Missouri Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

Finding the right lawful file template might be a have a problem. Needless to say, there are a lot of web templates available on the Internet, but how do you find the lawful develop you want? Use the US Legal Forms web site. The support gives 1000s of web templates, for example the Missouri Acknowledgment by Debtor of Correctness of Account Stated, which you can use for enterprise and private needs. All of the kinds are examined by pros and meet up with federal and state demands.

If you are previously authorized, log in to the profile and then click the Obtain button to obtain the Missouri Acknowledgment by Debtor of Correctness of Account Stated. Make use of profile to appear throughout the lawful kinds you possess bought previously. Go to the My Forms tab of your respective profile and have yet another duplicate in the file you want.

If you are a fresh user of US Legal Forms, listed below are straightforward directions so that you can adhere to:

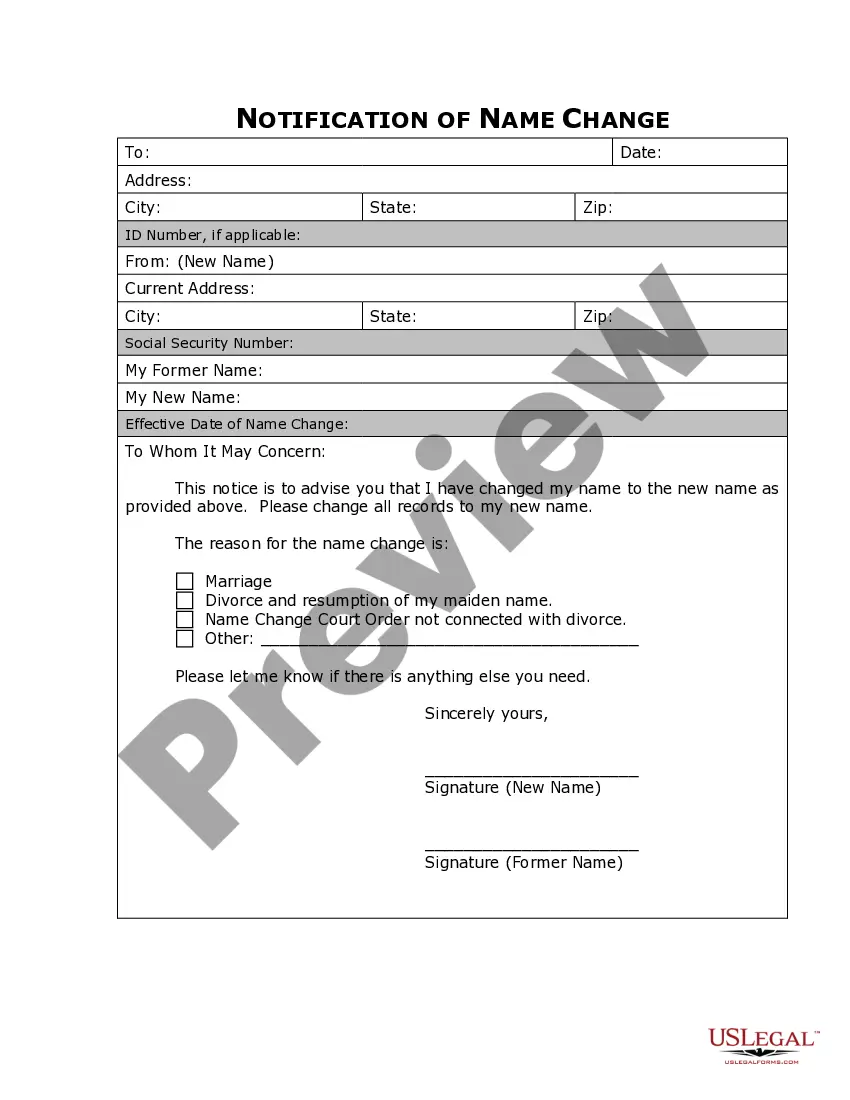

- Initially, be sure you have chosen the appropriate develop for the town/region. You may look over the shape utilizing the Review button and study the shape explanation to guarantee it will be the best for you.

- In the event the develop does not meet up with your requirements, utilize the Seach area to obtain the proper develop.

- When you are sure that the shape would work, click on the Get now button to obtain the develop.

- Opt for the prices prepare you need and enter in the necessary details. Build your profile and purchase your order with your PayPal profile or bank card.

- Choose the file structure and down load the lawful file template to the system.

- Full, modify and printing and signal the received Missouri Acknowledgment by Debtor of Correctness of Account Stated.

US Legal Forms will be the most significant local library of lawful kinds where you can see a variety of file web templates. Use the company to down load appropriately-created paperwork that adhere to status demands.

Form popularity

FAQ

There are three elements of an account stated claim: (1) the account was presented, (2) by mutual agreement, it was accepted as correct, and (3) the debtor promised to pay the amount so stated. The second and third elements may be shown by the debtor's failure to object to the stated amount within a reasonable time.

The cause of action of an account stated is based on principles of contract law. There must be an express or implied agreement between the creditor and debtor that the debtor owes the amount set forth in the account.

Account stated refers to a document summarizing the amount a debtor owes a creditor. An account stated is also a cause of action in many states that allows a creditor to sue for payment.

Account stated refers to a document summarizing the amount a debtor owes a creditor. An account stated is also a cause of action in many states that allows a creditor to sue for payment.

The most common way to defeat an action for account stated is to show that the debt claimed is new, i.e., that there was no prior course of dealing between the parties or, at best, only a very short period with very few transactions.

Under California law, "[a]n account stated is an agreement, based on prior transactions between the parties, that the items of an account are true and that the balance struck is due and owing."4 The three elements of the claim are 1) previous transactions between the parties establishing the relationship between debtor ...

Collections actions involving the sale of goods often include two varieties of ?account? claims in addition to traditional breach of contract theories: ?account stated? and ?open account.? Generally, an account stated claim alleges the failure to pay an agreed-upon balance, while an open account claim alleges an ...

The elements of account stated are: (1) prior transactions between the parties which establish a debtor-creditor relationship; (2)an express or implied agreement between the parties as to the amount due; and (3) an express or implied promise from the debtor to pay the amount due.