No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

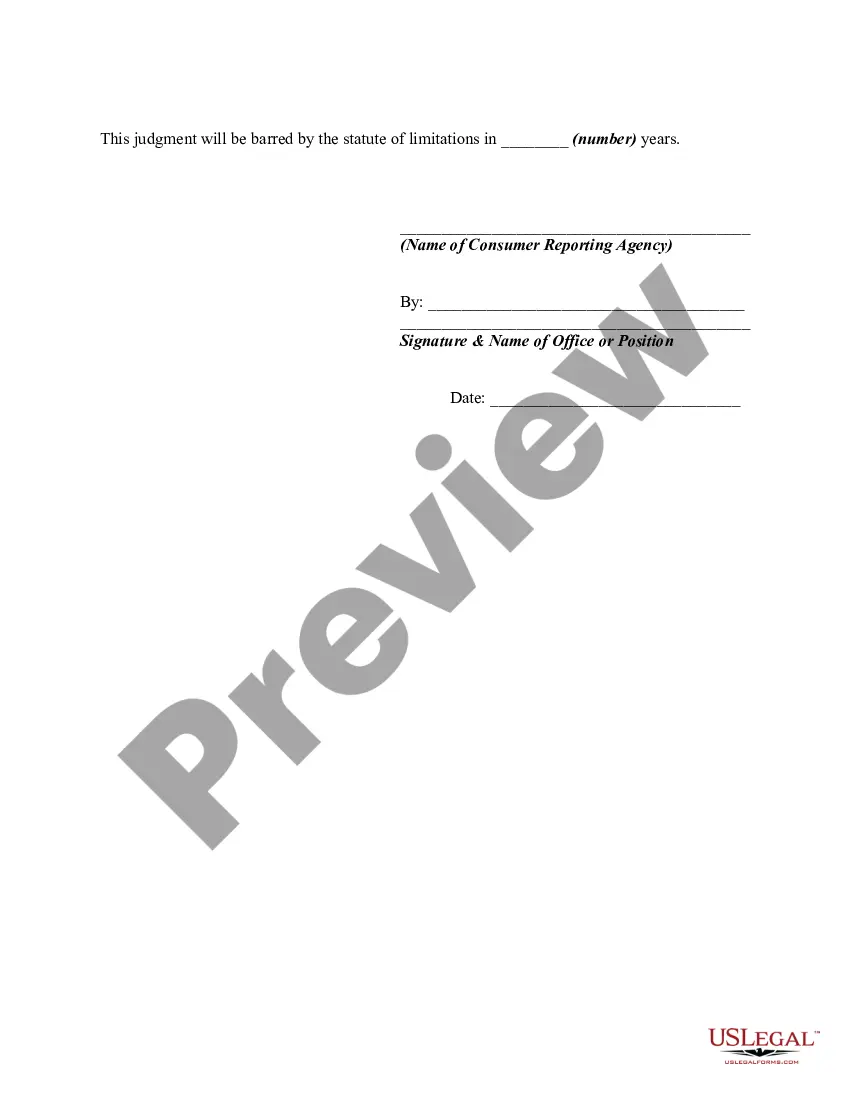

Missouri Report to Creditor by Collection Agency Regarding Judgment Against Debtor

Description

How to fill out Report To Creditor By Collection Agency Regarding Judgment Against Debtor?

If you have to complete, obtain, or produce legitimate record layouts, use US Legal Forms, the greatest assortment of legitimate kinds, that can be found online. Utilize the site`s easy and practical look for to get the documents you want. A variety of layouts for business and personal functions are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Missouri Report to Creditor by Collection Agency Regarding Judgment Against Debtor within a few clicks.

Should you be already a US Legal Forms consumer, log in for your profile and then click the Down load button to obtain the Missouri Report to Creditor by Collection Agency Regarding Judgment Against Debtor. You can even gain access to kinds you earlier delivered electronically within the My Forms tab of your respective profile.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your right area/region.

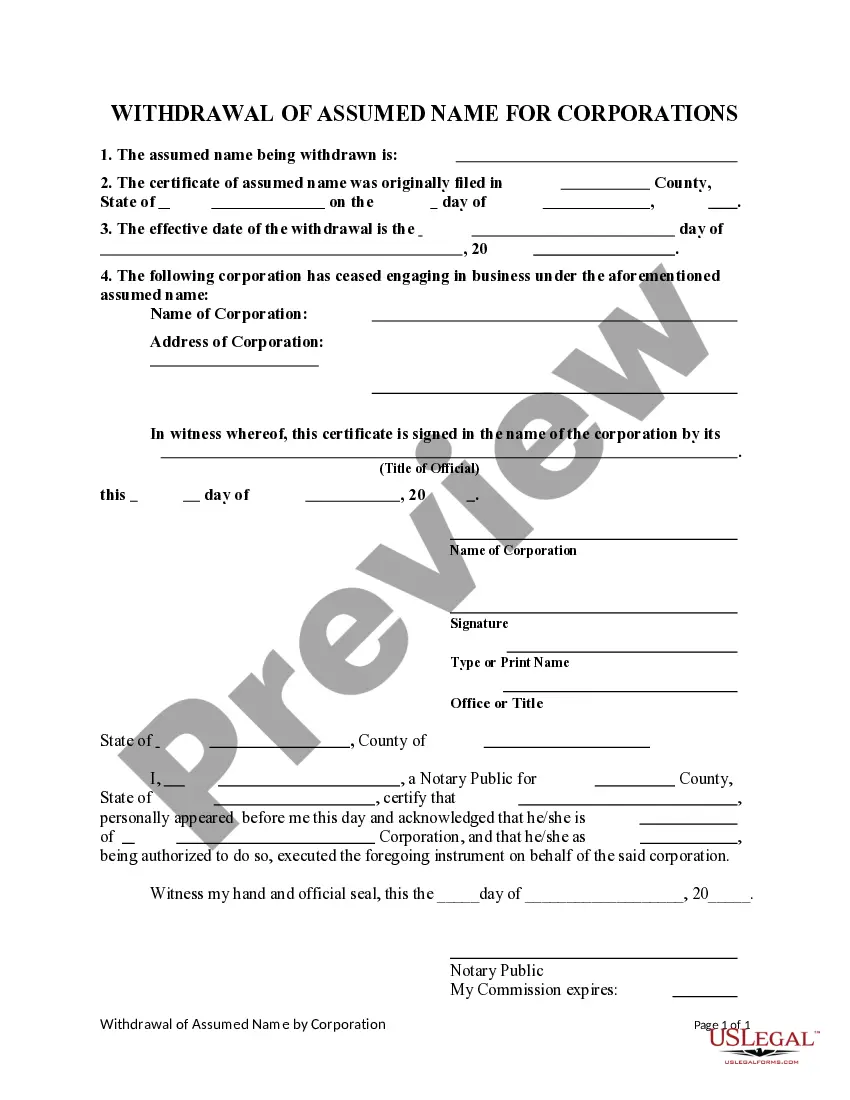

- Step 2. Utilize the Preview solution to look through the form`s articles. Never forget to read through the outline.

- Step 3. Should you be unsatisfied using the develop, make use of the Search discipline towards the top of the display screen to discover other versions in the legitimate develop design.

- Step 4. Once you have discovered the form you want, go through the Buy now button. Select the pricing strategy you choose and include your credentials to sign up for the profile.

- Step 5. Process the financial transaction. You may use your credit card or PayPal profile to complete the financial transaction.

- Step 6. Choose the file format in the legitimate develop and obtain it on the gadget.

- Step 7. Total, modify and produce or indication the Missouri Report to Creditor by Collection Agency Regarding Judgment Against Debtor.

Each legitimate record design you purchase is yours for a long time. You have acces to every single develop you delivered electronically inside your acccount. Go through the My Forms segment and decide on a develop to produce or obtain once more.

Contend and obtain, and produce the Missouri Report to Creditor by Collection Agency Regarding Judgment Against Debtor with US Legal Forms. There are millions of expert and express-specific kinds you can utilize for the business or personal needs.

Form popularity

FAQ

Missouri Judgments Payments made through garnishments starts the ten-year time limit each time a garnishment amount is collected. If the judgment creditor files a motion to revive the judgment, they will need to serve the debtor and a show cause hearing will be held.

Missouri differs when it comes to the statute of limitations in comparison to the other 49 states typical six-year window. In Missouri, the statute of limitations for oral contracts is five years, written contracts are 10 years, promissory notes are 10 years, and open-ended debts are five years.

Missouri Civil Statutes of Limitations at a Glance Injury to property, trespassing, and enforcement of written contracts carry a five-year statute of limitations. The longest time limit for civil suits is reserved for fraud, rent collection, debt collection, and judgments. This time limit is 10 years.

Yes, you can settle a debt even if a lawsuit has already been filed against you. Some lenders may allow you to pay off your debt through either a repayment plan or partial lump-sum settlement.

A judgment is a court order stating that you owe the debt collector money because of a lawsuit. You may have received a judgment because the court decided in favor of the debt collector in a trial, or because you did not respond to a lawsuit that was filed against you.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

A Missouri judgment is valid for ten (10) years from the latter of (1) the date of entry of the judgment or (2) the date that a plaintiff last successfully tried to execute on the judgment as reflected by a Court record.

If you don't pay a debt, a creditor or its debt collector generally can sue you to collect. If they go to court and win, the court will enter a judgment against you.