Missouri Commercial Lease - Long Form

Description

How to fill out Commercial Lease - Long Form?

It is feasible to dedicate time online searching for the authentic document template that meets the state and federal requirements you desire.

US Legal Forms provides a vast selection of authentic forms that are evaluated by professionals.

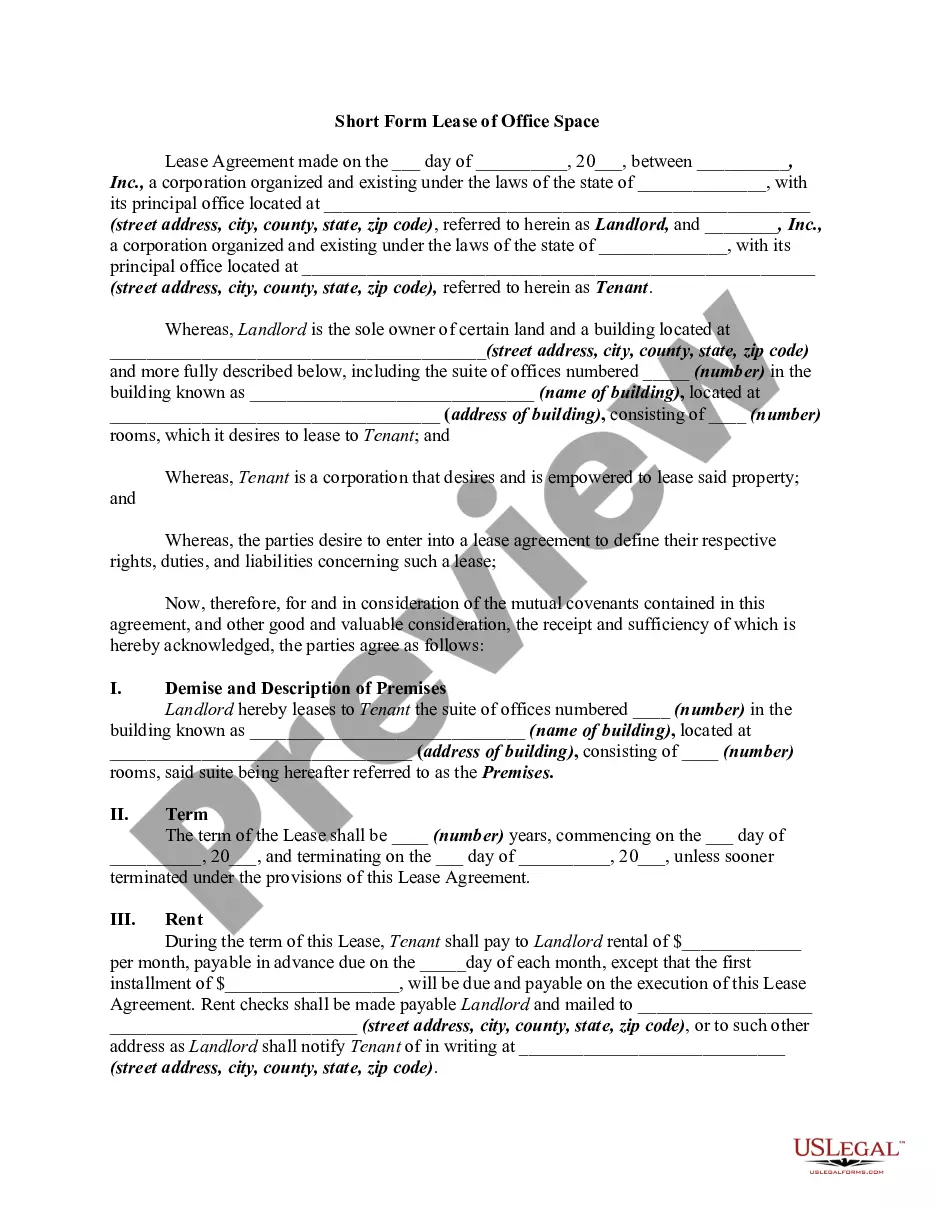

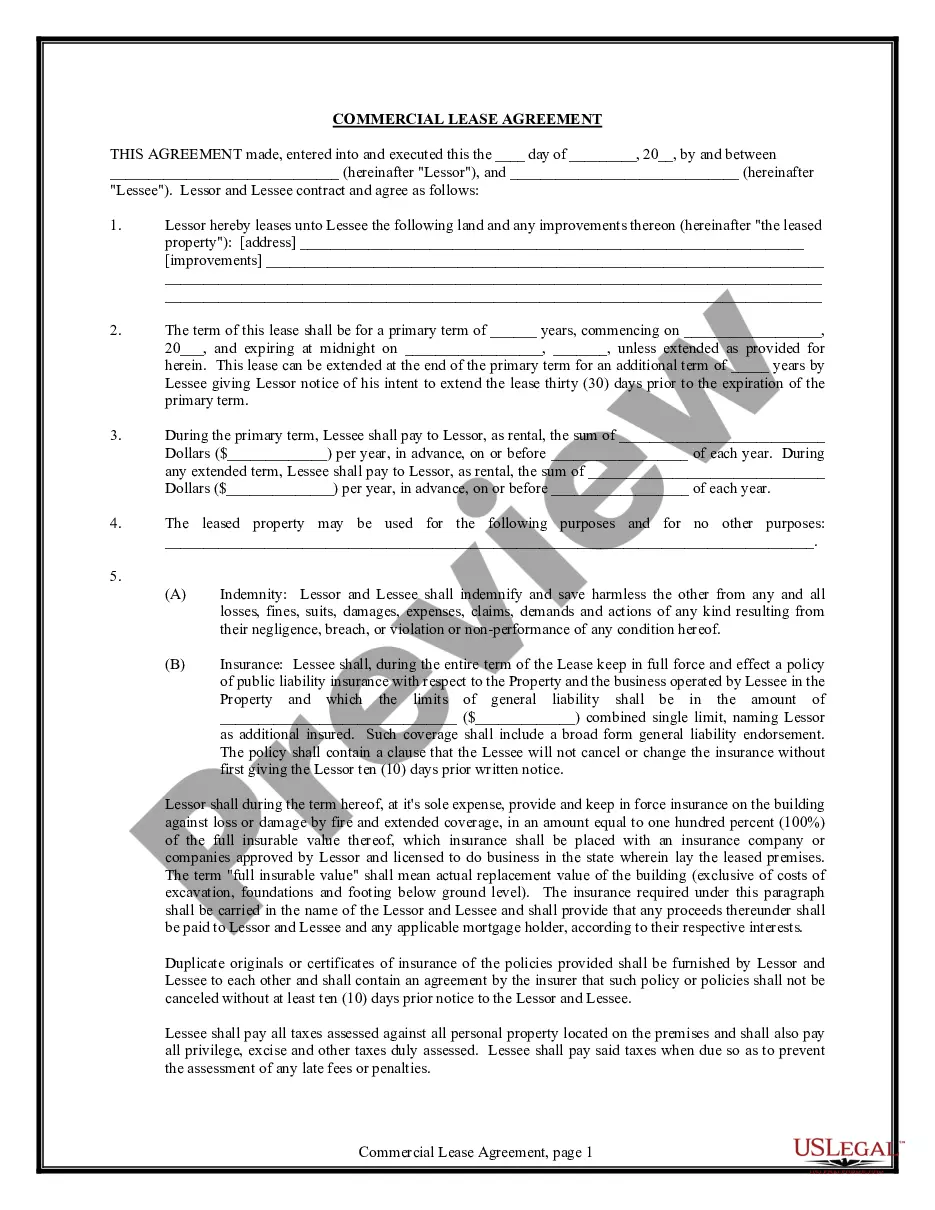

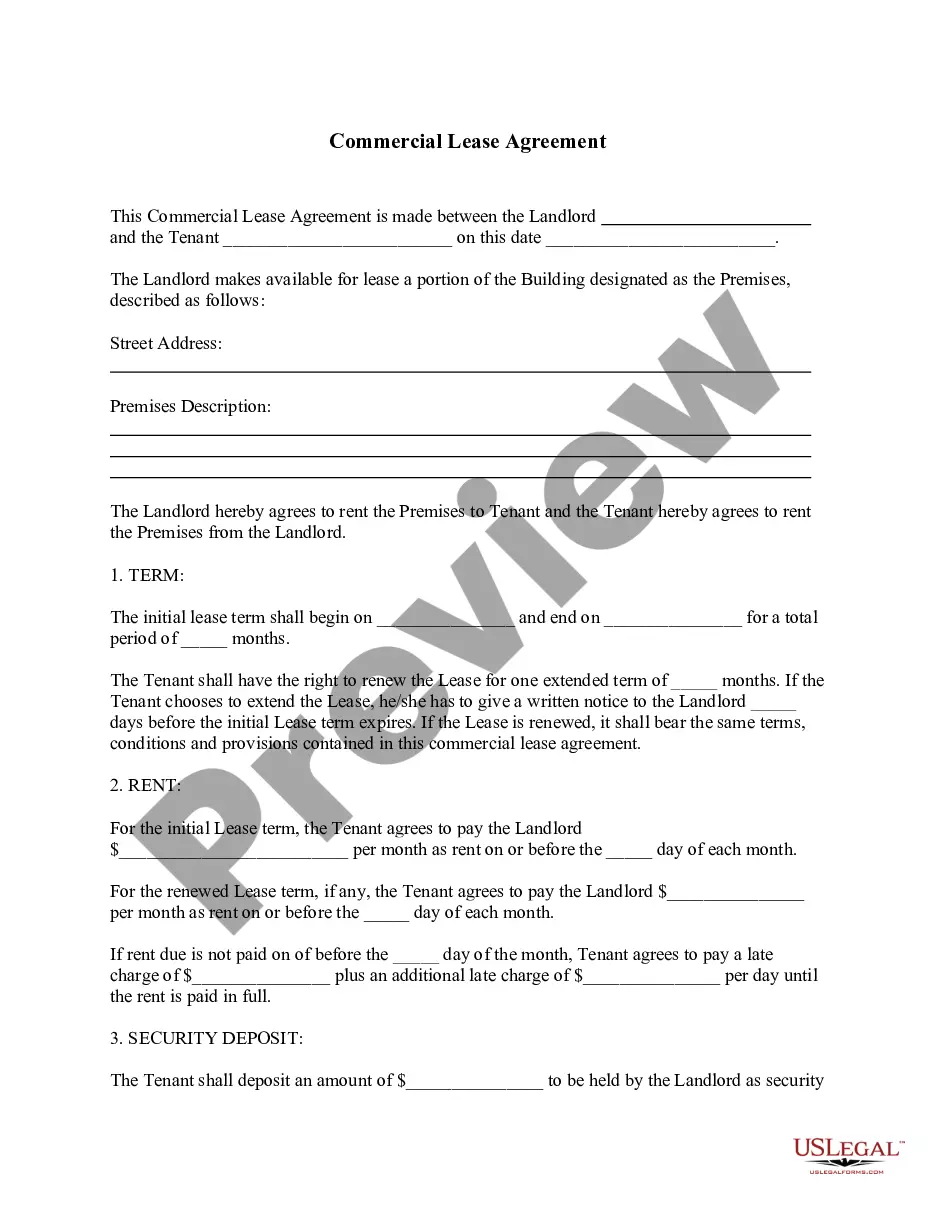

You can effortlessly acquire or print the Missouri Commercial Lease - Long Form from the service.

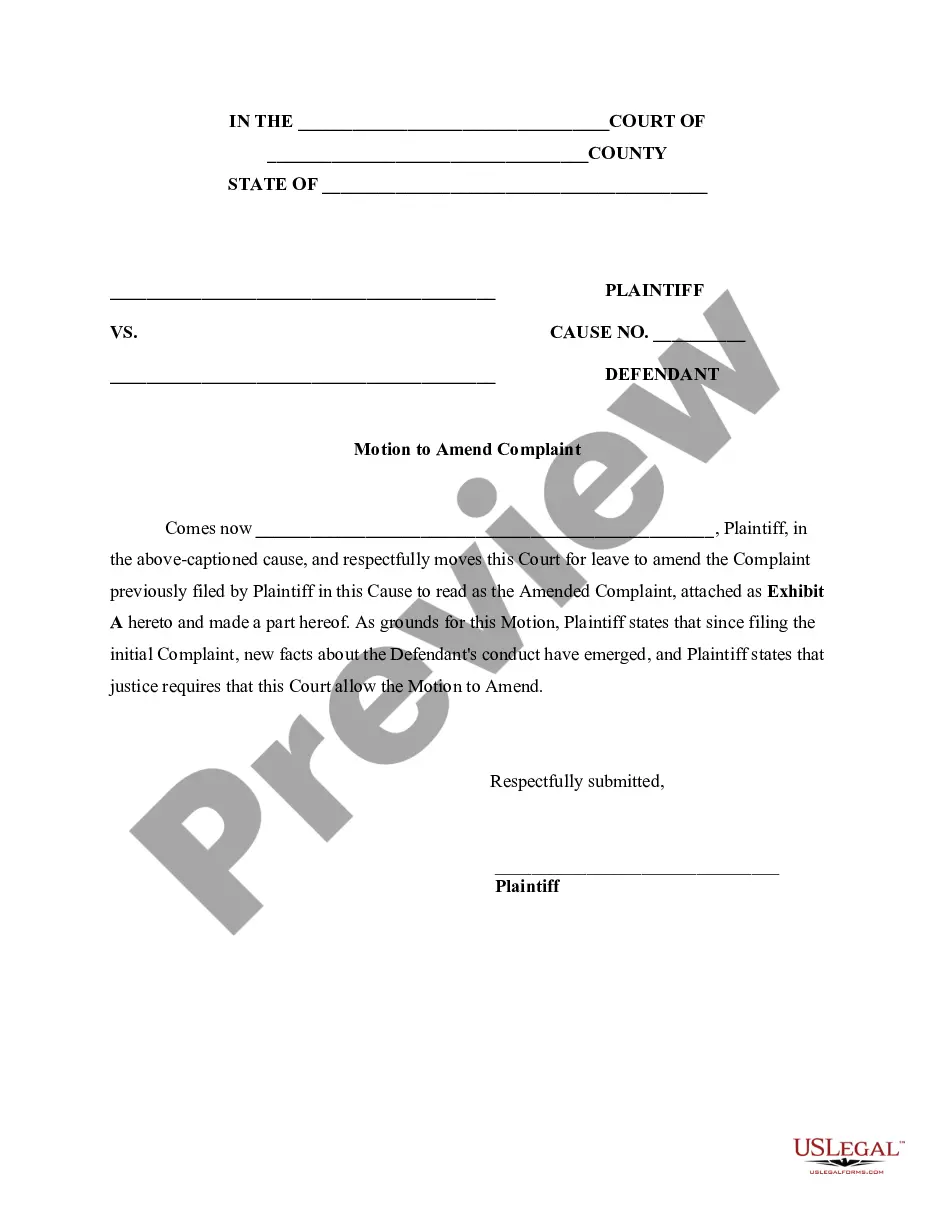

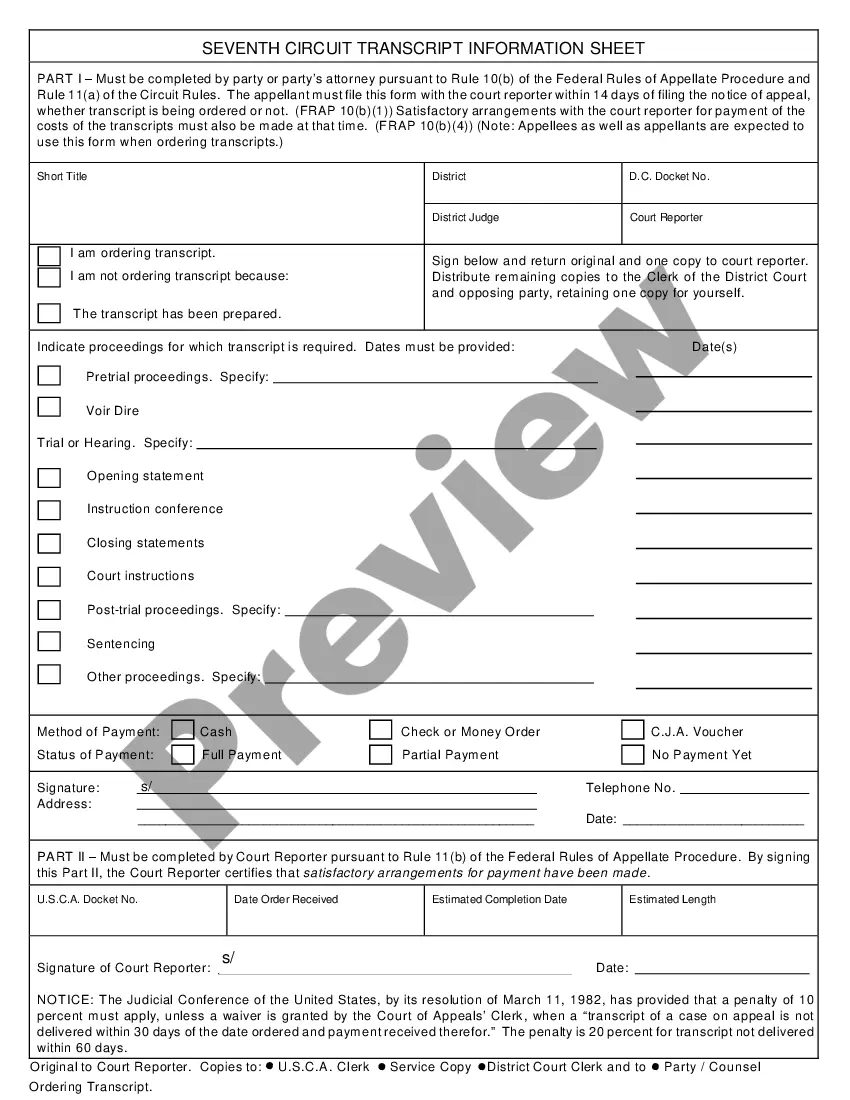

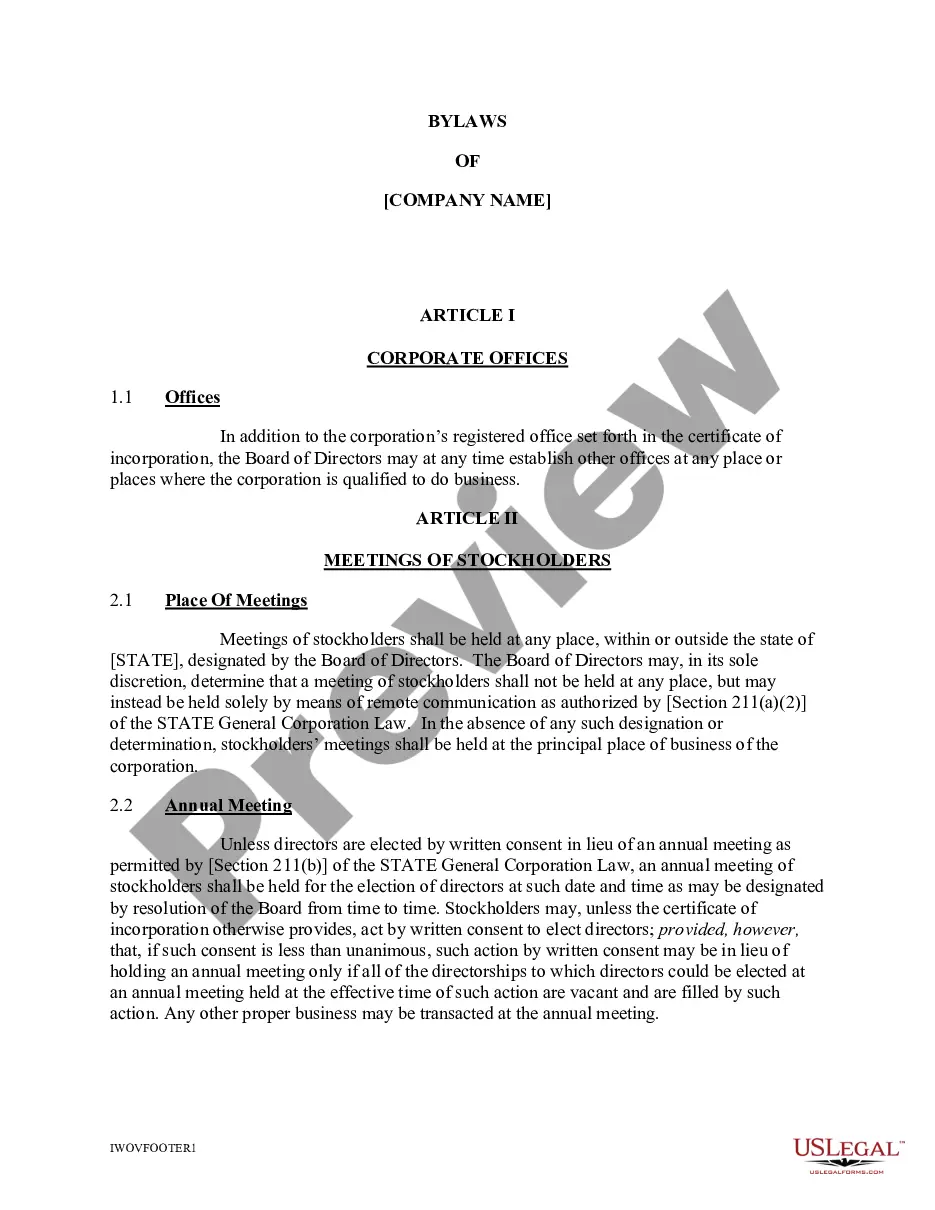

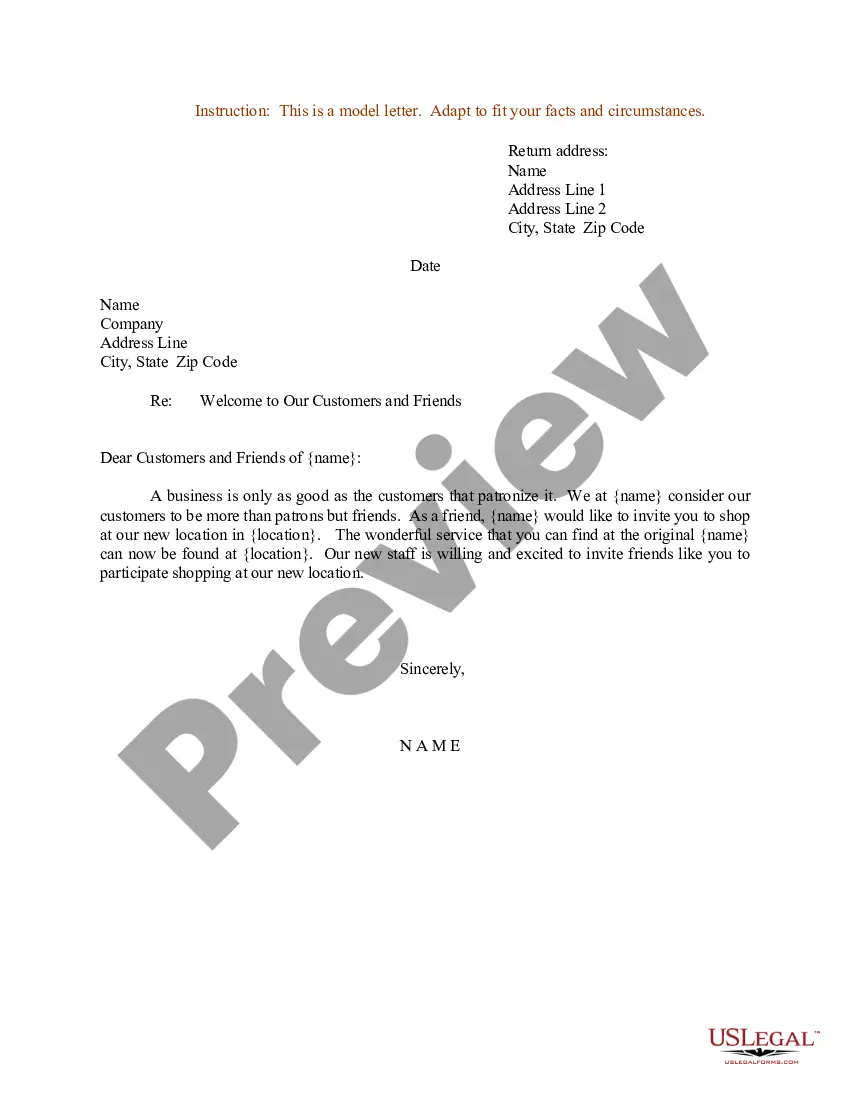

If available, utilize the Preview button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Missouri Commercial Lease - Long Form.

- Each authentic document template you purchase is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click on the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for your state/city of choice.

- Review the form details to confirm you have selected the right form.

Form popularity

FAQ

While the required credit score for a Missouri Commercial Lease - Long Form can vary by landlord, most commonly, a score of 650 or higher is considered favorable. Some landlords may be flexible and consider additional factors like your financial history and business stability. To improve your chances of leasing, maintain a good credit record and prepare all relevant financial documents that showcase your ability to meet lease obligations.

Starting commercial leasing involves several key steps. First, define your business needs and budget, then start searching for suitable properties. When you find potential spaces, evaluate the lease terms, and prepare your financial documents, which may be necessary for lease approval. Using platforms like US Legal Forms can facilitate this process, providing templates and resources tailored for your Missouri Commercial Lease - Long Form needs.

Writing a letter to exit a Missouri Commercial Lease - Long Form requires clarity and professionalism. Start by addressing the landlord, clearly stating your request to terminate the lease and the reasons for this decision. Include any important dates related to the lease termination and refer to specific clauses from your lease agreement that support your request. It’s beneficial to offer a smooth transition plan to maintain a positive relationship.

To secure a Missouri Commercial Lease - Long Form, you should start by researching available properties that meet your business needs. Connect with real estate agents or use online services to find listings. Once you identify a suitable space, you can submit an application, negotiate terms, and sign the lease agreement once approved. Documents such as financial statements and business plans may be necessary during this process.

Getting approved for a Missouri Commercial Lease - Long Form typically takes anywhere from a few days to a few weeks. The timeline depends on various factors such as your financial documents, landlord's review process, and background checks. To expedite your approval, ensure all your paperwork is complete and presented clearly. This preparation can significantly reduce delays.

Yes, a handwritten lease agreement can be legally binding. As long as it includes all necessary terms and is signed by both parties, it can stand up in court. However, utilizing a structured document like the Missouri Commercial Lease - Long Form from uslegalforms is recommended for clarity and thoroughness.

The three main types of commercial leases are gross leases, net leases, and percentage leases. Each type outlines different responsibilities for both landlords and tenants regarding expenses like maintenance and property taxes. Understanding each type aids in finding the best option for your needs while utilizing the Missouri Commercial Lease - Long Form can help clarify the specifics.

A landlord can certainly write up their own lease, but they need to be cautious. Properly outlining terms and ensuring that the lease complies with Missouri laws is crucial. Utilizing the Missouri Commercial Lease - Long Form from uslegalforms can streamline this process and prevent common pitfalls.

Absolutely, you can write up your own lease agreement. Just keep in mind the legal requirements that must be met to ensure it holds up in court. The Missouri Commercial Lease - Long Form from uslegalforms is a great resource that can guide you in creating a comprehensive and legally sound document.

Yes, you can type up your own lease agreement. However, ensure that all essential elements are included to avoid potential legal issues down the line. Using a pre-formatted document like the Missouri Commercial Lease - Long Form from uslegalforms helps you cover all necessary areas while ensuring compliance with local regulations.