The Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. The purpose of the Act is to insure that consumer information obtained and used is done in such a way as to insure its confidentiality, accuracy, relevancy and proper utilization. Credit reporting bureaus are not permitted to disclose information to persons not having a legitimate use for this information. It is a federal crime to obtain or to furnish a credit report for an improper purpose.

Missouri Complaint by Consumer against Wrongful User of Credit Information

Description

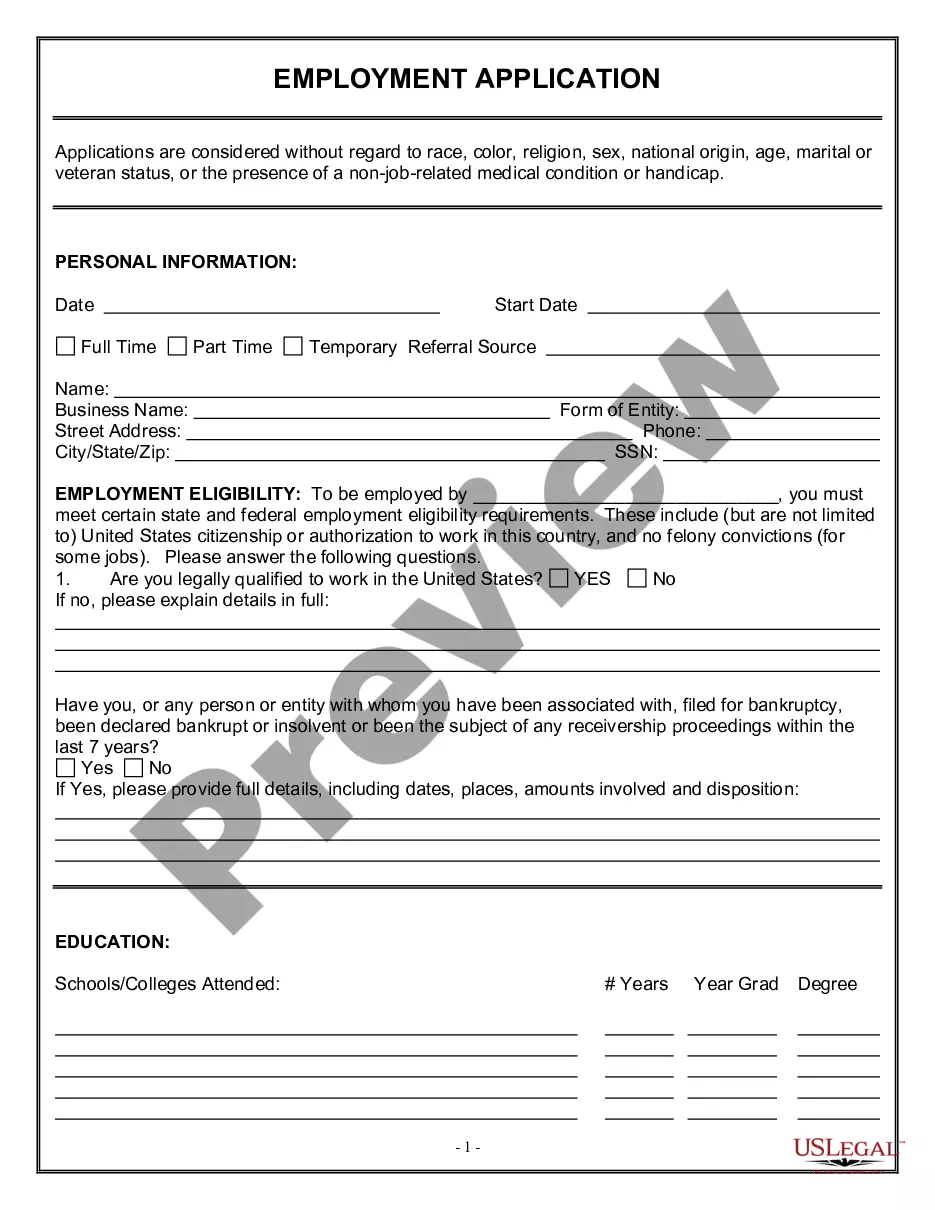

How to fill out Complaint By Consumer Against Wrongful User Of Credit Information?

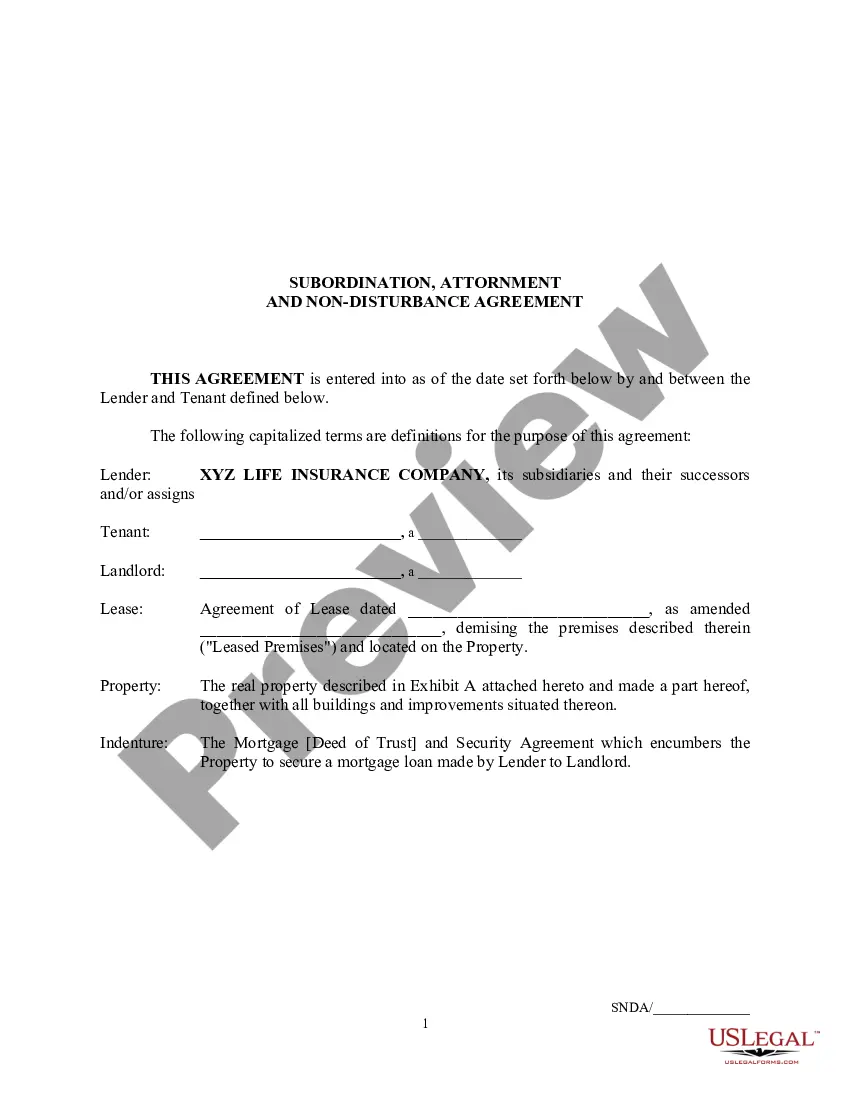

US Legal Forms - one of the most prominent collections of legal documents in the USA - provides a variety of legal form templates that you can download or print. Utilizing the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the most current forms such as the Missouri Complaint by Consumer against Wrongful User of Credit Information in moments.

If you have an account, Log In and download the Missouri Complaint by Consumer against Wrongful User of Credit Information from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously acquired forms from the My documents section of your account.

To utilize US Legal Forms for the first time, here are straightforward steps to get started: Ensure you have selected the correct form for the city/state. Click the Preview button to review the form's content. Check the form summary to verify that you have chosen the right form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to register for the account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the obtained Missouri Complaint by Consumer against Wrongful User of Credit Information. Every template you added to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Missouri Complaint by Consumer against Wrongful User of Credit Information with US Legal Forms, the most extensive collection of legal form templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- Explore a vast range of legal documents.

- Efficiently manage your forms and documents.

- Enjoy lifetime access to your downloaded forms.

- Easily navigate the user-friendly interface.

Form popularity

FAQ

In most cases, the FDIC will try to find another banking institution to acquire the failed bank. If that happens, customers' accounts will simply transfer over to the new bank. You will get information about the transition, and you will likely get new debit cards and checks (if applicable).

If you do not have an email address, you may call the Consumer Protection Hotline at 1-800-392-8222 to file your complaint by phone. Did you lose money as a result of this transaction? (The following 4 questions are required if money was loss as a result of this transaction.) Where/How did you make this purchase?

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.

Missouri's consumer protection statutes prohibit the act, use or employment by any person of any deception, fraud, false pretense, false promise, misrepresentation, unfair practice or the concealment, suppression, or omission of any material fact in connection with the sale or advertisement of any merchandise ( ...

Reporting Fraud Call the Consumer Protection Hotline at 1-800-392-8222.

How does the FDIC resolve a closed bank? In the unlikely event of a bank failure, the FDIC acts quickly to protect insured depositors by arranging a sale to a healthy bank, or by paying depositors directly for their deposit accounts to the insured limit. Purchase and Assumption Transaction.