A license authorizes the holder to do something that he or she would not be entitled to do without the license. Licensing may be directed toward revenue raising purposes, or toward regulation of the licensed activity, or both. Statutes frequently require that a person obtain a license before practicing certain professions such as law or medicine, or before carrying on a particular business such as that of a real estate broker or stock broker. If the license is required to protect the public from unqualified persons, an assignment of that license to secure a loan would probably not be enforceable.

Missouri Assignment of Business License as Security for a Loan

Description

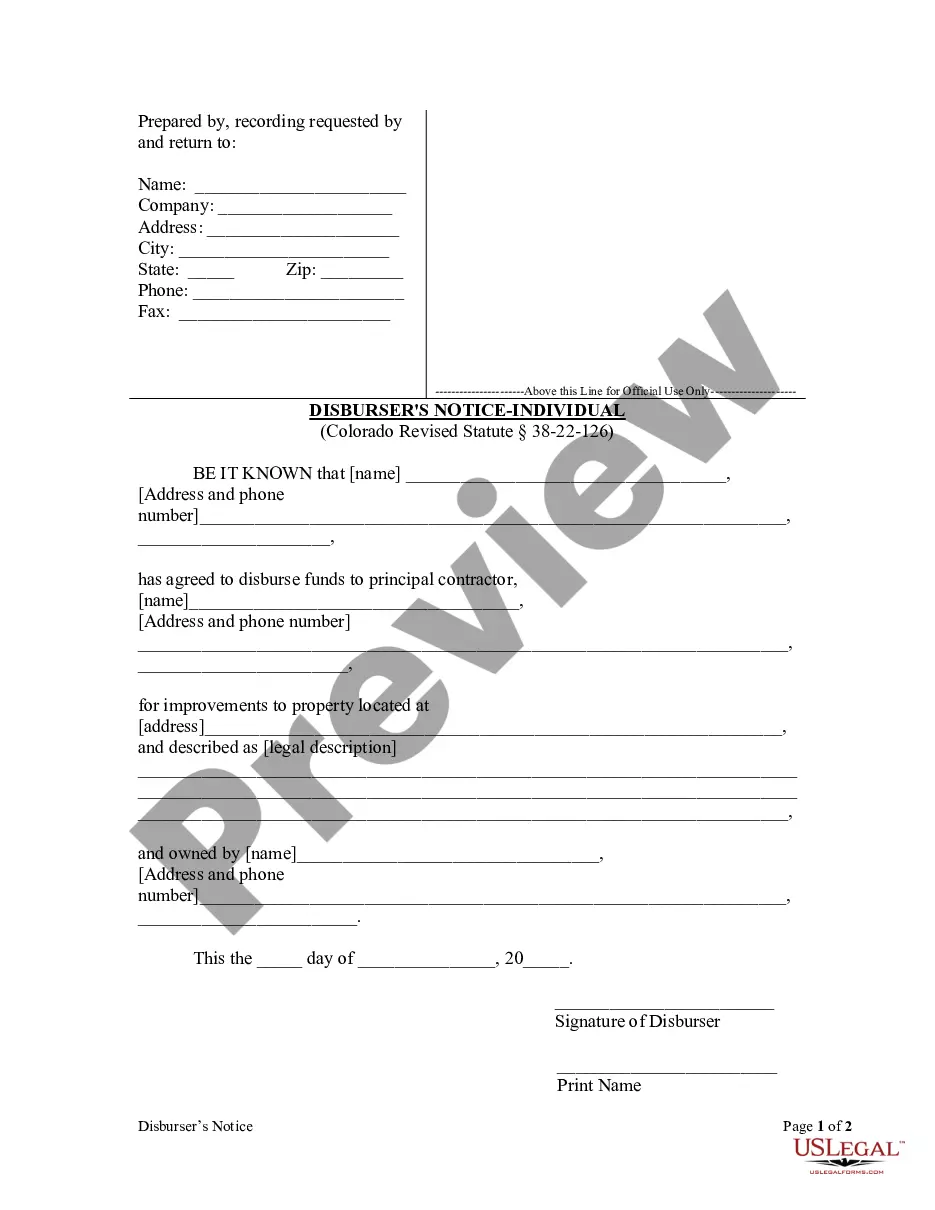

How to fill out Assignment Of Business License As Security For A Loan?

You can dedicate numerous hours online attempting to locate the proper legal document template that meets both state and federal requirements you need.

US Legal Forms offers a multitude of legal forms that are reviewed by experts.

You can obtain or create the Missouri Assignment of Business License as Security for a Loan through their service.

If available, use the Review button to view the document template as well. If you wish to find another version of the document, use the Search field to locate the template that suits your needs.

- If you possess a US Legal Forms account, you may sign in and then click the Download button.

- Subsequently, you can complete, edit, print, or sign the Missouri Assignment of Business License as Security for a Loan.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the downloaded form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred county/city.

- Review the form description to confirm that you have chosen the appropriate document.

Form popularity

FAQ

Let's get started with your first six steps: Decide on your business structure. Register with the Missouri Secretary of State. Obtain an Employer Identification Number (EIN) Register for Missouri business taxes. File paperwork to hire employees. Check for city and county licenses and permits, and obtain industry licenses.

Do You Need a Business License in Missouri? Most local governments in Missouri require business licenses on a city or county level. As with many other states in the U.S., the only business license regulated at the state level in Missouri is the sales tax license, sometimes commonly called a seller's permit.

A sole proprietorship or partnership can operate under the owner's full first and last name without registering, but if the business will using under a name other than the owner's name, a Fictitious Name Registration (sometimes referred to as a DBA or Doing Business As) with the Missouri Secretary of State.

The Missouri Tax Registration (commonly referred to as the state sales tax number or sales tax license) is needed when a business makes retail sales or has employees. Registration for the Business Tax Registration is through the Missouri Department of Revenue website.

Missouri doesn't have a general business license for LLCs, so there are no fees there. If your business has to get an occupational license or municipal (city or county) permit, the fees are hard to predict. Depending on your LLC's location, and what type of business or industry you're in, the fee varies.