A Missouri Buy Sell Agreement Between Shareholders and a Corporation is a legal document that outlines the terms and conditions for the transfer of shares between shareholders in a corporation. This agreement ensures the smooth transition of ownership in the event of certain triggering events, such as death, disability, retirement, or voluntary or involuntary termination of a shareholder. Keywords: Missouri Corporation, Shareholders, Buy Sell Agreement, Transfer of Shares, Triggering Events, Ownership Transition. There are different types of Missouri Buy Sell Agreements that can be drafted between shareholders and a corporation, depending on the specific circumstances and needs of the parties involved. Some common types of buy-sell agreements include: 1. Cross-Purchase Agreement: In this type of agreement, the remaining shareholders in the corporation have the right to buy the shares of the departing shareholder. Each remaining shareholder agrees to purchase a proportionate share of the departing shareholder's shares. 2. Redemption Agreement: This agreement is structured so that the corporation has the option to buy the shares of the departing shareholder. The corporation typically uses its own funds or borrows money to buy back the shares. 3. Hybrid Agreement: A hybrid buy-sell agreement combines elements of both cross-purchase and redemption agreements. It allows both the corporation and the remaining shareholders to have the option to buy the shares of the departing shareholder. 4. Wait-and-See Agreement: This type of agreement allows the parties to delay the decision regarding who will buy the departing shareholder's shares until a specified triggering event occurs. The agreement will contain provisions that outline the process for determining the buyer(s) at that future point. When drafting a Missouri Buy Sell Agreement Between Shareholders and a Corporation, it is important to cover key aspects such as the purchase price and payment terms of the shares, any restrictions on transferability of shares, dispute resolution mechanisms, valuation methods for determining the fair market value of shares, funding mechanisms for the purchase (e.g., life insurance policies), and the roles and responsibilities of the parties involved. Additionally, the agreement should address other important provisions, including rights of first refusal of existing shareholders, non-competition clauses, restrictions on the sale of shares to third parties, and put/call options that allow shareholders to force the sale or purchase of shares. By having a well-drafted buy-sell agreement in place, shareholders and the corporation can ensure that the transfer of shares is conducted smoothly, avoiding potential conflicts and ensuring the continued stability and success of the corporation.

Missouri Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Buy Sell Agreement Between Shareholders And A Corporation?

Are you in a situation where you need documents for both business or personal reasons daily.

There are many legal document templates available online, but finding reliable ones isn't straightforward.

US Legal Forms offers thousands of form templates, including the Missouri Buy Sell Agreement Between Shareholders and a Corporation, designed to meet state and federal requirements.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, fill in the required details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Buy Sell Agreement Between Shareholders and a Corporation template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/county.

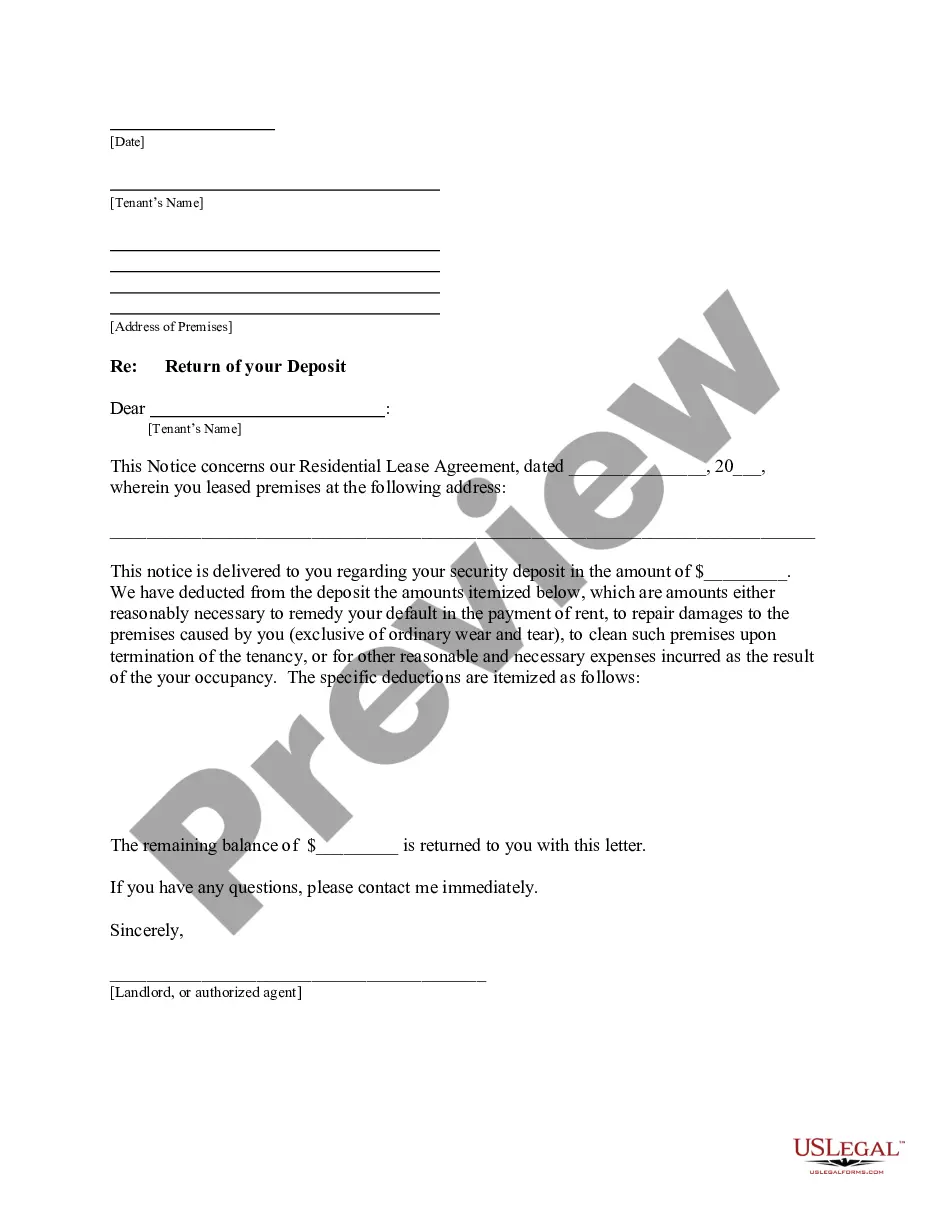

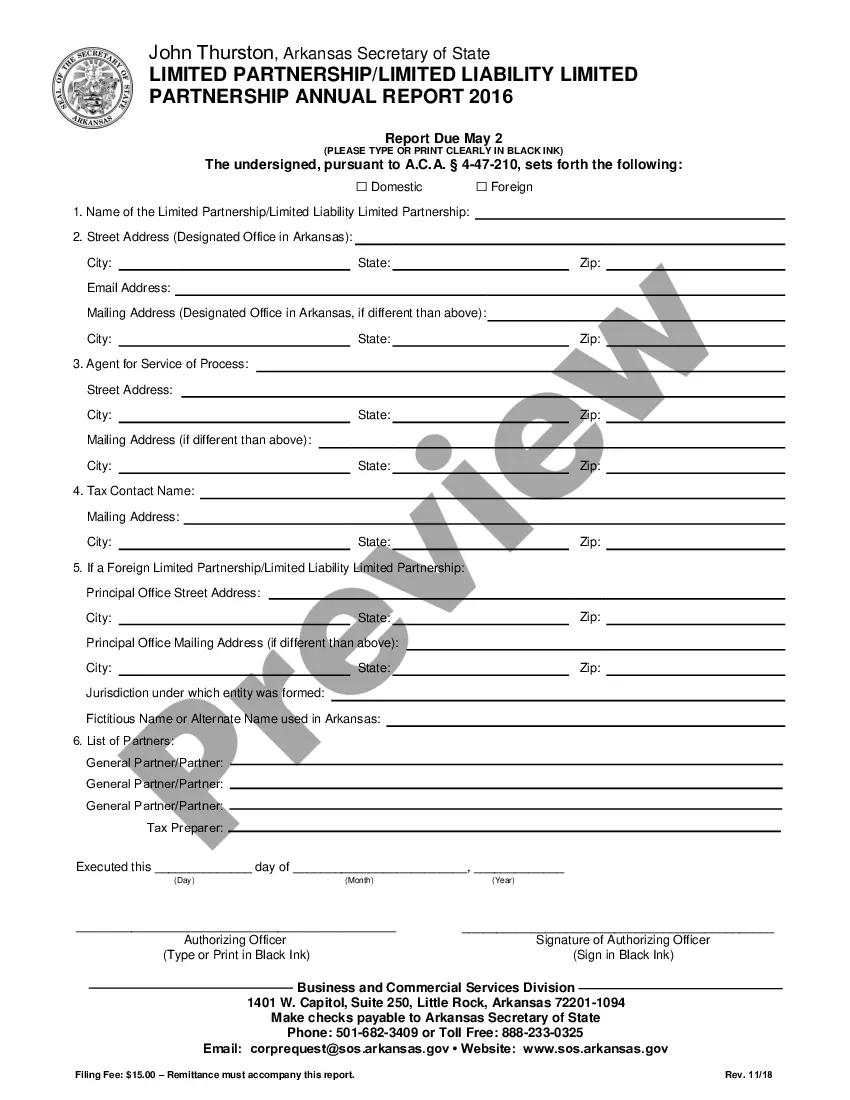

- Use the Preview button to review the template.

- Read the description to confirm that you have chosen the correct form.

- If the form isn’t what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The creation of a buy-sell agreement typically involves collaboration between shareholders and a knowledgeable attorney. This collaborative effort ensures the agreement addresses all relevant concerns while adhering to state-specific requirements. Utilizing a Missouri Buy Sell Agreement Between Shareholders and a Corporation can help align the interests of all parties involved, fostering better communication and understanding.

Buy-sell agreements are usually drafted by corporate attorneys familiar with the state’s specific regulations. These professionals understand the intricacies of Missouri laws and can tailor the agreement to fit the unique circumstances of your corporation. Using a qualified service or a legal platform, like uslegalforms, can facilitate the drafting process, ensuring comprehensive coverage of all necessary aspects.

To execute a buy-sell agreement, all shareholders must agree to the terms outlined in the document. They will then sign the agreement, often in the presence of a notary public to validate the execution. Implementing a Missouri Buy Sell Agreement Between Shareholders and a Corporation can streamline ownership transitions and provide clarity in ownership stakes.

Typically, an attorney experienced in corporate law drafts the sales agreement. This professional ensures that the document meets legal standards and accurately reflects the intentions of the shareholders involved. When dealing with a Missouri Buy Sell Agreement Between Shareholders and a Corporation, it is crucial to have expert guidance to avoid potential disputes in the future.

When writing a Missouri Buy Sell Agreement Between Shareholders and a Corporation, start by defining the purpose of the agreement and identifying involved parties. Include essential clauses covering triggering events, valuation methods, and payment processes. You may also consider consulting a legal professional or using platforms like US Legal Forms to ensure your agreement adheres to local laws and adequately protects all shareholders.

To fill out a Missouri Buy Sell Agreement Between Shareholders and a Corporation, first identify all shareholders and their ownership percentages. Next, detail the triggering events that may activate the buy-sell provisions. Finally, incorporate a clear valuation method for shares and outline the payment terms to ensure all parties understand their rights and obligations.

A shareholder agreement sets the overall governance rules for shareholders, including voting rights and decision-making processes, while a Missouri Buy Sell Agreement Between Shareholders and a Corporation specifically focuses on the sale and transfer of shares under certain conditions. In essence, the buy-sell agreement is a subset of the broader shareholder agreement, tailored to facilitate smoother transitions.

A Missouri Buy Sell Agreement Between Shareholders and a Corporation typically includes terms for triggering events, valuation methods for shares, and payment terms. It also outlines the rights and obligations of shareholders in the event of a sale or transfer. Furthermore, the agreement may specify what happens in case of death, disability, or retirement of a shareholder.

While a buy-sell agreement provides many benefits, it also has disadvantages. For example, it can create rigidity in ownership transfers, which may not suit all business scenarios. Additionally, if not properly valued, it could lead to disputes among shareholders. Awareness of such issues is essential when drafting a Missouri Buy Sell Agreement Between Shareholders and a Corporation to ensure it meets the needs of all parties involved.

Writing a buy-sell agreement involves several key steps. First, clearly identify all parties involved and their ownership percentages. Then, outline the triggering events that would prompt a sale, such as retirement or death, and stipulate valuation methods for the shares. Using a Missouri Buy Sell Agreement Between Shareholders and a Corporation template can simplify this process and ensure you include all necessary legal details.