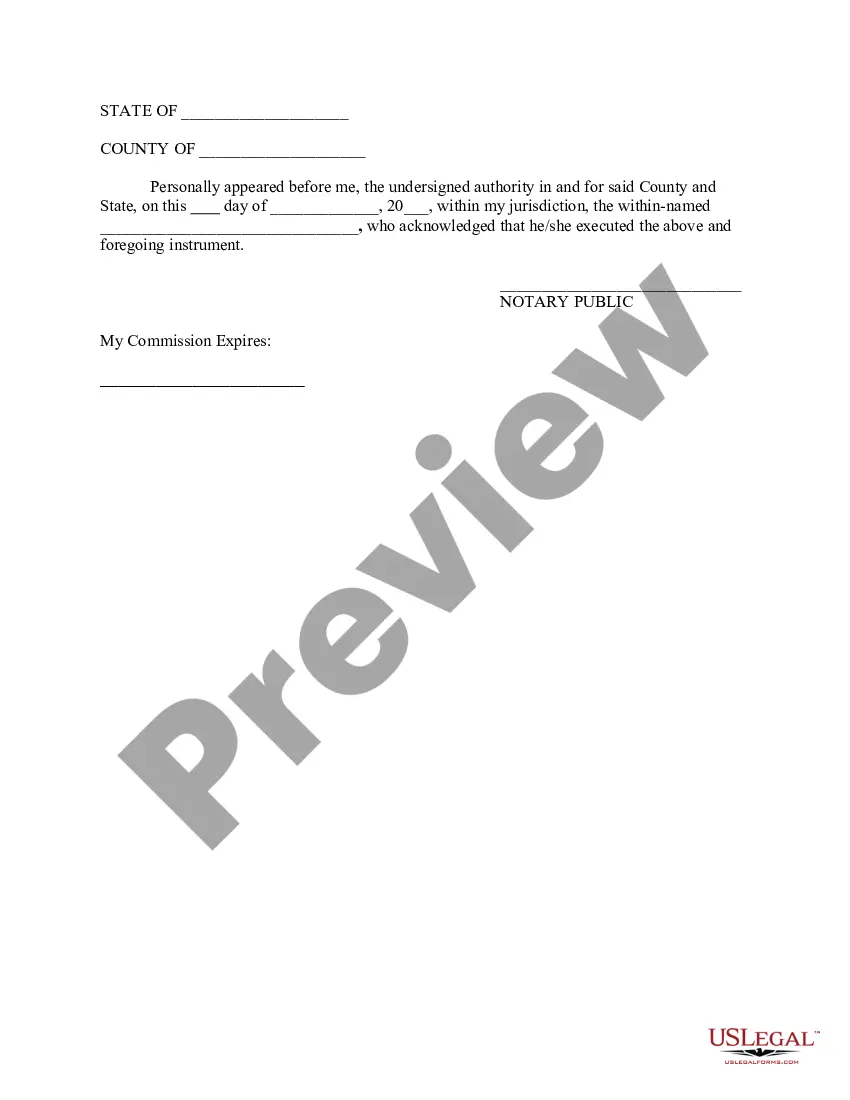

The Missouri Certificate of Heir is a legal document that allows individuals to obtain the transfer of title to a motor vehicle without going through the probate process. This certificate becomes relevant when a vehicle has not been specifically bequeathed in a will. This article aims to provide a detailed description of the Missouri Certificate of Heir and the different types that exist. In Missouri, when a person passes away and has a motor vehicle that was not mentioned in their will, it can create complications for transferring the vehicle's title to the rightful heir. To resolve this issue, the Missouri Certificate of Heir is employed to establish the proper heir and guide the transfer process. The Certificate of Heir serves as legal proof that an individual is entitled to inherit the deceased person's vehicle. It is a critical document required by the Missouri Department of Revenue to transfer the title without probate. There are two types of Missouri Certificate of Heir forms commonly used to obtain the transfer of title to a motor vehicle without probate: 1. Affidavit for Transfer of Decedent's Motor Vehicle: This certificate is used when the deceased person did not leave a will or had only a personal property memorandum, which does not include the vehicle. The Affidavit for Transfer of Decedent's Motor Vehicle form must be completed by the rightful heir(s) and notarized. It requires information such as the decedent's name, date of death, vehicle details, and the relationship between the heir(s) and the deceased. 2. Affidavit for Transfer of Decedent's Motor Vehicle — Small Estate: This form is used when the estate of the deceased person qualifies as a "small estate," as defined by Missouri law. To qualify, the total value of the estate, including the vehicle, must be $40,000 or less. This affidavit simplifies the process for heirs when the estate falls within the small estate guidelines. To obtain the Missouri Certificate of Heir, interested parties must contact the local Probate Division of the Circuit Court or the Missouri Department of Revenue. The appropriate form must be completed accurately, notarized, and submitted along with any supporting documentation requested by the authorities. By utilizing the Missouri Certificate of Heir, individuals can navigate the transfer of a motor vehicle's title without probate, ensuring a smooth and lawful process.

Missouri Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Missouri Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Discovering the right legal record template can be a have a problem. Of course, there are a variety of web templates available on the net, but how do you find the legal type you will need? Make use of the US Legal Forms internet site. The service delivers thousands of web templates, like the Missouri Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), that can be used for company and personal demands. Each of the varieties are examined by pros and meet federal and state demands.

In case you are already signed up, log in for your account and then click the Down load option to obtain the Missouri Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Make use of your account to search throughout the legal varieties you possess bought previously. Visit the My Forms tab of the account and acquire one more backup of the record you will need.

In case you are a fresh consumer of US Legal Forms, listed below are simple instructions for you to adhere to:

- Very first, be sure you have chosen the appropriate type to your metropolis/region. You can look through the form making use of the Preview option and study the form explanation to guarantee it is the right one for you.

- In the event the type will not meet your needs, take advantage of the Seach discipline to find the appropriate type.

- When you are certain that the form is suitable, click the Buy now option to obtain the type.

- Select the pricing strategy you would like and enter in the necessary details. Design your account and pay money for your order using your PayPal account or bank card.

- Select the data file structure and obtain the legal record template for your device.

- Comprehensive, edit and print out and indication the attained Missouri Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

US Legal Forms is definitely the biggest catalogue of legal varieties in which you can find a variety of record web templates. Make use of the company to obtain appropriately-created files that adhere to state demands.

Form popularity

FAQ

6 Tips to Avoid Paying Tax on Gifts Respect the annual gift tax limit. ... Take advantage of the lifetime gift tax exclusion. ... Spread a gift out between years. ... Leverage marriage in giving gifts. ... Provide a gift directly for medical expenses. ... Provide a gift directly for education expenses. ... Consider gifting appreciated assets.

While some car owners consider selling the car for a dollar instead of gifting it, the DMV gift car process is the recommended, not to mention more legitimate, way to go.

The new vehicle owner: Will not pay state or local tax on a gift transaction; and. Cannot use or transfer the license plates that were on the vehicle at the time it was gifted (if applicable).

How do I avoid paying sales tax on a car in Missouri? You already paid the tax. The title is from another state. A nonprofit organization uses the car. You received the car as a gift. Following an accident, an insurance company purchased the car.

If your state allows it, consider naming a transfer-on-death (TOD) beneficiary for your vehicles.

Missouri Sales Tax will not be assessed on a vehicle acquired by gift provided the donor or decedent has paid all sales tax. **A gift statement must be submitted. The statement must be signed by at least one of the donor(s) and include the year, make, and identification number.

Or, if the co-owner is now deceased, proof of death is required (i.e., copy of death certificate, newspaper obituary clipping, funeral home card) with the unassigned title. You may then apply and pay an $8.50 title fee and a $6 processing fee for a new title in your name alone (or you may add a different co-owner).

What You'll Need to Do to Transfer your Vehicle Title in Missouri Visit any DOS License office near you. ... Submit the required documents, your application, ID and your payment. Receive a temporary vehicle title. Receive your vehicle title via U.S. mail.