A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Missouri Conditional Guaranty of Payment of Obligation

Description

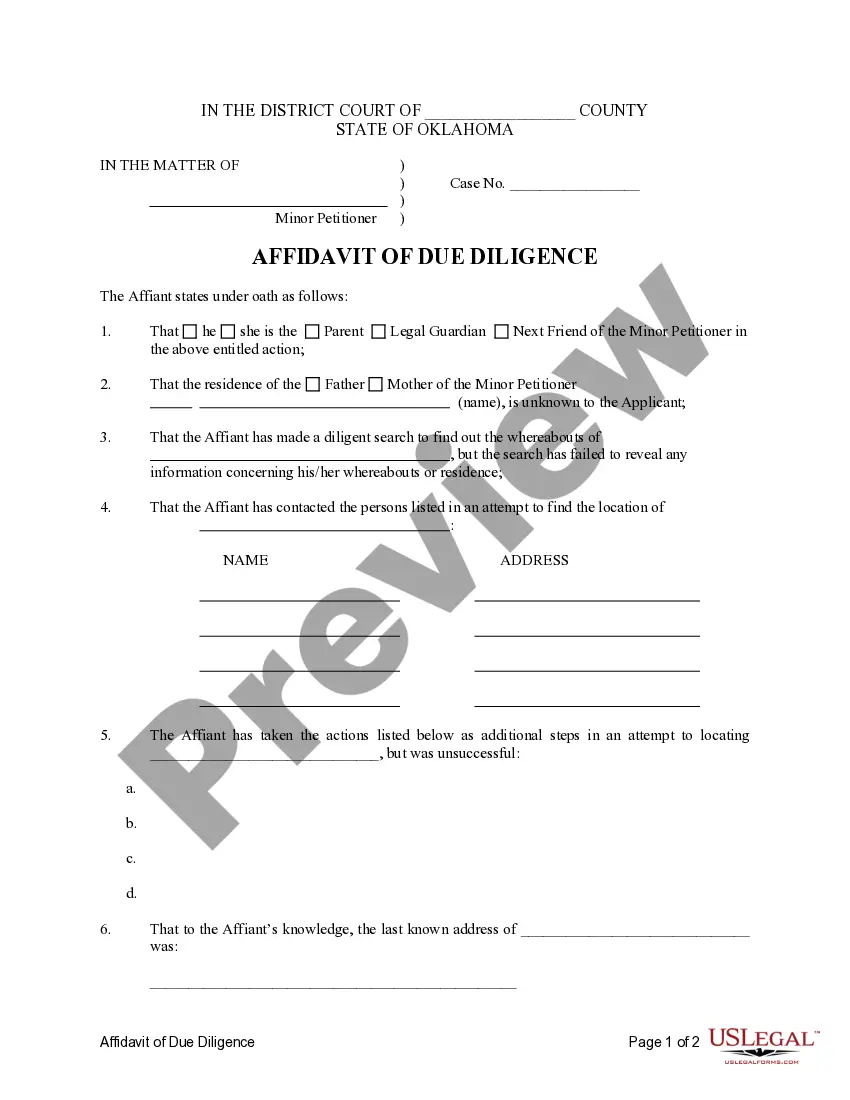

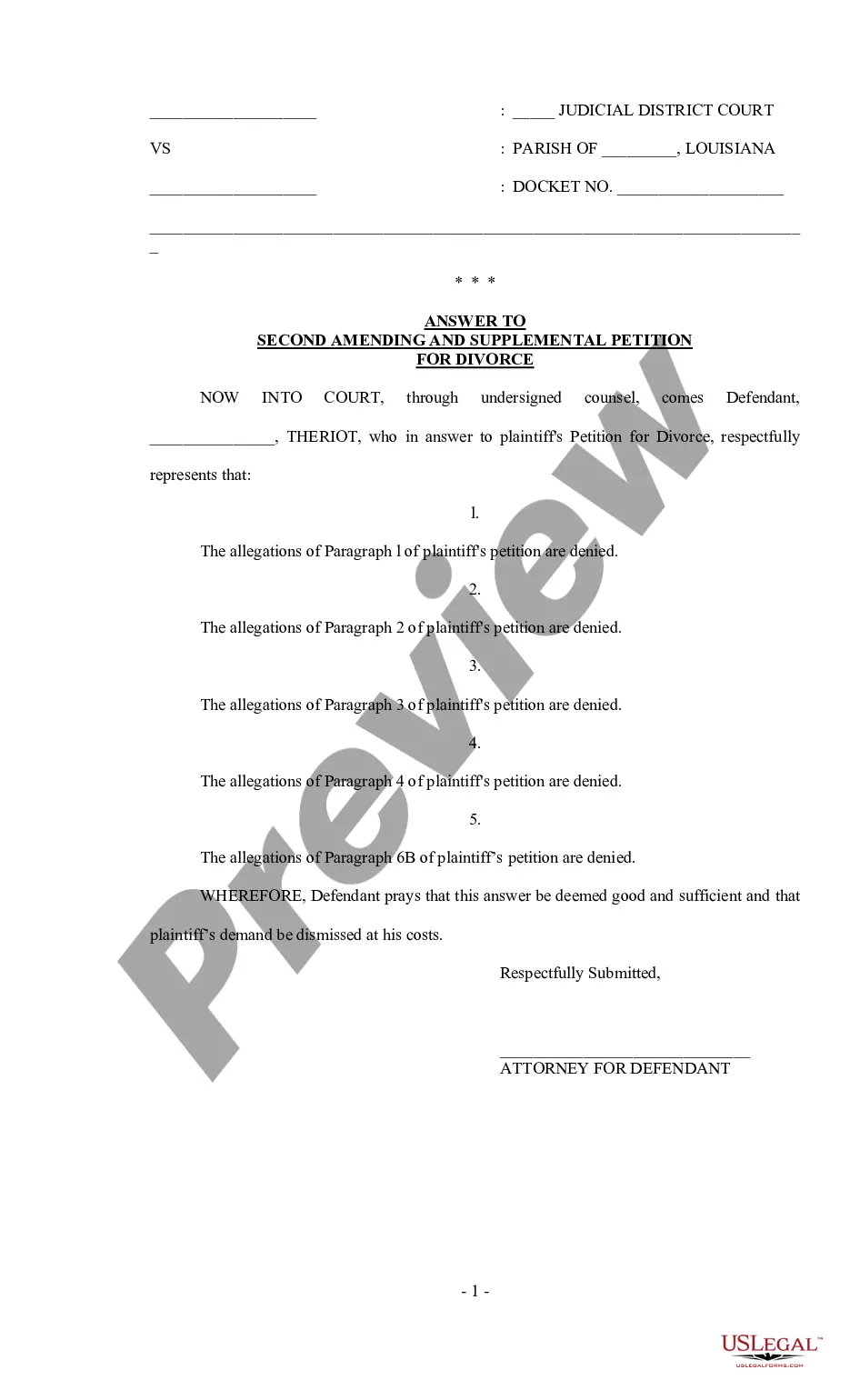

How to fill out Conditional Guaranty Of Payment Of Obligation?

If you are looking to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms accessible online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need. Various templates for business and personal purposes are categorized by types and clauses, or by keywords.

Use US Legal Forms to quickly obtain the Missouri Conditional Guaranty of Payment of Obligation in just a few clicks.

Each legal document template you obtain is yours for an extended period. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Missouri Conditional Guaranty of Payment of Obligation with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Missouri Conditional Guaranty of Payment of Obligation.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct jurisdiction.

- Step 2. Use the Preview option to review the form’s details. Remember to read through the description.

- Step 3. If you are unsatisfied with the form, utilize the Search bar at the top of the screen to find alternative forms within the legal template.

- Step 4. After you have located the form you need, click the Buy Now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Missouri Conditional Guaranty of Payment of Obligation.

Form popularity

FAQ

The right to rescind a contract typically ends when the rescission period expires or if you waive this right. Certain actions, such as beginning performance under the contract, may also forfeit your ability to rescind. It is advisable to consider these factors closely when entering into agreements tied to the Missouri Conditional Guaranty of Payment of Obligation. Clarity in these contexts can help you make informed decisions.

Yes, Missouri has provisions that can be interpreted as a buyer's remorse law, typically providing a three-day period for contract rescission. This law is designed to protect consumers from hasty decisions in transactions, particularly for items like vehicles or home purchases. Always consult legal tools, like those from uslegalforms, to ensure your rights are upheld within the scope of the Missouri Conditional Guaranty of Payment of Obligation.

The right to rescind a contract in Missouri enables you to void a contract within a specific timeframe. This right generally applies to consumer transactions and allows for the reconsideration of certain agreements. By exercising this right, you can protect yourself from binding obligations that may no longer suit your needs. It is crucial to understand how this right relates to the Missouri Conditional Guaranty of Payment of Obligation.

In Missouri, the rescission period typically lasts three business days, allowing you to cancel certain contracts. This applies primarily to consumer transactions, providing a safety net for buyers. During this time, you may reconsider your decision without facing penalties. Understanding the rescission period is important when dealing with obligations, such as those stated in the Missouri Conditional Guaranty of Payment of Obligation.

A guaranty of recourse obligations is a contractual agreement that allows the creditor to seek payment from the guarantor if the primary obligor defaults. This type of guaranty provides an additional layer of security for creditors. It is important to stay informed about how this applies to a Missouri Conditional Guaranty of Payment of Obligation, particularly when assessing risk.

The five rules of contract law include offer, acceptance, consideration, capacity, and legality. These rules work together to ensure that all parties involved in a contract understand their obligations and rights. Knowing these rules, especially regarding a Missouri Conditional Guaranty of Payment of Obligation, can safeguard your interests in contractual agreements.

The four essential rules of contract law include an offer, acceptance, consideration, and mutual assent. Each rule forms the foundation of a valid contract, ensuring that all parties agree on the responsibilities laid out. When dealing with a Missouri Conditional Guaranty of Payment of Obligation, these rules become critical in understanding your contractual commitments.

In Missouri, you may have the right to cancel a contract under certain conditions, such as if you signed under duress or if the contract is voidable. Additionally, some contracts have a specified cooling-off period, which allows withdrawal without penalty. Understanding your rights in light of a Missouri Conditional Guaranty of Payment of Obligation can help you navigate contract cancellation.

A contract becomes legally binding in Missouri when it includes an offer, acceptance, consideration, and mutual intent to be bound by the agreement. The terms must be clear, and both parties must have the legal capacity to enter into the contract. Understanding the specifics of a Missouri Conditional Guaranty of Payment of Obligation can ensure that parties meet these legal requirements.