Missouri Sample Letter for Withheld Delivery

Description

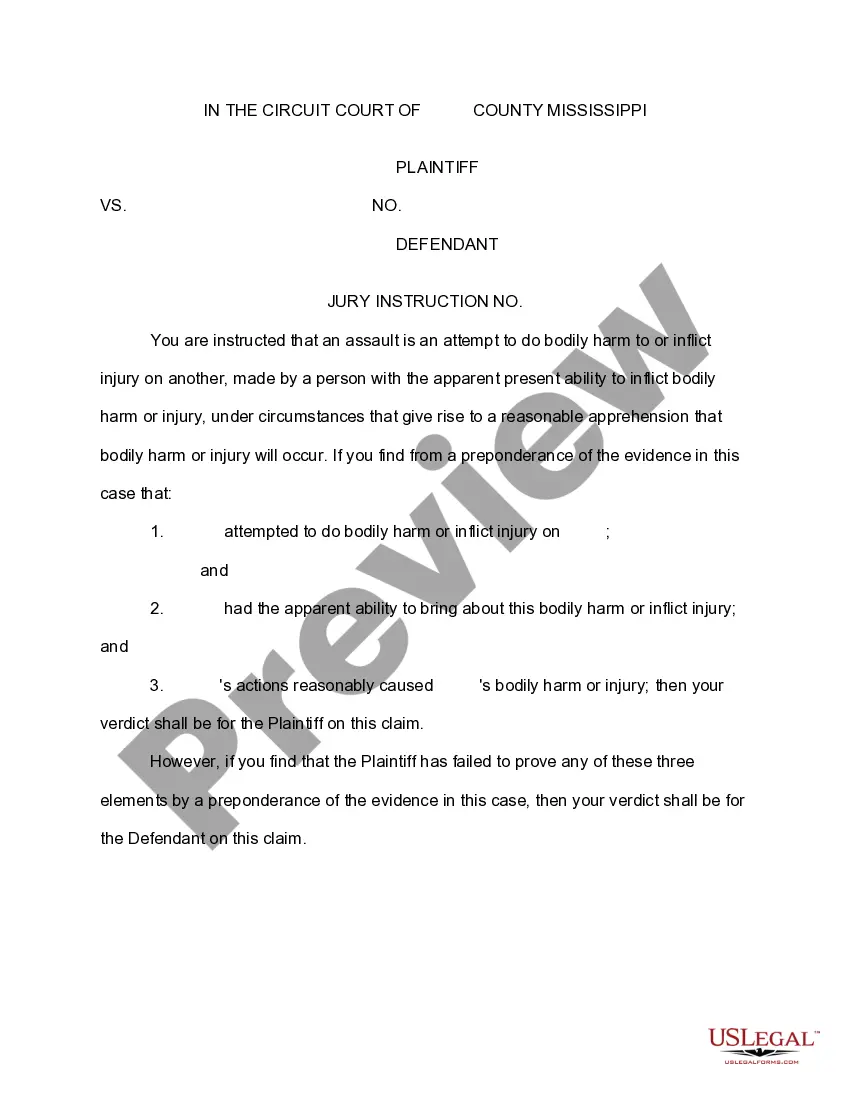

How to fill out Sample Letter For Withheld Delivery?

US Legal Forms - one of the most extensive collections of authorized templates in the USA - provides a broad assortment of legal document formats that you can obtain or create.

Using the site, you can find thousands of forms for business and personal reasons, sorted by categories, statements, or keywords. You can access the latest versions of forms such as the Missouri Sample Letter for Withheld Delivery within moments.

If you already have a monthly membership, Log In to obtain the Missouri Sample Letter for Withheld Delivery from the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously obtained forms in the My documents section of your account.

Confirm the purchase. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Complete, revise, and print and sign the acquired Missouri Sample Letter for Withheld Delivery. Each template you added to your account has no expiration date and belongs to you indefinitely. Thus, if you want to obtain or create another copy, simply revisit the My documents section and click on the form you need. Gain access to the Missouri Sample Letter for Withheld Delivery with US Legal Forms, the most extensive library of authorized document templates. Utilize numerous professional and state-specific formats that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/county.

- Click the Preview option to review the form's details.

- Check the form description to confirm that you have chosen the right one.

- If the form does not meet your requirements, use the Search section at the top of the screen to find one that does.

- Once satisfied with the form, verify your selection by clicking on the Get now button.

- Then, choose the payment plan you prefer and provide your information to create an account.

Form popularity

FAQ

Yes, Missouri has its own version of the W4 form that employees need to fill out for state withholding purposes. This form helps you indicate your tax situation and allows you to claim allowances that adjust your state tax withholdings accordingly. If you're unsure how to fill it out correctly, the Missouri Sample Letter for Withheld Delivery can offer insights and guide you through the process. Always ensure your information is accurate to prevent withholding errors.

The Missouri annual withholding reconciliation process requires employers to match their total wage payments to the total taxes withheld throughout the year. This ensures accurate reporting and compliance with state laws. If discrepancies arise, you may receive a notice that resembles a Missouri Sample Letter for Withheld Delivery. Therefore, maintaining accurate records is crucial for resolving any withholding issues.

Indeed, Missouri provides a state withholding form for employees to clarify their tax withholding preferences. The form allows you to claim allowances based on your personal circumstances, affecting how much tax gets withheld from your paycheck. Misunderstanding this form can lead to issues, so refer to resources that discuss the Missouri Sample Letter for Withheld Delivery for further clarification about withholding regulations.

Yes, Missouri does have state tax forms for various tax situations, including income tax returns. Each form serves different types of taxpayers, so it’s important to know which one applies to you. If you have questions about a specific form, resources such as the Missouri Sample Letter for Withheld Delivery can shed light on compliance and tax obligations. Always keep your forms updated to avoid any issues with state authorities.

State withholding and federal withholding serve similar purposes but are not the same. Federal withholding applies to your income taxes at the national level, while state withholding pertains specifically to state income taxes, like those in Missouri. To ensure accurate withholding, familiarize yourself with the requirements of both levels. You may also come across documents, including the Missouri Sample Letter for Withheld Delivery, which can provide additional guidance.

Filling out the Missouri W4 involves providing essential information, such as your name, address, and Social Security number. It also requires you to indicate your withholding allowances, which directly affect your tax withholdings. For a clearer understanding, consider referring to resources that explain the Missouri Sample Letter for Withheld Delivery. Using the correct information on the W4 can help you optimize your tax withholdings throughout the year.

The Missouri Department of Revenue may send you a letter for various reasons, including a request for more information regarding your tax return or informing you about a tax adjustment. If you receive a notice that mentions a Missouri Sample Letter for Withheld Delivery, it’s essential to review it carefully. The letter aims to clarify any discrepancies or issues with your withholding. Responding promptly can help avoid penalties and ensure compliance.

Applying for tax-exempt status in Missouri involves completing and submitting the required forms to the Department of Revenue. You will need to provide supporting documentation that confirms your eligibility for tax exemption. It's essential to follow the guidelines closely to ensure your application is processed smoothly. A Missouri Sample Letter for Withheld Delivery could serve as a helpful addition to your application.

To qualify for exemption from withholding, you must meet the criteria established by the Missouri Department of Revenue. Typically, this includes having no tax liability in the previous year and expecting none for the current year. It’s important to provide documentation supporting your claim. A Missouri Sample Letter for Withheld Delivery can be an effective way to present your case.

Yes, Missouri has specific forms for state withholding tax, including the Form MO-W4 for employees. This form is crucial for setting your tax withholding correctly based on your exemption status. You can easily find these forms on the Missouri Department of Revenue’s website. Using a Missouri Sample Letter for Withheld Delivery could help clarify any details when submitting your paperwork.