and select the Download option to obtain the Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. You can also access forms you have previously saved from the My documents section of your account.

If you are utilizing US Legal Forms for the first time, follow the steps outlined below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Review option to inspect the form's content. Remember to read the description. Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions in the legal form repository. Step 4. Once you have found the form you need, click on the Get now option. Choose the pricing plan you prefer and input your details to register for an account. Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify and print or sign the Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage.

- Every legal document template you acquire is yours permanently.

- You have access to every form you saved in your account.

- Click the My documents section and select a form to print or download again.

- Be proactive and download and print the Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage with US Legal Forms.

- There are thousands of professional and state-specific forms you can use for your personal or business needs.

Form popularity

FAQ

In Missouri, an insurance company typically has 30 days to investigate a claim after receiving all necessary documentation. This timeframe is crucial for ensuring timely processing and resolution of your claim. If you feel that your claim is not being handled properly, you may consider filing a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to seek a formal review. Platforms like USLegalForms can provide the necessary templates to assist you in this process.

To file a complaint against an insurance company in Missouri, start by gathering all relevant documentation, including your policy details and any correspondence with the insurer. You can then submit a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage through the Missouri Department of Insurance. This formal process allows you to seek clarity on your coverage and ensure that your rights are upheld. Additionally, consider using platforms like USLegalForms to streamline the filing process and access helpful resources.

A declaratory judgment in insurance is a formal legal statement that clarifies the rights and responsibilities of the parties involved in an insurance contract. Specifically, when you file a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it allows you to seek a court's interpretation of your policy. This type of judgment can help you understand whether your coverage applies to a particular situation. By using this legal tool, you can effectively address any uncertainties that may arise regarding your insurance policy.

The purpose of a declaratory judgment is to provide clarity and legal certainty regarding a specific issue. In the context of a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, this legal action helps individuals understand their rights and obligations under a policy. By seeking this judgment, you can resolve disputes without waiting for further legal complications. This process ultimately promotes a smoother resolution for all parties involved.

To obtain a declaratory judgment, certain requirements must be met. The party must demonstrate an actual controversy exists, and the court must have jurisdiction over the matter. In the case of a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it is crucial to provide sufficient evidence and legal grounds for the request. Using resources like USLegalForms can assist in ensuring compliance with these requirements.

An example of a motion for declaratory judgment could be a request to determine the validity of a credit life insurance policy. In this motion, the party would outline the specific issues regarding the Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, seeking the court's interpretation. This can help clarify the rights of all parties involved and resolve uncertainties.

While a declaratory judgment can provide clarity, it may also have disadvantages. For instance, it may not resolve all aspects of a dispute or lead to additional litigation. When considering a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it is essential to weigh these factors and consult with legal resources like USLegalForms to make an informed decision.

A CC declaratory judgment refers to a judgment that clarifies the rights and obligations of the parties involved in a case. In Missouri, this may pertain to various legal matters, including a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Understanding the nuances of a CC declaratory judgment can help you navigate legal complexities effectively.

Filing a declaratory judgment in Missouri involves submitting a petition to the appropriate court. You need to include relevant details about the dispute, such as the specifics of your Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Using a platform like USLegalForms can simplify this process, providing you with templates and guidance to ensure all necessary information is included.

The burden of proof for a declaratory judgment typically rests with the party seeking the judgment. In the context of a Missouri Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, the plaintiff must demonstrate that there is a legitimate controversy regarding the policy's coverage. The court will then evaluate the evidence presented to make an informed decision.