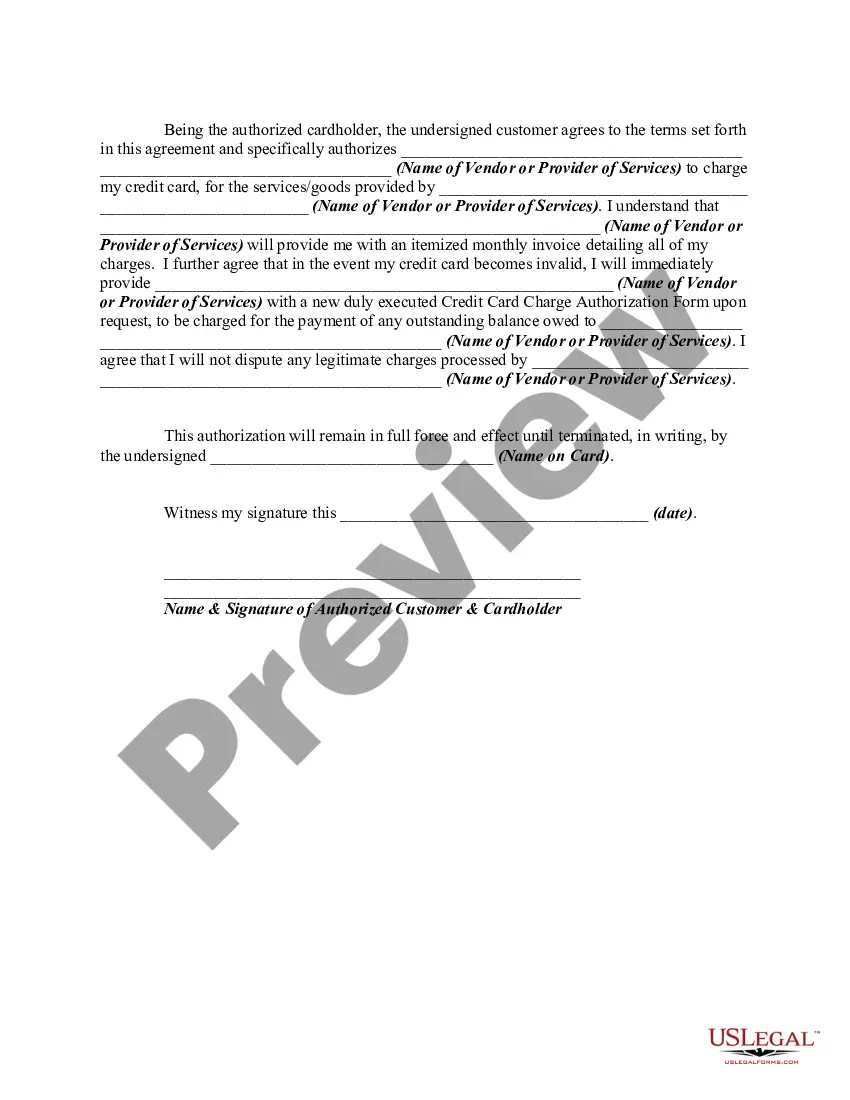

This form represents an agreement to allow a regular vendor or service provider the right to charge a customer's credit card as payment for the service.

Missouri Credit Card Charge Authorization Form

Description

How to fill out Credit Card Charge Authorization Form?

Are you currently in a position where you require documents for both business or personal purposes frequently.

There are numerous legitimate document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template forms, such as the Missouri Credit Card Charge Authorization Form, which are designed to meet federal and state requirements.

Once you obtain the appropriate form, just click Purchase now.

Choose the pricing plan you want, fill out the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Missouri Credit Card Charge Authorization Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

- Utilize the Review option to inspect the form.

- Examine the details to confirm you have selected the proper form.

- If the form is not what you're looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

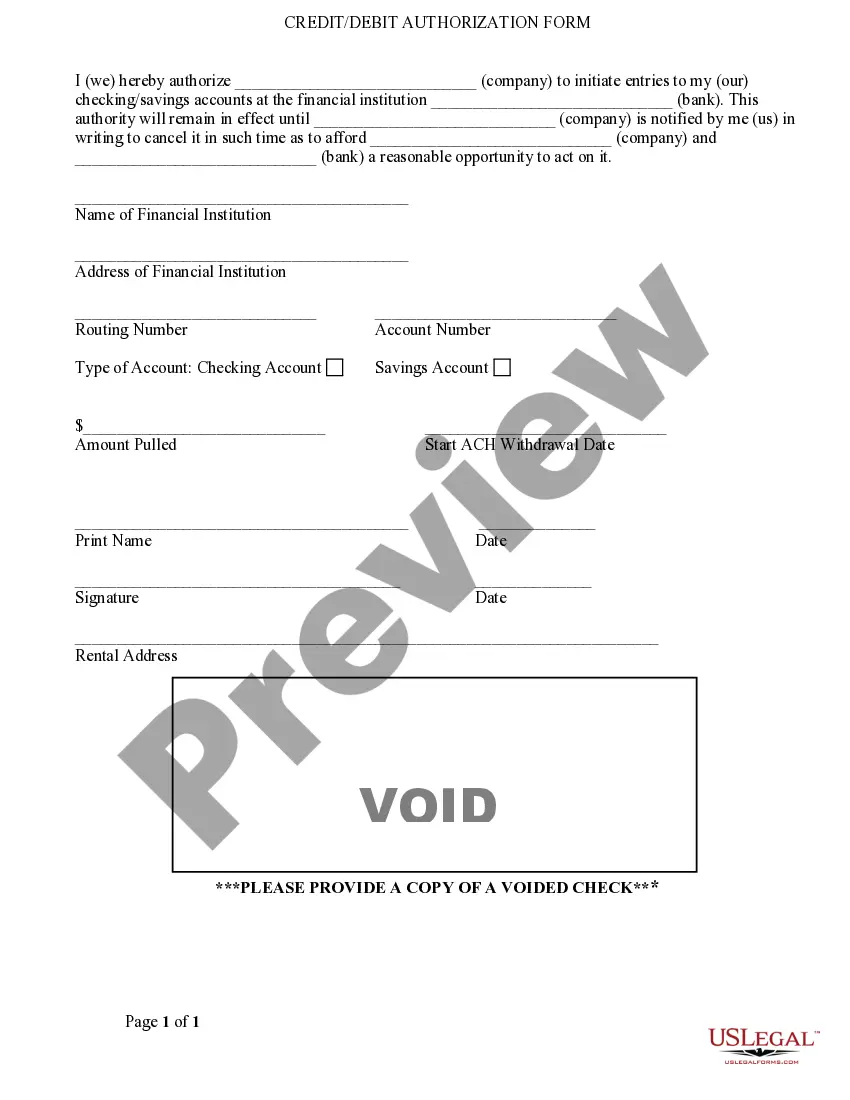

Sending Request to the Acquirer. First, the customer's credit card is swiped through a card reader or the card number is manually entered into a terminal. ... Submitting Request to the Issuer. ... Checking the Funds in the Credit Card. ... Finalising the Credit Card Authorisation. ... Taking Notification from Payment Processor.

What Is an Authorized Amount? An authorized amount is a sum that a merchant transmits to a credit or debit card processor to make sure the customer has the funds required to make a purchase?the approved amount of money to be charged.

How Does Payment or Credit Card Authorization Work? Step 1: The customer uses their credit card at checkout. ... Step 2: An authorization request is sent to the bank. ... Step 3: The request is approved or declined.

Credit card authorization forms are a best practice for merchants. Although it's not legally required, you should ask your lawyer when they would suggest using one.

A credit card authorization form is a document that customers (or cardholders) fill out to grant businesses the permission to charge their credit card. Credit card authorization forms are more often used for larger purchases (think cars, computers, etc.) than they are for smaller, everyday items.

The merchant sends a request to their acquirer, also called a credit card processor ? PayPal, for example. The acquirer then submits a request to the credit card issuer. The issuer reviews the customer's account and decides if enough funds exist to cover the cost of the sale.

Your credit card authorization form ought to include the following details: The credit card information like card type, the cardholder's name, the card number, and the card expiry date. The merchant's business information ? like name, address and contact number/mail ID.

Someone may take the information on the credit card authorization form for malicious purposes like identity theft. Not to mention signing the form for multiple transactions can damage the customer experience.