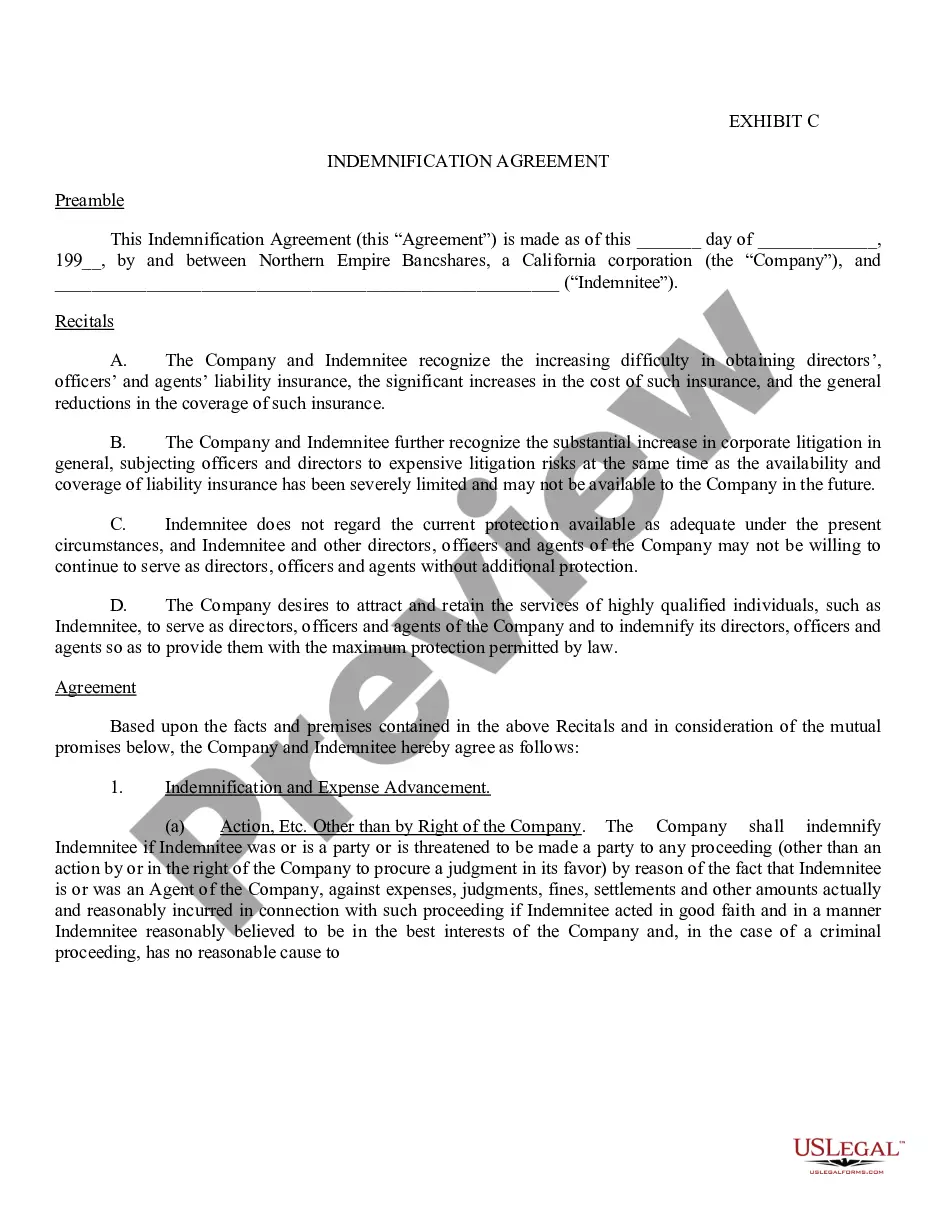

A deed in lieu of foreclosure is a method sometimes used by a lienholder on property to avoid a lengthy and expensive foreclosure process, with a deed in lieu of foreclosure a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor basically deeds the property to the bank instead of them paying for foreclosure proceedings. Therefore, if a debtor fails to make mortgage payments and the bank is about to foreclose on the property, the deed in lieu of foreclosure is an option that chooses to give the bank ownership of the property rather than having the bank use the legal process of foreclosure.

Missouri Offer by Borrower of Deed in Lieu of Foreclosure

Description

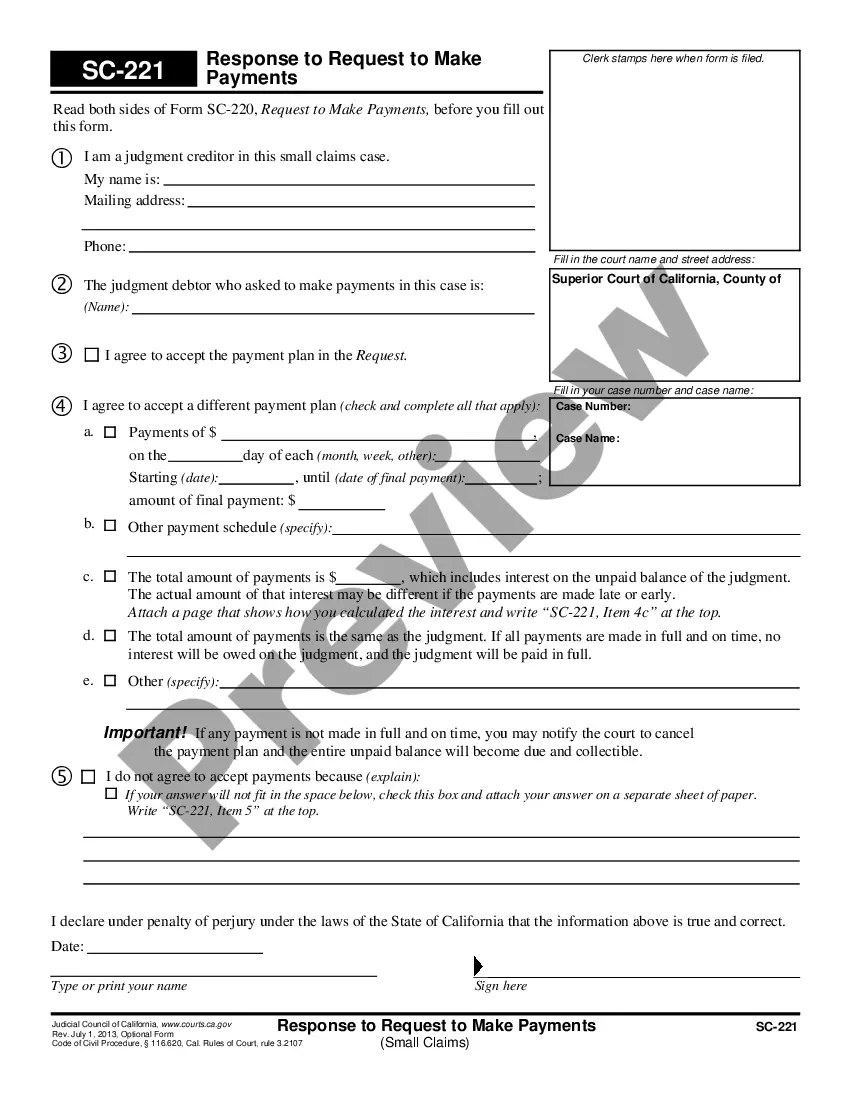

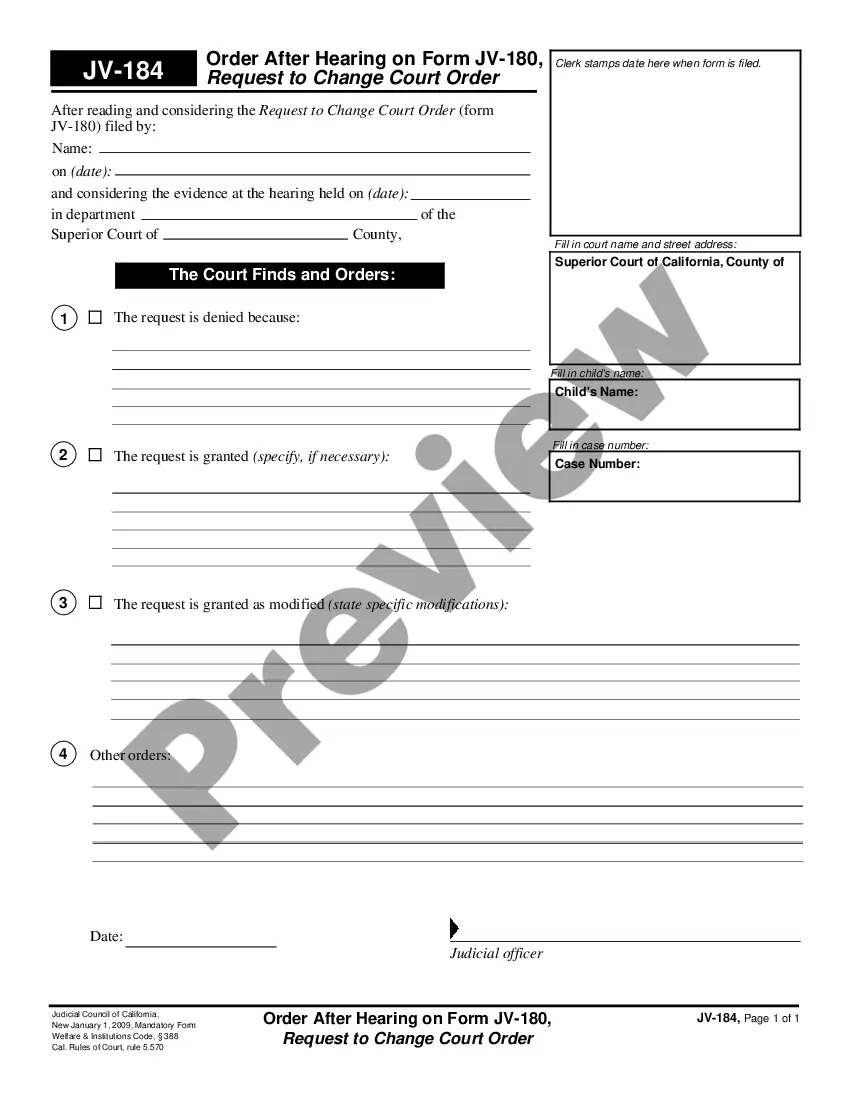

How to fill out Offer By Borrower Of Deed In Lieu Of Foreclosure?

Discovering the right lawful file design can be a battle. Obviously, there are plenty of themes available on the net, but how will you discover the lawful kind you want? Use the US Legal Forms internet site. The assistance gives thousands of themes, like the Missouri Offer by Borrower of Deed in Lieu of Foreclosure, that you can use for company and personal requirements. All the varieties are examined by professionals and satisfy federal and state specifications.

When you are already authorized, log in to the bank account and click on the Download button to obtain the Missouri Offer by Borrower of Deed in Lieu of Foreclosure. Make use of bank account to check throughout the lawful varieties you have bought previously. Go to the My Forms tab of your respective bank account and get an additional duplicate in the file you want.

When you are a whole new user of US Legal Forms, listed below are easy guidelines that you should adhere to:

- Initially, be sure you have selected the proper kind to your metropolis/state. You may examine the form utilizing the Review button and browse the form outline to guarantee this is basically the best for you.

- In case the kind will not satisfy your needs, use the Seach area to discover the correct kind.

- When you are certain that the form is suitable, go through the Get now button to obtain the kind.

- Opt for the costs plan you desire and type in the needed info. Create your bank account and purchase the order with your PayPal bank account or credit card.

- Opt for the document formatting and down load the lawful file design to the gadget.

- Full, change and produce and sign the received Missouri Offer by Borrower of Deed in Lieu of Foreclosure.

US Legal Forms may be the biggest library of lawful varieties in which you can discover a variety of file themes. Use the company to down load professionally-manufactured papers that adhere to state specifications.

Form popularity

FAQ

Declare Bankruptcy But you need to understand the concept of chapter 7 and chapter 13 of bankruptcy. Chapter 13 bankruptcy in Missouri: It is a common option to go for to stop foreclosure. ing to chapter 13 bankruptcy, you are given a payment plan of 3 or 5 years to catch up with the payment in arrears.

A "deed in lieu of foreclosure" occurs when a lender agrees to accept a deed (title) to the property instead of foreclosing. With a deed in lieu of foreclosure, the deficiency amount is the difference between the total mortgage debt and the property's fair market value.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

Under Missouri law, if the foreclosing lender buys the property at the foreclosure sale, you get one year to redeem the home following the sale. If a third party buys the home at the sale, you don't get a right to redeem.

Borrowers must be delinquent for 120 days before a Notice of Sale can be issued, and the sale is to occur forty to fifty days after the notice. Lenders must give at least a twenty-day notice of the sale. They must publish the foreclosure in a newspaper in the county where the property is located.

A deed in lieu of foreclosure is sometimes referred to as a friendly foreclosure because it is a nonjudicial procedure. In a mortgage, the mortgagor owns the mortgage, while the mortgagee owns the property.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

By accepting a deed in lieu of foreclosure, lenders may take possession of the property sooner and keep it in better condition. The lender may be more likely to approve a request for a deed in lieu on a home in good condition so they can sell the property quickly and at a fair market rate.