Missouri Increase Dividend - Resolution Form - Corporate Resolutions

Description

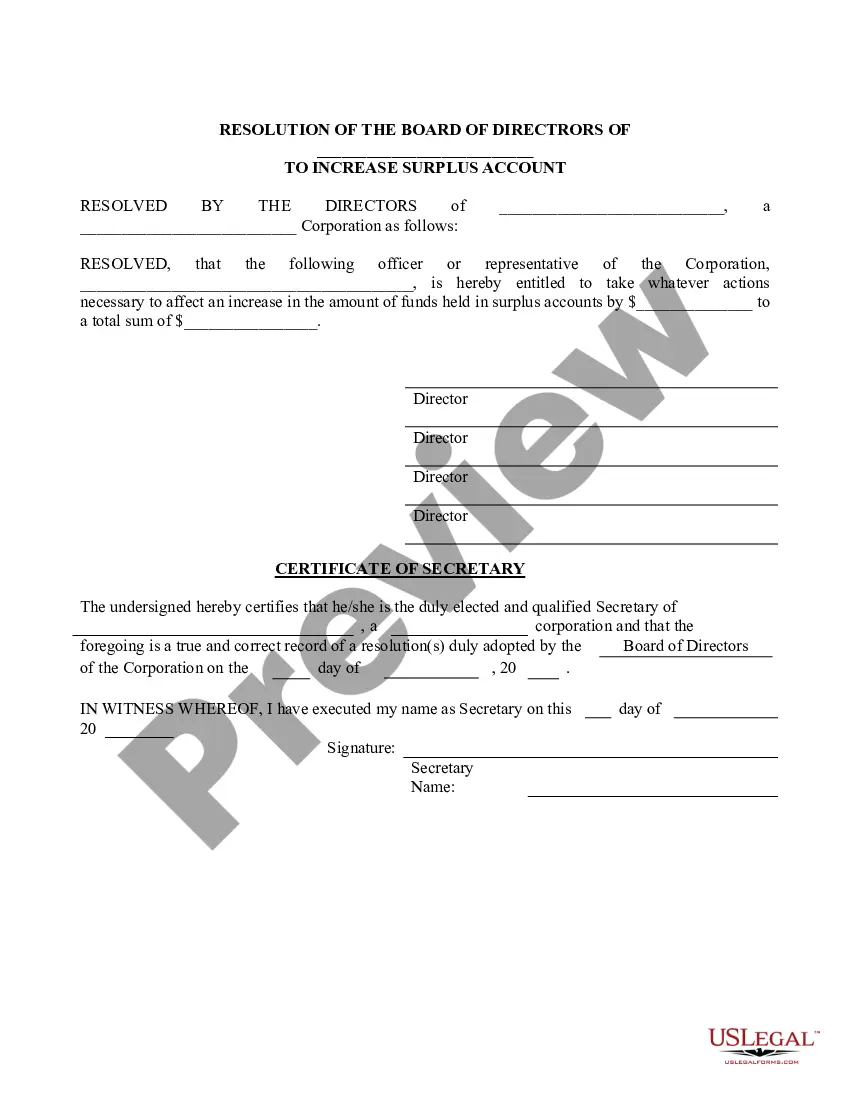

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

If you need to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the leading selection of legal forms available online.

Take advantage of the website's simple and user-friendly search feature to locate the documents you require.

A wide assortment of templates for business and personal purposes is organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the payment. You can utilize your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Missouri Increase Dividend - Resolution Form - Corporate Resolutions in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to receive the Missouri Increase Dividend - Resolution Form - Corporate Resolutions.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the type, utilize the Search box at the top of the screen to find other forms in the legal document library.

Form popularity

FAQ

Your US corporate tax return should be mailed to the address specified on your tax return form, typically the IRS service center designated for your state. For Missouri residents, check the IRS website for the correct mailing address. For corporate resolutions regarding dividends, consider filing the Missouri Increase Dividend - Resolution Form - Corporate Resolutions to ensure compliance with both state and federal regulations.

Mail your Missouri corporate tax return to the Missouri Department of Revenue at P.O. Box 470, Jefferson City, MO 65105-0470. Confirm that you have all pertinent information included with your return for accuracy. If you are changing any dividend policies, include the Missouri Increase Dividend - Resolution Form - Corporate Resolutions for clarity.

To properly mail your MO 1120, you should send it to the same address as your Missouri tax return: P.O. Box 470, Jefferson City, MO 65105-0470. Make sure to include all required forms and schedules. Utilizing the Missouri Increase Dividend - Resolution Form - Corporate Resolutions can help streamline your submission process.

Yes, Missouri does tax Global Intangible Low-Taxed Income (GILTI) as part of the state's corporate income tax. Businesses should stay informed about how GILTI impacts overall tax liability. Properly documenting your income and deductions on the Missouri Increase Dividend - Resolution Form - Corporate Resolutions can help manage your tax obligations more effectively.

To send your Missouri tax return, you should direct it to the Missouri Department of Revenue at P.O. Box 470, Jefferson City, MO 65105-0470. Ensure that you include all necessary documents with your return. If you are using the Missouri Increase Dividend - Resolution Form - Corporate Resolutions, attach it along with your return to comply with legal requirements.

Missouri has a state income tax rate that ranges from 1.5% to 5.4%, depending on income brackets. This tax applies to individuals and businesses alike. Staying updated on tax rates ensures compliance and proper financial planning. For businesses concerned about dividends, the Missouri Increase Dividend - Resolution Form - Corporate Resolutions can provide clarity on handling these matters.

Yes, Missouri imposes a corporate income tax on businesses operating within the state. The tax applies to a corporation’s net taxable income at a fixed rate. Understanding corporate taxation can guide your financial decisions. Moreover, using the Missouri Increase Dividend - Resolution Form - Corporate Resolutions can assist in effectively managing your company's financial strategies.

Yes, if your business is registered as a corporation in Missouri, you need to file the corporate income tax. Filing is essential to stay compliant with state regulations and avoid penalties. Even if your corporation did not generate income, filing may still be required. Incorporate tools like the Missouri Increase Dividend - Resolution Form - Corporate Resolutions to stay organized and informed.

The corporate income tax rate in Missouri currently is 4%. This rate applies to a corporation's taxable income. Keeping up with the current tax regulations is essential for business owners. To manage financial decisions related to dividends, consider using the Missouri Increase Dividend - Resolution Form - Corporate Resolutions as a key part of your strategy.

In Missouri, dividends are typically taxed as income on the shareholders' tax returns. The tax rate applicable depends on the individual’s total income and tax bracket. It's important for shareholders to report dividends accurately to avoid penalties. Accurate documentation is vital, and resources like the Missouri Increase Dividend - Resolution Form - Corporate Resolutions can help manage this process efficiently.