A Limited Partnership Agreement (PA) in Missouri is a legal contract that establishes the rights and responsibilities of a limited liability company (LLC) and a limited partner within a limited partnership (LP). This agreement outlines the terms and conditions governing the relationship between the participating parties, including the management, operations, profits, and losses of the partnership. In Missouri, there are various types of Limited Partnership Agreements between a Limited Liability Company and a Limited Partner. These agreements can include general provisions applicable to all Pas, but may also differ based on the specific needs and objectives of the partnership. Some common types include: 1. General LP Agreement: This type of PA outlines the overall structure, governance, and decision-making processes of the limited partnership. It defines the roles and responsibilities of the LLC and the limited partner, including the contribution of capital, distribution of profits, and management authority. 2. Capital Contribution Agreement: This specific PA focuses on the capital investments made by the limited partner. It details the amount of capital the limited partner must contribute, the timeline for contributions, and any terms or conditions related to those investments. 3. Profit and Loss Sharing Agreement: This PA specifically addresses the distribution of profits and losses between the LLC and the limited partner. It outlines the allocation percentages or ratios for sharing profits and losses, as well as any conditions or exceptions that may apply. 4. Management Agreement: In some Pas, the LLC may assume the role of the general partner, responsible for managing the day-to-day operations of the limited partnership. This agreement specifies the LLC's authority, decision-making power, management fees (if applicable), and other relevant aspects of their managerial role. 5. Dissolution and Liquidation Agreement: This PA defines the process and conditions under which the limited partnership may be dissolved, including the distribution of assets and liabilities. It also outlines the responsibilities and obligations of the LLC and the limited partner in the event of dissolution. Missouri's Limited Partnership Agreement Between a Limited Liability Company and Limited Partner must comply with state laws and regulations. It is strongly recommended that parties seeking to form such a partnership consult with legal professionals to ensure all appropriate clauses, considerations, and requirements are included in the agreement. Additionally, the agreement should address any other specific matters relevant to the partnership, such as dispute resolution, non-compete clauses, confidentiality agreements, and governing law provisions.

Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

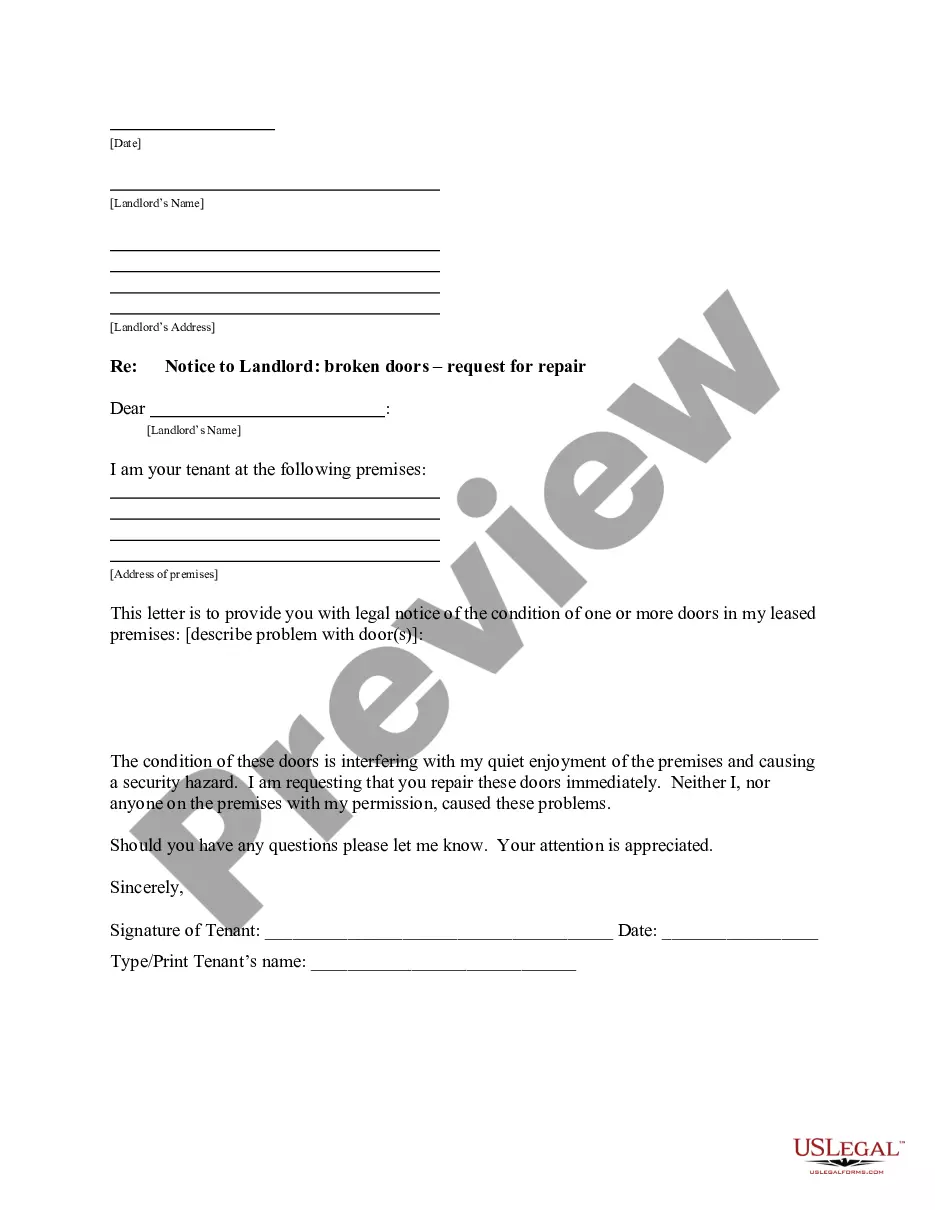

How to fill out Missouri Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Selecting the appropriate authorized document template may pose challenges.

Naturally, there are countless formats accessible online, but how can you locate the authorized document you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner, which you can use for business and personal purposes.

You can browse the document using the Review button and read the document description to confirm it is suitable for you.

- All the templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Acquire button to download the Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Use your account to browse the authorized documents you have previously acquired.

- Go to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, verify that you have selected the correct document for your location.

Form popularity

FAQ

Yes, a Limited Liability Partnership can serve as a partner in another LLP. This structure allows for flexible business arrangements and shared responsibilities among partners. When establishing your Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner, consider how to integrate LLPs effectively to enhance your business strategy and provide additional operational strength.

The major difference lies in the roles of the partners. In a limited partnership, there are general partners who manage the business and limited partners who contribute capital but are not involved in day-to-day operations. Conversely, in a limited liability partnership, all partners can participate in management while enjoying limited liability. When drafting a Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner, it's vital to understand these distinctions to align responsibilities and risks accurately.

To transfer ownership of an LLC in Missouri, you need to follow the procedures outlined in your operating agreement, if one exists. Generally, you will need to document the transfer agreement and can also notify the Missouri Secretary of State if required. Utilizing a Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner can provide clarity during the transfer process, ensuring compliance and protecting all parties involved.

Yes, while an operating agreement is not legally required in Missouri, it is highly recommended for LLCs. This document outlines the management structure, responsibilities, and operational rules for the business. By implementing a robust operating agreement, especially when entering into a Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner, members can avoid potential disputes and ensure smoother operations.

Limited liability refers to a financial protection that shields owners from being personally responsible for debts and obligations of the business. A limited partner, however, is a specific type of partner in a limited partnership who has limited involvement and liability relative to the business's operations. When drafting a Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner, recognizing these roles is crucial to ensuring proper risk management.

A Limited Company (Ltd) is a business structure that limits the liability of its owners, protecting their personal assets from business debts. In contrast, a Limited Liability Partnership (LLP) is a partnership where some or all partners have limited liabilities. In the context of a Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner, understanding these distinctions helps business owners choose the suitable structure for their needs.

If a limited partner in a limited partnership withdraws or becomes inactive, it may affect the partnership's overall structure and operations. Generally, the remaining partners may need to adjust the partnership agreement to account for this change. Consulting a legal professional is wise to modify your Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner accordingly.

Yes, you can have both a limited company and a partnership operating simultaneously. This can be particularly advantageous when you want to separate assets and liabilities or expand business opportunities. A comprehensive Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner will help define the roles and relationships clearly.

Yes, Missouri is often considered a good state for forming an LLC due to its favorable tax structure and business-friendly regulations. The state offers various resources to support businesses, making it easier to start and maintain an LLC. To establish a strong foundation, consider incorporating a Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

The main difference between an LLC and an LLP in Missouri lies in the ownership and management structure. An LLC can have members while an LLP has partners who actively participate in management. If you are considering business formation, ensure to draft a solid Missouri Limited Partnership Agreement Between Limited Liability Company and Limited Partner that reflects your structure and goals.

Interesting Questions

More info

There are few reasons why someone might form an LULL with limited liability and limit partners as in these situations you will often take care of your personal liability to pay for any actions you take in the partnership for you and your partner. ALL Partnerships are formed in the same way a limited partnership is a partnership if a limited liability company is the legal name for the business, however some states allow for a partnership name if limited liability is an important reason. Also, if you have invested in real estate where the LLC is formed under. LCS are frequently used to create a limited liability company so you and your partner can share the LLC for personal use. One advantage of the LULL is a partner can be added to the LLC even if the LLC does not have any partners. This gives the LCS ability to make it bigger or add more LCS to increase profits. LULL Partnerships can also be used to own an investment.