Missouri Direct Deposit Form for Employees

Description

How to fill out Direct Deposit Form For Employees?

Selecting the optimal official document template can be a significant challenge.

Of course, there are numerous web templates accessible online, but how can you find the official version you require.

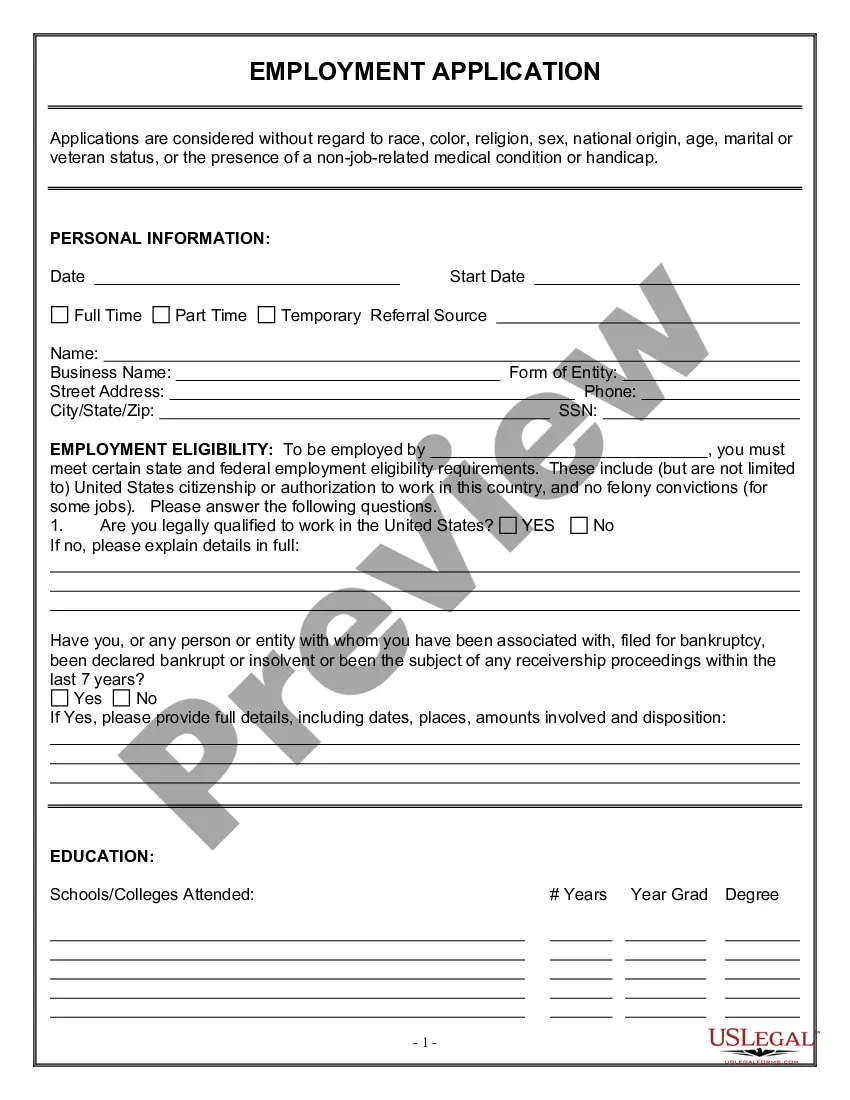

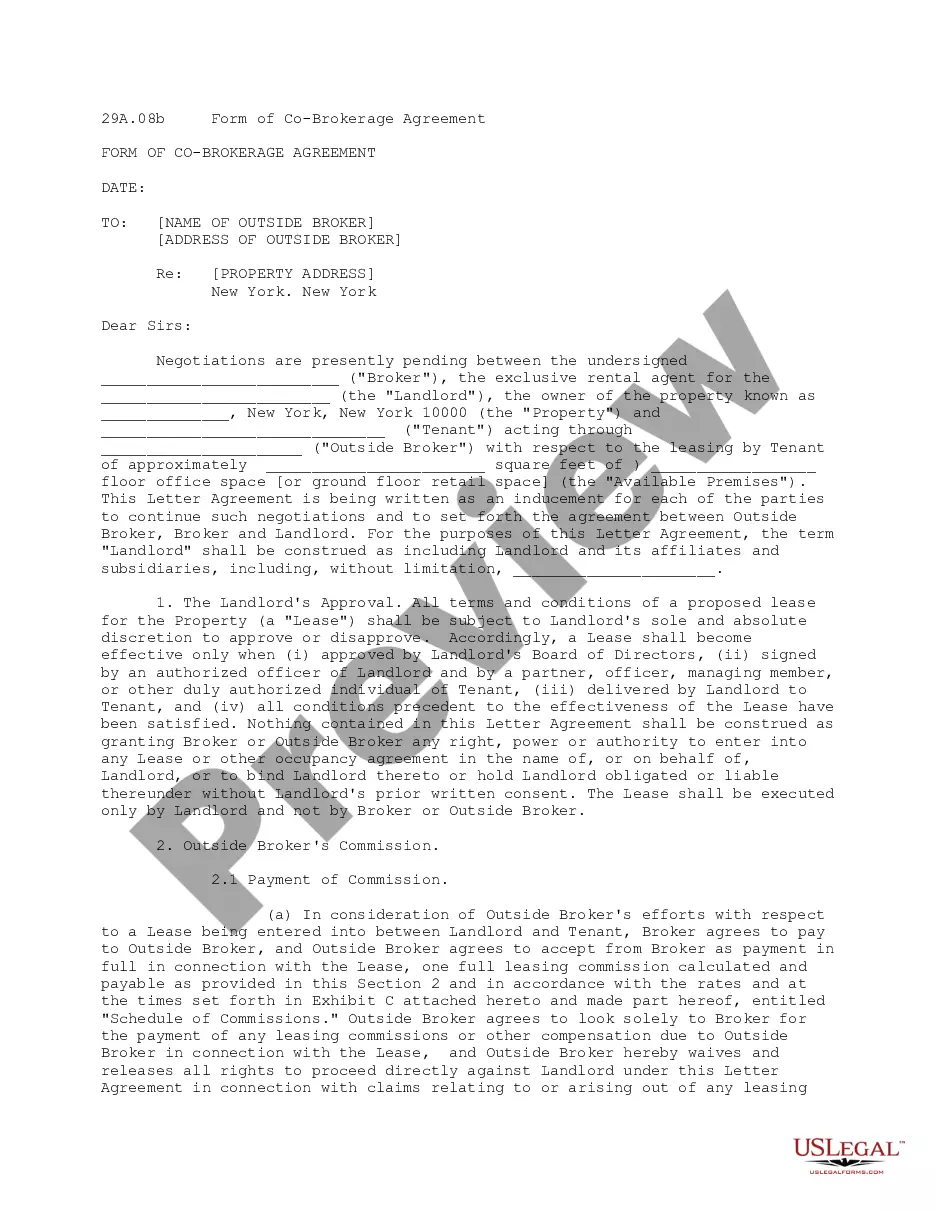

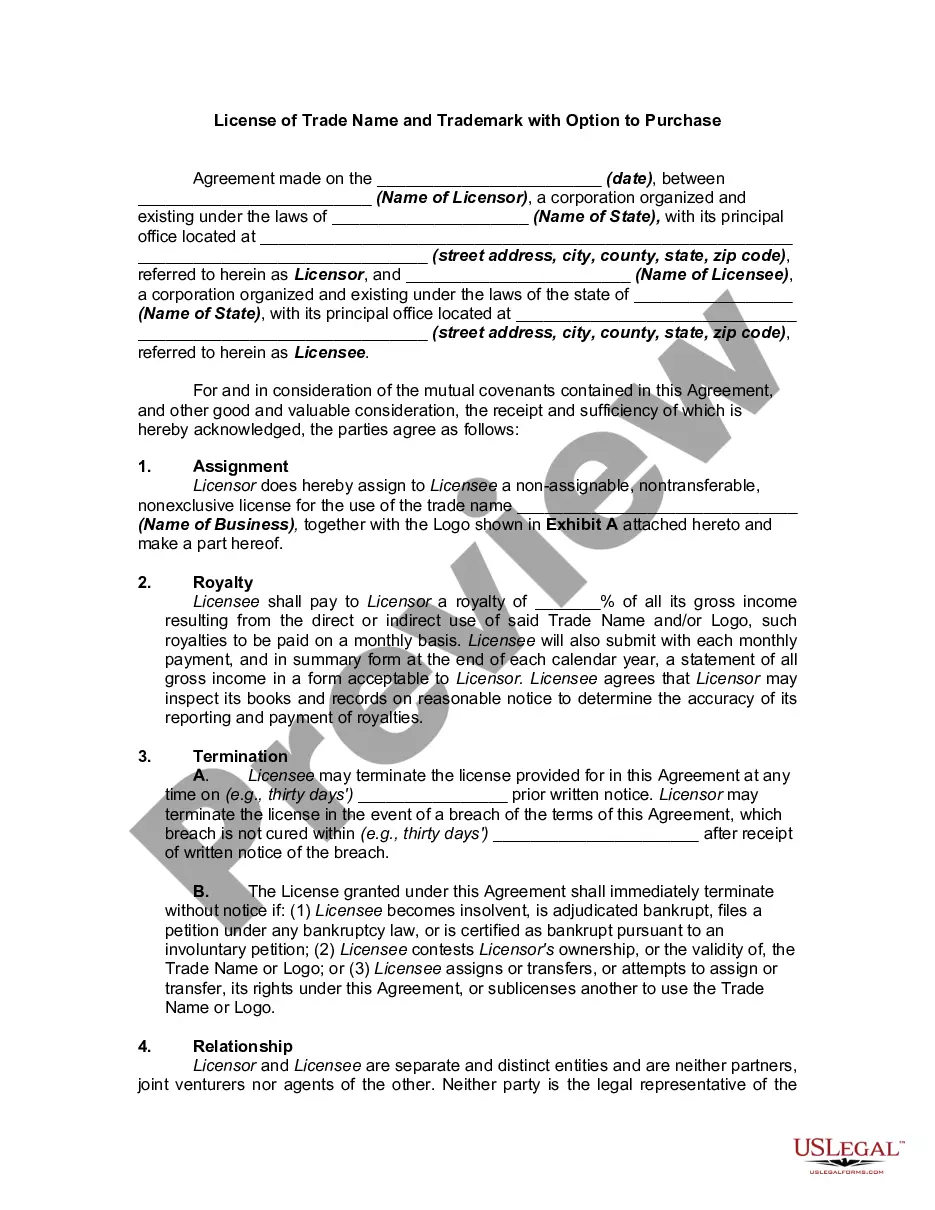

Utilize the US Legal Forms website. This service provides a vast selection of templates, including the Missouri Direct Deposit Form for Employees, which can be utilized for both business and personal purposes.

First, ensure you have selected the correct form for your area. You can review the form using the Review button and examine the form summary to confirm it is the appropriate one for you.

- All of the forms have been verified by professionals and comply with state and federal standards.

- If you are already a registered user, Log In to your account and click on the Acquire button to obtain the Missouri Direct Deposit Form for Employees.

- Use your account to browse through the official forms you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some easy steps for you to follow.

Form popularity

FAQ

For direct deposit, you don’t need a specific tax form, but the W-4 form is essential for tax withholding. Completing the W-4 form accurately will help your employer determine how much tax to withhold from your paycheck. Pair this with your Missouri Direct Deposit Form for Employees to ensure your payment and taxes are managed correctly.

To obtain a voided check for direct deposit, simply write 'VOID' across a blank check from your checking account. Make sure not to sign or fill in any other information on the check. You can then submit this voided check along with your Missouri Direct Deposit Form for Employees to your employer, ensuring they have the necessary information for direct deposits.

New employees in Missouri typically need to complete several forms, including the Missouri Direct Deposit Form for Employees and the W-4 tax form. These forms provide your employer with essential information for payroll and tax withholding purposes. It's crucial to fill out these forms correctly to ensure smooth processing of your payroll and state taxes.

Your employer requires the Missouri Direct Deposit Form for Employees to set up direct deposit for your paycheck. This form collects your banking information, including your account number and bank routing number. By completing this form, you ensure that your salary is deposited directly into your bank account, allowing for convenience and faster access to your funds.

Filling out a deposit form involves providing critical information, such as your name, account number, and the amount you wish to deposit. Make sure to double-check your banking details for accuracy. Following these steps ensures that your deposit processes smoothly and without delay.

To enroll employees in direct deposit, provide them with the Missouri Direct Deposit Form for Employees. Ensure they fill out their banking information completely and accurately. Once collected, review the forms and ensure they are signed before initiating the direct deposit process.

Yes, employers in Missouri can require employees to utilize direct deposit for their wages. However, they must inform employees through a written policy. The Missouri Direct Deposit Form for Employees is designed to facilitate this process efficiently and securely.

On your Missouri Direct Deposit Form for Employees, include your name, address, and employer information at the top. Additionally, you should provide your banking details, such as the account number and routing number. Always remember to sign and date the form to confirm your authorization.

To complete an ACH enrollment form, start by providing your details, such as name and address. Next, enter your banking information, including the bank name, routing number, and account number. Finally, ensure you authorize the form by signing and dating it, allowing your employer to process your direct deposit.

In the context of a direct deposit form, 'branch' refers to the specific location of your bank where your account is held. It helps identify the exact place linked to your routing number. Always ensure that you fill this section accurately to avoid any processing delays.