The Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legal document that facilitates the transfer of ownership rights and assets of a sole proprietorship business located on leased premises in the state of Missouri. This agreement outlines the terms and conditions of the sale, ensuring both the seller and the buyer understand their respective rights and obligations. Keywords: Missouri Agreement for Sale of Business, Sole Proprietorship, Leased Premises, transfer of ownership rights, assets, terms and conditions, seller, buyer, legal document, state of Missouri. Different types of Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises may include: 1. Missouri Agreement for Sale of Business with Leased Retail Space: This agreement specifically relates to the sale of a retail business operating on leased premises. It covers aspects such as inventory, customer contracts, and lease assignment. 2. Missouri Agreement for Sale of Service-based Sole Proprietorship with Leased Office Space: This agreement is designed for the sale of a service-based business, such as a consultancy or accounting firm, operating in leased office space. It focuses on transferring client contracts, intellectual property, and ensuring a smooth transition of operations. 3. Missouri Agreement for Sale of Sole Proprietorship with Leased Industrial Space: This type of agreement caters to businesses operating in leased industrial spaces, such as manufacturing or warehouse facilities. It includes provisions relating to equipment, machinery, and any ongoing contracts with suppliers or vendors. 4. Missouri Agreement for Sale of Sole Proprietorship with Leased Restaurant Space: This agreement is specific to the sale of a restaurant or food-related business located in leased premises. It covers aspects such as licenses, permits, equipment, inventory, and any existing agreements with suppliers. In essence, the Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises serves as a comprehensive legal framework to facilitate the smooth transfer of a sole proprietorship business from one party to another, ensuring all relevant assets, rights, and obligations are properly accounted for and transferred.

Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

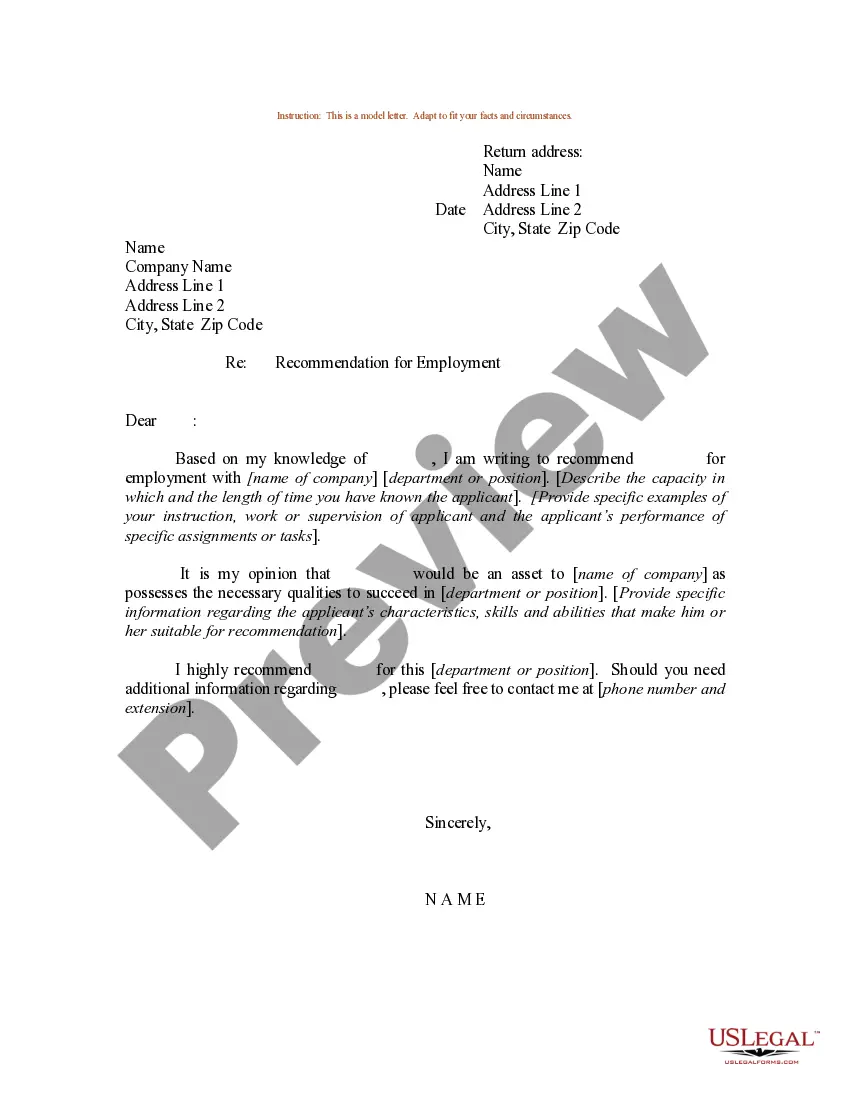

How to fill out Missouri Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

If you want to acquire, obtain, or produce authentic document templates, use US Legal Forms, the largest collection of legal forms that is accessible online.

Utilize the site’s simple and efficient search to locate the documents you require.

A selection of templates for business and personal purposes are categorized by type and state, or by keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form design.

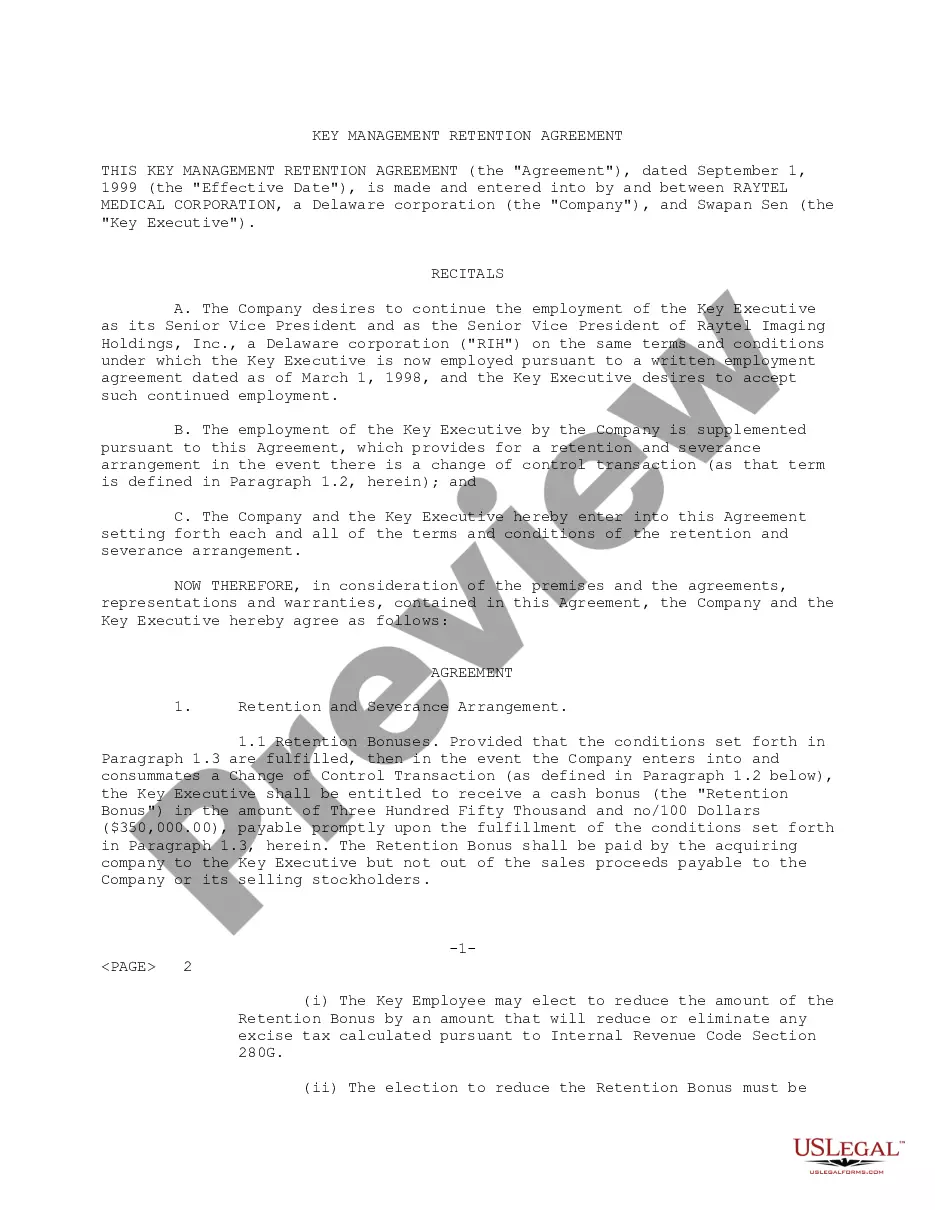

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

- Use US Legal Forms to find the Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the details of the form. Don’t forget to read the description.

Form popularity

FAQ

Yes, sole proprietors in Missouri typically need a business license. The requirements can vary depending on your location and the type of business you operate. It is essential to check with local authorities to determine the exact licensing requirements. Securing a business license also helps in creating a trustworthy image when using the Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

To write a simple contract agreement, start by clearly identifying the parties involved. Include essential details such as the purpose of the agreement, specific terms, and conditions. It is vital to outline the obligations of each party to ensure clarity. For a Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises, consider using a template for accuracy and compliance.

Closing a business involves several important steps, including notifying employees, settling debts, and filing necessary paperwork. If you're closing a business operated as a sole proprietorship with leased premises, ensure that your Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises is finalized for a smooth transition. To make the process easier, consider seeking assistance from platforms like USLegalForms, which can guide you through the closing procedure and required documents.

Yes, you generally need a business license to sell online in Missouri. This applies whether you operate as a sole proprietor or an LLC. When preparing your Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it's crucial to ensure that all required licenses and permits are in place. USLegalForms can help you navigate the licensing requirements specific to your business type.

Missouri does not legally require an operating agreement for an LLC; however, it is highly recommended. This document outlines the management structure and operating procedures for your business. If you later decide to sell your business, using a Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises becomes easier when your LLC has a clear framework established. Consider using services like USLegalForms to create an effective operating agreement tailored to your needs.

Absolutely, you can run a business from home in Missouri, provided you follow local zoning laws and obtain necessary permits. Home-based businesses are quite common and can benefit from reduced overhead costs. If you're considering a Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it's important to clarify how your home setup may affect legal agreements.

Yes, if your business engages in retail sales, provides services subject to sales tax, or hires employees, you will need a Missouri tax ID number. This ID helps track your business's tax obligations and ensures compliance with state tax laws. When drafting a Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises, consider discussing tax implications with a professional to avoid any pitfalls.

To determine if you need a business license in Missouri, check both state and local government websites for guidelines. Many businesses require a license to operate legally, particularly those involved in specific industries or services. Utilizing a Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises can help establish your business legally, ensuring your operations are above board.

Yes, a sole proprietor generally needs a business license in Missouri, particularly if you plan to operate under a fictitious name or if your business engages in regulated activities. It's essential to check local regulations, as requirements can vary by city or county. Consider obtaining a Missouri Agreement for Sale of Business by Sole Proprietorship with Leased Premises to ensure all compliance needs are met.

Interesting Questions

More info

Roth Fundamental Analysis Technical Analysis Sell Options Index Buy Options Sell Options Buy Options.