A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

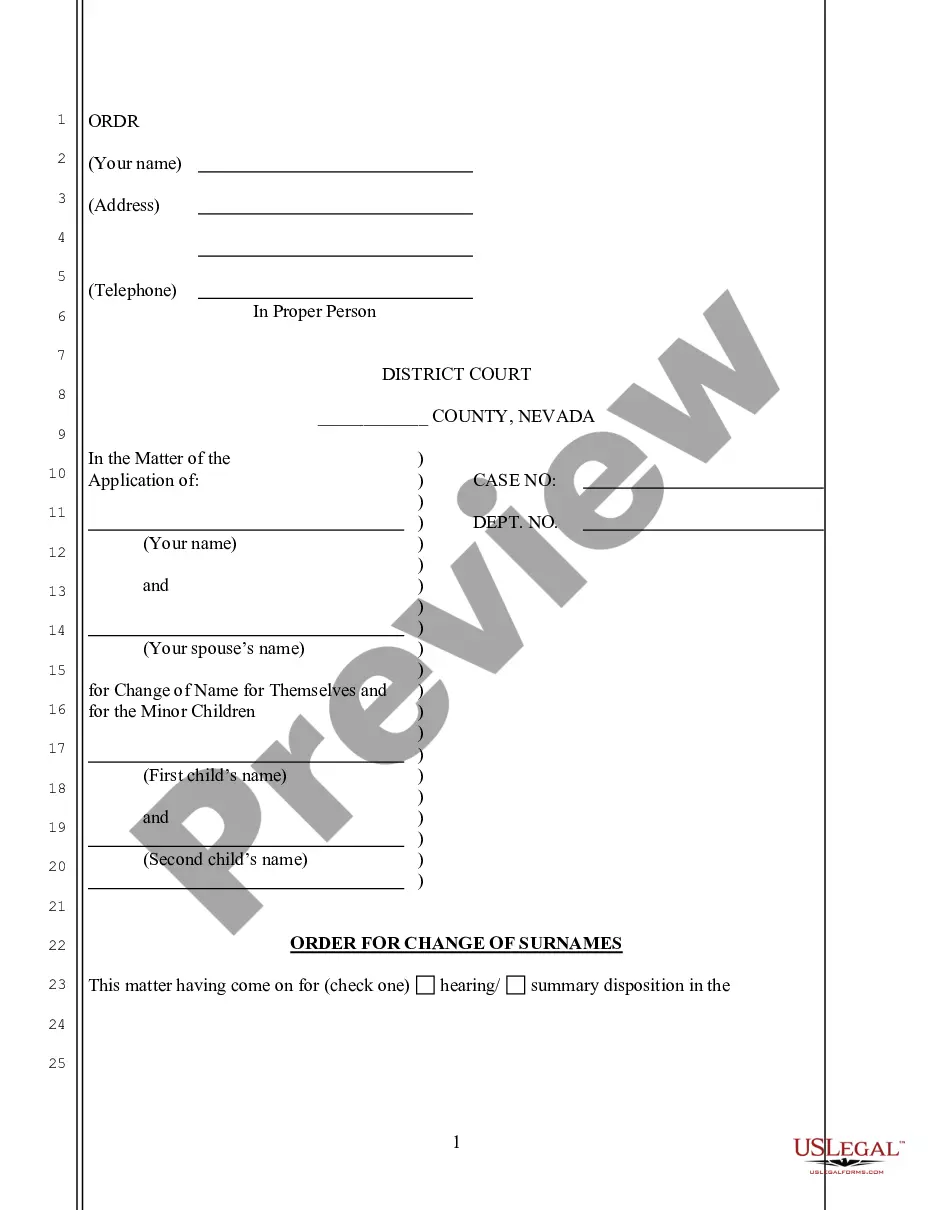

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

You can allocate effort online looking for the valid document template that meets the state and federal requirements you desire.

US Legal Forms offers a vast array of valid forms that can be examined by professionals.

You can easily acquire or print the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability with my help.

If you want to find another version of your form, use the Look for field to locate the template that meets your needs and requirements.

- If you currently have a US Legal Forms account, you may Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

- Each valid document template you receive is yours permanently.

- To get an additional copy of the obtained form, visit the My documents tab and select the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure you have chosen the correct document template for the area/city of your choice. Review the form description to confirm you have selected the right one.

- If available, utilize the Review option to examine the document template as well.

Form popularity

FAQ

Terminating a personal guarantee associated with the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability often involves notifying the creditor in writing. Ensure your termination request includes valid reasons, such as completing obligations under the guarantee. You may also need to negotiate terms with the creditor. Using services like US Legal Forms can help you draft effective termination letters.

To invalidate a personal guarantee related to the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, you may need to prove that the guarantee lacked essential elements such as proper consent or was signed under duress. It is crucial to gather evidence that highlights these aspects. Consulting a legal expert can provide clarity on your specific situation. Platforms like US Legal Forms offer resources that can guide you through this process.

A personal guarantor is an individual who assumes responsibility for the debt, risking personal assets if the borrower defaults. Conversely, a corporate guarantor is a business entity that takes on the debt liability, thus protecting individual members from personal financial risk. Recognizing these distinctions helps when examining the implications of the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability in different contexts.

A guarantor accepts full responsibility for the debt, allowing creditors to claim the full amount from them if necessary. In contrast, a limited guarantor is responsible only for a specified amount or under certain conditions. Understanding these roles is vital in navigating the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, ensuring all parties are clear about their obligations.

The time limit for enforcing a personal guarantee typically aligns with the statute of limitations for written contracts, which can be up to ten years in Missouri. However, specific circumstances may alter the enforceability period. Being aware of these timelines is essential when dealing with the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, as it ensures timely legal action.

Enforcing a guarantee involves documented communication of the debt to the guarantor along with any necessary legal proceedings. Initiating a lawsuit may be required if the guarantor fails to fulfill their obligations. The Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability allows creditors to pursue legal remedies effectively to recover outstanding amounts.

Getting around a personal guarantee can be quite challenging, as it serves as a legal commitment. However, negotiating directly with the creditor for a waiver or modification of the guarantee can sometimes be an option. Crafting sound financial strategies, such as demonstrating improved solvency, may also encourage creditors to reconsider the enforceability of the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

Yes, personal guarantees are generally enforceable, provided that they meet legal requirements, such as a clear agreement and consideration. In Missouri, the Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability establishes the foundation for such enforceability. Enforcing a guarantee ensures that those responsible for the debt are held accountable, thereby protecting creditors' rights.

To enforce a personal guarantee under the Missouri Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, a creditor can begin by providing clear documentation of the debt. This typically involves showing signed agreements that outline the guarantor's obligations. If necessary, pursuing legal action may be an option, and working with a legal professional ensures you follow the proper procedures to hold the guarantor accountable.