Often a not for profit organization such as a school or a community theatre will sell space in the programs that are to be published for events or a season. This is a generic sample of an agreement to purchase space in such a program.

Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event

Description

How to fill out Agreement To Order Space For Advertising In A Program For A Season Or An Event?

Are you facing a scenario where you will require documents for potential business or personal purposes nearly every workday.

There is an array of legal document templates accessible online, but finding reliable types is challenging.

US Legal Forms offers a vast selection of form templates, such as the Missouri Agreement to Reserve Space for Advertising in a Program for a Season or an Event, which are designed to meet state and federal regulations.

You can find all the document templates you have purchased in the My documents section.

You can obtain another copy of the Missouri Agreement to Reserve Space for Advertising in a Program for a Season or an Event at any time if needed. Just click on the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- After that, you can download the Missouri Agreement to Reserve Space for Advertising in a Program for a Season or an Event template.

- If you don’t have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/county.

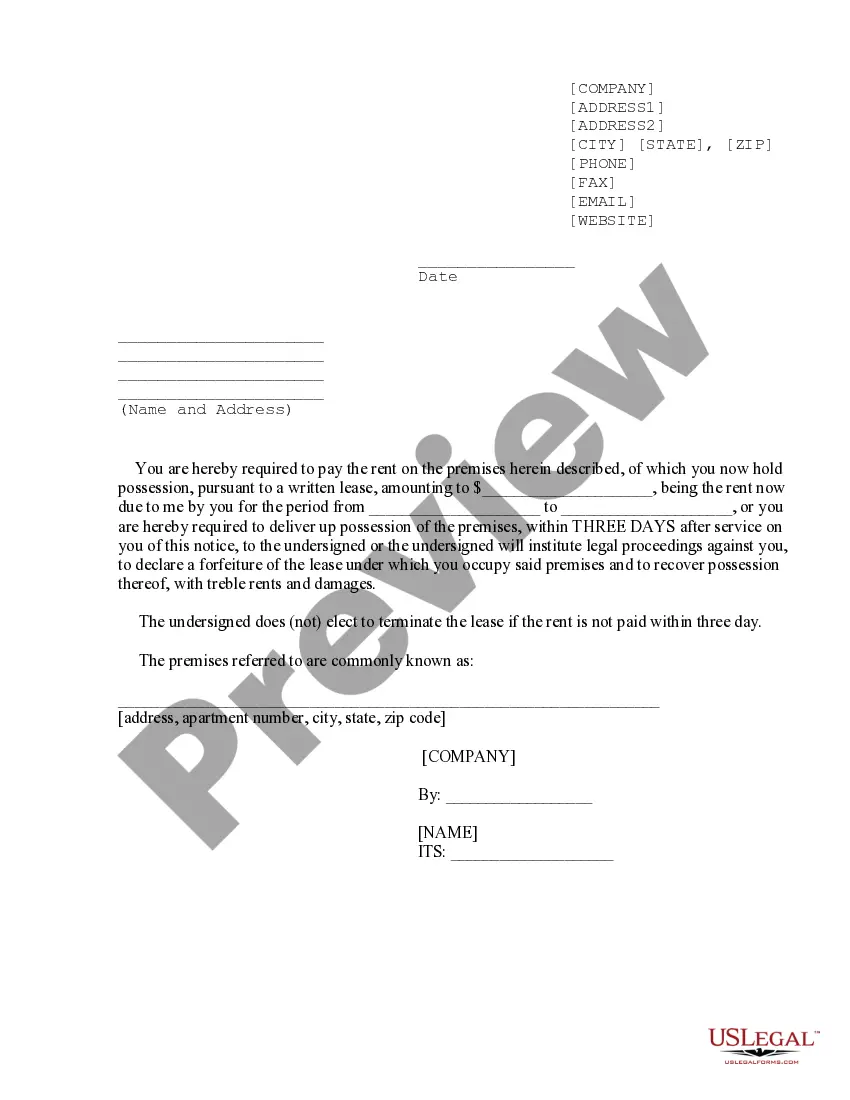

- Use the Preview button to check the form.

- Review the details to ensure you have selected the correct form.

- If the form isn’t what you are looking for, utilize the Search field to locate the form that meets your needs and criteria.

- Once you find the appropriate form, click on Buy now.

- Choose the payment plan you prefer, fill in the necessary details to process your payment, and place an order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

To fill out the Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event, start by gathering all necessary information, including the event details and advertising specifics. Next, clearly enter your name, address, and contact information in the designated area. Be sure to specify the type of advertisement you want and where it will appear in the program. Finally, review the completed form for accuracy before submitting it to ensure your advertising request meets the event’s requirements.

Exempt status in Missouri refers to the classification that allows certain organizations or individuals to avoid specific taxes. This status typically applies to non-profit organizations, government entities, and specific charitable purposes. Gaining exempt status can benefit your organization financially, especially when considering expenditures related to advertising agreements like the Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event.

Individuals who may be exempt from Missouri income tax often include certain disabled veterans, low-income earners, and dependents based on specific criteria. Understanding the guidelines set forth by the Missouri Department of Revenue can help you determine your eligibility. This knowledge is useful for financial planning, especially if you are entering into contracts or agreements, such as a Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event.

To change your business address with the Missouri Secretary of State, you must submit a change of address form either online or by mail. Make sure to provide all necessary details, such as your business name and the new address. This process is essential for maintaining good communication and legal standing, particularly if your business is involved in marketing and advertising agreements, including a Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event.

Filling out form 149 in Missouri involves providing accurate information about your business and tax situation. Review the form carefully and complete each section thoroughly, including your federal employer identification number and business address. If needed, you can consult resources or seek assistance from platforms like USLegalForms to ensure your submission aligns with state requirements. Properly completing the form is important when establishing agreements that involve advertising, such as a Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event.

To be exempt from sales tax in Missouri, you must qualify under specific categories outlined by the state. These categories include resellers, governmental bodies, and certain non-profits. You can apply for an exemption certificate and provide it to your suppliers to avoid sales tax on qualifying purchases. Understanding these details can enhance your financial planning, especially when considering costs associated with a Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event.

To run a craft stall, you typically need supplies for your crafts, a setup that includes tables and displays, and importantly, any necessary business licenses for your area. Creating an inviting environment can attract more customers, and you might also consider utilizing a Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event to enhance your promotional efforts.

Yes, if you plan to sell crafts in Missouri, you will likely need a business license to operate legally. This license ensures compliance with state regulations and helps you build credibility with customers. Additionally, utilizing a Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event can amplify your marketing efforts.

Yes, selling at craft fairs typically requires a business license in Missouri. This requirement ensures you are following state laws and can help facilitate a smooth selling experience. A Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event can also be beneficial for promoting your craft stall effectively.

In Missouri, items such as certain groceries, prescription drugs, and some clothing items are exempt from sales tax. It's important to review the state's list of tax-exempt items to ensure compliance. Additionally, understanding the implications of a Missouri Agreement to Order Space for Advertising in a Program for a Season or an Event can assist in navigating sales tax scenarios.