Title: Missouri Lease of Machinery for Use in Manufacturing — A Detailed Overview Introduction: The Missouri Lease of Machinery for use in Manufacturing is a legally binding agreement that outlines the terms and conditions for leasing machinery and equipment required in various manufacturing operations within the state of Missouri. This comprehensive contract facilitates the smooth operation and growth of manufacturing businesses by providing an efficient and cost-effective way to acquire the necessary machinery. This article will delve into the key aspects of the Missouri Lease of Machinery for use in Manufacturing, covering its types, benefits, and important considerations. Keywords: Missouri, Lease of Machinery, Manufacturing, Machinery Lease Agreement, Types of Leases, Benefits, Considerations Types of Missouri Lease of Machinery for use in Manufacturing: 1. Operating Lease: An operating lease permits manufacturers to lease machinery and equipment for a specific duration, typically a shorter term. This type of lease is ideal for businesses seeking flexibility in upgrading their machinery or adapting to changing manufacturing requirements. 2. Financial Lease: A financial lease, also known as a capital lease, is a long-term lease option. It allows manufacturers to lease machinery for the entirety of its useful life or pay for it in installments until it becomes fully owned. Financial leases are advantageous for manufacturers who plan to utilize the machinery for an extended period and benefit from potential tax advantages. Benefits of Missouri Lease of Machinery for use in Manufacturing: 1. Cost Savings: Leasing machinery eliminates the need for large upfront investments, allowing manufacturers to conserve capital for other operational expenses and investments in business growth. 2. Technological Advancement: Leasing machinery ensures access to the latest technology and equipment, enabling manufacturers to remain competitive and maintain high productivity levels without bearing the burden of owning outdated machinery. 3. Flexibility and Scalability: With lease agreements, manufacturers can easily upgrade or modify their machinery to adapt to changing market dynamics, production needs, or to accommodate business growth without the complexities associated with equipment disposal or sale. 4. Tax Advantages: Eligible lease payments may be tax-deductible, reducing the overall tax burden for manufacturers. Additionally, certain leased equipment may qualify for specific tax incentives or credits. Important Considerations for Missouri Lease of Machinery for use in Manufacturing: 1. Lease Terms: Manufacturers should thoroughly review and negotiate lease terms, including lease duration, rental amount, maintenance responsibilities, termination clauses, and renewal options, to ensure the agreement aligns with their business requirements. 2. Maintenance and Repairs: Clearly defining the party responsible for machinery maintenance and repairs is crucial in a lease agreement. Determining whether the lessor or lessee will shoulder these obligations helps avoid potential disputes and ensures smooth machinery operation. 3. Insurance Coverage: Manufacturers must assess the insurance requirements outlined in the lease agreement, understanding liability coverage for potential damages, theft, accidents, or any unforeseen incidents involving the machinery. Conclusion: The Missouri Lease of Machinery for use in Manufacturing offers manufacturers an advantageous means to access, utilize, and upgrade essential machinery and equipment. Understanding the different lease types, benefits, and crucial considerations empowers manufacturers to make informed decisions when entering into agreements tailored to their unique business needs. As with any legal commitment, it is recommended to consult legal experts to ensure compliance with all applicable laws and regulations.

Missouri Lease of Machinery for use in Manufacturing

Description

How to fill out Missouri Lease Of Machinery For Use In Manufacturing?

Are you currently in a location where you require documents for either business or personal activities every single day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast collection of form templates, including the Missouri Lease of Machinery for manufacturing purposes, designed to comply with both federal and state regulations.

Once you find the appropriate form, click Buy now.

Choose the payment plan you prefer, provide the necessary information to make your purchase, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Missouri Lease of Machinery for manufacturing format.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you need and ensure it is for your specific city/state.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not match what you are looking for, use the Lookup section to find the form that suits your needs and requirements.

Form popularity

FAQ

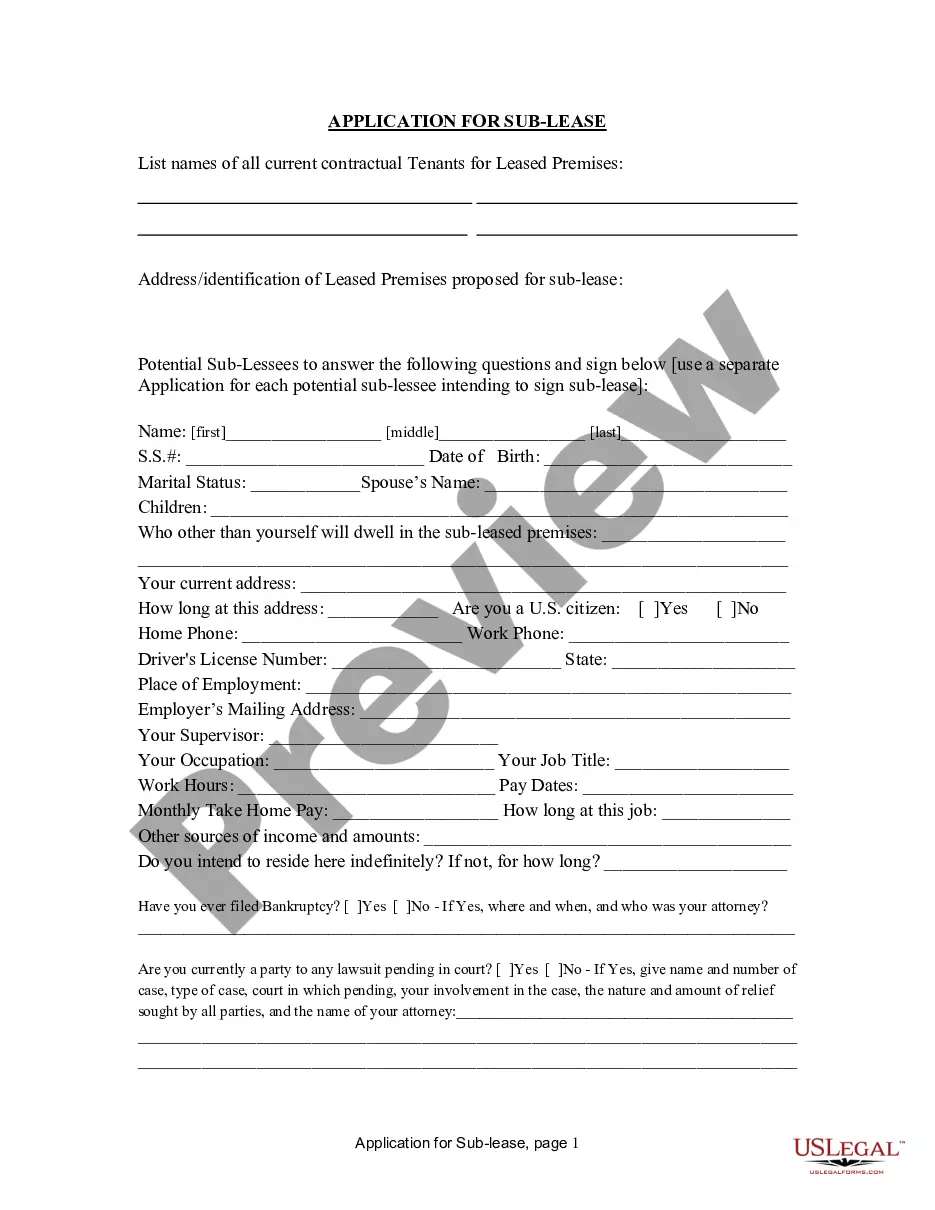

Leasing a machine involves signing a contractual agreement with a leasing company, allowing you to use the machine for a specified period. You will make regular payments, which may vary based on the lease terms. A Missouri Lease of Machinery for use in Manufacturing enables businesses to utilize essential equipment while conserving capital, as ownership is not transferred at the lease's conclusion.

Getting out of an equipment lease can be a complex process, but it's manageable. Start by reviewing your lease agreement for exit clauses that may allow you to terminate early. If options are limited, discussing the situation with your leasing company or seeking adjustments could help reduce financial strain. For more tailored advice, consider resources on uslegalforms that can guide you through this process.

An equipment lease can be categorized as either an operating lease or a capital lease, depending on its terms. A Missouri Lease of Machinery for use in Manufacturing often functions as an operating lease, meaning you do not own the equipment at the end of the term. This type of lease provides flexibility, allowing you to return the machinery without further obligation.

To set up a Missouri Lease of Machinery for use in Manufacturing, start by identifying the machinery you need and connecting with a trusted leasing company. Prepare the necessary documentation, such as financial statements and business information, to present your leasing application. Once approved, review the lease agreement carefully, noting terms like payment schedules and duration, before signing.

Filling out Form 149 in Missouri is straightforward. You will need to provide your business name, address, and tax ID number, along with details about your purchases. Accessing this form online through the Missouri Department of Revenue's website can simplify the process, allowing you to effectively manage your tax-exempt purchases related to a Missouri Lease of Machinery for use in Manufacturing.

To get a tax-exempt number in Missouri, you need to apply through the Missouri Department of Revenue by filing a Form 113. This number enables your organization to make purchases without paying sales tax. For businesses involved in manufacturing, securing this number is advantageous, especially when considering a Missouri Lease of Machinery for use in Manufacturing.

In Missouri, equipment rental generally incurs sales tax, including rentals related to manufacturing activities. However, specific exemptions may apply if the equipment is used directly in manufacturing processes. It's crucial to check the details before finalizing a Missouri Lease of Machinery for use in Manufacturing to ensure compliance with state tax laws.

The manufacturing exemption in Missouri allows certain equipment and machinery used directly in manufacturing to be exempt from sales tax. This exemption applies to items that are necessary for the production process, which can significantly reduce your costs. When considering a Missouri Lease of Machinery for use in Manufacturing, knowing about this exemption can be beneficial for your budgeting.

An agricultural exemption in Missouri applies to activities directly engaged in farming, including the use of machinery. This exemption can benefit manufacturers producing agricultural machinery, especially if they engage in a Missouri Lease of Machinery for use in Manufacturing. It is crucial to stay updated on eligibility criteria to take full advantage of these tax benefits.

Missouri law outlines several categories of tax-exempt items, including machinery, tools, and materials used directly in manufacturing. If your business is centered on a Missouri Lease of Machinery for use in Manufacturing, many of the machines you lease may fall under this exemption category. Always consult a tax professional to maximize your tax savings.

More info

Equipment Leasing Basics: As part of equipment leasing your business needs to make sure that you have a fully set up setup in place with everything in place with the leasing company. This will allow you to get your equipment in place, test the equipment, and make sure that everything works. As part of equipment leasing, you need to understand that you do not buy these things and then just start using them. This would be very difficult and very laborious as you would have to rent a large amount of space. There are various equipment services providers in Thailand such as: • Holland and Finch — Holland & Finch is an international equipment provider with many assets in Thailand such as a factory in Bangkok with over 400 employees. Holland and Finch offers full service leasing of heavy equipment such as forklifts, excavators and forklift trailers. They also have a large inventory of heavy equipment available.