US Legal Forms - one of many largest libraries of legitimate forms in America - gives a variety of legitimate document themes you are able to acquire or produce. While using site, you can get 1000s of forms for enterprise and person functions, categorized by classes, says, or search phrases.You can find the most up-to-date variations of forms such as the Missouri Agreement Between Widow and Heirs as to Division of Estate within minutes.

If you currently have a registration, log in and acquire Missouri Agreement Between Widow and Heirs as to Division of Estate through the US Legal Forms local library. The Download button will appear on every kind you see. You have access to all in the past saved forms within the My Forms tab of your bank account.

If you wish to use US Legal Forms initially, here are easy directions to help you started off:

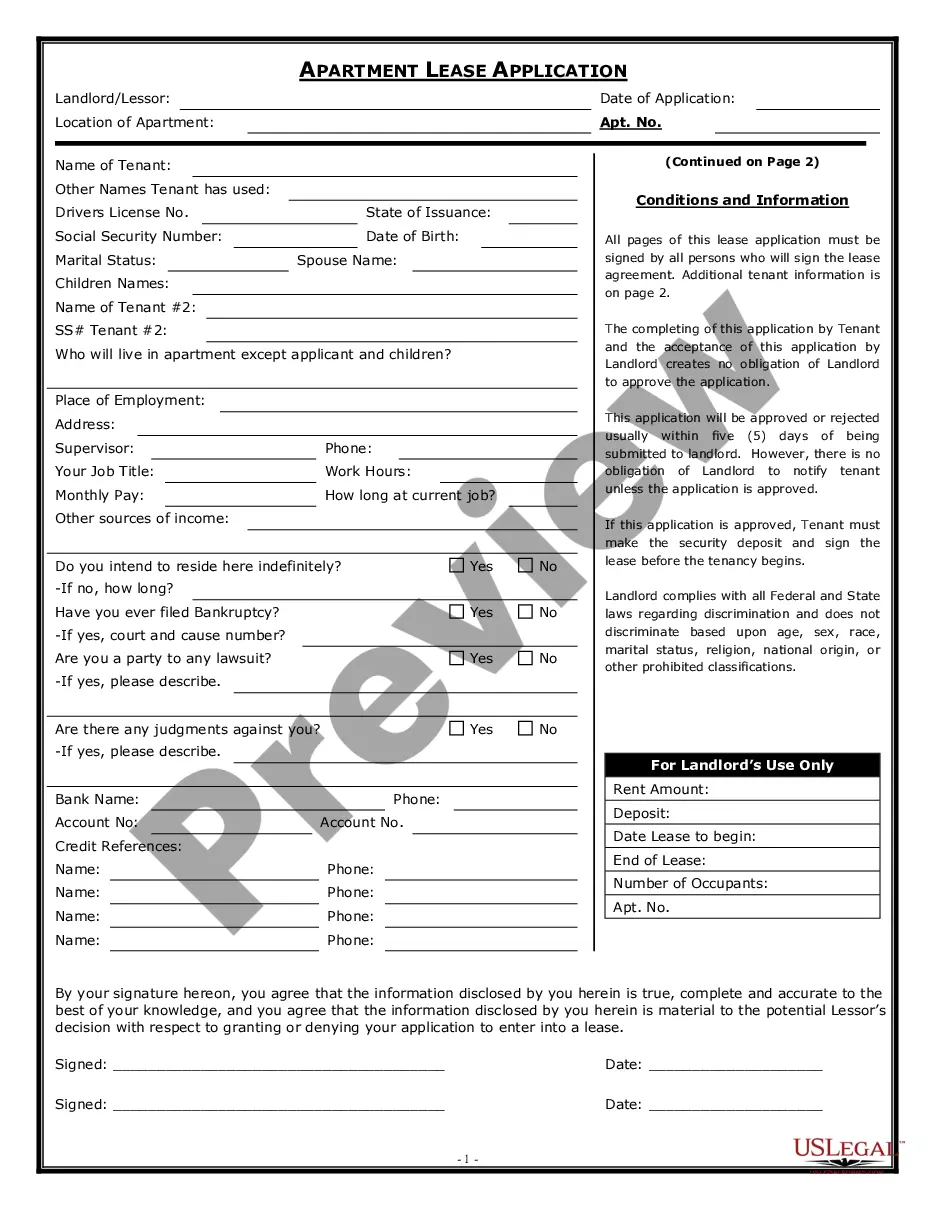

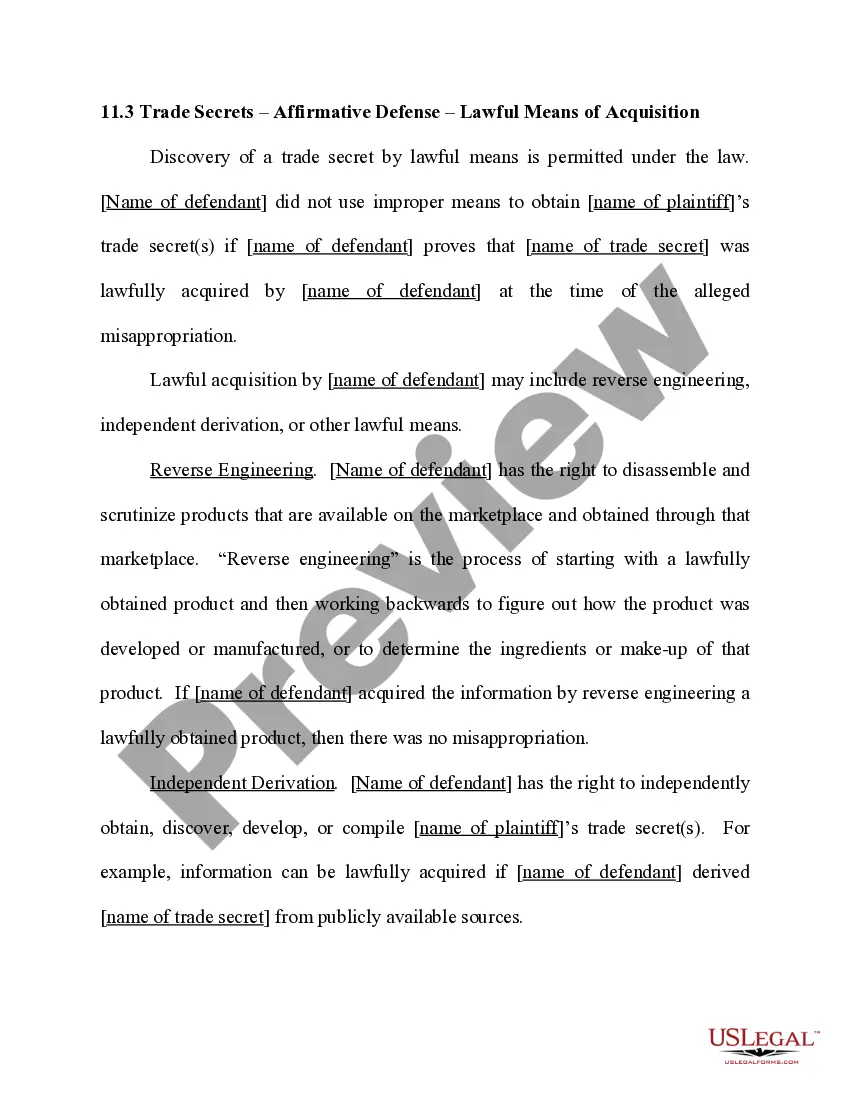

- Be sure you have picked the correct kind to your metropolis/region. Click the Review button to examine the form`s information. Look at the kind information to ensure that you have chosen the appropriate kind.

- If the kind doesn`t match your requirements, use the Lookup discipline on top of the monitor to discover the one that does.

- If you are content with the shape, confirm your choice by clicking the Buy now button. Then, opt for the rates plan you like and provide your credentials to sign up for the bank account.

- Procedure the financial transaction. Use your bank card or PayPal bank account to finish the financial transaction.

- Choose the file format and acquire the shape on your own device.

- Make changes. Fill up, revise and produce and indication the saved Missouri Agreement Between Widow and Heirs as to Division of Estate.

Each and every template you added to your money does not have an expiration day and is also your own permanently. So, if you would like acquire or produce an additional version, just check out the My Forms portion and click about the kind you will need.

Get access to the Missouri Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms, the most extensive local library of legitimate document themes. Use 1000s of expert and condition-specific themes that satisfy your business or person requires and requirements.