Missouri Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

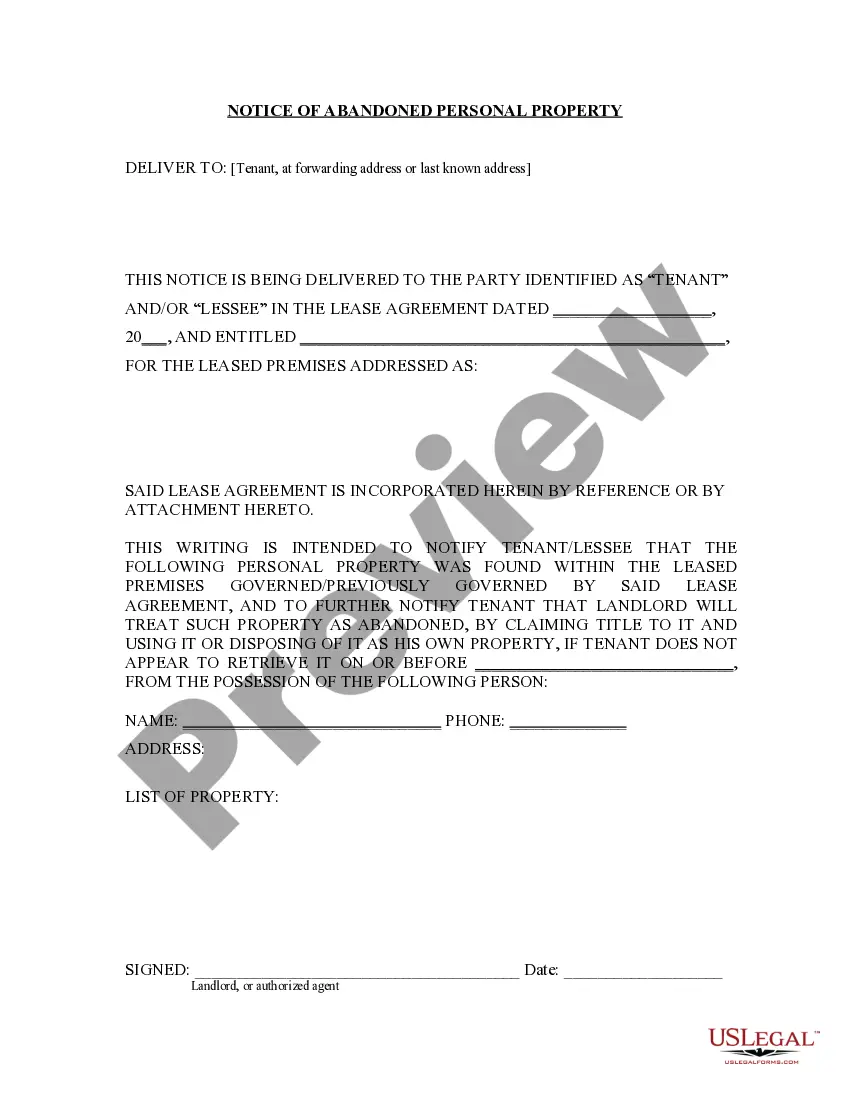

How to fill out Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

Are you presently in the position that you need papers for either organization or personal reasons virtually every day time? There are plenty of lawful papers themes available on the Internet, but discovering types you can depend on is not simple. US Legal Forms gives 1000s of develop themes, much like the Missouri Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death, that happen to be written to fulfill state and federal requirements.

When you are previously acquainted with US Legal Forms internet site and also have your account, merely log in. After that, you can acquire the Missouri Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death web template.

If you do not offer an account and need to start using US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is for the correct metropolis/state.

- Make use of the Review key to examine the shape.

- See the description to actually have chosen the right develop.

- In case the develop is not what you`re looking for, take advantage of the Look for industry to discover the develop that fits your needs and requirements.

- Once you obtain the correct develop, simply click Buy now.

- Opt for the rates strategy you desire, fill out the required information to create your account, and buy an order making use of your PayPal or Visa or Mastercard.

- Decide on a handy file structure and acquire your backup.

Locate every one of the papers themes you have purchased in the My Forms menu. You can obtain a additional backup of Missouri Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death anytime, if possible. Just select the necessary develop to acquire or print the papers web template.

Use US Legal Forms, probably the most comprehensive selection of lawful types, to save lots of efforts and prevent faults. The assistance gives expertly produced lawful papers themes that you can use for a variety of reasons. Generate your account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

However, once the three nationwide credit bureaus ? Equifax, Experian and TransUnion ? are notified someone has died, their credit reports are sealed and a death notice is placed on them. That notification can happen one of two ways ? from the executor of the person's estate or from the Social Security Administration.

Your loved ones or the executor of your will should notify creditors of your death as soon as possible. To do so, they'll need to send each creditor a copy of your death certificate. Creditors generally pause efforts to collect on unpaid debts while your estate is being settled.

Write a letter to one of the nationwide credit reporting agencies. Whichever agency you contact ? TransUnion, Equifax or Experian ? will then notify the other two on your behalf. Along with a copy of the death certificate, please also include the following for the deceased: Legal name.

Using the credit report as your guide, contact all banks and credit card companies at which the deceased had an open account and close those accounts as quickly as possible. You will need to provide a certified copy of the death certificate to close the account.

How to Write a Death Announcement Full name of the deceased. State that they have died. Date and location of death. Funeral and/or memorial date, time, and location. Optional information, such as for donations.

Do credit card debts die with you? A common misconception is that any credit card debts are automatically written off. Instead, any individual debts must be paid using the money the deceased has left behind. Only if there isn't enough money in the estate may the debt be written off.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.