Title: Comprehensive Guide to Missouri Sample Letters for Insufficient Funds Introduction: Missouri sample letters for insufficient funds are essential tools for individuals, organizations, and businesses seeking to communicate with recipients who have issued bounced or insufficient fund checks. These letters are designed to inform the recipient about the issue, notify them of the consequences, and request prompt payment. This article provides a detailed description of what Missouri sample letters for insufficient funds entail, their significance, and offers examples of different types available. Keywords: Missouri, sample letters, insufficient funds, bounced checks, consequences, prompt payment 1. Understanding Missouri Sample Letters for Insufficient Funds: Missouri sample letters for insufficient funds are formal correspondences sent by individuals, organizations, or businesses to recipients who have provided checks that were returned unpaid due to insufficient funds. These letters clearly explain the situation, convey the consequences of their actions, and request immediate payment to rectify the issue. 2. Importance of Missouri Sample Letters for Insufficient Funds: a. Legal documentation: These letters serve as important legal documentation of communication between parties involved, ensuring transparency and evidence in case of future disputes. b. Professionalism: By using redrafted sample letters, senders can maintain a professional tone and convey their message effectively. c. Clear communication: These letters help to clearly state the problem, consequences, and expectations, leaving no room for misunderstanding. 3. Types of Missouri Sample Letters for Insufficient Funds: a. Formal Demand Letter: This type of letter is a stern communication that demands immediate payment for the bounced check, warns the recipient of potential legal action or additional penalties, and provides a timeline for payment resolution. b. Payment Reminder Letter: This letter serves as a gentle reminder to the recipient regarding their obligation to settle the outstanding bounced check. It emphasizes the importance of timely payment to avoid further consequences. c. Follow-up Letter: If initial attempts to contact the recipient have been unsuccessful, a follow-up letter can be sent. It restates the issue, provides a final deadline for payment, and further emphasizes the urgency of resolving the matter. d. Letter Acknowledgement: In cases where the recipient has issued an insufficient fund check unintentionally, this letter serves as an acknowledgement of their intent to rectify the situation by providing a replacement check or making immediate payment. Conclusion: Missouri sample letters for insufficient funds are vital resources for addressing bounced or insufficient fund checks. They assist in clear communication, legal documentation, and maintaining professionalism for both senders and recipients. By understanding the importance and various types of these letters, individuals can effectively handle such situations, emphasizing swift resolution and promoting healthy financial relationships. Keywords: Missouri, sample letters, insufficient funds, bounced checks, consequences, prompt payment.

Missouri Sample Letter for Insufficient Funds

Description

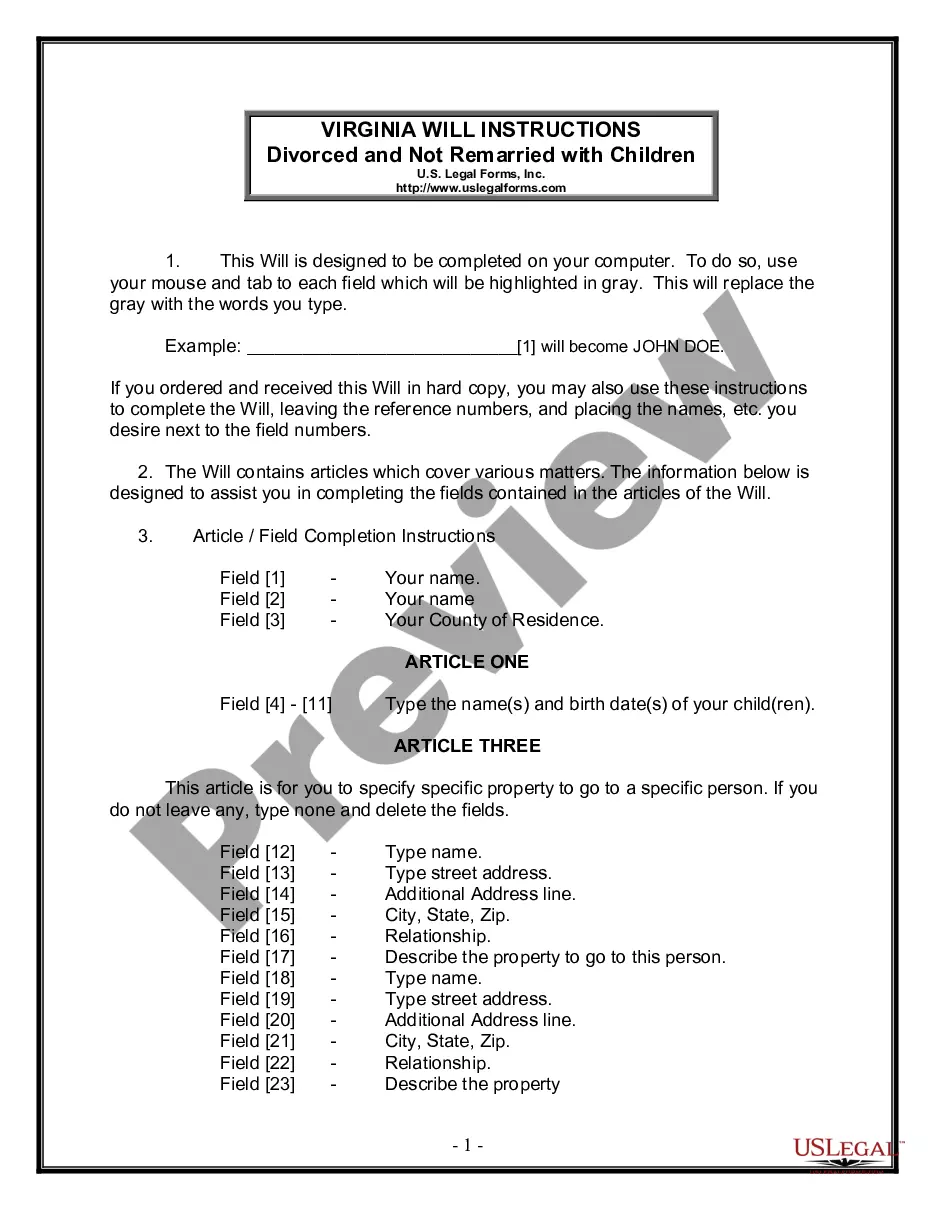

How to fill out Missouri Sample Letter For Insufficient Funds?

US Legal Forms - one of several most significant libraries of legitimate types in the States - delivers a wide range of legitimate papers web templates you may download or print out. Using the website, you will get a large number of types for organization and person functions, sorted by groups, suggests, or search phrases.You will find the latest models of types such as the Missouri Sample Letter for Insufficient Funds within minutes.

If you already have a subscription, log in and download Missouri Sample Letter for Insufficient Funds from your US Legal Forms catalogue. The Obtain switch can look on each and every type you perspective. You gain access to all earlier saved types in the My Forms tab of your own accounts.

In order to use US Legal Forms the very first time, here are easy instructions to obtain began:

- Be sure you have chosen the proper type to your city/state. Select the Preview switch to examine the form`s information. Read the type explanation to ensure that you have selected the proper type.

- In the event the type does not suit your requirements, use the Look for area at the top of the display to find the the one that does.

- When you are happy with the form, verify your selection by simply clicking the Buy now switch. Then, select the pricing plan you want and offer your accreditations to register to have an accounts.

- Approach the financial transaction. Utilize your credit card or PayPal accounts to complete the financial transaction.

- Choose the file format and download the form on your own system.

- Make alterations. Complete, modify and print out and signal the saved Missouri Sample Letter for Insufficient Funds.

Each format you included with your account lacks an expiry particular date and is the one you have eternally. So, if you would like download or print out another version, just proceed to the My Forms segment and then click around the type you will need.

Obtain access to the Missouri Sample Letter for Insufficient Funds with US Legal Forms, probably the most extensive catalogue of legitimate papers web templates. Use a large number of skilled and state-particular web templates that meet your organization or person requirements and requirements.

Form popularity

FAQ

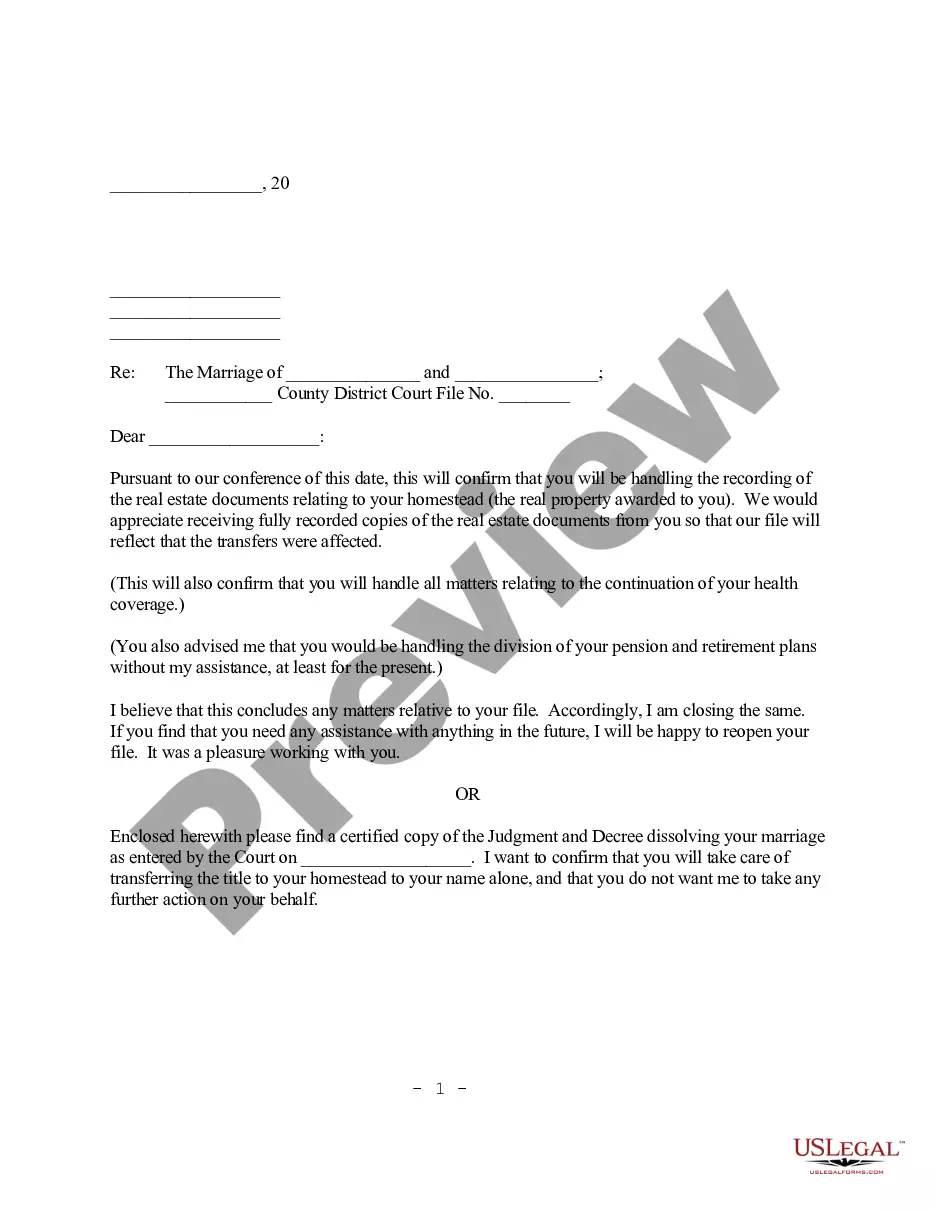

This letter serves as notice that your check number __________________,drawn on _______________________Bank or Credit Union, dated _________________, in the amount of $________________, made payable to _____________________, has been refused payment by your bank for the reason of lack of funds, insufficient funds, stop ...

This letter serves as notice that your check number __________________,drawn on _______________________Bank or Credit Union, dated _________________, in the amount of $________________, made payable to _____________________, has been refused payment by your bank for the reason of lack of funds, insufficient funds, stop ...

Send certified mail. The check you wrote for $________, dated ______, which was made payable to _____________(write your/payee's name here), was returned by ______________ (write name of bank) because ____________(account was closed OR the account had insufficient funds).

Writing bad checks can cause a variety of problems. You may have to pay significant fees, you could lose the ability to write checks in the future, you risk legal issues, and your credit can suffer. Learn what can go wrong if you write a check for more than you have in your bank account.

Contact the customer Explain the situation to them. Ask the customer to pay with cash or credit card. If you can't reach the customer by phone, you can try sending a bounced check letter to customer. Tell the customer why you are contacting them.

I am writing to let you know that your [Check No. _______] in the amount of [$_____] has been returned to us by your bank marked ?Insufficient Funds.? You are a valued customer, and we understand that there may have been a minor error in your bookkeeping or a misunderstanding between you and your bank.

Contact the customer Explain the situation to them. Ask the customer to pay with cash or credit card. If you can't reach the customer by phone, you can try sending a bounced check letter to customer. Tell the customer why you are contacting them.

Send certified mail. The check you wrote for $________, dated ______, which was made payable to _____________(write your/payee's name here), was returned by ______________ (write name of bank) because ____________(account was closed OR the account had insufficient funds).

The Demand Letter Your demand letter must request that you be paid the full amount of the check, any bank fees and the cost of mailing the demand. It also tells the person who gave you the bad check, that if they do not pay within 30 days of your mailing the demand letter, you can sue for the check plus damages.