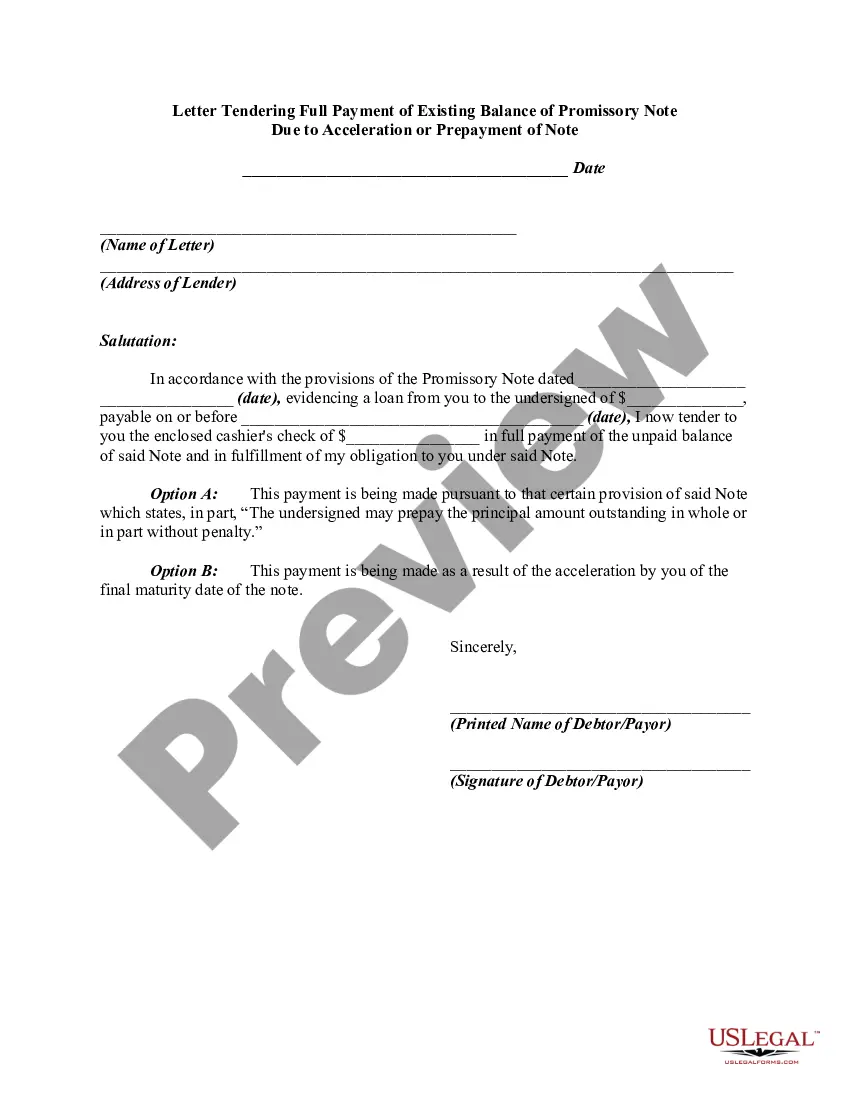

A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

Title: Understanding Missouri Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment Introduction: In Missouri, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a legal document used when the borrower intends to repay their outstanding balance on a promissory note before its maturity date. This article aims to provide a detailed description of this process, including its purpose, essential components, and any additional types or variations of such letters in Missouri. Keywords: Missouri, Letter, Tendering, Full Payment, Existing Balance, Promissory Note, Acceleration, Prepayment. 1. Purpose of the Missouri Letter Tendering Full Payment: The purpose of the Missouri Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is to formally notify the lender that the borrower intends to repay their outstanding balance in full before the note's scheduled maturity date. It signifies the borrower's intent to settle the debt early and allows for appropriate arrangements to be made to finalize the loan repayment process. 2. Key Components of the Letter: a. Borrower's Information: Include the legal name, address, and contact details of the borrower. b. Lender's Information: Provide the lender's name, contact details, and address. c. Promissory Note Details: Mention important information related to the promissory note, such as the date of execution, maturity date, original principal sum, and any applicable interest rates or fees. d. Full Payment Amount: Clearly state the exact amount the borrower intends to pay, which should include both the principal balance and any outstanding interest or charges. e. Payment Method: Specify the preferred method of payment (e.g., certified check, wire transfer) and provide relevant instructions or details for the lender to facilitate the repayment process. f. Deadline for Acceptance: Set a reasonable deadline by which the lender should acknowledge the letter, accept the payment, and provide a release or satisfaction of the promissory note. g. Signature: The letter must be signed by the borrower to indicate their consent and authenticity. 3. Variations of the Missouri Letter Tendering Full Payment: a. Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: This variation is used specifically when the promissory note has been accelerated by the lender due to default or breach of loan terms, prompting the borrower to tender full payment to satisfy the debt and avoid additional consequences. b. Letter Tendering Full Payment of Existing Incentivized Balance of Prepaid Promissory Note: In cases where the promissory note contains prepayment incentives or discounts for early repayment, this variation is used when the borrower wishes to take advantage of such benefits and tenders full payment accordingly. c. Letter Tendering Partial Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment: This variation is applicable if the borrower intends to make a partial payment towards the outstanding balance instead of a full payment. It specifically addresses situations where complete repayment is not possible but partial settlement is offered. Conclusion: A Missouri Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is a crucial legal document when a borrower seeks to repay their outstanding debt in advance. By notifying the lender of their intent, borrowers can initiate the proper procedures for loan clearance and ensure a smooth and satisfactory repayment experience. Remember to consult legal professionals or notaries to ensure compliance with Missouri laws and regulations governing promissory notes and loan agreements.Title: Understanding Missouri Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment Introduction: In Missouri, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a legal document used when the borrower intends to repay their outstanding balance on a promissory note before its maturity date. This article aims to provide a detailed description of this process, including its purpose, essential components, and any additional types or variations of such letters in Missouri. Keywords: Missouri, Letter, Tendering, Full Payment, Existing Balance, Promissory Note, Acceleration, Prepayment. 1. Purpose of the Missouri Letter Tendering Full Payment: The purpose of the Missouri Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is to formally notify the lender that the borrower intends to repay their outstanding balance in full before the note's scheduled maturity date. It signifies the borrower's intent to settle the debt early and allows for appropriate arrangements to be made to finalize the loan repayment process. 2. Key Components of the Letter: a. Borrower's Information: Include the legal name, address, and contact details of the borrower. b. Lender's Information: Provide the lender's name, contact details, and address. c. Promissory Note Details: Mention important information related to the promissory note, such as the date of execution, maturity date, original principal sum, and any applicable interest rates or fees. d. Full Payment Amount: Clearly state the exact amount the borrower intends to pay, which should include both the principal balance and any outstanding interest or charges. e. Payment Method: Specify the preferred method of payment (e.g., certified check, wire transfer) and provide relevant instructions or details for the lender to facilitate the repayment process. f. Deadline for Acceptance: Set a reasonable deadline by which the lender should acknowledge the letter, accept the payment, and provide a release or satisfaction of the promissory note. g. Signature: The letter must be signed by the borrower to indicate their consent and authenticity. 3. Variations of the Missouri Letter Tendering Full Payment: a. Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: This variation is used specifically when the promissory note has been accelerated by the lender due to default or breach of loan terms, prompting the borrower to tender full payment to satisfy the debt and avoid additional consequences. b. Letter Tendering Full Payment of Existing Incentivized Balance of Prepaid Promissory Note: In cases where the promissory note contains prepayment incentives or discounts for early repayment, this variation is used when the borrower wishes to take advantage of such benefits and tenders full payment accordingly. c. Letter Tendering Partial Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment: This variation is applicable if the borrower intends to make a partial payment towards the outstanding balance instead of a full payment. It specifically addresses situations where complete repayment is not possible but partial settlement is offered. Conclusion: A Missouri Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is a crucial legal document when a borrower seeks to repay their outstanding debt in advance. By notifying the lender of their intent, borrowers can initiate the proper procedures for loan clearance and ensure a smooth and satisfactory repayment experience. Remember to consult legal professionals or notaries to ensure compliance with Missouri laws and regulations governing promissory notes and loan agreements.