Missouri Option to Purchase Stock - Long Form

Description

How to fill out Option To Purchase Stock - Long Form?

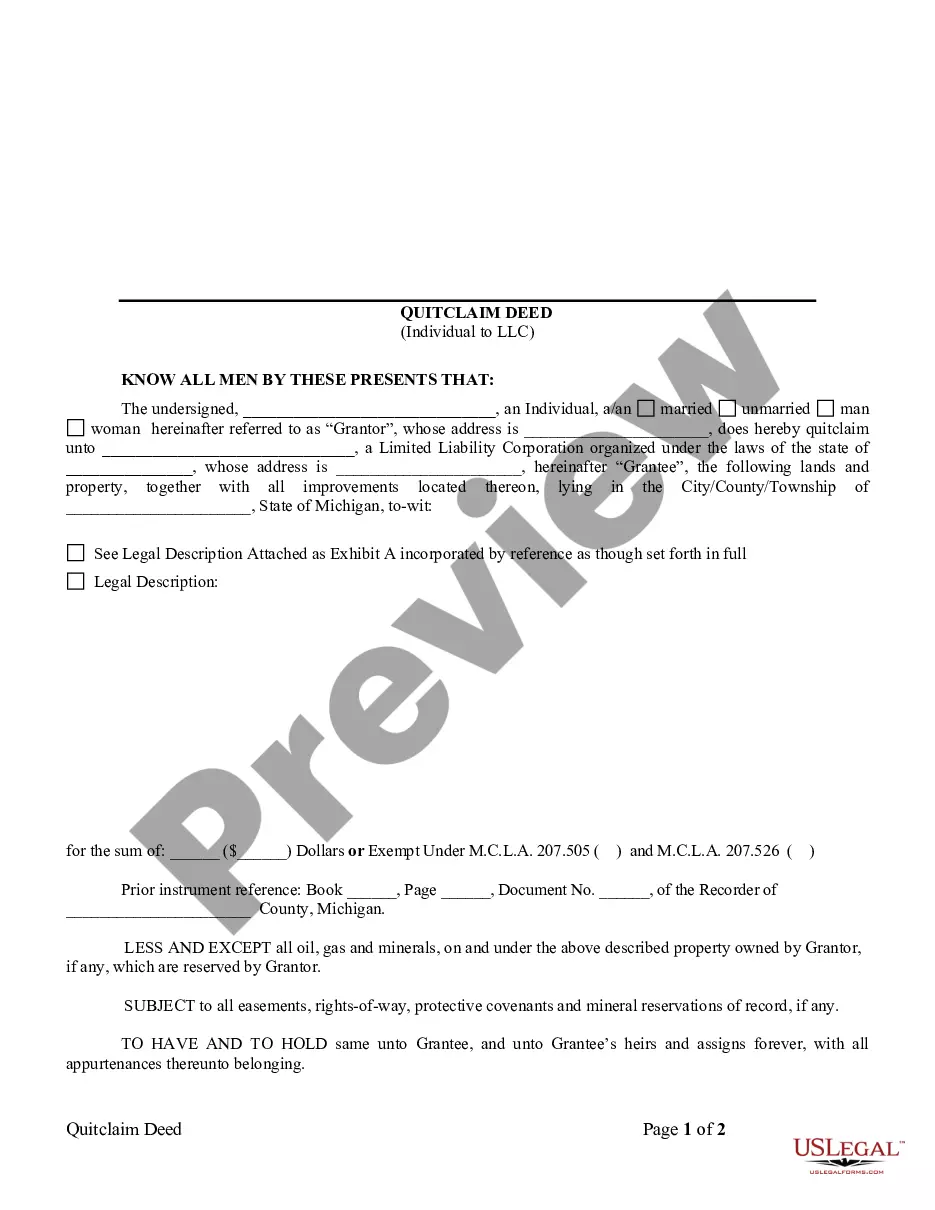

Selecting the appropriate legal document template can be challenging. Of course, there are numerous templates accessible online, but how can you secure the legal document that you need? Turn to the US Legal Forms site. This service offers a wide array of templates, including the Missouri Option to Purchase Stock - Long Form, which you may utilize for both business and personal purposes. All templates are reviewed by professionals and comply with federal and state regulations.

If you already have an account, Log In to your account and click the Download button to retrieve the Missouri Option to Purchase Stock - Long Form. Use your account to check the legal documents you have previously acquired. Navigate to the My documents section of your account and obtain another copy of the document you need.

For those who are new users of US Legal Forms, here are straightforward instructions to follow: First, verify that you have chosen the right form for your city/region. You can browse the form using the Review option and examine the form description to ensure it’s suitable for your needs. If the form does not satisfy your requirements, utilize the Search field to find the correct form.

- Once you are confident that the form is correct, click on the Get now button to obtain the document.

- Select the pricing plan you prefer and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, edit, print, and sign the downloaded Missouri Option to Purchase Stock - Long Form.

- US Legal Forms is the largest repository of legal documents where you can discover a variety of document templates. Use this service to acquire properly crafted documents that adhere to state regulations.

Form popularity

FAQ

You should mail your completed MO-1040 form to the address specified in the instruction guide that accompanies the form. Typically, this will depend on whether you are expecting a refund or if you owe taxes. If you are unsure, you can use the resources available on the UsLegalForms platform for detailed mailing instructions to avoid any discrepancies.

No, you should not attach your federal return to your Missouri return. Each return is filed separately, and submitting them together could cause confusion, potentially delaying processing. If you need assistance understanding the requirements, consider exploring the resources available on the US Legal Forms platform, which can guide you through the filing process effectively.

You must send your Missouri W2 and W3 forms to the Missouri Department of Revenue along with any accompanying information. Typically, the address is P.O. Box 2200, Jefferson City, MO 65105-2200 for these forms. Ensure that everything is complete and schedules are appropriately included to avoid processing delays.

To mail your Missouri 1040 tax form, address it to the Missouri Department of Revenue, P.O. Box 2200, Jefferson City, MO 65105-2200. This address applies to residents filing a paper return. For ease and clarity, always refer to the Missouri Department of Revenue site for any changes regarding mailing addresses.

You should send your Missouri state tax return to the Missouri Department of Revenue at the designated address for your specific form type. For individual income tax returns, it is typically sent to P.O. Box 2200, Jefferson City, MO 65105-2200. Make sure you check for the latest address on the official Missouri Department of Revenue website to ensure accuracy.

To mail your Missouri tax payment, please send it to the Missouri Department of Revenue. Ensure that you include your Social Security number or Employer Identification Number on the payment. This helps the department apply your payment correctly. Remember, using certified mail or a tracking service can provide peace of mind.

MO-1040 Fillable Calculating Document. Individual Income Tax Return - Fillable and Calculating Form (NOTE: For optimal functionality, save the form to your computer BEFORE completing or printing and utilize Adobe Reader.) 2019. 5/3/2021. MO-1040 Fillable Calculating Document.

Open market options When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an optionor the stock you acquired by exercising the optionyou must report the profit or loss on Schedule D of your Form 1040.

Form MO-A, Part 1, computes Missouri modifications to federal adjusted gross income. Modifications on Lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state tax purposes.

The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward. For those who previously filed MO-1040P, you will now file Form MO-1040 and attach Form MO-PTS and Form MO-A, if applicable. See MO-1040 Instructions for more details.