In Missouri, a consulting agreement with a former shareholder refers to a legal document that outlines the terms and conditions of a consulting arrangement between a company and a former shareholder who has transitioned into a consulting role. This agreement is designed to establish the nature and scope of the consulting services, as well as the compensation, rights, and responsibilities of both parties involved. The consulting agreement generally contains several important elements. Keywords that may be relevant to this type of agreement include: 1. Parties: The agreement identifies the parties involved, i.e., the company and the former shareholder acting as a consultant. Their full legal names and addresses are typically mentioned in this section. 2. Purpose: The purpose of the consulting arrangement is explained. This may include specific focus areas or projects that the consultant will be working on, such as providing strategic advice, sharing industry expertise, or assisting with the transition of ownership. 3. Term: The agreement specifies the duration of the consulting relationship, including the starting and ending dates or any conditions that may terminate the agreement early. The term may vary depending on the needs and objectives of both parties. 4. Scope of Services: This section outlines the specific services the consultant will provide, delineating the responsibilities, tasks, and deliverables expected from the former shareholder. It may also address any limitations or exclusions related to the scope of work. 5. Compensation: The consultant's compensation, whether it be a fixed fee, hourly rate, or performance-based remuneration, is clearly stated in this section. Details regarding invoicing, payment terms, and any other financial obligations are also included. 6. Confidentiality and Non-Disclosure: The agreement emphasizes the importance of safeguarding any confidential or proprietary information disclosed between the parties during the consulting engagement. It may include clauses outlining non-disclosure provisions, intellectual property rights, and restrictions on the use of confidential information. 7. Non-Competition and Non-Solicitation: This section restricts the consultant from engaging in activities that could be potentially competitive with the company during or after the consulting period. It may also prohibit the consultant from soliciting employees, clients, or customers of the company for a certain period of time. 8. Dispute Resolution: In case of any conflicts or disputes arising from the agreement, the process for resolving such issues is described. This may involve mediation, arbitration, or other dispute resolution methods as per the preference of the parties involved. Different types or variations of Missouri consulting agreements may exist depending on the specific circumstances and requirements of the parties involved. They may include consulting agreements for a fixed term, on a project basis, or even with additional provisions tailored to address unique scenarios. It is important to note that while this description provides a general guideline, it is crucial to consult with an attorney or legal professional experienced in Missouri contract law to ensure the agreement conforms to all applicable legal requirements and adequately protects the interests of both parties.

Missouri Consulting Agreement - with Former Shareholder

Description

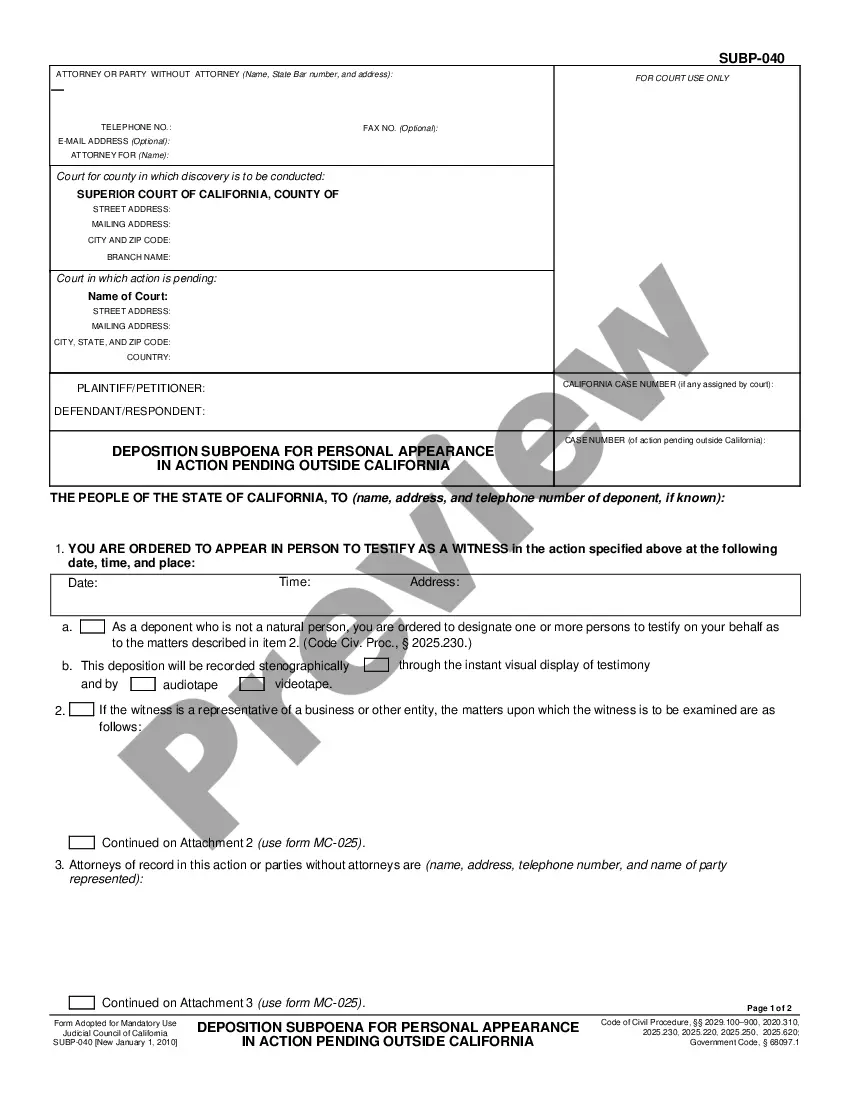

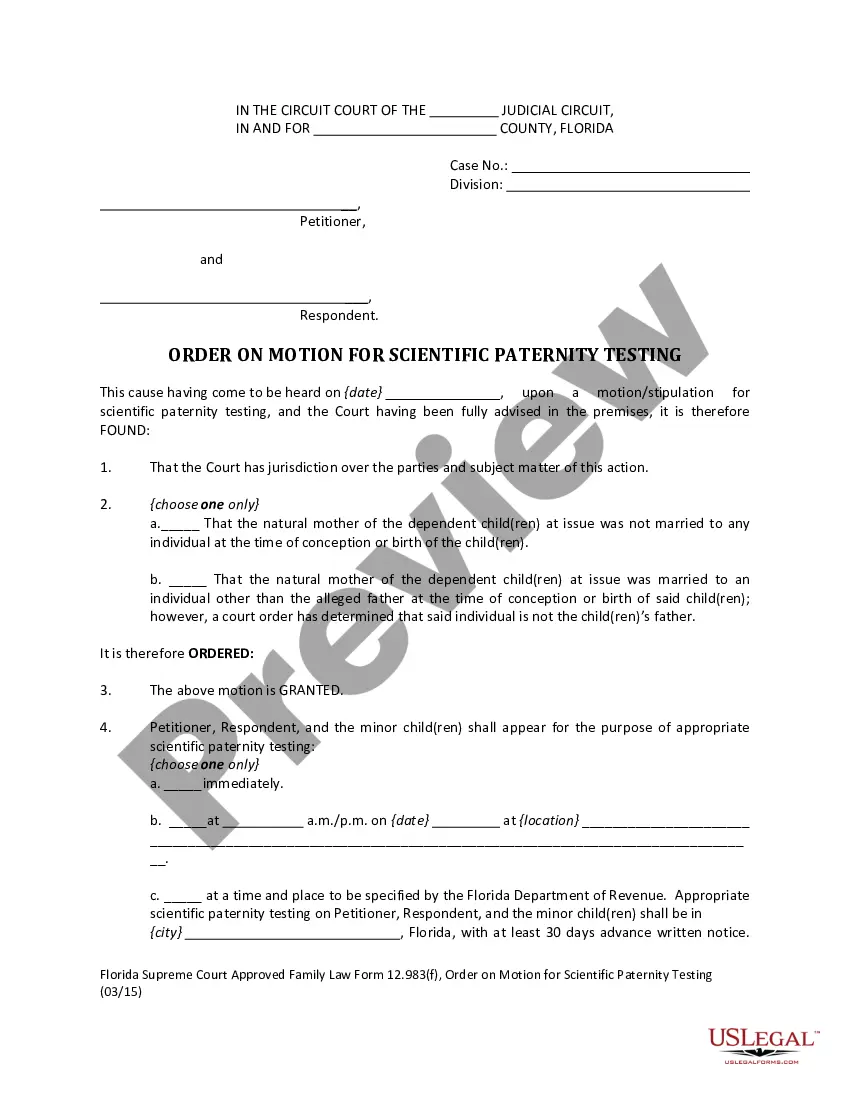

How to fill out Missouri Consulting Agreement - With Former Shareholder?

Selecting the optimal legal document template can be challenging. Indeed, numerous formats are accessible online, but how do you find the legal form you need? Leverage the US Legal Forms website. This platform provides a vast array of templates, including the Missouri Consulting Agreement - with Former Shareholder, suitable for both business and personal purposes.

All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Missouri Consulting Agreement - with Former Shareholder. Use your account to navigate through the legal forms you have previously purchased. Visit the My documents section of your account and download another copy of the document you need.

Complete, edit, print, and sign the obtained Missouri Consulting Agreement - with Former Shareholder. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize this service to acquire properly crafted paperwork that complies with state regulations.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have chosen the correct form for your area/county. You can preview the document using the Preview option and read the description to confirm it suits your needs.

- If the form does not meet your requirements, utilize the Search field to locate the appropriate document.

- Once you are certain the form is suitable, click the Purchase now button to obtain the document.

- Select the pricing plan you want and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template onto your device.

Form popularity

Interesting Questions

More info

This agreement shall govern on the following matters: 1. The contract shall be a binding contract entered into in Singapore. 2. The term of this agreement shall be one year commencing on the first day of month in month out. 3. In case of no activity, the agreement may be terminated by Company after 14 days written notice after written request received from the Consulting Consultant which written request shall give name and address of the Consultant and the Consultant shall deliver a proof of receipt of notice of the termination notice. 4. The Consulting Consultant shall provide the Company with a deposit of 50,000 in the amount of 30% of the Contract fee and the other amount payable as per the Consultant Agreement. 5. Consulting Consultant shall have the payment at all times under the following circumstances: 1. Consultants will not breach the Contract. 2. Consultant shall complete the work by 30th (Day) of (Month). 3. Consultant shall complete the work within the time allotted. 4.