This form is a Class Action Complaint. Plaintiffs seek damages and injunctive relief from defendants for liability under the Racketeer Influenced and Corrupt Organizations Act(RICO). Plaintiffs contend that the defendants' actions justify an award of substantial punitive damages against each.

Missouri Complaint for Class Action For Wrongful Conduct - RICO - by Insurers

Description

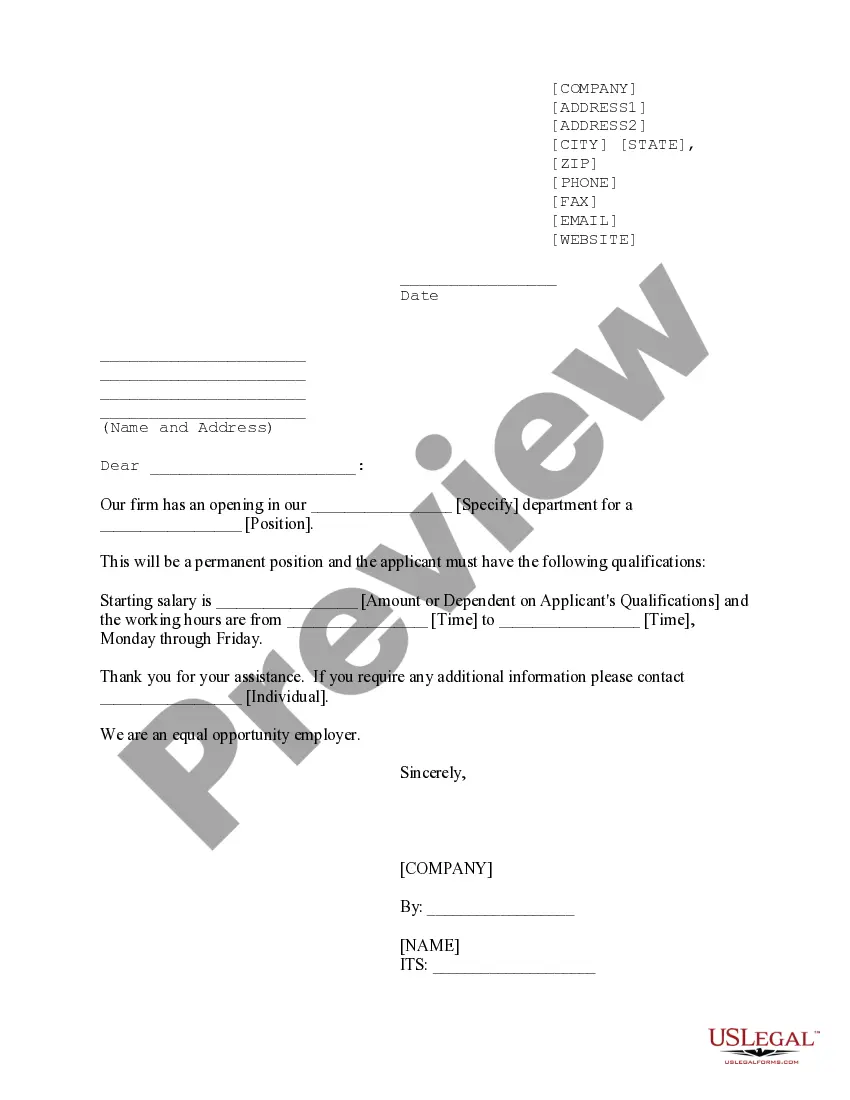

How to fill out Complaint For Class Action For Wrongful Conduct - RICO - By Insurers?

You might spend numerous hours online looking for the valid document template that complies with the federal and state requirements you need.

US Legal Forms provides thousands of valid templates that are reviewed by professionals.

You can download or print the Missouri Complaint for Class Action For Wrongful Conduct - RICO - by Insurers from my assistance.

If available, utilize the Review option to browse through the document template as well. To find an additional version of your form, use the Search field to locate the template that suits your needs and requirements. Once you have found the template you require, click on Get now to continue. Select the pricing plan you need, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the valid form. Choose the format of your document and download it to your system. Make changes to your document if possible. You can complete, edit, sign, and print the Missouri Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. Download and print thousands of document templates using the US Legal Forms site, which offers the largest selection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Missouri Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

- Every valid document template you acquire is yours permanently.

- To retrieve an additional copy of the purchased form, visit the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for your region/area of interest.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

The Unfair Claims Practice Act in Missouri aims to protect consumers from unfair treatment by insurance companies. It prohibits practices such as delaying claims processing or providing inadequate reasons for claim denial. If you believe your insurance company has violated this act, you can file a Missouri Complaint for Class Action For Wrongful Conduct - RICO - by Insurers to seek justice and compensation.

To file a Missouri Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, start by gathering all relevant documents related to your claim. You can file your complaint with the Missouri Department of Insurance, or you may choose to pursue legal action by consulting an attorney experienced in class action lawsuits. Using platforms like US Legal Forms can simplify this process, providing you with the necessary forms and guidance to ensure your complaint is properly filed.

The UNFAIR CLAIMS SETTLEMENT PRACTICES ACT gives a company 30 days to investigate a claim, with some exceptions. The insurer should provide the necessary claim forms and reasonable assistance on completing those forms to the insured within 10 working days of notification of the claim.

All of the following, if performed frequently enough to indicate a general business practice, are unfair claims settlement practices, EXCEPT: Failing to acknowledge with reasonable promptness communications regarding claims.

An example of an Unfair Claims Settlement Practice is failing to promptly provide reasonable explanations for the denial of claims. This means that when an insurance company denies a claim, they should give a clear and reasonable explanation for the denial in a timely manner.

An unfair claims practice is what happens when an insurer tries to delay, avoid, or reduce the size of a claim that is due to be paid out to an insured party.

Insurance companies in state have at least 30 days to acknowledge a claim and decide whether or not to pay it. Missouri does not have a specific time frame in which the final payment must be made, however, and only mandates that it be done in a prompt manner.

You May Have a Bad Faith Claim If the Insurance Company Failed to Live Up to Its Contractual Duties. Bad faith consists of failing to abide by an obligation of loyalty or the implied covenant of good faith and fair dealing.